Clean Energy Transition Market Research, 2028

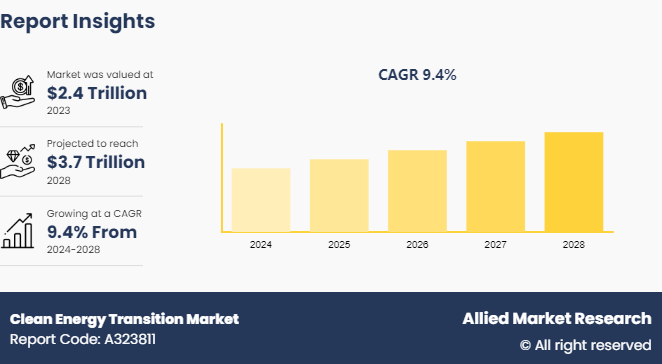

The global clean energy transition market size was valued at $2.4 trillion in 2023, and is projected to reach $3.7 trillion by 2028, growing at a CAGR of 9.4% from 2024 to 2028.

Market Introduction and Definition

The clean energy transition refers to the global shift from fossil fuel-based energy systems to renewable and sustainable energy sources. This transition is driven by the urgent need to mitigate climate change, reduce greenhouse gas emissions, and enhance energy security. Key components of the clean energy transition include the adoption of renewable energy technologies such as solar, wind, hydro, and geothermal power, as well as the development of energy storage solutions, electric vehicles, and smart grid infrastructure.

The burning of fossil fuels for energy is the largest source of carbon dioxide emissions, which significantly contribute to global warming and its associated impacts, such as extreme weather events, rising sea levels, and biodiversity loss. By shifting to renewable energy, which generates little to no greenhouse gas emissions, societies are significantly reducing their carbon footprint. In addition, the clean energy transition enhances energy security by reducing dependence on imported fossil fuels and fostering energy independence.

Key Takeaways

- The clean energy transition market report covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major clean energy transition industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Public and private sector collaboration is playing a crucial role in advancing the clean energy transition. Large-scale projects such as wind farms and solar power plants, are becoming more common, supported by robust financial backing from both governmental bodies and private enterprises. In addition, governments are implementing policies and regulations that support the clean energy transition. Incentives such as tax credits, subsidies, and renewable energy mandates encourage investments in green technologies. Moreover, international agreements such as the Paris Agreement have committed countries to reducing their carbon emissions, thereby driving the need for cleaner energy solutions. All these factors are expected to drive the growth of the clean energy transition market during the forecast period.

However, the transition to clean energy technologies faces significant challenges due to limited availability of critical materials essential for their production. These materials, such as rare earth elements (REEs) , lithium, cobalt, and platinum-group metals (PGMs) , are crucial components in renewable energy systems such as solar panels, wind turbines, and electric vehicle batteries. Furthermore, the extraction and processing of these critical materials have significant environmental and social impacts. All these factors hamper the clean energy transition market growth.

Advancements in energy storage solutions are pivotal to accelerating the clean energy transition. These innovations encompass a wide range of technologies and strategies aimed at overcoming the intermittency of renewable energy sources such as solar and wind. Furthermore, advancements in energy storage are driving down costs and improving efficiency. As R&D efforts continue, innovations such as advanced materials, improved manufacturing processes, and enhanced system management capabilities are making storage solutions more affordable and reliable. This reduction in costs makes renewable energy more competitive with traditional fossil fuels and creates new market opportunities in both developed and developing regions for the global clean energy transition market during the forecast period.

Market Segmentation

The clean energy transition market is segmented into type, end use and region. By type, the market is classified into renewable energy, energy efficiency, electrification, hydrogen, and others. By end use, the market is classified into industrial, commercial, residential, and utility. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific region is experiencing a significant shift towards clean energy driven by several key factors such as region's rapid economic growth has led to increasing energy demand, prompting governments and industries to seek sustainable alternatives to traditional fossil fuels. This economic dynamism has created a compelling case for investing in renewable energy sources such as solar, wind, and hydroelectric power, which offer abundant resources across many countries in the region. In addition, technological advancements and declining costs of renewable energy technologies have made clean energy more accessible and economically viable across Asia-Pacific. Innovations in solar photovoltaics, wind turbines, and energy storage systems have significantly reduced upfront costs and improved efficiency that makes renewable energy projects increasingly competitive with conventional energy sources.

- Countries in the Asia-Pacific are setting ambitious renewable energy targets. For instance, China aims to peak carbon emissions before 2030 and achieve carbon neutrality by 2060. Moreover, India plans to reach 175 GW of renewable energy capacity by 2022 and 450 GW by 2030.

- Offshore and onshore wind energy projects are expanding, particularly in China, Japan, and South Korea. Offshore wind is gaining traction due to its high-capacity factors and proximity to densely populated coastal areas.

- The deployment of battery storage systems is increasing to address the intermittency of renewable energy sources. Lithium-ion batteries are the most common, but advancements in alternative technologies like solid-state batteries are emerging.

- Green hydrogen is gaining momentum as a versatile energy carrier, with projects underway in Australia, Japan, and South Korea. It has potential applications in industry, transportation, and energy storage.

Competitive Landscape

The major players operating in the clean energy transition market outlook include NextEra Energy, Inc., Iberdrola, S.A., Ørsted A/S, Tesla Inc., Enel Spa, Vestas Wind Systems A/S, BYD Company Ltd., Brookfield Asset Management, Schneider Electric, and Plug Power Inc.

Global Renewable Electricity Capacity

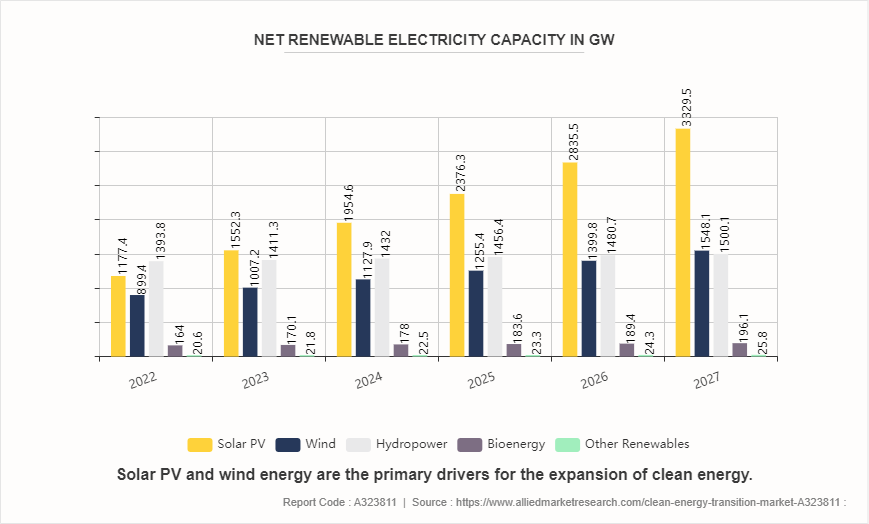

The projected growth in renewable electricity capacity from 2022 to 2027, reaching 6, 599.6 GW in 2027, signifies a substantial acceleration in the clean energy transition. Solar PV and wind energy are the primary drivers of this expansion, with solar PV capacity set to nearly triple and wind energy to increase by more than 70% over the five-year period. This rapid scale-up in renewable capacities is expected to reduce dependency on fossil fuels, thereby lowering greenhouse gas emissions and mitigating climate change impacts. The steady increase in hydropower, bioenergy, and other renewables diversifies the energy mix, enhancing energy security and resilience. Moreover, the expanding renewable capacity fosters technological advancements and cost reductions makes clean energy more accessible and affordable. This transition supports environmental sustainability and promotes economic growth by stimulating investments in green technologies and infrastructure.

Industry Trends

- Solar and wind energy are the fastest-growing sources of power generation. The declining costs of solar panels and wind turbines, along with improvements in efficiency, have made these technologies highly competitive.

- Advances in battery technology, particularly lithium-ion batteries, have enhanced the capacity and efficiency of energy storage systems. This is critical for balancing supply and demand and ensuring grid stability.

- In 2022, at the IEA's ministerial meeting, 15 IEA member countries and the European Union endorsed a joint commitment through which they pledged to provide an annual funding stream $21.64 million to the IEA's CETP through 2030, with the goal of supporting clean energy investment in emerging economies and accelerating the global transition to net zero emissions.

- The adoption of EVs is accelerating, driven by technological advancements, government incentives, and growing environmental awareness. This includes passenger cars, buses, and even heavy-duty trucks.

Key Sources Referred

- Clean Energy Transition Institute

- International Energy Agency

- Energy Transitions Commission

- Clean Energy Ministerial

- International Renewable Energy Agency

- International Atomic Energy Agency

- UN Environment Program

- World Bank

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clean energy transition market analysis from 2024 to 2028 to identify the prevailing clean energy transition market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clean energy transition market overview and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their clean energy transition market share.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global clean energy transition market trends, key players, market segments, application areas, and market growth strategies.

Clean Energy Transition Market Report Highlights

| Aspects | Details |

| Market Size By 2028 | USD 3.7 Trillion |

| Growth Rate | CAGR of 9.4% |

| Forecast period | 2024 - 2028 |

| Report Pages | 340 |

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | NextEra Energy, Inc., Enel Spa, BYD Company Ltd., Vestas Wind Systems A/S, Brookfield Asset Management, Plug Power Inc., Iberdrola, S.A., Tesla Inc., Ørsted A/S, Schneider Electric |

The global clean energy transition market was valued at $2.4 trillion in 2023, and is projected to reach $3.7 trillion by 2028, growing at a CAGR of 9.4% from 2024 to 2028.

Asia-Pacific is the largest regional market for Clean Energy Transition.

Residential is the leading application of Clean Energy Transition Market

Innovations in energy storage solutions are the upcoming trends of Clean Energy Transition Market in the globe.

The major players operating in the clean energy transition market include NextEra Energy, Inc., Iberdrola, S.A., Ørsted A/S, Tesla Inc., Enel Spa, Vestas Wind Systems A/S, BYD Company Ltd., Brookfield Asset Management, Schneider Electric, and Plug Power Inc.

Loading Table Of Content...