Cladding Market Research, 2032

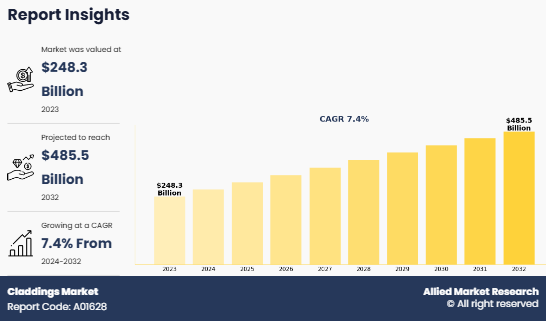

Global cladding market size was valued at $248.3 billion in 2023, and is projected to reach $485.5 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032. Cladding is defined as a non-loadbearing skin or layer attached to the outside or inside of a building and includes all moisture barriers and siding materials used to cover the outside of a structure. Cladding systems provide versatile long lasting energy saving advantages, which are designed to meet the most demanding aesthetic and functional requirements. By selecting cladding materials tailored to the elevation or exposure, users can optimize both physical performance and aesthetics. Cladding is typically made from wood, metal, plastic (vinyl), masonry, or an expanding range of composite materials.

Cladding Market Overview

The cladding market has been experiencing significant growth due to the rising demand for energy-efficient and sustainable building solutions. Cladding plays a crucial role in enhancing the aesthetic appeal, durability, and insulation properties of buildings. The increasing focus on green buildings and the adoption of advanced materials, such as fiber cement and composite materials, have driven the growth of the cladding market across residential, commercial, and industrial sectors. In 2023, the market witnessed notable developments, with Asia-Pacific leading in revenue share.

One of the key factors propelling the cladding market is the rapid urbanization and industrialization in emerging economies. This trend has led to a surge in construction activities, creating a demand for high-performance cladding solutions. Additionally, stringent regulations promoting energy-efficient building practices have encouraged the adoption of innovative cladding systems. The availability of a wide range of materials, such as terracotta, ceramics, and metal, allows architects and builders to tailor cladding solutions to meet both functional and aesthetic requirements.

The cladding market is also benefiting from technological advancements in material science. Innovations such as lightweight cladding panels and self-cleaning surfaces are becoming increasingly popular among end-users. Moreover, manufacturers are focusing on sustainability by incorporating recyclable materials and reducing the environmental footprint of their products. This has not only enhanced the cladding market. appeal but has also aligned it with global efforts toward carbon neutrality and resource efficiency.

Despite its growth, the cladding market faces certain challenges, including the high cost of installation and maintenance. Small to medium-sized enterprises often find it difficult to invest in advanced cladding systems due to budget constraints. Additionally, fluctuating raw material prices and supply chain disruptions pose risks to the cladding market. However, increasing investments in research and development are expected to mitigate these issues and create opportunities for further expansion.

The cladding market is poised for robust growth, driven by rising construction activities, sustainability trends, and technological advancements. As consumer preferences shift toward durable and eco-friendly building materials, the cladding market is likely to witness further innovation and diversification. With the Asia-Pacific region leading the market and other regions catching up, the future of the cladding market looks promising for both manufacturers and end-users alike.

Cladding Market Dynamics

The cladding market is largely driven by rise in residential and commercial constructions, government regulations regarding zero energy buildings, and increase in demand for sustainable cladding systems. However, the cladding market growth is restrained due to factors such as high material and installation costs and lack of skilled labor availability.

Growth in residential & non-residential constructions:

The global cladding market is witnessing robust growth, primarily driven by expansion of residential and non-residential construction activities. In the residential sector, rapid urbanization and population growth have increased the demand for new housing developments, with governments globally investing in affordable housing initiatives and urban redevelopment projects. In addition, rise in popularity of energy-efficient and sustainable homes has increased the adoption of advanced cladding materials that offer thermal insulation, durability, and aesthetic appeal. In the non-residential sector, surge in infrastructure development, including commercial buildings, educational institutions, healthcare facilities, and industrial complexes, has significantly boosted demand for high-performance cladding solutions. Such factors offer lucrative growth opportunities for the market growth.

Modern architectural trends emphasizing sustainability and safety and rise in adoption of prefabricated construction methods, have further augmented the cladding market growth. Moreover, regions such as Asia-Pacific, the Middle East, and Africa are experiencing a construction boom, driving the need for durable and innovative cladding materials. Such factors highlight the essential role of cladding in improving both the functionality and design of buildings, making it a cornerstone of modern construction.

Impact of Government Regulations on the Cladding Market:

Government regulations play a crucial role in shaping the cladding market, influencing both opportunities and challenges. Strict building codes and safety standards mandate the use of fire-resistant, energy-efficient, and environmentally sustainable cladding materials in construction projects. These regulations, particularly stringent in developed regions such as North America and Europe, have increased the adoption of advanced cladding solutions that meet these criteria. However, compliance with such regulations often increases material costs and imposes additional certification and testing requirements, creating barriers for manufacturers and developers.

In some cases, government policies promoting green building practices and energy efficiency, such as subsidies or tax incentives, have positively impacted the market by encouraging the use of sustainable cladding systems. At the same time, incidents related to cladding safety concerns, such as fire hazards, have resulted in stricter regulations, prompting manufacturers to innovate and provide safer, higher-performing products. Overall, while government regulations aim to enhance building safety and sustainability, they also add complexity and cost pressures to the cladding market.

Increase in Use of Fiber Cement:

Fiber cement in commercial and residential construction is primarily used for cladding, molding & trimming, and for other applications. Use of fiber cement as a cladding material has witnessed significant growth over the last few years. This increase in use of fiber cement as a cladding material is due to its ability to improve the buildings̢۪ sustainability. Fiber cement is widely available from renewable sources and has high tensile strength and is relatively low cost. Although fiber cement presently accounts for only a minor share of the cladding market, its adoption is expected to increase during the forecast period.

High Material and Installation Cost:

High material and installation costs of cladding pose a significant challenge to the cladding market growth. Advanced cladding materials, such as metal composites, fiber cement, and natural stone, come with premium price tags due to their durability, aesthetic appeal, and performance benefits. In addition, the installation process can be labor-intensive and requires skilled professionals, further escalating overall project costs. For large-scale commercial and industrial projects, these expenses can substantially impact budgets, prompting some developers to opt for more cost-effective alternatives.

In emerging economies, where budget constraints are more significant, the adoption of high-end cladding materials is often limited, hindering the cladding market growth. Although innovative manufacturing techniques and modular construction methods are gradually lowering costs, the financial burden of premium cladding solutions continues to be a significant barrier to widespread adoption. such factors may restraint the market.

Cladding Market Segmental Overview

The cladding market overview is segmented into product type, application, type, and region.

By product type, the cladding market is segmented into fiber cement, composite material, terracotta, ceramics, and others. The terracotta segment held a dominant position in the market in 2023, attributed to its durability, natural aesthetic appeal, and eco-friendly characteristics, making it a popular choice in both residential and commercial applications. However, the composite material segment is expected to witness the highest growth during the forecast period, driven by its lightweight, versatile, and high-strength properties. By product type, the market is segmented into fiber cement, composite material, terracotta, ceramics, and others, each catering to diverse construction needs and preferences. The growing demand for sustainable and energy-efficient building materials further supports the expansion of these segments, particularly in regions with stringent environmental regulations.

By application, the cladding market is segmented into residential, commercial, and industrial. The commercial, and industrial segment dominated the market in 2023, driven by extensive construction activities in office spaces, retail centers, and hospitality projects that prioritize aesthetic appeal and energy efficiency. However, the residential segment is projected to grow at a significant CAGR during the forecast period, fueled by rising urbanization, increasing demand for modern housing, and a shift toward sustainable building practices.

By type, the cladding market is segmented into exterior cladding, and interior cladding. The exterior cladding segment dominated the market in 2023, accounting for more than half of the market share in terms of revenue. This dominance is attributed to the widespread use of exterior cladding in protecting buildings from environmental factors, enhancing thermal insulation, and improving architectural aesthetics. However, the interior cladding segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing demand for decorative and functional interior solutions in residential and commercial spaces which drives the market. Based on type, the market is divided into exterior and interior cladding, with each segment catering to distinct applications and preferences in construction and design.

By Region:

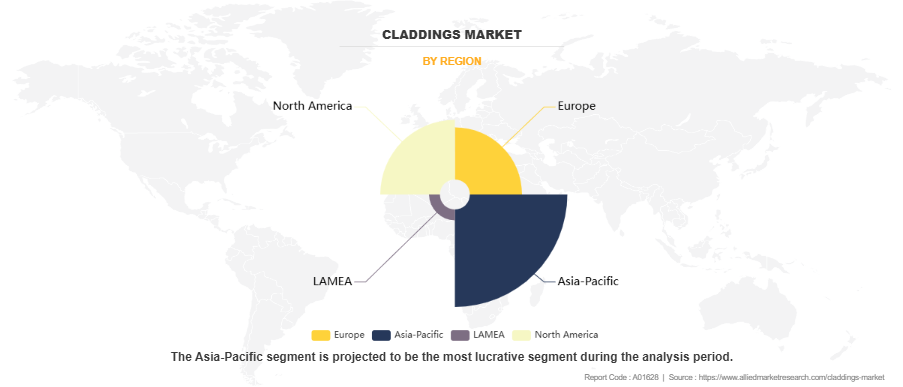

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region is projected to grow at the fastest rate during the forecast period, as countries in the region are expected to experience significant expansion in the construction sector, driving a substantial demand for cladding systems, which will inturn propel the cladding market.

In 2023, Asia-Pacific accounted for the largest cladding market share, and it is expected to grow at a significant CAGR throughout the forecast period. The Asia-Pacific region dominated the market overview in terms of revenue in 2023, accounting for the largest market share. This dominance is driven by rapid urbanization, increasing construction activities, and growing investments in infrastructure development across emerging economies such as China, India, and Southeast Asian countries. The region's rising demand for energy-efficient and aesthetically appealing building materials further supports market growth. The cladding market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA, with Asia-Pacific expected to maintain its growth momentum at a significant CAGR throughout the forecast period, fueled by government initiatives promoting sustainable construction practices.

Competition Analysis

Key companies profiled in the report for the cladding market include Acme Brick Company, Alcoa Inc., Axiall Corporation, Boral Limited, CSR Limited, Etex Group, Armstrong Metalldecken AG, James Hardie Plc, Nichiha Corporation, and Tata Steel Limited. Acquisition, partnership, and product launch are the key strategies being adopted by major players to remain competitive in the cladding market. For instance, in 2024, James Hardie Plc announced the launch of an innovative fiber cement cladding solution designed to improve durability and aesthetic appeal, targeting both residential and commercial markets.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging cladding market trend and dynamics.

- In-depth cladding market analysis is conducted by constructing market estimations for the key market segments between 2023 and 2032.

- Extensive analysis is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global cladding market forecast analysis from 2024 to 2032 is included in the report.

- The key players within the market are profiled in this report and their strategies are analyzed thoroughly, which helps to understand the competitive outlook of the cladding industry.

Claddings Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 485.5 billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2023 - 2032 |

| Report Pages | 185 |

| By Product Type |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | CSR Limited, Tata Steel Limited, Acme Brick Company, Nichiha Corporation, Etex Group, Armstrong Metalldecken AG, James Hardie Plc, Boral Limited, Alcoa Inc., Axiall Corporation |

Analyst Review

Claddings can be defined as the materials used to cover the exterior of the structure. The global claddings market is estimated to witness significant growth during the forecast period. Increase in urbanization and growth in consumer expenditure are some of the key factors that drive the claddings industry. One of the key factors driving the global claddings market is government regulations towards zero energy buildings. A zero-energy building (ZEB) is a residential or commercial building with highly reduced energy needs through efficiency gains such that the balance of energy needs can be supplied with renewable technologies. As the energy used by the building sector continues to increase there is an increase in need to regulate this energy consumption by designing buildings that can offset the growth in energy demands. The U.S. Department of Energy (DOE) has established an aggressive goal to create the technology and knowledge base for cost-effective zero-energy commercial buildings (ZEBs) by 2025. One of the efficient ways of reducing the energy consumption is by installing energy efficient cladding. Energy efficient cladding systems offer a higher thermal resistance and fewer thermal breaks than typical cladding systems, so less energy is required to heat and cool the building. Some of the most common energy efficient systems available in the claddings market are exterior insulation and finish systems (EIFS) and insulated metal wall panels. EIFS is a lightweight cladding that can emulate the appearance of numerous building materials, including brick, stone, metal panels, siding, and stucco. It can also be used as a retrofit over existing claddings. Compared to other cladding materials EIFS is a cost-effective system in terms of both materials and installation costs.

The claddings market was valued at $248,323.1 million in 2023, and is projected to reach $485,457.5 million by 2032, registering a CAGR of 7.4% from 2024 to 2032.

Asia-Pacific is the largest regional market for Claddings

Residential, commercial, industrial is the leading application of Claddings Market

Growth in residential & non-residential constructions and impact of government regulations on the claddings market upcoming trends of Claddings Market in the globe.

Acme Brick Company, Alcoa Inc., Axiall Corporation, Boral Limited, CSR Limited, Etex Group, Armstrong Metalldecken AG, James Hardie Plc, Nichiha Corporation, and Tata Steel Limited.

Loading Table Of Content...

Loading Research Methodology...