Chlorinated Paraffin Market Overview: 2031

The global chlorinated paraffin market size was valued at $1.6 billion in 2021, and is projected to reach $2.7 billion by 2031, growing at a CAGR of 5.4% from 2022 to 2031.

How to Describe Chlorinated Paraffin

Chlorinated paraffin is defined as a complex mixture of polychlorinated n-alkanes. It is produced by the synthesis of chlorine gas with paraffin fractions at a temperature of about 100°C. The residues of chlorine and hydrochloric acid are removed using nitrogen upon attainment of the desired degree of chlorination. Glycidyl ether, epoxidized vegetable oil, or organophosphorous compounds are added to the final product for enhanced stability at high temperatures. It is used in a wide range of industrial applications, such as flame retardants, plasticizers, metal working fluids, adhesives, coatings, and others.

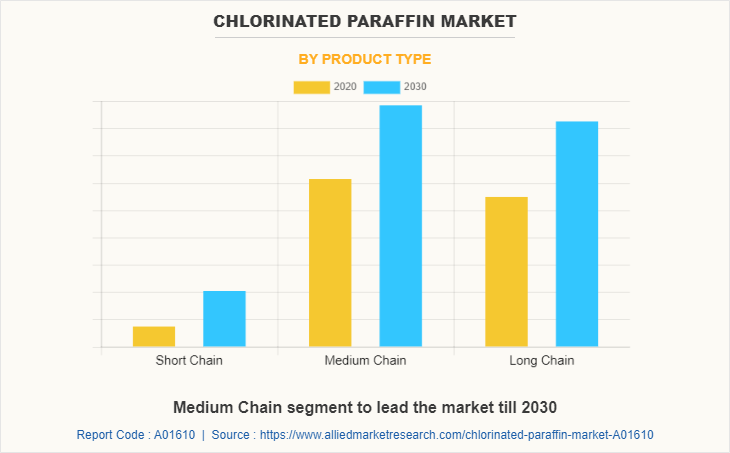

Based on the alkane chains length, the chlorinated paraffins are generally divided into short-chain (SCCPs, C10–C13), medium-chain (MCCPs, C14–C17), and long-chain CPs (LCCPs, C>17). Alkyl chain length composition and the degree of chlorination can be changed in order to produce the resulting products suited for different industrial applications. Such bulk applications include their usage as high-temperature lubricants, plasticizers, and flame retardants in various products, such as polyvinyl chloride flooring, paints, and leather sealants. SCCPs are primarily utilized in metalworking applications and leather processing, as flame retardants, and in sealants, textiles, rubbers, paints & coatings. MCCPs and LCCPs are utilized as industrial metalworking lubricants and as plasticizers in flexible polyvinyl chloride.

According to JSTOR, a part of ITHAKA, a non-profit organization, global production of chlorinated paraffin amounts to approximately 2,30,000 metric tons annually. The manufacturing cost of chlorinated paraffin is low, which in turn is predicted to surge its demand in applications, including paints & coatings, plastic, and lubricating additives.

Report Key Highlighters:

- 20 countries are covered in the chlorinated paraffin market report. The report covers segment analysis of each country in both value and volume during the forecast period 2021-2031.

- More than 3,700 product literatures, industry releases, annual reports, and other such documents of key industry participants have been reviewed to obtain a better understanding of the market and gain competitive intelligence.

- The chlorinated paraffin market is fragmented in nature with numerous manufacturers such as Aditya Birla Chemicals; Altair Chimica S.p.A.; Caffaro Industrie; Dover Chemical Corporation; Handy Chemical Corporation, Inc.; Ineos Chlor; Inovyn; KLJ Group; LEUNA Tenside GmbH, and Química del Cinca. Also tracked key strategies such as product launches, acquisitions, mergers, expansion, etc. of the players operating in the chlorinated paraffin market.

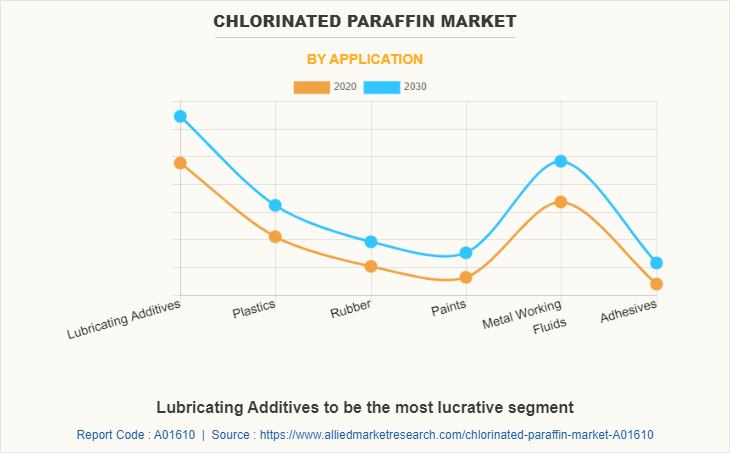

Rising demand for chlorinated paraffin from various applications such as lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives is predicted to drive the market growth during the forecast period

Chlorinated paraffin is used as paint, which is largely utilized for aesthetics, whereas coatings are generally used to avoid substrate degradation or corrosion protection. Chlorinated paraffins are employed as a plasticizer and in certain instances as flame retardants in different polyvinyl chloride (PVC) products, such as cutting oils and high-pressure lubricating oils. They are used in lubricating additives to improve lubricant performance in the automotive, marine, aviation, and industrial sectors. At high temperatures, chlorinated paraffin, generates hydrochloric acid, which combines with the metal surface and creates a thin but solid lubricant coating. Also, chlorinated paraffin is widely preferred due to its stain resistance.

Further, expansion of construction sector is expected to boost market growth in the next years, owing to increased population and rise in housing needs in emerging regions. This is owing to the significant use of PVC in the production of sheets, films, cables, wires, pipes, and other related items. Chlorinated paraffins are extensively used in PVC products owing to their superior technical properties.

Moreover, rising demand for metalworking fluids in industrial applications is anticipated to propel the demand for chlorinated paraffin during the forecast period. Easy availability of raw materials is expected to fuel the demand for chlorinate paraffin primarily in the Asia-Pacific region. However, the availability of substitutes in various applications is one of the key restraints for market growth. Companies are manufacturing biodegradable alternatives that are easy to dispose of and are not subject to stringent rules. Also, stringent government regulations pertaining to the use of chlorinated paraffins and the anticipated ban on some grades in certain applications are predicted to hinder the market growth in the near future.

Chlorinated Paraffin Market Segment Review

The chlorinated paraffin market is segmented into product type, application, and region. By product type, the market is categorized into short chain, medium chain, and long chain. On the basis of application, the market is categorized into lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. The chlorinated paraffin market share is analyzed across all significant regions and countries.

China continues to produce all types of chlorinated paraffin to meet its domestic demand for polymer and other applications. According to the National Center for Biotechnology Information, chlorinated paraffin is employed as a flame retardant in commercial furniture, especially in automobile upholstery. Chlorinated paraffin has been proposed as an ideal chemical compound for usage as a flame retardant in residential upholstered furniture in the U.S. Further, the North American chlorinated paraffin industry did not identify textiles as a primary area for the usage of chlorinated paraffin as flame retardants. Nowadays, chlorinated paraffin is not utilized as a flame retardant in residential furniture in the U.S.; however, it is employed as a flame-retardant back coating for residential furniture upholstery in the UK

Asia-Pacific dominated the market with the highest revenue share in 2021. Asia-Pacific is anticipated to exhibit the highest growth potential for chlorinated paraffin owing to its extensive use in numerous applications such as lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives. In Asia-Pacific, there is rising demand for flame retardants and PVC compounds, which is anticipated to surge the demand for chlorinated paraffin in the region. Further, rising industrialization in densely populated countries such as China and India along with growing demand from the plastic and metalworking sectors is projected to have a favorable influence on the Asia-Pacific chlorinated paraffin market growth during the forecast period.

Medium Chain segment dominated the global chlorinated paraffin market in terms of revenue, in 2021. Medium chain chlorinated paraffins have alkane chains lengths C14–C17. They are often used to substitute short chain chlorinated paraffins, since short chain chlorinated paraffin is banned in some countries. Medium chain chlorinated paraffins are used in exceptional cases as ingredients of cooling lubricant oils. This is mainly due to the costly disposal and rejection of the customers due to health, safety, and environmental reasons. Medium chain chlorinated paraffin is mainly used in cryogenic machining, which utilizes oil-based cooling fluids. It is mainly utilized as a plasticizer in the synthetic rubber processing industry owing to its full compatibility, good stability, non-flammability, and other characteristics.

Metal Working Fluids segment dominated the global chlorinated paraffin market in terms of revenue, in 2021. Chlorinated paraffin is used as an extreme-pressure additive in metal-working lubricants. Its primary benefits in lubricants include cost-effectiveness, compatibility with other additives, excellent solubility in a broad range of base oils, and others. Besides, it is used as a plasticizer and, in certain cases, as a flame retardant in various polyvinyl chloride (PVC) products used in metalworking fluids such as cutting oils and high-pressure lubricating oils.

Which are the Leading Companies in Chlorinated Paraffin

The major players operating in the global chlorinated paraffin market include Aditya Birla Chemicals; Altair Chimica S.p.A.; Caffaro Industrie; Dover Chemical Corporation; Handy Chemical Corporation, Inc.; Ineos Chlor; Inovyn; KLJ Group; LEUNA Tenside GmbH, and Química del Cinca. These players have been adopting various strategies to gain a higher share or to retain leading positions in the market. Business expansion is the most adopted strategy by these players.

For instance, in January 2022, Altair Chimica SpA expanded its business by adopting a modern and green approach involving the installation and start-up of the fourth reactor for manufacturing ‘eco-bio’ chlorinated paraffin. This is expected to enhance biodegradability and environmental sustainability. With the installation of the fourth reactor, the company will expand production potential at the photo-chlorination plant by 25%, enabling it to meet its manufacturing target of 16,000 tons annually.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the chlorinated paraffin market analysis from 2021 to 2031 to identify the prevailing chlorinated paraffin market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the chlorinated paraffin market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global chlorinated paraffin market trends, key players, market segments, application areas, and market growth strategies.

Chlorinated Paraffin Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.7 billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2021 - 2031 |

| Report Pages | 272 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Altair Chimica S.p.A., Qumica del Cinca, Handy Chemical Corporation, Inc., DOVER CHEMICAL CORPORATION, Ineos Chlor, LEUNA Tenside GmbH, Caffaro Industrie, Aditya Birla Chemicals, KLJ Group, Inovyn |

Analyst Review

According to the opinions of various CXOs of leading companies, the chlorinated paraffin market is driven by the growing plastic and metal working industries. Also, chlorinated paraffins are widely used in applications such as lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives. Chlorinated paraffin is used as an extreme pressure additive in gear oils and metal working lubricants. Furthermore, it is utilized as a plasticizer as well as flame retardant in coatings, sealants, adhesives, and PVC compounds. Chlorinated paraffin is also utilized in rubber as natural and synthetic rubber in order to enhance the lubrication. It is utilized in rubber compounds to inhibit rubber breaking in tires.

Growth of PVC industry due to surge in construction activities along with rise in applications of PVC in the healthcare and other industries is also expected to boost the demand for chlorinated paraffin during the forecast period. However, anticipated prohibition to the use of these chlorinated paraffins is expected to hamper the growth of the market. Besides, the market is expected to be hampered by the availability of application-specific substitutes to chlorinated paraffins.

Factors that drive the growth of the global chlorinated paraffin market are rise in PVC and metal working industry coupled with growth of aerospace & industrial sector. In addition, growth in automotive sector is also expected to fuel the demand for chlorinated paraffin in the near future as chlorinated paraffins are used in car tires in automotive industry.

The global chlorinated paraffin market size was valued at $1.6 billion in 2021, and is projected to reach $2.7 billion by 2031, registering a CAGR of 5.4% from 2022 to 2031.

The major players operating in the global chlorinated paraffin market include, Aditya Birla Chemicals; Altair Chimica S.p.A.; Caffaro Industrie; Dover Chemical Corporation; Handy Chemical Corporation, Inc.; Ineos Chlor; Inovyn; KLJ Group; LEUNA Tenside GmbH; and Química del Cinca.

Based on product type, medium chain segment was the highest revenue contributor to the market in 2021.

Based on application, metal working fluids segment was the highest revenue contributor to the market in 2021.

Asia-Pacific is anticipated to dominate the chlorinated paraffin market during the forecast period owing to the extensive use of chlorinated paraffin in numerous applications such as lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives.

The chlorinated paraffin market is segmented into product type, application, and region. By product type, the market is categorized into short chain, medium chain, and long chain. On the basis of application, the market is categorized into lubricating additives, plastics, rubber, paints, metal working fluids, and adhesives.

Shift of production to long chain chlorinated paraffin is the opportunity for the chlorinated paraffin market growth.

Loading Table Of Content...