China, India and Southeast Asia Automotive OEM Telematics Market Outlook - 2026

The China, India and Southeast Asia automotive OEM telematics market was valued at $5,207.3 million in 2018 and is projected to reach $38,723.4 million by 2026, registering a CAGR of 27.1% from 2019 to 2026.

Automotive OEM telematics are preinstalled solutions installed in automobiles, which comprise telematics equipment, connectivity, and services. The services are provided either free of cost or on a subscription basis. Automotive manufacturers need to adhere to the safety standards defined by the governments of respective regions. The eCall system is one of the standard devices used in European vehicles for automatically dialing a helpline number and send location details in case of emergencies. The European car manufacturing industry has been closely working with connectivity device manufacturers and telecom service providers to offer connectivity solutions, which are as per the industry standards. Automotive OEM Telematics Market Size in Southeast Asia is anticipated to grow at a significant growth rate.

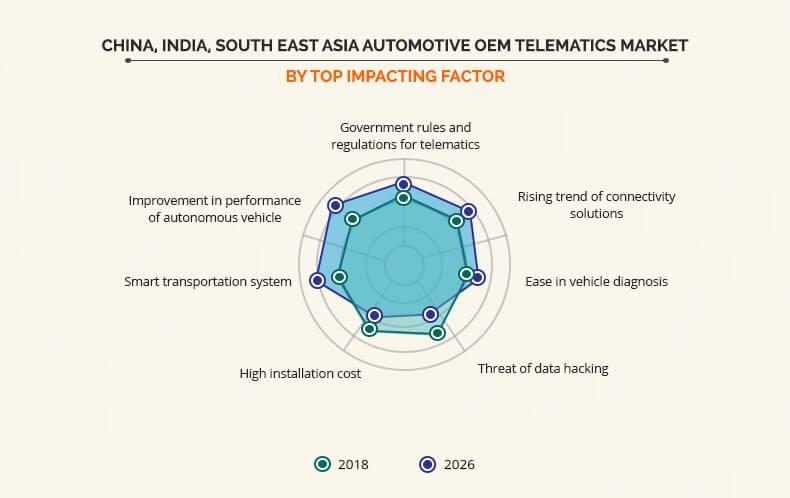

Stringent government rules and regulations for telematics, increase in fleet management, and rise in concern regarding safety & security are the key factors that significantly contribute toward the growth of the China, India and Southeast Asia automotive OEM telematics market. Moreover, rise in trend of connectivity solutions are expected to boost the growth of the China, India and Southeast Asia automotive OEM telematics market. In addition, vehicle diagnose due to the telematics systems fuels the market growth. However, threat of data hacking, and unavailability of uninterrupted & seamless connectivity are some of the factors that restrict the growth of the market. Automotive OEM Telematics Market Share in Southeast Asia is lower as compared to China and India.

The key players operating in the China, India and Southeast Asia automotive OEM telematics market include Verizon, Harman, TomTom, AT&T, Vodafone Group PLC, Ford Motors Co., BMW, Telefonica, MiX Telematics, and Trimble Navigation Limited.

Government rules and regulations for telematics

Government rules and regulations for the safety, security, and tracking of vehicles in different regions drives the growth of the telematics market. For instance, in April 2018, government of India passed rule for all the public transport vehicles over six-seater capacity should have tracking device installed in them. In addition, in December 2017, the Ministry of Industry and Information Technology (MIIT) and the Standardization Administration of China (SAC) jointly established national guidelines for the development of telematics systems. Therefore, government regulations for vehicle telematics fuels the growth of the market. Automotive OEM Telematics Market Size in India has significant share to China, India and Southeast Asia Automotive OEM Telematics Industry.

Rising trend of connectivity solutions

Smartphones have changed the definition of connectivity over time. People wish to stay connected with the outer world even while travelling. Now that connectivity has become the need of the hour, automobile manufacturers adopt connectivity solutions in their vehicles to boost their automobile sales. Consumers are expecting their vehicles to perform tasks similar to computers and smart phones. Automotive OEM Telematics Market Size in China has the highest share in the market and is anticipated to maintain its lead during the forecast period.

Adding connectivity solutions in the vehicle has become the top most priority for automobile manufacturers. Many connectivity solutions are integrated in modern cars. These need internet service to perform their respective functions. Connectivity can be provided in a car using embedded, integrated, or tethered connectivity solutions. The automotive industry is witnessing a phase of digital revolution. Over the next few years, automobiles will be completely transformed into communication objects. Therefore, the telematics market is expected to grow at a promising rate due to the rise in customer demands for staying connected 24*7 even while travelling. In addition, Automotive OEM Telematics Market Share in China is anticipated to grow at a significant growth rate.

Ease in vehicle diagnosis

Advance diagnostic system is expected to boost the growth of the commercial telematics market. In advanced diagnostics, the system in the car will supply data of the vehicle to both the automobile dealer and the customer, which can help predict potential automobile issues before they take place.

In fleet management, it is easy to track vehicle records and decide which vehicle has travelled the most and accordingly offer service with the help of connectivity solutions. The diagnostic service offered is an efficient way to diagnose the status of the vehicles. It allows the consumers to manage the maintenance of their vehicle, thus saving money and time by avoiding unwanted expenses & breakdowns. The system provides a maintenance schedule and timely reminders to the consumer. The diagnostic system keeps a track of the smoke emission and fuel consumption of the vehicles, thereby monitoring its engine health. This service sends a detailed report about the vehicle to the decision maker who decides on the service schedules for the automobile. Thus, ease of vehicle diagnosis with the help mobile applications is expected to fuel the growth of the market.

Threat of data hacking

Telematics is a relatively new technology. Events, such as unauthorized access to multiple car connectivity solutions or breaking into the in-vehicle connectivity system can restrict the commercial telematics market. The major security concern is that the hacker has access to the computer system of the cars as well as to the data that it collects and stores. Thus, hacking threats of vehicle with telematics systems is one of the factors expected to hamper the growth of the market.

High installation cost

The additional costs incurred while providing connectivity in the vehicle is expected to restrict the growth of the commercial telematics market. Providing connectivity solutions in the vehicle incurs additional expenses to the consumers in the form of hardware, connectivity solutions, and telecom service charges. These additional costs bestowed upon the consumer have a significant impact on the commercial telematics market. Thus, high installation cost of commercial telematics systems is expected to hinder the market.

Smart transportation system

The safety services offered in vehicles with telematics solutions are an appropriate example of cutting edge aftermarket technology, which involves sharing data between the vehicle and the humans. Safety is a combination of telecommunication and automobile technology used to improve vehicle efficiency, reduce fuel consumption & maintenance cost, enhance security & safety measures, and assist the driver to enhance his overall driving experience. Features such as live traffic updates, automatic toll transactions, insurance telematics, road-side assistance in case of accidents or breakdowns and smarty routing & tracking will provide an exponential growth opportunity for the key players operating in the commercial telematics market.

Improvement in performance of autonomous vehicle

There are several solutions offered in the market that collect, manage, explore, interpret, and analyze the driving data of a particular driver. Cars with telematics systems generate a huge amount of data every minute, providing an opportunity for superior consumer experience and establishing new business avenues in autonomous driving. In addition, Automotive OEM Telematics Market Share in India is expected to experience a lucrative growth rate.

Key Benefits for China, India and Southeast Asia Automotive OEM Telematics Market:

- This study presents analytical depiction of the China, India and Southeast Asia automotive OEM telematics market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2018 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

China, India, Southeast Asia Automotive OEM Telematics Market Report Highlights

| Aspects | Details |

| By VEHICLE TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | MiX Telematics, Vodafone Group, Telefónica S.A, TRIMBLE INC, Verizon, TomTom International BV, BAYERISCHE MOTOREN WERKE AKTIENGESELLSCHAFT (BMW), AT&T, Ford Motor Company, HARMAN International (Samsung Electronics) |

Analyst Review

Telematics is a methodology of monitoring the location and movement of a vehicle by combination of global positioning system (GPS) and on-boards diagnostics systems. With the help of GPS and diagnostics system, it is possible to record the speed and internal behavior of the vehicle. Telematics systems are majorly adopted by the automobile insurance companies, fleet management companies, and others to monitor the location and behavior of the vehicle.

Ford Motors and BMW are the key leaders in the automotive OEM infotainment market. Harman has a Tier-1 supplier network in automotive OEM telematics services. Market giants, such as Ford, Toyota, and BMW, have consolidated their market position, hardware reliability, open platforms, and quality through various innovations in their services and extensive regional coverage.

Government rules and regulations for telematics, increase in fleet management, and better safety & security for driver and vehicle drive the growth of the China, India, Southeast Asia automotive OEM telematics market globally. Moreover, growth in production of passenger vehicles in developing countries of Asia-Pacific is majorly characterized by rise in disposable income. These factors are largely responsible for the expansion in the China, India, Southeast Asia automotive OEM telematics market, as the growth of telematics is directly related to advancement in the applications of the passenger vehicle segment.

The market is analyzed among Asia-Pacific regions, currently in year 2017, China is the highest revenue contributor, and Southeast Asia is expected to dominate the market during the forecast period. This growth is attributed to increase in demand for various types of vehicles in this region.

Loading Table Of Content...