Chitosan Market Overview:

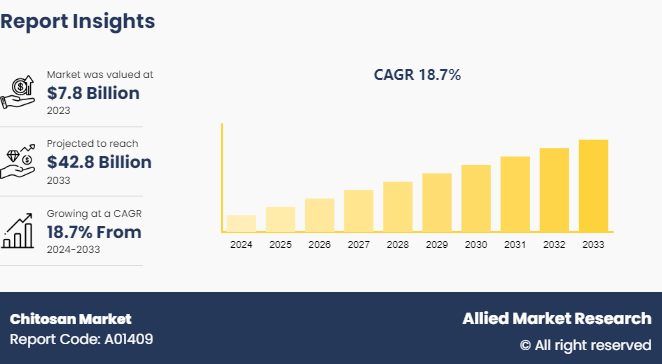

The global chitosan market size was valued at $7.8 billion in 2023, and is projected to reach $42.8 billion by 2033, growing at a CAGR of 18.7% from 2024 to 2033.

Market Introduction and Definition

Chitosan is a natural polysaccharide derived from chitin, which is found in the exoskeletons of crustaceans such as shrimp, crabs, and lobsters. It is produced through a process of deacetylation, where chitin is treated with an alkaline substance to remove acetyl groups, converting it into chitosan. This biopolymer is known for its biocompatibility, biodegradability, and non-toxicity, making it highly valuable in various applications.

Chitosan possesses excellent film-forming and gelling properties, which are beneficial in medical and pharmaceutical fields for wound dressings, drug delivery systems, and tissue engineering. It also has antimicrobial properties, enhancing its use in food preservation and packaging. In agriculture, chitosan is used as a natural pesticide and plant growth enhancer. In addition, its ability to chelate metals makes it useful in water treatment processes for removing heavy metals and other contaminants. Chitosan's versatility and eco-friendly nature drive its demand across multiple industries, despite production and regulatory challenges.

Key Takeaways

- The chitosan market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major chitosan industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Rise in demand for chitosan in water treatment is a significant driver propelling the growth of the chitosan market. Chitosan, a natural biopolymer derived from chitin, exhibits remarkable adsorption and flocculation properties, making it highly effective in water treatment processes. Its ability to remove heavy metals, organic pollutants, and pathogens from wastewater has garnered attention from industries, municipalities, and environmental agencies globally. With increasing concerns about water scarcity, pollution, and the need for sustainable solutions, chitosan's role in water treatment has become increasingly prominent. According to a report published by the National Institution for Transforming India (NITI Aayog) , in February 2021, India's wastewater treatment plants market stood at $2.4 billion in 2019 and is projected to reach $4.3 billion by 2025, owing to increase in demand for municipal and sewage water treatment plants across the country.

Furthermore, chitosan offers several advantages over traditional chemical coagulants and flocculants, such as being biodegradable, non-toxic, and environmentally friendly. This has led to its widespread adoption in various water treatment applications, including drinking water purification, industrial wastewater treatment, and stormwater management. In addition, stringent regulations governing water quality standards and discharge limits have prompted industries to invest in advanced water treatment technologies, further driving the demand for chitosan-based solutions.

Limited availability of source materials for chitosan production poses a significant constraint on the growth of the chitosan market. Chitosan is primarily derived from crustacean shells, such as shrimp and crabs, making its availability subject to factors like seasonal fluctuations, fishing regulations, and environmental sustainability concerns. As demand for chitosan continues to rise across various industries, including pharmaceuticals, cosmetics, and food, the finite supply of crustacean shells is expected to restrain the increasing market demand. This limited availability can lead to price volatility and supply chain disruptions, hindering the scalability and competitiveness of chitosan-based products. Moreover, concerns about overfishing, environmental impact, and ethical sourcing practices further exacerbate the challenges associated with material availability. Addressing these constraints through sustainable sourcing practices, alternative raw material sources, and technological innovations is expected to be crucial for unlocking the full potential of the chitosan market.

The expansion of chitosan applications in agriculture and horticulture presents a promising opportunity for the market growth. Chitosan, with its natural biodegradability, biocompatibility, and antimicrobial properties, offers numerous benefits in crop protection, soil enhancement, and plant growth promotion. In agriculture, chitosan-based formulations can effectively control pests and diseases, reduce the need for chemical pesticides, and improve crop yields. In addition, chitosan's ability to stimulate plant defense mechanisms and enhance nutrient uptake makes it valuable for promoting healthier plant growth and improving soil fertility in horticultural settings. As the demand for sustainable agricultural practices and eco-friendly solutions continues to rise, there is rise in interest in chitosan-based products among farmers and horticulturists. This trend is expected to drive the adoption of chitosan in agricultural and horticultural applications, thereby fueling the market growth in the coming years.

Market Segmentation

The chitosan market is segmented into source, application, and region. By source, the market is classified into shrimp, squid, crab, krill, and others. By application, the market is divided into water treatment, biomedical and pharmaceutical, cosmetics, food and beverage, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the chitosan market include PRIMEX EHF, ADVANCED BIOPOLYMERS AS, Panvo Organics Pvt Ltd., Heppe Medical Chitosan GmbH, G.T.C. Bio Corporation, Kitozyme S.A., Novamatrix, Agratech International, Inc., Golden-Shell Pharmaceutical Co. Ltd., and Qingdao Yunzhou Biochemistry Co. Ltd.

Recent Key Strategies and Developments

- In July 2023, Axio Biosolutions Pvt. Ltd. obtained 510 (k) clearance from the U.S. Food and Drug Administration (FDA) for its Axiostat Gauze line of enhanced hemostatic gauze, designed to prevent severe traumatic bleeding. The Axiostat Z-fold Hemostatic gauze, which is entirely chitosan-based, is built on advanced biomaterial technology and has already received CE certification. This product is used by various military forces worldwide to control trauma-related bleeding.

- In May 2023, FMC Corporation partnered with Syngenta Crop Protection to introduce an innovative weed control solution for rice. This solution features Tetflupyrolimet, a novel active ingredient discovered and developed by FMC for use in rice, with support from Syngenta.

- In March 2023, Meron Group introduced new dessert premixes specifically designed for the HoReCA sector. The company's launch will focus on ready-to-use premixes and specialized blends.

- In November 2022, Chitogen Inc., a U.S.-based medical manufacturing company, signed a letter of intent with Tru Shrimp to purchase commercial quantities of chitosan derived from the ground-up exoskeletons of farm-raised shrimp. This initiative aims to support the construction of a large-scale shrimp farm in South Dakota, U.S.

- In September 2021, KitoZyme unveiled a new version of its vegan chitosan at Vitafoods. The company has developed a patented process for industrial-scale production of chitin and chitosan from fungi. This groundbreaking innovation has significantly influenced the perception and potential applications of these biopolymers.

- In March 2021, in Brazil, the University of Brasilia, in collaboration with the University of Campinas, Centro de Pesquisa em Biotecnologia Ltda, Hospital Regional da Asa Norte (HRAN) , Hospital da Região Leste (HRL) , and Hospital Universitário de Brasília (HUB/UnB) , conducted the VESTA clinical trial to evaluate the efficacy of a novel respirator.

- In April 2020, Axio Biosolutions Private Limited introduced MaxioCel, a next-generation chitosan-based wound dressing. MaxioCel offers rapid healing and high comfort, benefiting patients with pressure ulcers, venous leg ulcers, diabetic foot ulcers, post-surgical wounds, cavity wounds, donor site wounds, and skin abrasions.

- In March 2020, Bioavanta-Bosti, a leader in chitosan nanoparticle research, has introduced Novochizol, an innovative chitosan nanoparticle technology. Novochizol is designed to deliver and confine potential anti-COVID-19 medications directly to the lungs of critically ill patients.

Regional Market Outlook

Growth of the chitosan market in the Asia-Pacific region is being driven by rise in demand from multiple industries. The water treatment industry is witnessing significant growth due to rising concerns about water pollution and scarcity, leading to higher adoption of chitosan-based solutions for wastewater treatment. In addition, the pharmaceutical industry's expanding applications of chitosan in drug delivery systems and wound healing are contributing to the market growth. Furthermore, the booming fish production sector in Asia-Pacific is driving the demand for chitosan in aquaculture applications, such as shrimp farming and fish feed additives. Collectively, these factors are fueling the growth of the chitosan market in the region.

- According to The National Fisheries Development Board, in India, total fish production during 2020 was estimated to be 12.60 million metric tons, of which nearly 65% was from the inland sector and about 50% of the total production was from culture fisheries, constituting about 6.3% of the global fish production.

- The expanding middle-class and aging demographic, rise in urbanization, and rising incomes, are key drivers of pharmaceutical sales growth in China. As per CEIC Data, pharmaceutical sales revenue in China surged to $223, 946 million in June 2022 from $146, 041 million in April 2022. The nation hosts a sizable and varied domestic pharmaceutical industry, featuring roughly 5, 000 manufacturers, including numerous small to medium-sized enterprises.

- India stands out as a significant and growing participant in the global pharmaceutical industry. As per PIB India, it serves as one of the leading sources of generic medications globally, contributing 20% of the global supply in terms of volume. Indian pharmaceuticals are shipped to over 200 nations, with particular emphasis on the U.S. as a primary destination.

- As per the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil) , India shipped pharmaceutical products, including bulk drugs and drug intermediates, valued at $24.62 billion during the fiscal year 2021-22.

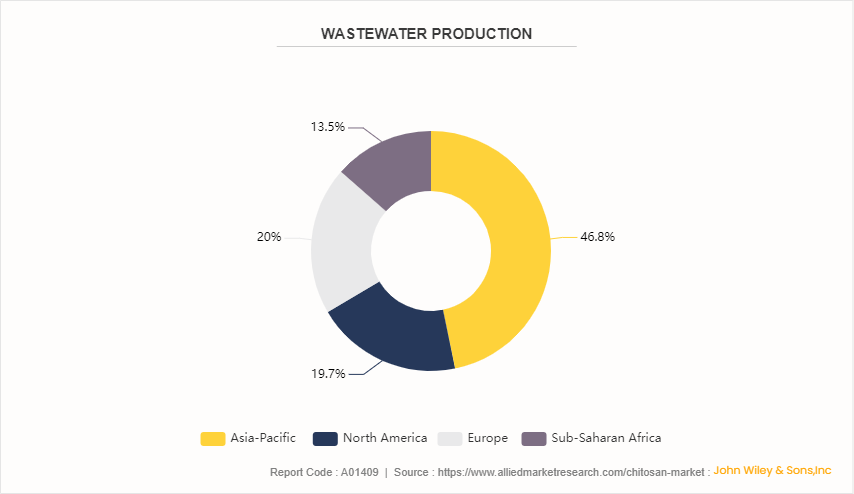

- According to the NITI Aayog India, 380 billion m3 of wastewater is generated annually across the world. Based on the rate of population growth and urbanization, the daily wastewater generated is expected to increase by 24% (470 billion m3) by the end of 2030 and 51% (574 billion m3) by 2050.

- Waste management and sanitation remain a problem in developing Asia. Most Asian cities do not have effective wastewater treatment systems. In the Philippines, only 10% of wastewater is treated while in Indonesia 14%, in Vietnam, it is 4%, and in India, it is 9%. All these factors create new opportunities for the chitosan market in Asia-Pacific.

Increasing Wastewater Production to Drive Growth of Chitosan Market

Rise in production of wastewater globally, is expected to drive the growth of the chitosan market. Chitosan, with its excellent adsorption properties, is highly effective in removing heavy metals, dyes, and other contaminants from wastewater. As industrialization and urbanization continue to escalate, the demand for efficient and eco-friendly water treatment solutions rises. Chitosan offers a sustainable alternative to traditional chemical treatments, aligning with the growing emphasis on environmental conservation and stringent regulatory standards for wastewater management. Consequently, the expanding need for advanced wastewater treatment solutions will propel the adoption and growth of chitosan in this sector.

Industry Trends

- The demand for non-GMO cosmetic components, such as chitosan, is rising due to increase in the number of health-conscious consumers. This trend in the global market for cosmetic ingredients indicates a growing preference for non-GMO-certified products. Concerns among parents about the ingredients in baby products have led to a preference for functional, non-GMO, and unmodified substances, likely driving the chitosan market growth in the near future.

- In March 2021, a VESTA clinical trial was conducted in collaboration with the University of Brasilia, University of Campinas, Hospital da Região Leste (HRL) , Hospital Universitário de Brasília (HUB/UnB) , Hospital Regional da Asa Norte (HRAN) , and Centro de Pesquisa em Biotecnologia Ltda. The trials aimed to evaluate the effectiveness of a novel respirator equipped with chitosan nanoparticles in reducing COVID-19 infection rates among healthcare professionals.

- The invention of tissue engineering is gaining popularity as it replaces biological functions and improves tissues such as skin, muscle, cartilage, blood vessels, bladder, and bone. Chitosan is the primary biomaterial used in tissue engineering due to its non-toxicity, low allergenicity, biocompatibility, biodegradability, and bioactivity. In wastewater treatments, chitosan is used as an adsorbent and flocculant, effectively removing pollutants from industrial, textile, pulp, paper, and municipal wastewater, including heavy metal ions.

- Chitosan's hydrophobicity, biocompatibility, and biodegradability are key characteristics driving the chitosan market growth. Specific modifications of chitosan’s chemical structure are fostering its use in biomedicine, food and beverages, pharmaceuticals, and cosmetics. Chitosan nanoparticles are emerging as potential drug delivery agents, creating numerous opportunities in the chitosan market. In addition, chitosan is used to manufacture environment-friendly pesticides (agrochemicals) , assisting beneficial soil microorganisms while inhibiting harmful ones.

Key Sources Referred

- Indian Brand Equity Foundation

- Pharmaceutical Export Promotion Council of India

- PIB India

- CEIC Data

- The National Fisheries Development Board

- NITI Aayog India

- Pharmaceutical Export Promotion Council of India (Pharmexcil)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the chitosan market analysis from 2024 to 2033 to identify the prevailing chitosan market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the chitosan market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global chitosan market trends, key players, market segments, application areas, and market growth strategies.

Chitosan Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 42.8 Billion |

| Growth Rate | CAGR of 18.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Source |

|

| By Application |

|

| By Region |

|

| Key Market Players | PRIMEX EHF, G.T.C. Bio Corporation, Novamatrix, Kitozyme S.A., Panvo Organics Pvt Ltd., Golden-Shell Pharmaceutical Co. Ltd., Qingdao Yunzhou Biochemistry Co. Ltd., ADVANCED BIOPOLYMERS AS, Heppe Medical Chitosan GmbH, Agratech International, Inc. |

Analyst Review

The chitosan market for water treatment accounted for the highest share as it covered more than one-third of the global market. Other than water treatment, the biomedical & pharmaceuticals market is expected to grow at the fastest rate, owing to the extensive research activities focused on using chitosan for transdermal drug delivery systems and as a hemostatic agent in bandages. Chitosan is known to have excellent hemostatic properties and can clot blood faster than other hemostatic agents. HemCon, Celox, Chitoseal, QuikClot, and Chitoflex are some of the commercialized chitosan based dressings that are used to control moderate to severe bleeding. The cost of pharmaceutical grade chitosan with around 90% degree of deacetylation varies from $35 to $70 per kilogram.

Chitosan Based Commercial Hemostatic Dressings

Commercial Name | Company | Material | Function |

HemCon | HemCon | Freeze-dried chitosan acetate salt | Stops bleeding in emergency situations |

Chitoflex | HemCon | Chitosan based biocompatible and antibacterial wound dressing | To control moderate to severe bleeding by stuffing in the wound |

Chitoseal | Abbott | Chitosan based dressing with cellulose coating | For major wounds with bleeding |

Clo-sur | Scion | Chitosan based pressure pad | Accelerates wound healing when applied topically |

TraumaStat | Ore-Medix | Freeze-dried chitosan containing highly porous silica | To stop bleeding of superficial wounds, minor cuts, and abrasions |

Syvek-Patch | Marine Polymer Technologies | Made of fully acetylated, high molecular-weight chitin in a crystalline, three-dimensional beta structure array | 7 times faster in achieving hemostasis than fibrin glue |

QuikClot eX | Z-Medica Corporation | Chitosan based | To stop bleeding in emergency situations |

BST-CarGel | Biosyntech Company | Chitosan-glycerophosphate hydrogels | Cartilage repair |

Based on the source from which chitosan is extracted, the market can be segmented across shrimp, crab, squid, and krill. Although, squid pen is a rich source of chitin, large scale production is not feasible due to its low availability. Consequently, shrimp and crab are the two major sources for chitin and chitosan production; as shrimp shell waste yields 25-40% chitin, while crab yields about 20% chitin.

Geographically, Asia-Pacific dominates the global chitosan industry, accounting for more than half of the total market size. Asia-Pacific has abundant raw materials owing to the presence of coastal areas, resulting in a significant presence of both, small and large scale market players. The processing of shell waste must be done immediately as the microbes tend to start reducing the chitin content rapidly. However, freezing the shells can help retain the chitin content for a longer time. Thus, during the export and import of shell waste, the shells are preserved by drying or freezing methods. The key market players in Thailand are more focused on the production of agricultural grade chitosan.

The chitosan market was valued at $7.8 billion in 2023 and is estimated to reach $42.8 billion by 2033, exhibiting a CAGR of 18.7% from 2024 to 2033.

Expanding applications in food and beverage industry is the upcoming trend of Chitosan Market in the globe.

Asia-Pacific is the largest regional market for Chitosan .

PRIMEX EHF, ADVANCED BIOPOLYMERS AS, Panvo Organics Pvt Ltd., Heppe Medical Chitosan GmbH, G.T.C. Bio Corporation, Kitozyme S.A., Novamatrix, Agratech International, Inc., Golden-Shell Pharmaceutical Co. Ltd., and Qingdao Yunzhou Biochemistry Co. Ltd. are the top companies to hold the market share in Chitosan.

Water treatment is the leading application of Chitosan Market.

Loading Table Of Content...