Insurance Business Process Outsourcing (BPO) is a specialized outsourcing solution catering to insurance companies, encompassing a range of services like claims processing, policy administration, actuarial support, and regulatory compliance. It leverages emerging technologies such as blockchain and data analytics to optimize operations, improve accuracy, ensure regulatory adherence, and capitalize on emerging market opportunities, driving innovation, and sustainable growth.

The insurance BPO market is experiencing a notable trend towards technology adoption which is strengthening the market growth. Chinese insurance BPO providers are embracing advanced technologies to enhance operational efficiency and deliver better customer experiences. Automation, artificial intelligence (AI), and data analytics are being utilized to streamline processes, reduce errors, improve accuracy, and increase the speed of service delivery. In addition, with growing competition in the insurance sector, companies in China are prioritizing customer experience as a key differentiator.

BPO service providers are aligning their services to meet the changing customer expectations by offering personalized interactions, multi-channel support, and quicker turnaround times for policy issuance and claims settlement.

China insurance industry is subject to stringent regulations, and adherence to compliance requirements is crucial. BPO providers are investing in robust governance, risk management, and compliance frameworks to ensure data security, privacy, and regulatory compliance.

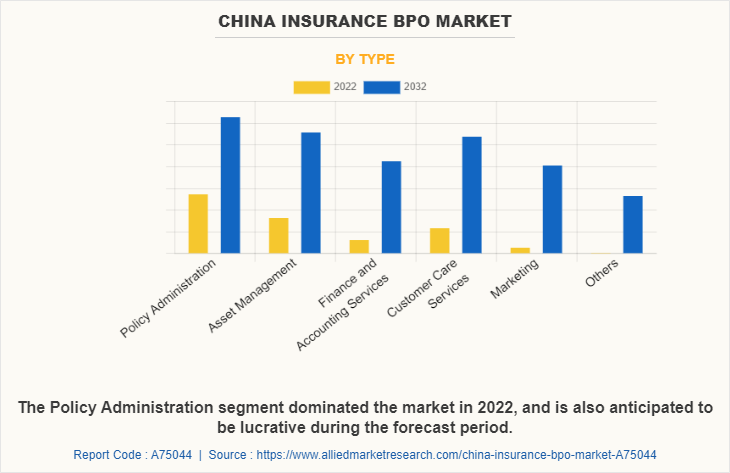

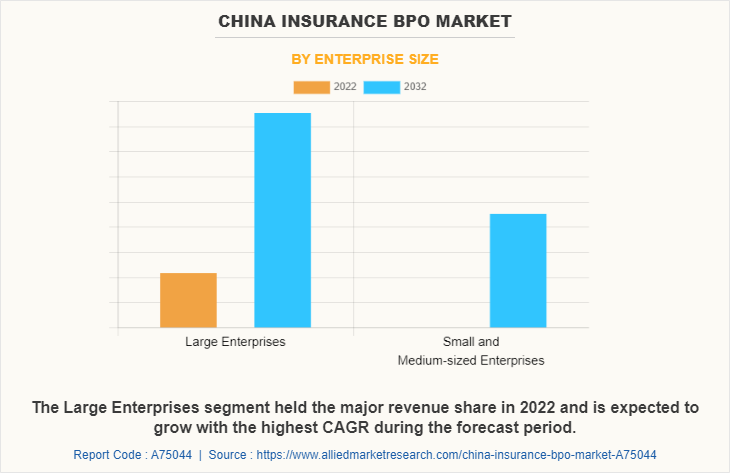

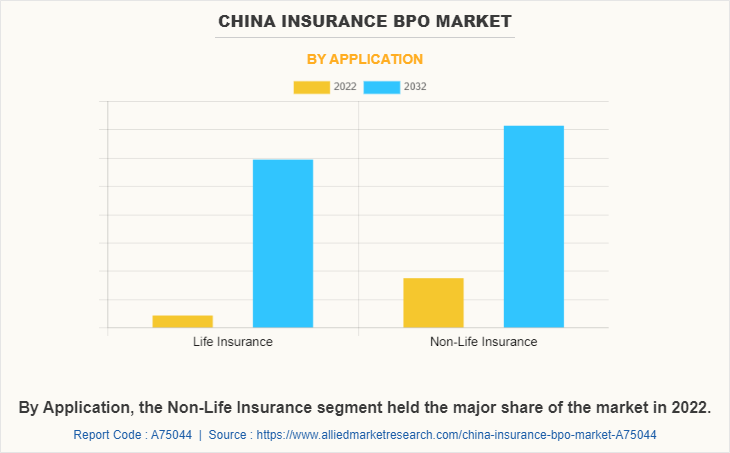

The insurance BPO market is segmented based on type, application, and enterprise size. By type, the segment is classified into asset management, policy administration, finance and accounting services, customer care services, market, and others. On the basis of application, the insurance BPO market is categorized into the life insurance and the non-life insurance market. By enterprise size, the market is bifurcated into small and medium-sized enterprises and large enterprise sizes. Prominent players covered in this research study are Cognizant, DXC Technology, Wipro, Infosys, Accenture, HCL Technologies, Xerox, Genpact, CGI Group, and Capgemini.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the China Insurance BPO Market analysis from 2022 to 2032 to identify the prevailing China Insurance BPO industry opportunities.

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- In-depth analysis of the China Insurance BPO Market growth assists to determine the prevailing market opportunities.

- The report includes an analysis of the regional as well as China Insurance BPO Market share, key players, market segments, application areas, and market growth strategies.

- Major countries are mapped according to their revenue contribution to the China Insurance BPO Market size.

- Identify key players and their strategic moves in the China Insurance BPO Market forecast.

- Assess and rank the top factors that are expected to affect the growth of the China Insurance BPO Market outlook.

China Insurance BPO Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 84 |

| By Type |

|

| By Enterprise Size |

|

| By Application |

|

| Key Market Players | PwC, CGI, IBM, Accenture, S3 Group, Deloitte, Capgemini, TCS (Tata Consultancy Services), Fidelity, Lenovo |

The China Insurance BPO Market is projected to grow at a CAGR of 11% from 2022 to 2032

Lenovo, IBM, Accenture, Deloitte, PwC, Capgemini, S3 Group, CGI, Fidelity, TCS (Tata Consultancy Services) are the leading players in China Insurance BPO Market

1. Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

2. Analyze the key strategies adopted by major market players in china insurance bpo market.

3. Assess and rank the top factors that are expected to affect the growth of china insurance bpo market.

4. Top Player positioning provides a clear understanding of the present position of market players.

5. Detailed analysis of the china insurance bpo market segmentation assists to determine the prevailing market opportunities.

6. Identify key investment pockets for various offerings in the market.

China Insurance BPO Market is classified as by type, by enterprise size, by application

Loading Table Of Content...

Loading Research Methodology...