Circuit Breakers Market Overview

The global circuit breakers market size was valued at $11.9 billion in 2023, and is projected to reach $23 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033. The circuit breaker market is driven by rising electrification, expanding infrastructure, and the growing demand for a reliable power supply. Additionally, rapid industrialization, urbanization, and the increasing integration of renewable energy sources are key factors fueling market growth.

Key Market Trends

Based on type, the interior circuit breaker segment is projected to lead the market throughout the analysis period.

By insulation type, gas segment is expected to dominate the market throughout the analysis period.

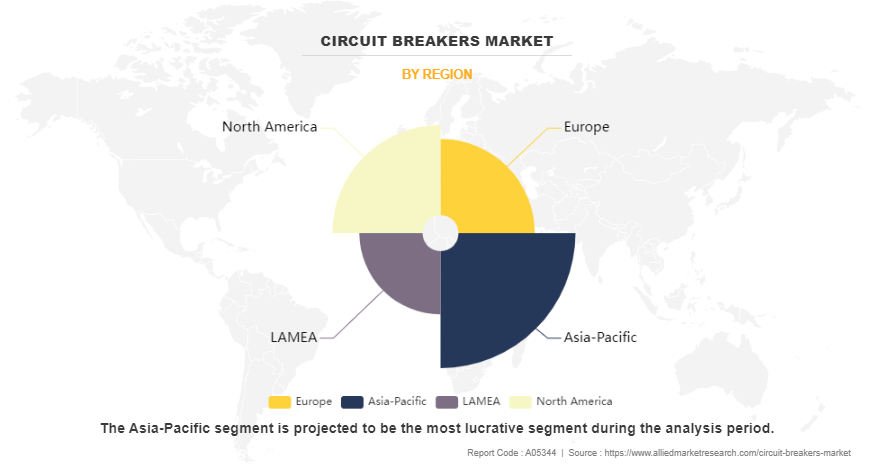

Regionally, Asia-Pacific led the market during the analysis period, driven by a significant surge in regional demand for reliable power protection solutions

Market Size & Forecast

2033 Projected Market Size: USD 23 billion

2023 Market Size: USD 11.9 billion

Compound Annual Growth Rate (CAGR) (2024-2033): 6.9%

Key Takeaways

The global circuit breakers market is highly fragmented, with several players including ABB, Eaton, Siemens, Kirloskar Electric Company, LS ELECTRIC Co., Ltd, Powell Industries, Alstom SA, Mitsubishi Electric Corporation, Schneider Electric, and Toshiba Corporation.

More than 4,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and circuit breakers market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Circuit breakers market news and key industry trends are also included in the report.

What is the role of circuit breakers

A circuit breaker is an electrical safety device designed to automatically interrupt the flow of current in an electrical circuit when it detects an overload, short circuit, or other fault condition. It serves as a protective measure to prevent damage to electrical equipment, reduce the risk of fire, and ensure the safety of individuals working with electrical systems. It rapidly opens when a fault occurs and breaks the circuit and stops the flow of electricity.

Market Dynamics

As electrical systems become more complex and widespread, the need for robust protection against potential hazards such as overloads, short circuits, and electrical fires has grown significantly. Stricter safety regulations and compliance requirements across industries, businesses, and homes boost the adoption of advanced circuit breakers to safeguard both people and equipment. Increase in adoption of renewable energy systems, electric vehicles, and smart homes accelerates the need for circuit breakers designed to handle new and unpredictable electrical loads, ensuring systems operate safely within regulatory frameworks. All these factors are expected to drive the demand for circuit breakers during the forecast period.

However, high initial cost of circuit breakers, particularly advanced vacuum circuit breakers (VCBs) and SF6 circuit breakers, is a significant barrier to their widespread adoption, especially in price-sensitive markets or regions with limited infrastructure budgets. These circuit breakers, which offer advanced features and higher interrupting ratings, come with a substantial upfront investment compared to simpler devices. This cost burden is particularly challenging for utility companies and industries that require large quantities of circuit breakers for infrastructure upgrades. All these factors hamper circuit breakers market growth.

Moreover, innovations in materials and designs have made circuit breakers more compact, reliable, and cost-effective. For instance, the development of vacuum circuit breakers and sulfur hexafluoride (SF6) alternatives has made circuit breakers more efficient in high-voltage applications, improving their performance and reducing environmental impact. These innovations enhance the functionality of circuit breakers and contribute to sustainability goals by minimizing greenhouse gas emissions. All these factors are anticipated to offer new growth opportunities for the circuit breakers market during the forecast period.

Circuit Breakers Market Segment Review:

The circuit breakers market is segmented into system type, product type, voltage, insulation type, installation, end user, and region. On the basis of type, the market is divided into interior circuit breaker and strap circuit breaker. On the basis of product type, the market is segregated into D-type circuit breakers, E-type circuit breakers, G-type circuit breakers, M-type circuit breaker, B-type circuit breakers, front-accessible E-type circuit breakers, front-accessible G-type circuit breakers, and others. On the basis of voltage, the market is classified into low, medium, and high. On the basis of insulation type, the market is categorized into vacuum, air, gas, and oil. On the basis of installation, the market is bifurcated into indoor and outdoor. On the basis of end user, the market is fragmented into residential, commercial, industrial, and utilities. Region-wise, the circuit breakers market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Global Market By Type

The interior circuit breaker segment is expected to dominate the circuit breakers market throughout the analysis period. A The rising demand for interior circuit breakers is driven by the growing need for improved safety and reliability in residential, commercial, and industrial electrical systems. As urbanization accelerates and smart buildings are constructed, the adoption of advanced interior circuit breakers is increasing to protect against electrical faults and overloads. Furthermore, the shift toward energy-efficient solutions and adherence to strict safety regulations are further fueling their demand. Innovations in compact designs and the integration of circuit breakers with smart home systems also play a key role in their growing popularity.

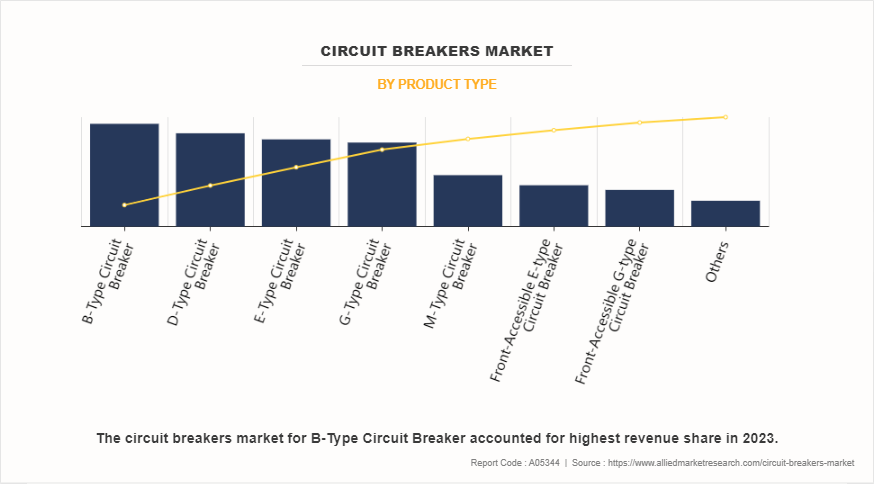

Global Market By Product Type

B-type circuit breaker accounted for highest revenue share in 2023. The demand for B-Type circuit breakers is increasing due to their effectiveness in residential and light commercial applications, where they offer reliable protection against low-level short circuits and overloads. These breakers are especially preferred in environments with mostly resistive loads, such as lighting and heating systems, ensuring both safety and reliability. The growing adoption of energy-efficient electrical systems and the ongoing construction of residential and commercial buildings further contribute to their demand. Additionally, adherence to safety standards and the need for accurate fault detection support their continued market growth.

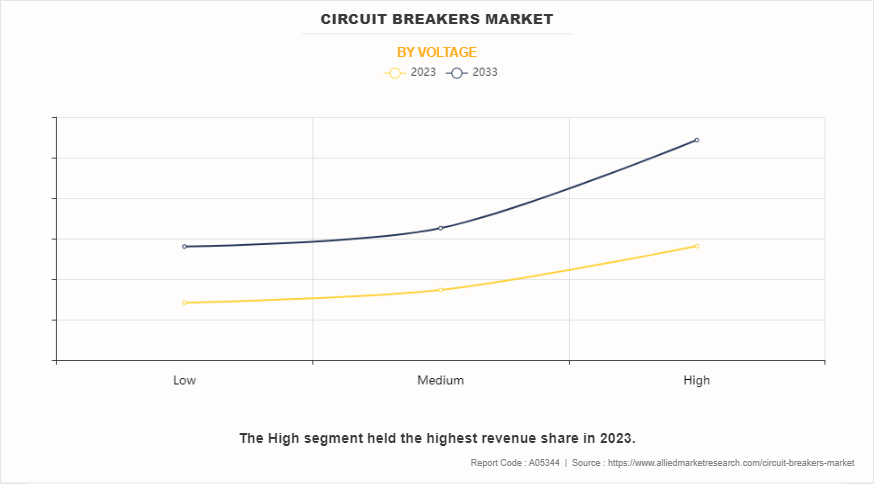

Global Market By Voltage

The high segment held the highest share in 2023. The demand for high-voltage circuit breakers is increasing due to the expansion of power transmission networks and the integration of renewable energy sources into the grid. These breakers are crucial for maintaining safety and reliability in high-voltage applications, safeguarding equipment and infrastructure from faults and overloads. Rising investments in infrastructure projects, especially in developing regions, along with the need to modernize aging electrical systems, are driving their adoption. Moreover, advancements in smart grid technology and the growing electrification of industrial sectors are further fueling the demand for high-voltage circuit breakers.

Global Market By Insulation Type

Gas segment is expected to dominate the circuit breakers market throughout the analysis period. The demand for gas-insulated circuit breakers is rising due to their exceptional performance in high-voltage applications and compact design, which makes them ideal for installations in space-limited environments. These breakers provide high reliability, low maintenance, and excellent insulation, all of which are critical for modern power grids. The increasing adoption of renewable energy projects, urbanization, and the expansion of transmission networks are major drivers behind the demand for gas-insulated circuit breakers. Additionally, the growing need for environmentally friendly solutions has spurred innovation in eco-efficient gas-insulated technologies, further accelerating market growth.

Global Market By Insulation

The outdoor segment held the highest revenue share in 2023. The demand for outdoor-installed circuit breakers is increasing due to their vital role in safeguarding electrical infrastructure within power generation, transmission, and distribution networks. Built to endure harsh environmental conditions, these breakers are crucial for ensuring grid stability and preventing outages. The growing investments in renewable energy projects and the expansion of power grids, particularly in rural and remote regions, are driving their adoption. Furthermore, the modernization of outdated infrastructure and advancements in weather-resistant materials and technologies are further fueling the rising demand for outdoor-installed circuit breakers.

Global Market By End User

The utilities segment accounted for the highest revenue share in 2023. The demand for circuit breakers in utilities is rising as power companies focus on improving grid reliability, safety, and efficiency. As transmission and distribution networks expand and renewable energy sources are integrated, utilities need advanced circuit breakers to handle increasing power loads and safeguard vital infrastructure. Furthermore, the drive for grid modernization, smart grid implementation, and adherence to stringent safety regulations is accelerating adoption. Innovations in high-voltage and digital circuit breakers designed specifically for utility applications are also contributing to the market's growth.

Global Market By Region

Asia-Pacific dominated the market during the analysis period. The Asia-Pacific region is witnessing a substantial increase in the demand for circuit breakers, fueled by rapid urbanization, industrial growth, and the expansion of power infrastructure. As nations in the region make significant investments in renewable energy, smart grid technologies, and the modernization of electrical networks, the need for reliable and efficient circuit breakers is growing. The ongoing construction of residential, commercial, and industrial buildings, coupled with a greater emphasis on electrical safety standards, further drives this demand. Additionally, the region's expanding economies and government efforts to enhance energy distribution and electrification in rural areas are contributing to the rising need for circuit breakers in the Asia-Pacific market.

Which are the Top Circuit Breakers companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the circuit breakers industry.

ABB

Eaton

Siemens

Kirloskar Electric Company

LS ELECTRIC Co., Ltd

Powell Industries

Alstom SA

Mitsubishi Electric Corporation

Schneider Electric

Toshiba Corporation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the circuit breakers market analysis from 2023 to 2033 to identify the prevailing circuit breakers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the circuit breakers market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global circuit breakers market trends, key players, market segments, application areas, and market growth strategies.

Circuit Breakers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 23 billion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 466 |

| By Type |

|

| By Product Type |

|

| By Voltage |

|

| By Insulation Type |

|

| By Installation |

|

| By End-user |

|

| By Region |

|

| Key Market Players | Siemens, LS ELECTRIC Co., Ltd, TOSHIBA CORPORATION, Powell Industries Inc., Schneider Electric, Alstom SA, Kirloskar Electric Company, Eaton, Mitsubishi Electric Corporation, ABB |

Analyst Review

According to the opinions of various CXOs of leading companies, the circuit breakers market is expected to witness an increase in demand during the forecast period. Rise in demand for electrical safety standards and rapid industrialization & urbanization are expected to boost the demand for circuit breakers during the forecast period. As electrical systems become more complex and widespread, safety becomes a critical concern. Faults such as overloads, short circuits, and electrical fires cause significant damage to property, equipment, and even lead to loss of life. To mitigate these risks, governments and regulatory bodies worldwide have implemented stricter electrical safety standards that mandate the use of advanced circuit protection devices, including circuit breakers. These devices are essential for ensuring that electrical systems operate safely within prescribed limits, providing automatic disconnection during faults and helping to prevent accidents. As safety regulations continue to tighten, the demand for reliable circuit breakers is expected to rise during the forecast period.

In addition, rapid industrialization and urbanization drives the demand for circuit breakers. As cities expand and industries grow, the need for robust electrical infrastructure increases. Electrical systems in urban areas and industrial settings must support larger, more complex networks, leading to higher electrical loads and an increased risk of faults. In these environments, circuit breakers are crucial in protecting electrical systems from damage caused by overloads and short circuits. The continuous development of industries, commercial sectors, and residential areas drives the need for safe and efficient electrical systems. As a result, the demand for circuit breakers to meet the growing safety and operational needs of these expanding systems continues to grow.

The circuit breakers market was valued at $11.9 billion in 2023, and is estimated to reach $23 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Key players in the circuit breakers market include ABB, Eaton, Siemens, Kirloskar Electric Company, LS ELECTRIC Co., Ltd, Powell Industries, Alstom SA, Mitsubishi Electric Corporation, Schneider Electric, and Toshiba Corporation.

Utilities is the leading application of Circuit Breakers Market.

Asia-Pacific is the largest regional market for Circuit Breakers.

The increasing demand for electrical safety standards, along with rapid industrialization and urbanization, is anticipated to drive the demand for circuit breakers throughout the forecast period.

Loading Table Of Content...

Loading Research Methodology...