Clean Energy Infrastructure Market Research, 2033

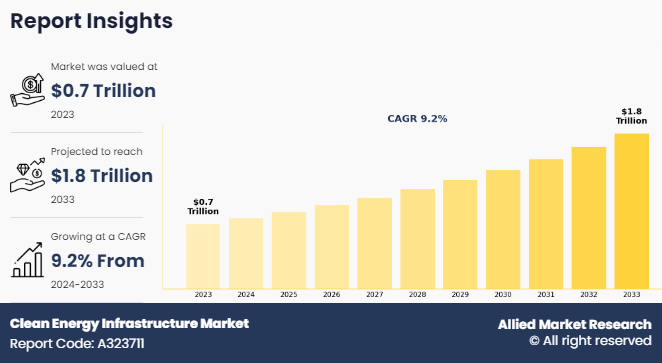

The global clean energy infrastructure market was valued at $0.7 trillion in 2023, and is projected to reach $1.8 trillion by 2033, growing at a CAGR of 9.2% from 2024 to 2033. Technological advancements in energy storage systems, such as improved battery technologies and grid-scale storage solutions, are key drivers for the clean energy infrastructure market by enabling more efficient and reliable integration of renewable energy sources such as solar and wind. Coupled with rising investments in smart grid infrastructure, these innovations enhance the flexibility, resilience, and efficiency of power networks, facilitating better energy management, reducing transmission losses, and supporting the shift toward decentralized and renewable energy generation.

Introduction

Clean energy infrastructure refers to the systems, technologies, and physical facilities designed to generate, store, transmit, and manage energy in ways that minimize environmental impacts and reduce reliance on fossil fuels. It encompasses renewable energy sources such as solar, wind, hydropower, geothermal, and biomass, as well as supporting technologies, such as energy storage systems, smart grids, electric vehicle (EV) charging networks, and energy-efficient buildings. The purpose of clean energy infrastructure industry is to transition away from traditional carbon-intensive energy models toward a more sustainable, resilient, and low-emission energy future.

Key Takeaways

- The global clean energy infrastructure market has been analyzed in terms of value ($billion). The analysis in the report is provided on the basis of infrastructure type, end use, 4 major regions, and more than 15 countries.

- The global clean energy infrastructure market report includes a detailed study covering underlying factors influencing the industry opportunities and trends.

- The major players operating in the clean energy infrastructure market include NextEra Energy, Inc., Enel Spa, Iberdrola, Canadian Solar, First Solar, SunPower Corporation, ACCIONA ENERGÍA, Suzlon Energy Limited, Adani Group., and Tata Power.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the alternators industry.

- Countries such as China, the U.S., Canada, Germany, and Brazil hold a significant share in the global clean energy infrastructure market.

Market Dynamics

Rapid developments in energy storage, smart grids, and renewable energy technologies are expected to drive the growth of clean energy infrastructure market during the forecast period. Technological advancements are transforming clean energy infrastructure, particularly through innovations in energy storage. Improved battery technologies, such as lithium-ion, solid-state, and flow batteries, are enhancing the storage and reliability of renewable energy. These advancements help manage intermittent sources like wind and solar by storing surplus energy for later use, contributing to more stable power grids and enabling round-the-clock clean energy generation. Large-scale renewable energy projects, including solar farms and offshore wind farms, are replacing traditional fossil fuel power plants, reducing the energy sector's carbon footprint. In addition, global hydropower capacity continues to grow, with installed capacity reaching 1,393 GW in 2022, driven by new projects and technological improvements. All these factors are expected to drive the growth of the global clean energy infrastructure market during the forecast period.

However, High initial investment costs remain one of the most critical challenges in the development of clean energy infrastructure. The capital required to build large-scale renewable energy projects such as solar power plants, wind farms, and energy grid upgrades can be substantial. For instance, solar and wind installations often involve high upfront costs for the acquisition of land, installation of advanced technology, and connection to existing grids. These expenses are amplified in regions where energy infrastructure is underdeveloped, requiring additional investments in grid expansion, storage systems, and transmission lines to support new renewable energy projects. Another factor contributing to high upfront investment costs is the need for advanced technology, particularly in the case of next-generation renewable systems and energy storage solutions. While renewable energy sources such as solar and wind have become more affordable in recent years, the incorporation of cutting-edge technologies such as grid-forming inverters, smart meters, and large-scale battery storage requires significant capital. These technologies are crucial for improving grid stability and enabling the integration of intermittent energy sources, but their high cost can present a barrier to widespread adoption. All these factors hamper the clean energy infrastructure market growth.

The rise of microgrids and distributed generation technologies allows energy production and consumption at the local level, reducing dependence on large, centralized energy grids. This shift is particularly attractive in regions with unstable energy infrastructure or in areas prone to natural disasters, where decentralized systems offer energy security and resilience. Additionally, decentralized systems are empowering communities and businesses to generate, store, and manage their energy needs, creating a new market for clean energy products and services. In December 2022, Bangalore Electricity Supply Company Limited (BESCOM) launched Phase 2 of its grid-connected rooftop solar initiative. This phase aimed at expanding the installation of solar panels, with BESCOM receiving a directive from the Union Ministry of New and Renewable Energy (MNRE) to deploy 10 MW of solar capacity. This effort is part of a broader strategy to encourage distributed energy generation. In November 2022, Michigan's distributed generation program experienced a 37% increase, welcoming 3,709 new customers. This growth brought the total number of participants to 14,262 and the total number of distributed generation installations to 14,446. The program primarily focused on solar energy, allowing customers to generate their own electricity and reduce their household energy expenses. All these factors are anticipated to offer new growth opportunities for the global clean energy infrastructure market.

Segments Overview

The global clean energy infrastructure market is segmented into well type, technology, application, end use, and region. On the basis of well type, the market is bifurcated into horizontal wells and vertical wells. On the basis of technology, the market is categorized into ultrasonic technology, standard sonic logging, multi finger calipers, and electromagnetic logging. By application, the market is divided into cement inspection and liner or casing corrosion inspection. By end use, the market is segmented into onshore wells and offshore wells. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Latin America.

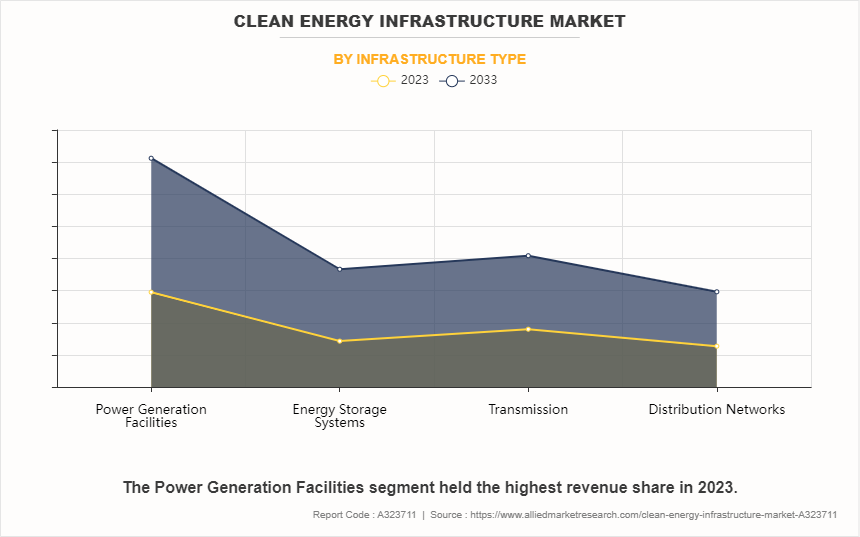

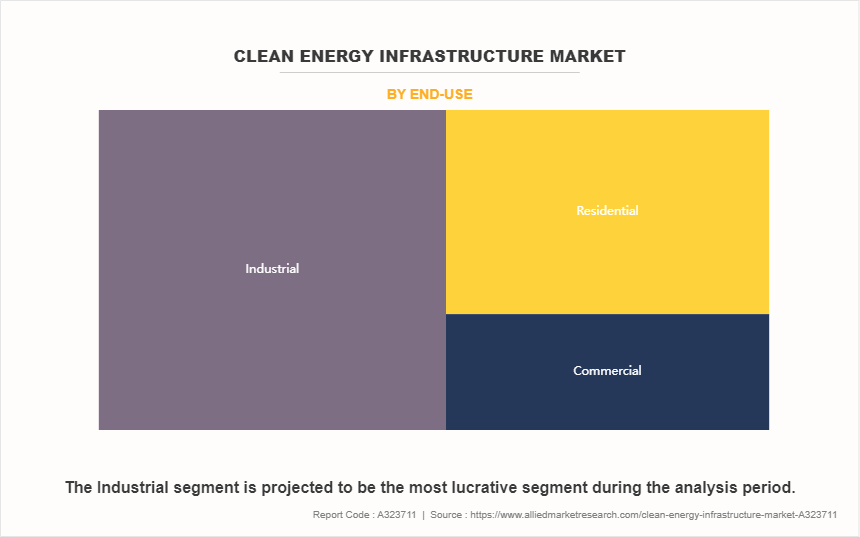

The clean energy infrastructure market is segmented into infrastructure type, end-use, and region. On the basis of infrastructure type, the market is classified into power generation facilitates, energy storage systems, transmission, and distribution networks. On the basis of end-use, the market is classified into residential, commercial, and industrial. Based on region the market is divided into North America, Europe, Asia-Pacific, and LAMEA.

On the basis of infrastructure type, the power generation facilities segment is the dominated the Clean Energy Infrastructure Market Size representing the CAGR of 9.2% during the forecast period. Clean energy infrastructure plays a vital role in power generation facilities, enabling the transition from fossil fuels to sustainable energy sources. In utility-scale solar power plants, the use of advanced technology such as solar trackers and energy storage systems enhances efficiency. Solar trackers allow PV panels to follow the sun’s path, maximizing energy capture throughout the day. Energy storage, in the form of batteries, addresses the intermittency issue by storing excess electricity for use during cloudy periods or nighttime.

On the basis of end-use, the industrial segment is the dominated the market representing the CAGR of 8.9% during the Clean Energy Infrastructure Market Forecast period. One of the foremost strategies in the industrial sector’s clean energy transition is the integration of renewable energy sources. Solar and wind power have emerged as prominent choices due to their scalability and decreasing costs. Many industrial facilities are now installing solar panels on their rooftops or within their premises to harness solar energy. In addition to solar and wind, biomass energy is gaining traction in industries with access to organic waste or by-products. Biomass can be converted into electricity or heat, offering a sustainable alternative to traditional energy sources. Industries such as paper, food processing, and agriculture, which generate significant amounts of organic waste, are particularly well-positioned to benefit from biomass energy systems.

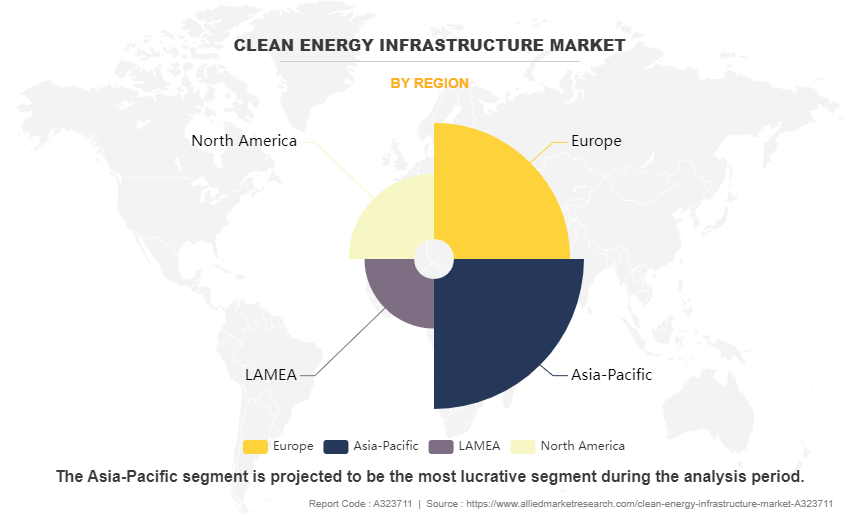

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, Middle East, and Latin America. The Asia-Pacific region accounted for more than one-third of the global clean energy infrastructure market share in 2023 and is expected to maintain its dominance during the forecast period. The Asia-Pacific region is emerging as a dominant player in the clean energy infrastructure market, driven by its rapid adoption of renewable energy technologies and ambitious national policies aimed at reducing carbon emissions. China leads the global race, with its massive investments in solar, wind, and hydropower projects, supported by a strong domestic manufacturing base for clean energy technologies. India follows closely, propelled by government initiatives like the National Solar Mission and commitments to increase renewable energy capacity.

Competitive Analysis

The key players operating in the clean energy infrastructure market include NextEra Energy, Inc., Enel Spa, Iberdrola, Canadian Solar, First Solar, SunPower Corporation, ACCIONA ENERGÍA, Suzlon Energy Limited, Adani Group., and Tata Power. In the global clean energy infrastructure market, companies have adopted agreement and acquisition strategies to expand the market or develop new products. For instance, in June 2024, NextEra Energy, Inc., announce agreement to develop up to 4.5 GW of new solar and energy storage projects.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clean energy infrastructure market analysis from 2023 to 2033 to identify the prevailing clean energy infrastructure market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clean energy infrastructure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global clean energy infrastructure market trends, key players, market segments, application areas, and market growth strategies.

Clean Energy Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1.8 trillion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2023 - 2033 |

| Report Pages | 289 |

| By Infrastructure Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Canadian Solar, Adani Group., Tata Power Renewable Energy Limited, First Solar, Inc., Suzlon Energy Limited, Enel Spa, NextEra Energy, Inc., Iberdrola S.A., ACCIONA Energia, SunPower Corporation |

Analyst Review

Increase in demand for energy is expected to drive the growth of clean energy infrastructure market during the forecast period. Rising global energy demand, particularly in emerging economies, is one of the most significant drivers for the expansion of clean energy infrastructure. As populations grow and urbanization intensifies, the need for more electricity and reliable power sources becomes paramount. Countries in regions such as Asia, Africa, and Latin America are experiencing rapid industrialization and economic development, which has led to a surge in energy consumption. Traditional energy sources, such as fossil fuels, are often insufficient to meet this growing demand, especially when considering the environmental and health impacts they impose. As a result, there is a pressing need for more sustainable and reliable energy solutions. Renewable energy, such as solar, wind, and hydropower, offers an attractive alternative to fossil fuels, as it provides cleaner and often more cost-effective energy solutions over the long term. Emerging economies, in particular, have vast untapped potential for renewable energy. For instance, countries with abundant sunlight, wind, and access to water sources are now looking at large-scale investments in renewable infrastructure to meet both current and future energy needs. These investments contribute to a greener energy mix and help to reduce dependence on imported fossil fuels, which can be subject to price volatility and supply chain disruptions.

However, energy transition costs for utilities are expected to restraint the growth of clean energy infrastructure market during the forecast period. The energy transition costs for utilities represent a significant financial challenge as they shift from traditional fossil fuel-based energy sources to renewable energy. Utilities with long-standing investments in coal, natural gas, and oil infrastructure often face substantial costs associated with this transition. These costs can manifest in the form of stranded assets, where investments in fossil fuel plants, pipelines, and related infrastructure become obsolete or unprofitable. As clean energy becomes more competitive and environmental regulations tighten, utilities may be forced to retire these assets prematurely, leading to financial losses.

Moreover, utilities must navigate the operational and financial complexities of maintaining a balance between traditional energy sources and renewable energy during the transition period. Fossil fuel plants often provide consistent baseload power, while renewables are more variable. Managing this balance while minimizing disruptions to the energy supply can be costly, requiring investments in energy storage or backup power solutions, which add further financial strain.

1.8 trillion is the estimated industry size of Clean Energy Infrastructure by 2033.

Increase in government policies and incentives Rapid developments in energy storage, smart grids, and renewable energy technologies are the upcoming trends of Clean Energy Infrastructure Market in the world.

Industrial is the leading application of Clean Energy Infrastructure Market.

Asia-pacific is the largest regional market for Clean Energy Infrastructure.

NextEra Energy, Inc., Enel Spa, Iberdrola, Canadian Solar, First Solar, SunPower Corporation, ACCIONA ENERGÍA, Suzlon Energy Limited, Adani Group., and Tata Power. are the top companies to hold the market share in Clean Energy Infrastructure

Loading Table Of Content...

Loading Research Methodology...