Circulating Tumor Cell Market Research, 2033

The global circulating tumor cells market size was valued at $11.8 billion in 2023, and is projected to reach $43.5 billion by 2033, growing at a CAGR of 13.9% from 2024 to 2033. The major factors driving the market growth are rising prevalence of cancer globally, increasing the demand for early diagnosis and personalized treatment. Furthermore, heightened awareness and investment in cancer research and development, along with the growing focus on liquid biopsy techniques, are propelling market growth. Circulating tumor cells (CTCs) are cancer cells that have detached from the primary tumor and circulate in the bloodstream, potentially leading to the formation of metastases in distant organs. These cells are significant in the context of cancer diagnosis, prognosis, and treatment monitoring because their presence often correlates with disease progression and can provide real-time insights into tumor dynamics. Various methods have been developed to detect and analyze circulating tumor cells, including immunomagnetic separation, microfluidic devices, and molecular assays. Immunomagnetic separation techniques use antibodies attached to magnetic beads to isolate circulating tumor cells based on specific cell surface markers. Microfluidic devices, on the other hand, exploit the size and physical properties of circulating tumor cells to separate them from normal blood cells. Molecular assays, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) , can identify genetic mutations and expressions specific to circulating tumor cells.

Key Takeaways

- The circulating tumor cells market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major circulating tumor cells industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to the circulating tumor cells market analysis key factors driving the growth of the market are rise in prevalence of cancer, technological advancements, increase in adoption of personalized medicine and non-invasive nature of circulating tumor cells tests. As cancer incidences increase globally, the demand for advanced diagnostic and monitoring tools has surged significantly. In 2023, the Pan American Health Organization reported around 20 million newly diagnosed cancer cases and 10 million cancer-related deaths. Circulating tumor cells are cancer cells that have detached from the primary tumor and circulate in the bloodstream, providing crucial information about the disease's progression and metastasis. Early and accurate detection of circulating tumor cells can significantly enhance treatment decisions, leading to better patient outcomes.Thus, the rise in the prevalence of the cancer is expected to contribute significantly in the circulating tumor cells market growth.

In addition, according to circulating tumor cells market opportunity analysis the rise in awareness about circulating tumor cells diagnosis is a significant driver for the circulating tumor cells market. This increased awareness is fueled by growing recognition among healthcare professionals and patients of the pivotal role circulating tumor cells play in cancer diagnosis, prognosis, and treatment monitoring. As awareness spreads, there is a greater demand for advanced diagnostic technologies and liquid biopsy methods that can detect and analyze circulating tumor cells with high precision. Thus, the rise in the awareness about the circulating tumor cells diagnosis is expected to drive the growth of the circulating tumor cells market size.

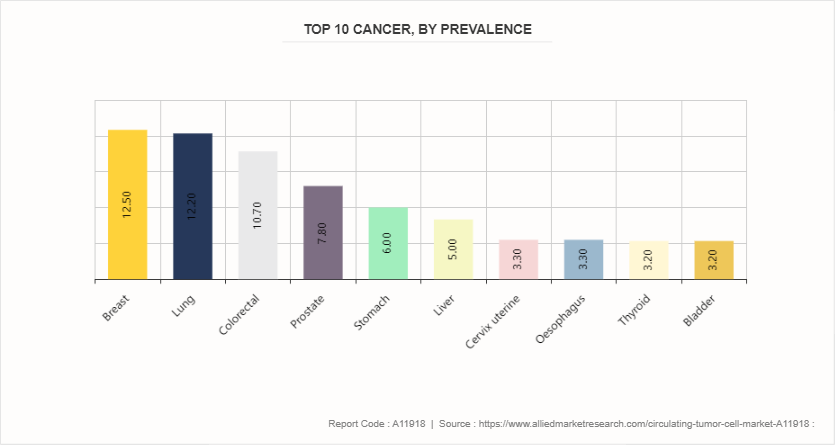

Top 10 Cancer by Type

The top ten types of cancer, listed by their prevalence, highlight a significant health burden worldwide. Breast cancer is the most common, accounting for 12.5% of cases. It is closely followed by lung cancer, which constitutes 12.2% of cases. Colorectal cancer is the third most prevalent, with 10.7% of cases. Prostate cancer, primarily affecting men, represents 7.8% of cancer diagnoses. Stomach cancer is also notable, comprising 6% of cases, while liver cancer makes up 5%. Both cervix uterine cancer and oesophageal cancer each account for 3.3% of cases, indicating a considerable impact on the global population. Thyroid and bladder cancers each have a prevalence of 3.2%. As cancer rates increase globally, there is a growing demand for effective diagnostic tools that can accurately detect and characterize suspicious lesions. Vacuum-assisted biopsy devices have emerged as an efficient diagnostic option, offering advantages over traditional biopsy methods such as core needle biopsy.

According to circulating tumor cells market trends analysis the growing prevalence of cancer is expected to significantly drive the growth of the circulating tumor cells market. With cancer incidence rates rising globally, there is an increasing need for advanced diagnostic and monitoring tools to improve patient outcomes. Circulating tumor cells, which are cancer cells that detach from primary tumors and circulate in the bloodstream, provide crucial insights into disease progression, metastasis, and treatment efficacy. As the demand for personalized medicine and targeted therapies intensifies, the role of circulating tumor cells in identifying suitable treatment regimens becomes even more critical. Moreover, advancements in circulating tumor cells detection and analysis technologies are making these tools more accessible and reliable, further boosting their adoption in clinical settings.

Market Segmentation

The circulating tumor cells industry is segmented into product, technology, application, specimen, end user, and region. By product, the market is divided into kits & reagents, blood collection tubes, and devices. As per technology, the market is divided into CTC detection & enrichment methods, CTC direct detection, and CTC analysis. By application, the market is classified into Research, Clinical, Drug/Therapy Development. By specimen, the market is divided into blood, bone marrow, and other body fluids. Depending on end user, the market is divided into hospital and clinics, diagnostic centers, and research and academic institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the circulating tumor cells market share owing to increasing prevalence of cancer, which necessitates the development of advanced diagnostic and monitoring tools, and advancements in technology, such as improved sensitivity and specificity of detection methods, which have enhanced the reliability and clinical utility of CTC assays. In addition, according to circulating tumor cells market forecast analysis Asia-Pacific region is expected to register significant growth in the forecast period owing to developing healthcare infrastructure, rising incidence of cancer across the region, fueled by factors such as aging populations, urbanization, lifestyle changes, and increasing focus on early cancer detection.

- In a 2024 article published by National Centre for Disease Informatics and Research, it was estimated that the projected cancer burden in India is expected to rise from 26.7 million DALYs (Disability-adjusted life year) in 2021 to 29.8 million in 2025.

- According to 2024 article by National Breast Cancer Foundation, Inc, in 2024, an estimated 310, 720 women and 2, 800 men will be diagnosed with invasive breast cancer.

- In an article published by European Commission, it was reported that in 2021, cancer was the second leading cause of death in Europe, with 1.1 million deaths.

Industry Trends

- According to 2024 article by National Cancer Institute, it was estimated that around 2, 001, 140 new cases of cancer will be diagnosed in the U.S. in 2024.

- According to 2023 article by National Library of Medicine, prevalence of circulating tumor cells among individuals with ovarian cancer undergoing chemotherapy ranges from 30% to 70%.

- According to 2021 article by American Cancer Society, there were close to 20 million new cases of cancer in the year 2022.

Competitive Landscape

The major players operating in the circulating tumor cells market include QIAGEN, Bio-Techne Corporation, Precision for Medicine, AVIVA Biosciences, BioCEP Ltd., Fluxion Biosciences, Inc., Greiner Bio-One International GmbH, Ikonisys, Inc., Miltenyi Biotec, and IVDiagnostics, Inc. Other players in the circulating tumor cells market include BioFluidica, Canopus Bioscience Ltd., Biolidics Limited, Creativ MicroTech, Inc., LungLife AI, Inc., and Epic Sciences.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the circulating tumor cell market analysis from 2024 to 2033 to identify the prevailing circulating tumor cell market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the circulating tumor cell market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global circulating tumor cell market trends, key players, market segments, application areas, and market growth strategies.

Circulating Tumor Cell Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 43.5 Billion |

| Growth Rate | CAGR of 13.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Product |

|

| By Technology |

|

| By Application |

|

| By Specimen |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ikonisys, Inc, BioCEP Ltd, AVIVA Biosciences, Miltenyi Biotec GmbH., Qiagen NV., Fluxion Biosciences, Inc, Greiner Bio-One International GmbH, Precision for Medicine, Inc., Bio-Techne Corporation, IVDiagnostics, Inc |

The global circulating tumor cells market size was valued at $11.8 billion in 2023.

The market value of Circulating Tumor Cell Market is projected to reach $43.5 billion by 2033

The forecast period for Circulating Tumor Cell Market is 2024-2033.

The base year is 2023 in Circulating Tumor Cell Market

Major key players that operate in the Circulating Tumor Cell Market are QIAGEN, Bio-Techne Corporation, Precision for Medicine, and AVIVA Biosciences

Loading Table Of Content...