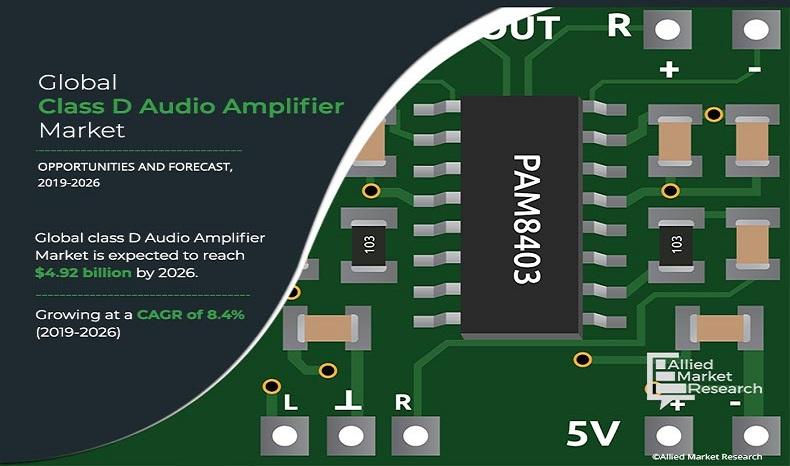

Class D Audio Amplifier Market Outlook - 2026:

The global class D audio amplifier market was valued at $2.49 billion in 2018, and is projected to reach $4.92 billion by 2026, registering a CAGR of 8.4% from 2019 to 2026. Class D audio amplifier is an electronic device, which multiplies the amplitude of the sound signals. Amplified sound signals can reach to the higher level and hence are suitable for loudspeakers or driving subwoofers. It offers varied advantages such as heat dissipation, energy efficiency, and space efficiency. It is an important consideration while designing portable music devices.

Class D amplifier is an integrated circuit (IC) inserted in an electronic device, which is used to increase the amplifier sound from low power electronic audio signal to high level audio signal. It is mostly used in sound systems such as home audio systems, musical instruments systems, loudspeakers, and sound reinforcement.

The purpose of an amplifier is to increase vibrations to the maximum extent of signals without affecting the frequency or any wavelength and help improve the efficiency of the system. Audio amplifier is also used in wireless communication and broadcasting. Hence, these factors are responsible for growth of the class D audio amplifier market.

The growth of the class D audio amplifier market is driven by substantial growth in demand for smart consumer electronics and high requirement of vehicle infotainment systems in the automotive sector. However, high installation cost, thus restrains the growth of the market. Furthermore, increase in popularity of IoT offers lucrative opportunities for the class D audio amplifier market growth.

The recent development in the class D audio amplifier market is “D” technology, which is used by various industries such as electronics, automotive, and home automation system. It is used in electronic devices capable of holding hundreds watt of power efficiently and used in low noise and high-power applications. Toshiba recently launched "TCB503HQ” for car audio that exhibits high resistance to power.

The large adoption of class D amplifiers in home audio systems can be attributed to the continuous technological innovations in these systems and increase in consumer demand for high-performance home theaters, which is associated with the rise in disposable income. In addition, developments in Wi-Fi and Bluetooth speakers, and dedicated speaker docks are expected to increase consumer spending on audio equipment for enhanced audio quality.

By Amplifier Type

Mono-Channel Amplifier segment is expected to secure the leading position throughout the forecast period

Segmentation:

The class D audio amplifier market is segmented on the basis of amplifier type, device, end use, and region. On the basis of amplifier type, the market is categorized into mono-channel, 2-channel, 4-channel, 6-channel and others.

By End Use

Automotive segment would exhibit the highest CAGR of 10.10% during 2019 - 2026

Device covered in the study include television sets, home audio systems, desktops & laptops, automotive infotainment systems, and others. End use includes consumer electronics, automotive and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Geography

Asia-Pacific region holds a dominant position in 2018 and would maintain the lead during the forecast period

Top Impacting Factors:

The notable factors positively affecting the class D audio amplifier market share include growth in demand for smart consumer electronics, high demand for vehicle infotainment systems in automotive sector. However, high installation cost hampers the market growth. Moreover, an increase in popularity of IoT offers huge market opportunities in the next six years.

Growth in Demand for Smart Consumer Electronics

The class D audio amplifier market size is witnessing significant growth recently due to its wide usage in consumer electronics appliances such as smartphones, laptops, and refrigerators. Manufacturers of these appliances are incorporating more amplifiers in their devices to add additional features and compete with other players in the highly competitive market.

High competition in the consumer electronic market, steady upgrades in the consumer electronic devices, and increase in automation in the automotive industry through electronic devices are anticipated to drive the market growth in the future.

High Installation Cost:

The latest display technologies such as transparent display and quantum dot displays are relatively high in cost due to its complex design. Hence, most of the latest display technologies are integrated in premium devices, which are not affordable. This factor is expected to restrict the growth of the market. However, various technological advancements are expected to minimize the effect of these factors.

Increase in Popularity of IoT:

In the current IT-dominant world, consumers are massively adopting automation-based solution and services. This has led to increased focus on IoT-based devices due to their innovative and advanced applications. IoT is a technology for providing internet or internetworking for almost all applications such as smartphones, microwaves, refrigerators, and buildings. IoT uses electronic software, sensors for connecting all these things to a common network.

Competitive Analysis:

The key players profiled in the class D audio amplifier industry include Infineon Technologies AG, Analog Devices Inc., NXP Semiconductors, On Semiconductor, ROHM Semiconductors, Renesas Electronics, ST Microelectronics, Qualcomm Technologies Inc., Texas Instruments and Toshiba Corporation. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

Key Benefits for Stakeholders:

- This study includes the analytical depiction of the global class D audio amplifier market size along with the current trends and future estimations to determine the imminent investment pockets.

- The class D audio amplifier market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact on the class D audio amplifier market trends.

- The current class D audio amplifier market forecast is quantitatively analyzed from 2018 to 2026 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the torque sensor market.

- The report includes the market share of key vendors and torque sensor market trends.

Class D Audio Amplifier Market Report Highlights

| Aspects | Details |

| By Amplifier Type |

|

| By Device |

|

| By End User |

|

| By Region |

|

| Key Market Players | Renesas Electronics, Texas Instruments, ON Semiconductor, Infineon Technologies AG, ROHM Semiconductors, STMicroelectronics, NXP Semiconductor, Analog Devices, Inc., Toshiba Corporation, Qualcomm Technologies, Inc. |

Analyst Review

The class D audio power amplifiers are electronic devices that are used to increase the sound of audio signals from low level to high level matching the convenience of MP3 audio players and loudspeakers in addition to reducing undesirable increase in noise and distortion. In addition, rise in demand for new technologies have been developed in power, which offers high efficiency to the system with minimal distortion. Hence, the demand for energy efficient audio system and high audio quality drives the growth of the market.

The demand for class D audio amplifier in the commercial sector is expected to increase rapidly during the forecast period, owing to various factors such as growth in demand for smart consumer electronics, high demand for vehicle infotainment systems in automotive sector. However, high installation cost, thus hampers the market growth globally. The market for class D audio amplifier in the commercial sector is analyzed and estimated in accordance with the impacts of drivers, restraints, and opportunities.

The major factor that affects the adoption rate of class D audio amplifier market in North America includes adoption of new technologies such as rise in demand for mobile phones, tablets, and gaming applications. New developments in audio amplifier technologies has led to shift from class A audio amplifier to class D audio amplifier. Continuous advancements in amplifier technology help improve the quality of sound. Innovation in audio is the key driver expected to boost the market growth during the forecast period.

The key players profiled in the report include Infineon Technologies, Analog Devices, Inc., NXP Semiconductor, ON Semiconductor, ROHM Semiconductors, Renesas Electronics, STMicroelectronics, QUALCOMM Technologies, Inc., Texas Instruments and Toshiba Corporation.

The Global Class D Audio Amplifier Market is expected to grow at a CAGR of 8.4% from 2019 to 2026.

The Global Class D Audio Amplifier Market is projected to reach $4.92 billion by 2026.

To get the latest version of sample report

Rise in demand for smart consumer electronics, high demand for vehicle infotainment systems in automotive sector and increase in popularity of IoT drives the growth of Class D Audio Amplifier Market.

The key players profiled in the report include Infineon Technologies AG, Analog Devices Inc., NXP Semiconductors, On Semiconductor, ROHM Semiconductors, Renesas Electronics, ST Microelectronics, Qualcomm Technologies Inc., Texas Instruments and Toshiba Corporation.

On the basis of top growing big corporations, we select top 10 players.

The Class D Audio Amplifier Market is segmented on the basis of amplifier type, device, end use, and region.

The key growth strategies of Class D Audio Amplifier market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Mono-Channel Amplifier segment is expected to secure the leading position throughout the forecast period.

LAMEA region would exhibit the highest CAGR of 10.80% during 2019 - 2026.

Loading Table Of Content...