China Playing Cards & Board Games Market Outlook - 2025

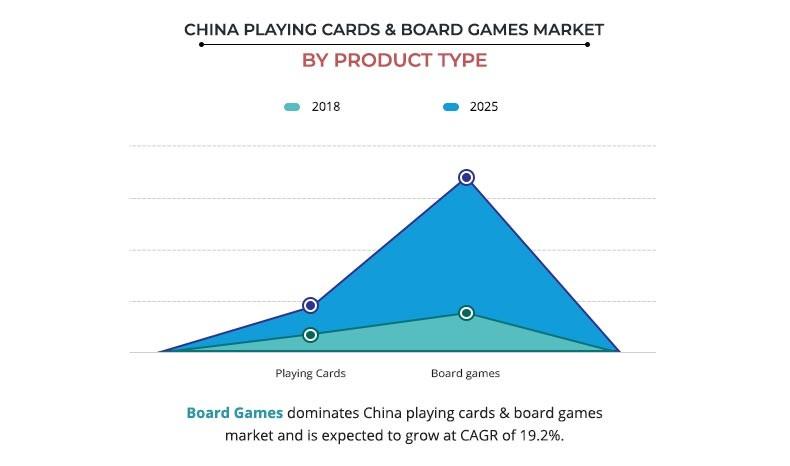

The China playing cards & board games market size was valued at $583.8 million in 2018, and is projected to reach $1,675.4 million by 2025, registering a CAGR of 16.3% from 2018 to 2025. In 2017, the board games segment accounted for approximately two-thirds share in the China playing cards & board games market and is projected to grow at the highest CAGR of 19.2%.

Playing cards are very popular and common products known by every age of person from child to adults. These are flat, rectangular pieces of layered pasteboard typically used for playing a variety of games of skill or chance. There are different types and variety of playing cards available in the market but the principle of all is that 52 cards are divided into four categories of 13 leaves—Spade, Heart, Diamond, and Club. They are used by kids, juvenile, and adults for leisure & recreational purpose. They are mostly used for gambling and hence have high demand across casinos, clubs, and other places. Blackjack, Bridge, Roulette, Sweeps, and Rummy are the popular games played in aforementioned places. Board games alternatively known as tabletop games are played using a board where pieces or counters are places and moved over the board. They also include cards and dice games. These games were traditionally played in their physical format using boards, cards, dice, and playing tokens. The China playing cards & board games market demand is also driven by factors such as rise in number of game bars & cafes, growth in popularity of such games in young population, and increase in number of crowdfunding platforms for designers & manufacturers. All of the above contribute to the China playing cards & board games market growth during the forecast period.

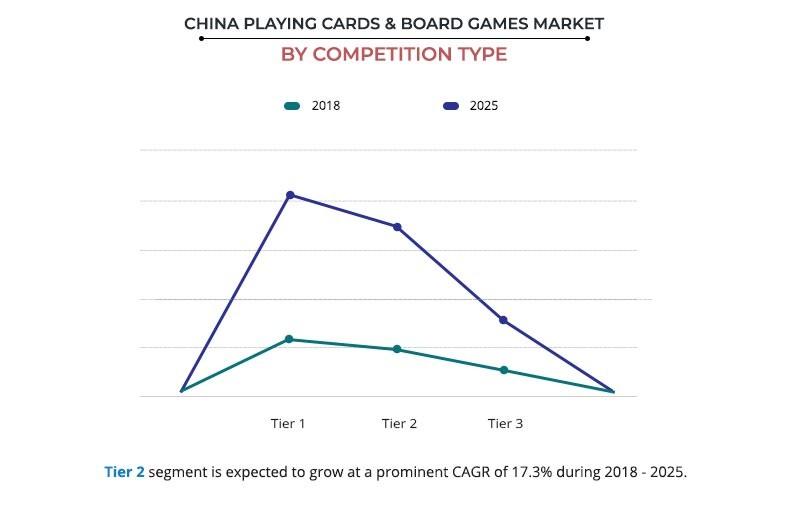

The China playing cards & board games market is segmented on the basis of product type and competition type. By product type, the market is bifurcated into playing cards and board games. By competition type, it is studied across Tier 1, Tier 2, and Tier 3 companies.

The China playing cards & board games market report contains competitive landscape for manufacturers and also provides extensive list of importers of the U.S. and Europe from China. The key companies profiled in the China playing cards & board games market report are ShangHai YaoJi Playing Card Co.,Ltd., Shenzhen YHD Packaging Products Co., Ltd., Shenzhen ITIS Packaging Products Co., Ltd, Shenzhen Yahong Color Printing Co., Ltd., Zhejiang Chinu Packing & Printing Co., Ltd., Ningbo Charron Industry Co., Ltd., Shenzhen Swarm Playing Cards Co., Ltd. Yangzhou Jinyi Stationery Co., Ltd., Yangzhou Jumbay International Trading Co., Ltd., and Dongguan Bright Sea Industrial Co., Ltd.

According to the China Playing cards & board games market forecast, in 2018, the board games dominated the China playing cards & board games market and is expected to grow at a CAGR of 19.2%. The increase in popularity and rise in number of live casinos help in the expansion of the China playing cards & board games Market. Ordinary playing cards are made up of paperboard but in the modern standards of living the most appealing and attractive playing cards are made on PVC coating card substrates and plastics laminated. Better look, non-effective on water, longer lasting and protection from dust are the advantages of such playing cards. The demand for customized playing cards such as gold foil, silver foil, and transparent PVC playing cards from various countries boost the growth of the China playing cards manufacturing industry.

According to the China playing cards & board games market analysis, in 2018, the Tier 1 category of competition type segment was the highest contributor with 46.0% and is estimated to grow at a CAGR of 16.0% from 2018 to 2025. Tier 2 category is estimated to reach $650.7 million by 2025 with a CAGR of 17.3%. Tier 1 firms are the largest, wealthiest, and most experienced in the industry. These firms are exclusive and main players of the market. These companies take on major commercial projects as they have the expertise, resources, and finances to take on such large-scale projects. These companies are capable to adopt technological advancements for the development of innovative products and hence cover most of the market in terms of revenue and volume. However, the market players in the Tier 2 category are prominent players of industry collectively occupying the considerable share in the China playing cards & board games industry. These companies are capable enough for large-scale production. Adoption of strong marketing initiatives and the development of strong distribution network can help these companies to improve their hold in the China Playing cards & board games market share.

Key Benefits for China Playing Cards & Board Games Market:

- This report provides a quantitative analysis of the current China playing cards & board games market trends, estimations, and dynamics of the market from 2018 to 2025.

- In-depth analysis of the market segmentation assists to determine the prevailing opportunity.

- Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players China playing cards & board games market.

- The report includes the analysis of the key players, market segments, and growth strategies.

China Playing Cards & Board Games Market Report Highlights

| Aspects | Details |

| By COMPETITION TYPE |

|

| By Product Type |

|

| Key Market Players | Yangzhou Jumbay International Trading Co., Ltd., Shenzhen Yahong Color Printing Co., Ltd, Ningbo Charron Industry Co., Ltd, Zhejiang Chinu Packing & Printing Co., Ltd, Yangzhou Jinyi Stationery Co., Ltd, ShangHai YaoJi Playing Card Co.,Ltd, Shenzhen Swarm Playing Cards Co., Ltd, Shenzhen ITIS Packaging Products Co., Ltd, Dongguan Bright Sea Industrial Co., Ltd, Shenzhen YHD Packaging Products Co., Ltd |

Analyst Review

The China playing cards & board games market is moderately concentrated and the top players dominate the largest share. Factors such as availability of raw materials, low labor cost, and larger production capabilities have resulted into low manufacturing cost, making China as the main exporter for the global playing cards & board games market. However, high shipping expenses, import duties and other tariffs acts as a restraint for many exporters. For instance, higher tariffs imposed on Chinese goods by the U.S. In addition, the emergence of new and cost effective manufacturing centers such as India & Vietnam are affecting the China playing cards & board games market. Furthermore, the leading vendors are rapidly leveraging technological advancement to offer innovations and upgrades to a large number of consumers in the market. Most of the playing cards & board games manufacturers in China are OEMs but now the manufacturers are focusing on R&D and taking the advantage of to develop new products. Thus, offering variety of new and innovative products to consumer. These manufacturers are competing on the basis of gameplay, differentiation, game genre, and platform type. The players are focusing on digitalization and developing supporting mobile applications to enhance customers' experiences in the playing cards & board games market.

Loading Table Of Content...