Claims Processing Software Market Research, 2030

The global claims processing software market size was valued at $33.9 billion in 2020, and is projected to reach $73.0 billion by 2030, growing at a CAGR of 8.3% from 2021 to 2030.

Claim processing software is a digital platform tailored to needs of insurers. Its primary purpose is to streamline claims to have a fast and efficient outcome. One of its most notable features is the offering of cloud-based solutions that enable access to the software on any computer with an internet connection. Any insurance company that uses claim processing software will benefit from its ability to manage the entire claim lifecycle from its first filing until it is closed in one centralized location. Claim automation software is developed with efficiency in mind, automating substantial portions of the workflow process.

Claims processing software allows insurance companies to handle every aspect of claims management within one system, allowing easy access to consumer data and improved workflow. In addition, it is used by independent adjusting firms to streamline the claims management process. Thus, this is a major factor that propels the claims processing software market growth. Furthermore, claims processing software eliminates the need for manual methods and reduces errors, saves time, and increases accuracy of data. Therefore, these are some of the factors that drive the market growth. However, startup cost of purchasing necessary insurance claim management software is a major factor that limits the claims processing software market. On the contrary, there is a surge in adoption of claims processing software by insurance firms in developing countries, owing to technological advancements in these countries. In addition, customer preference toward claims processing software, owing to faster claims settlement is expected to create lucrative claims processing software market opportunity in the upcoming years.

By component, the software segment generated highest revenue in 2020. This is attributed to the fact that claim processing software allows for a comprehensive view of claims, making it easier to spot inconsistencies and early detection of potential fraud. In addition, claims processing software can detect errors much more easily than the human eye. This is attributed to integrated machine learning and artificial intelligence that present accurate information to easily run reports and complete views of status situations. However, the services segment is expected to generate highest growth during the forecast period. This is attributed to the fact that claims processing services enables companies to seamlessly handle any volume of transactions. By efficiently balancing surges in processing requirements, claim processing service providers help healthcare practices to accelerate the time for processing claims. The time saved as a result of this can be better utilized to mitigate problems, improve cash flow, and concentrate on other core goals of an organization.

Region wise, North America generated highest revenue in 2020. This is attributed to the fact that North America has witnessed an increased rate of adoption of cloud-based solutions, owing to increase in digitization in insurance and e-commerce sectors, which drives growth prospects for the regional market significantly during the forecast period. Moreover, Asia-Pacific is attributed to grow significantly during the forecast period. This is attributed to growth in digitization and strong technological advancements in the region.

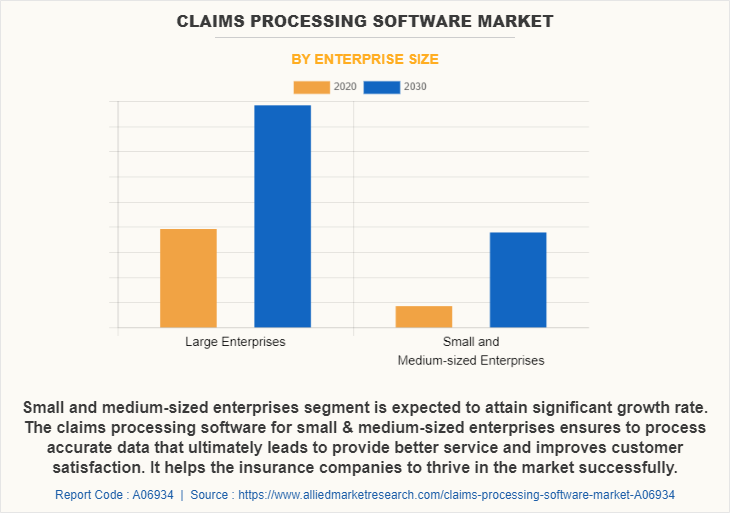

The claims processing software market is segmented on the basis of component, enterprise size, end user and region. By component, it is segmented into software and services. By enterprise size, it is bifurcated into large enterprises and small & medium enterprises. By end user, it is segregated into insurance companies, insurance intermediaries, agents & brokers, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Large enterprises segment acquired the major share of claims processing software market. Large enterprises intend to keep operating costs low in order to maximize profits. Business automation lowers the costs, and that’s one of the ways insurance companies use to gain a competitive advantage in the market.

By Region

Asia-Pacific is expected to exhibit significant growth during the forecast period. many financial institutions in Asia-Pacific are adopting claims processing software for boosting business efficiency, lowering compliance risk exposure, and increasing bureaucratic efficiency of the organization. Therefore, these are the major growth factors for the claims processing software market in the Asia-Pacific region.

Asia-Pacific is expected to exhibit significant growth during the forecast period. many financial institutions in Asia-Pacific are adopting claims processing software for boosting business efficiency, lowering compliance risk exposure, and increasing bureaucratic efficiency of the organization. Therefore, these are the major growth factors for the claims automation software market in the Asia-Pacific region.

The report analyzes the profiles of key players operating in the claims processing software market analysis include A1 Enterprise, Duck Creek Technologies, FINEOS, Hyland Software, Inc., Hawksoft, Inc., HIPPAsuite, Newgen Software Technologies Limited, Pegasystems Inc., Quick Silver and VENTIV TECHNOLOGY. These players have adopted various strategies to increase their market penetration and strengthen their position in the claims processing software industry.

Covid-19 Impact Analysis

The COVID-19 pandemic has positively impacted the claims processing software market which is attributed to the fact that consumers of health insurance and general insurance demanded for claims settlement because of ongoing health issues and business losses. This sudden surge in the claim settlement became difficult to manage for the insurance companies and thus, the insurance companies started to adopt claims processing software which could easily handle large amounts of claims at one time. Furthermore, it made the process faster, thus saving time and effort of employees. This, as a result increased the demand for insurance claims management software market during the COVID-19 pandemic.

Top Impacting Factors

Claims Processing Software Increases Productivity

Claims management process can be complex and it is important for insurers to find ways to streamline this process to reduce costs and increase customer satisfaction. By using claims processing platforms, insurers can easily increase their productivity and cut costs. A better claims processing software allows insurers to handle every aspect of claims management within one system, allowing for easy access toward customer data and improved workflow. Everything from inputting claim to negotiating settlements can be done within claims processing software. This software allows to move away from manually filling out forms and managing Excel spreadsheets by eliminating the need for these manual methods altogether. Furthermore, it reduces errors, saves time, and increases accuracy, thus increasing productivity. Therefore, these are the major growth factors for the claims processing software market.

Higher Startup Cost of Implementing Claims Processing Software

One major obstacle to convert from traditional claims processing to claims processing software is the startup cost of purchasing necessary hardware and software. Other start-up costs include training of the entire staff to learn how to enter and use the software. Once the system is in place, the records of all customers must be converted to electronic format, which takes many man hours and is very expensive to complete. Furthermore, since claims processing software requires a computer system, there is a chance that private information may be accessed by unauthorized individuals. A hacked system may reveal parts or all customer information including addresses, birth date, social security numbers, emails, and possibly other sensitive financial information along with their complete history. Therefore, these are the major factors that limit growth of the claims processing software industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the claims processing software market share from 2020 to 2030 to identify the prevailing claims processing software market forecast.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the claims processing software market outlook segmentation assists to determine the prevailing market opportunities.

- The report includes the analysis of the regional as well as global claims processing software market trends, key players, market segments, application areas, and market growth strategies.

Claims Processing Software Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Enterprise Size |

|

| By END USER |

|

| By Region |

|

| Key Market Players | a1 enterprise, inc., Hyland Software, Inc., HIPPAsuite, Pegasystems Inc., FINEOS, Duck Creek Technologies, Hawksoft, Inc., Newgen Software Technologies Limited, Quick Silver, VENTIV TECHNOLOGY |

Analyst Review

Claims processing is an important business function for insurance companies, public entities, and risk managers. The claims have to be handled timely to ensure quick settlement leading to customer satisfaction. Claims processing software is beneficial as it helps to effectively manage and analyze information pertaining to claims. Claims processing software helps to automate entire system of claims management by reducing settlement time and enhancing customer service. It provides faster and intuitive access to claims data records, which help in making effective decisions. Moreover, claim processing software can help insurance companies and risk managers to reduce exposure, increase employee productivity, reduce claim processing cycle time, and provide better customer service. Moreover, it helps enhance quality of service, which gives a competitive edge over other companies.

Furthermore, market players in the claims processing software market are adopting key strategies such as partnership and product launch to further enhance their offerings and improve customer service. For instance, Whatfix, global leader in the digital adoption platforms (DAP) space, announced a new partnership with Duck Creek Technologies, a leader in property and casualty (P&C) insurance software-as-a-service (SaaS) solutions. The partnership aims to enhance user experience claims handlers of for insurance carriers using Duck Creek Claims, while accelerating claims processing time and saving compliance costs. Whatfix's Digital Adoption Platform (DAP) integrates seamlessly with Duck Creek Claims to provide contextual information within the platform, enabling users to navigate claims processes without leaving the application. Adjusters get access to claims-specific solutions, including ready-to-use templates on state-specific help tips & smart nudges. This saves time, reduces costs, increases productivity, and in effect, provides a better customer experience. Low-code authoring environment and ability to merge existing knowledge repositories improves operational efficiency of learning and development teams. Therefore, these factors provide major lucrative opportunities for growth of the global claims processing software market.

Some of the key players profiled in the report include A1 Enterprise, Duck Creek Technologies, FINEOS, Hyland Software, Inc., Hawksoft, Inc., HIPPAsuite, Newgen Software Technologies Limited, Pegasystems Inc., Quick Silver, and VENTIV TECHNOLOGY. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Market players in the claims processing software market are adopting key strategies such as partnership and product launch to further enhance their offerings and improve customer service, which is becoming major trends in the market.

Insurance companies segment accounted for the highest revenue in claims procesing software market. Insurance claims management software helps insurance companies to manage and evaluate insurance claims. They allow insurance companies to manage the claims process with automated workflows, ensuring that all claim details are recorded within a centralized system.

North America accounted for the major share of claims procesing software market. Most insurance companies in the U.S. are adopting digital services to handle claims of the customers. Therefore, the claims processing software is increasingly used by companies to serve their customers. Moreover, health insurance claims are increasing in the U.S. and therefore, customers demand a robust claims settlement procedure.

The global claims processing software market size was valued at $33,894.3 million in 2020, and is projected to reach $73,046.1 million by 2030, registering a CAGR of 8.3% from 2021 to 2030.

Leading market players such A1 Enterprise, HIPPAsuite, Pegasystems Inc., and Duck Creek Technologies hold majority of the market share. However, other players in the market are also coming up with new strategies and partnering, collaborating, and expanding their business, which is further anticipated to boost the market growth in the future.

Loading Table Of Content...