China Oncology Drugs Market Outlook-2026

The China oncology drugs market was valued at $6,498.2 million in 2018 and is projected to reach $12,688.7 million by 2026, registering a CAGR of 8.7% from 2019 to 2026. Cancer is the second leading cause of death globally and is responsible for an estimated 9.6 million deaths in 2018. According to the data published by WHO, about 1 in 6 deaths is due to cancer globally. Being the most populous country in the world, cancer rates are significantly rising in China. As per Global Cancer Observatory 2018, the number of new cancer cases registered each year in China are 4,285,033. Amongst which, lung cancer constitutes 18.1%; Colorectum cancer is about 12.2%; Stomach cancer is approximately 10.6%; liver cancer constitutes 9.2%; breast cancer comprises of 8.6%, and other cancers is 41.1%.

Rise in incidence of various cancer conditions, aging population, westernized diet, shift to sedentary lifestyle, and surge in tobacco smoke exposure due to urbanization in China are the key factors that drive the growth of the cancer and thus boosting the growth of the China oncology drugs market. Furthermore, rise in cancer awareness and availability of cancer drugs are expected to boost the market growth. However, the use of traditional Chinese medicine (TCM) to cure cancer and high cost involved in new drug development coupled with threat of failure & adverse effects associated with cancer drug therapies are the factors expected to restrain the growth of the market. Conversely, high potential of emerging economies and increase in number of pipeline products are expected to provide new opportunities for market players in future.

China Oncology Drugs Market Segmentation:

The China oncology drugs market is segmented based on drug class type and indication. Depending on drug class type, the market is divided into chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. By indication, it is categorized into blood cancer, breast cancer, gastrointestinal cancer, prostate cancer, lung cancer, skin cancer, ovarian cancer, cervical cancer, kidney cancer, and other cancers. Region wise, the market is studied across China.

Segment Review

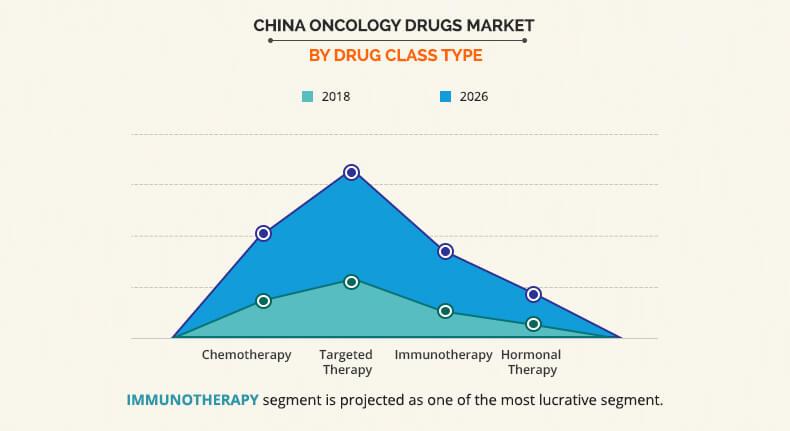

Based on drug class type, the China oncology drugs market is divided into chemotherapy, targeted therapy, immunotherapy, and hormonal therapy. According to drug class type, the targeted therapy segment occupied the largest oncology/cancer drugs market share in 2018. This is due to the ability of targeted therapies to kill only malignant cells, higher efficacy, and higher survival rates associated with their use. The immunotherapy segment is expected to show fastest growth during the forecast period registering a CAGR of 10.0%. This is attributed to surge in incidence of cancer in China and high unmet medical needs in some countries. Immunotherapy drugs are widely accepted as an ideal treatment option as these drugs are potentially harmless to the other living cells of the body, which makes them less toxic as compared to other modes of cancer therapies. Moreover, continuous efforts in R&D to design and develop new immunotherapeutic for the treatment of various cancer types serves as a key factor for the growth of the oncology drugs market.

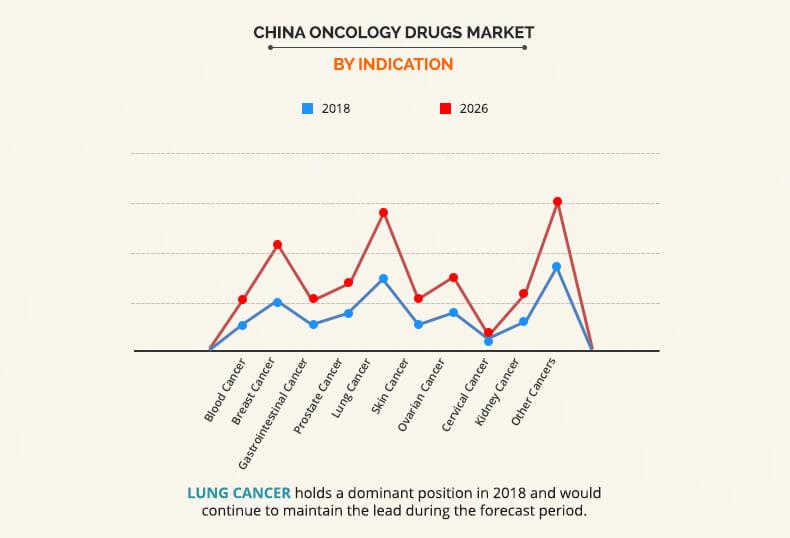

According to indication, the lung cancer segment occupied the largest oncology drugs market share in 2018. This is due to presence of huge geriatric population in China. The breast cancer segment is expected to experience fastest growth during the forecast period. This is due to technological developments in the field of cancer diagnostics and rise in the awareness related to the early diagnosis of cancer.

The China oncology drugs market possesses high growth potential, owing to rise in cancer awareness across the region and increase in R&D investment. Moreover, increase in disposable income; surge in research, development, & innovation activities; and rise in awareness related to different cancers are some other factors, which contribute toward the growth of the oncology/cancer drugs market in this region. In addition, widespread prevalence of certain cancers, such as breast cancer, and presence of huge geriatric population drive the market growth in this region.

The China oncology drugs market is highly competitive and the prominent players in the market have adopted various strategies for increasing their market share. These include expansion of their geographical presence through collaborations, product approval, development, and acquisition. Major players operating in the China oncology drugs market include AbbVie Inc., Astellas Pharma Inc., AstraZeneca PLC, Bristol-Myers Squibb Company, Celgene Corporation, F. Hoffmann-La Roche Ltd., Johnson & Johnson, Shanghai Junshi Biosciences Co., Ltd., Beigene, and Jiangsu Hengrui Medicine Co., Ltd.

Key Benefits For China Oncology Drugs Market:

- This report entails a detailed quantitative analysis along with the current China oncology drugs market trends from 2019 to 2026 to identify the prevailing opportunities along with the strategic assessment.

- The China oncology drugs market forecast is studied from 2019 to 2026.

- The China oncology drugs market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

China Oncology Drugs Market Report Highlights

| Aspects | Details |

| By Drug Class Type |

|

| By Indication |

|

| Key Market Players | JOHNSON & JOHNSON, CELGENE CORPORATION, ASTRAZENECA PLC, SHANGHAI JUNSHI BIOSCIENCES CO., LTD., BRISTOL-MYERS SQUIBB COMPANY, JIANGSU HENGRUI MEDICINE CO LTD., F. HOFFMANN-LA ROCHE LTD., ABBVIE INC., BEIGENE, ASTELLAS PHARMA INC. |

Analyst Review

The utilization of cancer drugs is expected to witness a significant growth in the near future owing to the rise in incidence of cancer in China. Furthermore, the China oncology drugs market growth is propelled by surge in geriatric population, increase in collaboration between pharmaceutical companies for development of novel cancer drugs, and rise in awareness associated with early detection of cancer among populace. However, complications associated with lower access to cancer medications are expected to hinder the market growth.

Moreover, rise in local players such as Beigene, Jiangsu Hengrui Medicine Co., Ltd. and others and industrial collaborations between the manufacturers is anticipated to propel the market growth in the near future for cancer drugs in China. In addition, initiatives adopted by the Chinese government to lower the price of certain drugs in China further fuels the market growth.

Loading Table Of Content...