Chromatography Resins Market Outlook - 2021–2030

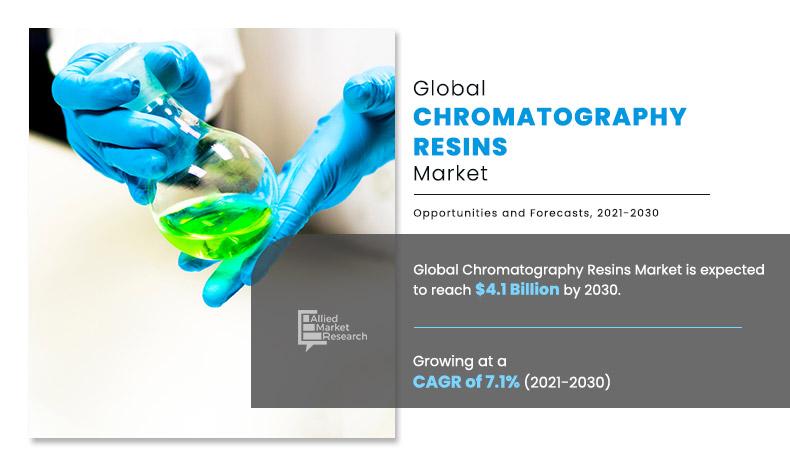

The global chromatography resins market size was valued at $2.1 billion in 2020, and is projected to reach $4.1 billion by 2030, growing at a CAGR of 7.1% from 2021 to 2030.

Chromatography resins are medias that are made up of cellulosic matrix used to aid chromatography process such as immobilization of biomolecules and purification of antibodies. Hydrophobic interaction resins, multimodal resins, size exclusion resins, and affinity resins are some examples of chromatographic resins that are available in the market.

Affinity chromatography resins are selective and effective resins that are widely used for antibody purification. In addition, these are also employed during purification of recombinant monoclonal antibody and bio-processing applications. Capturing of Fabs, dAbs, and single-chain fragment variable (scFv) antibody fragments using affinity resins containing agarose matrix is the key market trend. Factors such as binding capacity, minimal ligand leakage, and selectivity for a wide series of antibody fragments makes affinity resin widely adopted for protein purification application. Hydrophobic interaction resins are used for purification of protein, polypeptide, and nucleic acid. In addition, it can also be employed for adsorption of nonpolar materials and external active agents from aqueous solutions. Hydrophobic interaction chromatography technique does not require additional fusion of affinity tags during protein purification. This in turn reduces operational cost and makes it widely used protein purification technique. This factor is anticipated to escalate the adoption of HI resin and thereby augmenting the demand of the global market. All these factors collectively surge demand for chromatography resins, thereby augmenting the global chromatography resins market growth.

However, high production cost involved during the production of chromatography resins is anticipated to hamper the market growth.

On the contrary, multimodal or mixed mode chromatography resins are used for purification of histidine proteins and other biomolecules. In addition, it can also be employed during research, process development, and bioprocessing techniques for purification of biomolecules that are tough to discrete by other chromatography resins. Mixed mode chromatography resins are widely used owing to its selectivity and maximum degree of separation. Some separation or purification techniques are challenging and problematic. Multimodal chromatography resins are viable and advent resins that finds its application during polishing of viruses and other large biomolecule products. In addition, dual functionality and binding chromatography characteristics of these resins enables improved productivity, enhances higher sample load capability, and higher flow rates compared with size exclusion resins. This factor is anticipated to offer new opportunities in the global market.

The chromatography resins market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into hydrophobic interaction resin, multimodal or mixed-mode resin, size exclusion resin, affinity resin, ion-exchange resin, and others. By application, the market is divided into antibody purification, biomolecule separation & purifications, vaccination, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include Cytiva Lifesciences, Bio-Rad Laboratories Inc., Sartorius AG, Generon, Tosoh Bioscience, Bio-Works, Repligen Corporation, LAF-Biotechnology, JNC Corporation, and Anatrace Products LLC.

Chromatography resins market, by region

The North America chromatography resins market accounted for 43.3% of the market share in 2020 and is projected to grow at the highest CAGR of 7.6% during the forecast period. The chromatography industry in North America is increasing owing to growth in biotechnology and pharmaceutical companies. These companies help to discover new drugs for treatment, which in turn improves life expectancy. In addition, increasing focus from governmental bodies across North America in order to keep their voters healthy is another driving factor. All these factors collectively drive the demand for chromatography resins in North America region. Liquid chromatography systems are widely used chromatography systems in North America, which in turn is another considerable factor driving the growth of chromatography resins market in this region.

By Region

North America would exhibit highest CAGR of 7.6% during 2021-2030.

Chromatography resins market, by type

In 2020, the affinity resin type was the largest revenue generator, and is anticipated to grow at a CAGR of 7.2% during the forecast period. Capturing of Fabs, dAbs, and single-chain fragment variable (scFv) antibody fragments using affinity resins containing agarose matrix is the key market trend. Factors such as binding capacity, minimal ligand leakage, and selectivity for a wide series of antibody fragments makes affinity resin widely adopted for protein purification application. Moreover, these resins are capable of reducing process time and amount of resin usage during antibody fragment purification.

By Type

Ion-exchange resin type is the most lucrative segment

Chromatography resins market, by application

By application, the antibody purification segment dominated the global market in 2020, and is anticipated to grow at a CAGR of 7.4% during forecast period. Antibody purification process involves isolation antibodies from fluid pool such as polyclonal antibody or ascites fluid in order to obtain usable antibodies. Different chromatography resins are used depending upon the purification level of antibodies and its intended application. Protein A, Protein G, Protein A/G, and Protein L are types of affinity resins that are widely used chromatography resins for addressing and solving challenging downstream procedures of next-generation antibody purification and therapeutics. Protein A chromatography resins does not yield optimal results during capturing and purification of antibody modalities. However, unique selectivity of affinity chromatography resins makes it suitable resin compounds during antibody therapeutic process is the key market trend.

By Application

Antibody purification application is projected as the fastest growing segment

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current market trends and future estimations of global chromatography resins market from 2020 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

Impact Of Covid-19 On The Global Chromatography Resins Market

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and the economy around the globe. The chromatography resins market has been positively impacted due to the wake of the COVID-19 pandemic, owing to its dependence on biomolecule separation & purifications, vaccination, and protein separation application.

- Protein A derived chromatography resins are employed to overcome purification challenges that occur during development of coronavirus vaccines. For instance, Navigo and Repligen team have developed affinity resins that are used downstream processing (DSP) owing to its ability to escalate the purification speed and yield high quality COVID-19 vaccine.

- Navigo has developed protein A affinity resins that are developed or captured using spike protein from coronavirus. In addition, Repligen will offer chromatography beads that in turn enhances generation of high quality spike protein A affinity resins.

- COVID-19 vaccines are based on recombinant protein and production involves several challenges in DSP process. For instance, low concentration and high background capacity of host cell proteins make these vaccine production and purification a time consuming and high cost production steps. In addition, primary DSP steps includes chronological chromatography steps, manufacturers need to handle large volumes of liquid, and every protein vaccine requires newly developed-from-scratch DSP. Thus, to overcome these problems, vaccine manufacturers are following affinity chromatography techniques which in turn is escalating the demand of chromatographic resins amid COVID-19 pandemic.

- Affinity chromatographic resins are capable of binding and isolating target protein vaccine proficiently from insipid and compound liquid mixtures. Moreover, other types of COVID-19 vaccines such as m-RNA based those are under development by Curevac, BioNtech, and Moderna are employing affinity resins during production of vaccines. All these factors are driving the demand of the global market despite of ongoing COVID-19 pandemic.

- Apart from vaccine production, chromatography finds its application during understanding and production of diagnostic tools that are utmost important to curb the spread of virus. This is another considerable factor driving the demand of global market in the pandemic situation. Apart from vaccine production, chromatography technique is also employed to test COVID-19 infection through breath test. Growing demand for accuracy and swift recognition of COVID-19 infection in patients is growing which in turn escalating the demand and production of chromatographic resins. At early stage of COVID-19 pandemic, tests used to be carried out in laboratories. This process is time consuming, involves high cost, and requires resources. Thus, to overcome these problems, several research and development activities are carried and developed rapid diagnosis using gas chromatography-ion mobility spectrometry technique. All these factors have positively impacted on the growth of global chromatography resins market.

Chromatography Resins Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The global chromatography resins market is expected to exhibit high growth potential owing to its use in biomolecule separation & purifications, protein purification, and vaccine production & purification. Affinity chromatography resins are gaining importance in the market as these resins are effective for purifying antibodies that are further used in research & bioprocessing sector. In addition, these resins are designed to offer improved productivity and benefit large scale antibody fragment purification. Recent development in affinity chromatographic resin such as Protein G affinity resins aids purification of IgG’s from compound species. All these factors are driving the growth of global chromatography resins market.

Antibody fragments containing kappa light chains such as Fab’s are gaining importance in biopharmaceutical sector owing to its advantages over monoclonal compounds. Immunoprecipitation resins are capable of purifying these antibody fragments. his is not only gaining immense attention in the market but is also emerging as a key strategy in terms of gaining additional market demand. Moreover, Sepharose chromatographic resin along with immobilized NADP structural analog compound are widely used for enzyme purification. High capacity and formation of pressure stable polymer compounds make ion-exchange, affinity, and size exclusion resins widely used for purification of histidine tagged along with recombinant proteins.

Adoption of chromatography resins in biomolecule separation & purification application and development of affinity chromatography resins are the key factors boosting the chromatographic resins market growth

The global chromatography resins market forecast was valued at $2.1 billion in 2020, and is projected to reach $4.1 billion by 2030, growing at a CAGR of 7.1% from 2021 to 2030.

Cytiva Lifesciences, Bio-Rad Laboratories Inc., Sartorius AG, Generon, Tosoh Bioscience, Bio-Works, Repligen Corporation, LAF-Biotechnology, JNC Corporation, and Anatrace Products LLC are the most established players of the global chromatographic resins market.

Antibody purification industry is projected to increase the demand for chromatographic resins Market.

The chromatography resins market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into hydrophobic interaction resin, multimodal or mixed-mode resin, size exclusion resin, affinity resin, ion-exchange resin, and others. By application, the market is divided into antibody purification, biomolecule separation & purifications, vaccination, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Affinity chromatography resins are selective and effective resins that are widely used for antibody purification. In addition, these are also employed during purification of recombinant monoclonal antibody and bio-processing applications. Capturing of Fabs, dAbs, and single-chain fragment variable (scFv) antibody fragments using affinity resins containing agarose matrix is the key market trend. Factors such as binding capacity, minimal ligand leakage, and selectivity for a wide series of antibody fragments makes affinity resin widely adopted for protein purification application. Hydrophobic interaction resins are used for purification of protein, polypeptide, and nucleic acid. In addition, it can also be employed for adsorption of nonpolar materials and external active agents from aqueous solutions. Hydrophobic interaction chromatography technique does not require additional fusion of affinity tags during protein purification. This in turn reduces operational cost and makes it widely used protein purification technique.

Antibody purification and biomolecule separation & purifications applications are expected to drive the adoption of chromatographic resins.

Loading Table Of Content...