Clean Hydrogen Market Research, 2032

The global clean hydrogen market was valued at $3.8 billion in 2022 and is projected to reach $18.3 billion by 2032, growing at a CAGR of 14.8% from 2023 to 2032.

Key Report Highlights:

- The clean hydrogen market has been analyzed in terms of value ($ million) covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

Clean hydrogen has an extremely broad definition that includes various colors of hydrogen as per the carbon emissions of the production process. Blue and green hydrogen is considered clean hydrogen. This is due to lower and zero carbon emissions during blue and green hydrogen production.

Hydrogen is abundant in nature. It can be produced through sources such as fossil fuels, natural gas such as methane, hydrocarbons, renewable sources, and electrolysis, which is by separating water molecules. Based on the production method, hydrogen can be grey, black/brown, blue, green, or pink. Grey hydrogen is generated from fossil fuels such as natural gas or methane. During this production, no carbon emissions are captured and there is an estimated leakage of around 1.5% methane.

For black/brown hydrogen, black coal or lignite is used for producing hydrogen which has maximum damage to the environment. Blue hydrogen has a similar production process to that of grey hydrogen with carbon capture in the process. The carbon capture rate is assumed to be 98% and 68% with methane leakage of about 0.2% to 1.5% for grey and blue hydrogen, respectively. Green hydrogen is the cleanest hydrogen that is produced through electrolysis which has no leakage and zero carbon emissions only when the source of electricity is renewable sources such as solar or wind power.

According to the World Bank, the demand for hydrogen reached an estimated 87 million metric tons (MT) in 2020 and is expected to grow to 500–680 million MT by 2050. From 2020 to 2021, the hydrogen production market was valued at $130 billion and was estimated to grow up to 9.2% per year through 2030. Hydrogen is entirely supplied from fossil fuels, with 6% of global natural gas and 2% of global coal used for hydrogen production. As a consequence, the production of hydrogen is responsible for carbon dioxide (CO2) emissions of around 830 million tons of carbon dioxide per year (MtCO2/year).

Hydrogen is considered a building block for a clean energy economy. Hydrogen is used as feedstock in many industrial processes, metallurgical, and chemical processes. It can be used in fuel cell technology where it is used for producing heat, electricity, and water. It also has several applications in the transportation industry. The growing potential for hydrogen demand acts as a major driving factor for clean hydrogen market growth.

Hydrogen is also majorly used to produce ammonia, of which 80% is used for fertilizers production. This also contributes to the growth of the clean hydrogen industry. However, the high cost of clean hydrogen and relatively higher energy consumption in the production process when compared to other fuels restrain the clean hydrogen market growth. As hydrogen is highly volatile and inflammable, extensive safety procedures need to be followed which further adds to the final cost of clean hydrogen and thus acts as a market constraint.

Market Dynamics

Green hydrogen production is a difficult and costly task. The use of electrolyzers for production through renewable sources of electricity adds complexity to the overall supply chain. Commercially producing green hydrogen is coupled with technological advancements, improved efficiency, and lower costs of electrolyzers. Thus, the commercial viability of clean hydrogen production drives the growth of the clean hydrogen market. Hydrogen has been used in several industries as feedstock, reducing agents, removing impurities from ores, producing ammonia gas for fertilizers, and many more. However, potential applications of the product such as in building heating & cooling, aviation, shipping, iron & steel, chemicals, and hydrogen-based fuels augment the clean hydrogen market growth to meet the rising demand.

The hydrogen economy faces many challenges as there is a broad spectrum of hydrogen production methods with varied carbon emissions quantity. There is no defined standard or bar set for regulating and governing the market. Moreover, international hydrogen trade is also not regulated and is not encouraged at a large scale. These factors restrain the market growth for clean hydrogen. Meanwhile, clean hydrogen production can be done through electrolyzers and carbon capture technologies. Electrolyzers can be installed on the site location, near manufacturing plants, and other such application sites. This flexibility in producing clean hydrogen offers lucrative opportunities for the clean hydrogen industry growth.

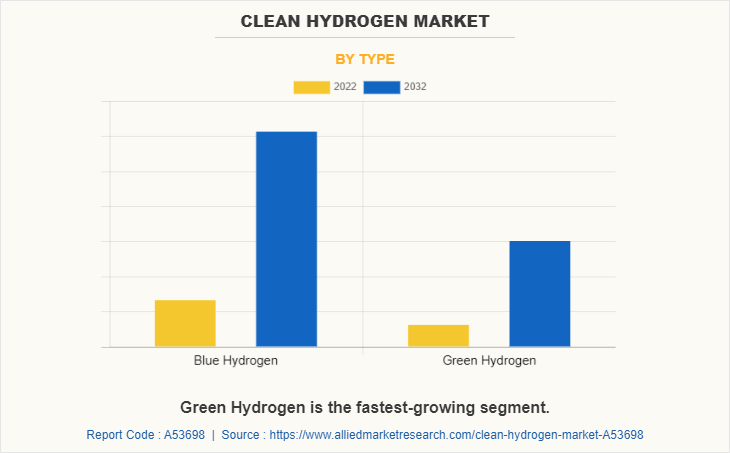

The clean hydrogen market size is studied based on type, method, application, and region.

Based on type, the clean hydrogen market is bifurcated into blue hydrogen and green hydrogen. Blue hydrogen is produced through steam reforming of natural gas. Majorly, methane is used for producing hydrogen. However, to term it as blue hydrogen, the carbon emission during the process is captured at the location and is stored for further utilization in any way or form. Carbon dioxide is obtained from the reforming of natural gas (with an efficiency of 60-65%), which has to be captured and stored.

Moreover, the use of hydrocarbons means that renewable sources are not used, and emissions are not zero. Blue hydrogen production has around 3.5-4 kg CO2 /kg H2. of carbon emissions. As of 2021, there were only two blue-hydrogen facilities globally that used natural gas to produce hydrogen at a commercial scale, as far as we can ascertain, one operated by Shell in Alberta, Canada, and the other operated by Air Products in Texas, the U.S. Blue hydrogen has a lower initial production cost due to the use of hydrocarbons.

Green hydrogen is obtained by separating hydrogen from oxygen through the electrolysis of water. This electrolysis can be carried out with energy from renewable sources, which makes the process more sustainable and provides us with a clean energy source. The hydrogen obtained in this way can be stored or used in industrial or heavy mobility processes, while the resulting oxygen is released into the atmosphere or can be used as a by-product.

In the same way, the electrolyzer generates heat that can be harnessed through the use of heat pump technologies for district heating. It is therefore a pollutant-free process. Green hydrogen is clean and is obtained from a renewable resource, using green energy sources. Another relevant aspect is water consumption. Generating 1 kg of hydrogen from electrolysis requires 10 liters of deionized water. Green hydrogen has a higher production cost. However, the development of new green hydrogen plants and commitment to the decarbonizing economy, and the development of new efficient technologies encourage the market growth for clean hydrogen.

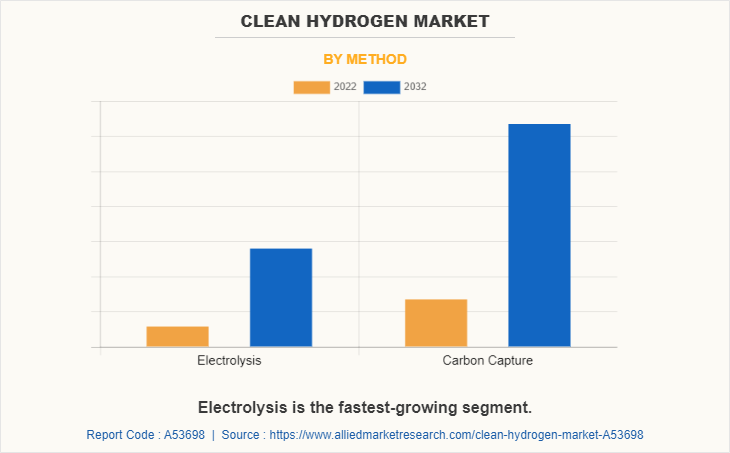

Depending on the method, the market is further classified into electrolysis and carbon capture. The electrolysis segment is further divided into alkaline electrolyzers, polymer electrolyte membrane electrolyzers (PEM), and solid oxide electrolyzers (SOE). Electrolysis is a process of converting water into hydrogen and oxygen molecules when electricity is applied. This is done through devices called electrolyzers. The electrolyzer systems are used for breaking water into hydrogen and oxygen through electrolysis. The electrolyzers consist of a cathode, an anode, and a membrane.

In electrolysis, hydrogen is collected on the cathode side, which is further stored for use in various industries. Oxygen is either released into the atmosphere or collected and used in further industrial processes. It is estimated that around 95% of the hydrogen produced is from fossil fuels. 1-4% of hydrogen is produced through electrolysis.

With the increase in emphasis on reducing carbon footprint, the use of hydrogen as fuel in industries such as automotive, locomotive, manufacturing, and chemical encourages the use of hydrogen produced from renewable sources, electrolyzers being one of them. Carbon capture technology is a form of carbon sequestration. While producing hydrogen through reforming or gasification process, carbon dioxide hence generated is captured at the location. Carbon capture technology is predicted to achieve 14 percent of the global greenhouse gas emissions reductions needed by 2050.

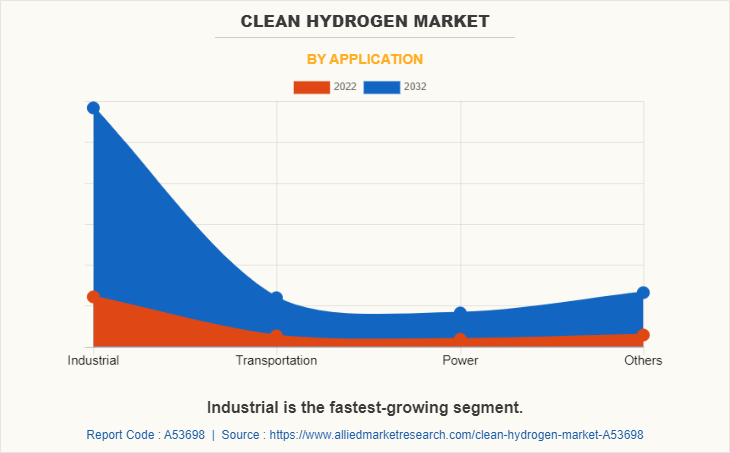

By application, the market is divided into industrial, transportation, power, and others. The industrial segment dominated the market revenue in 2022 and is expected to maintain its position during the clean hydrogen market forecast period. Hydrogen is rapidly being used for power generation as a clean energy source. Since the hydrogen generated from electrolysis leaves out a lower carbon footprint, thus the hydrogen generated through electrolysis is used as a conventional energy alternative.

The power generation segment significantly contributes to the growth of the clean hydrogen market. Hydrogen is considered an alternative to fossil fuels, as the reuse of water keeps continuing. Moreover, the use of wind and solar energy sources for electricity used in electrolysis has driven clean market growth. Hydrogen is required in many industrial sectors. For example, in the food industry, hydrogen is used to make hydrogenated vegetable oils such as margarine and butter.

Similarly, in some industries, it is used as feedstock to power the energy requirement during processing or operational activities. Such uses of hydrogen as industry feedstock drive the demand for on-site hydrogen generation plants. In others, the application of electrolyzers in aerospace, fertilizers, building heating & cooling, and refrigeration is studied. Hydrogen is used as a coolant in many industries thus leading to on-site demand for electrolyzers. Hydrogen gas is used in cooling, building heating, aerospace applications, and many other applications. As a coolant, it is used in power plant generators. In aerospace applications, liquid hydrogen is used as fuel. Such applications of hydrogen in the aforementioned sectors augment the demand for hydrogen, thereby driving the growth of the global clean hydrogen market.

By region, the clean hydrogen market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America dominated the clean hydrogen market share in 2023. This is attributed to a rise in activities in the on-site application of electrolyzers in the region. The presence of big corporations that produce clean hydrogen with major applications in the automobile and industrial sectors drives the demand for clean hydrogen. Moreover, the development of the transportation industry in Mexico acts as a key driving factor for North America clean hydrogen market.

In addition, the rise in electric vehicle demand that uses hydrogen fuel cells in Canada contributes toward clean hydrogen market growth. Europe is heavily focused on emissions-free green hydrogen, with a target to install 40 gigawatts of renewable hydrogen electrolyzer capacity by 2030. However, Europe’s green hydrogen capacity is set to reach just 2.7 gigawatts by 2025. The EU has $4.56 billion of annual funding potential for hydrogen projects in 2021-30.

The major players operating in the clean hydrogen industry are Saudi ARAMCO, Iberdrola, S.A., China Petroleum & Chemical Corporation (Sinopec), Linde plc, Exxon Mobil Corporation, FuelCell Energy, Inc., Air Products and Chemicals, Inc., Plug Power Inc., Orsted A/S, and Enel Green Power Spa. The other market players are NEL ASA, Air Liquide SA, Siemens Energy, Oil & Natural Gas Corporation, and Adani Green Energy.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clean hydrogen market analysis from 2022 to 2032 to identify the prevailing clean hydrogen market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clean hydrogen market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global clean hydrogen market trends, key players, market segments, application areas, and market growth strategies.

Clean Hydrogen Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.3 billion |

| Growth Rate | CAGR of 14.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | ExxonMobil, Plug Power Inc., Linde plc, FuelCell Energy Inc, Orsted A/S, Air Products & Chemicals Inc., China Petroleum & Chemical Corporation, Enel Green Power Spa, Iberdrola SA, Saudi Aramco |

Analyst Review

According to the insights from the CXO’s, hydrogen is projected to contribute around 15-17% to the energy mix by 2050. Clean hydrogen leaves a lower carbon footprint than other forms of hydrogen. This will aid in decarbonizing the carbon extensive economy and lead to a clean energy economy. Clean hydrogen production can be boosted by encouraging investments from both government and the public. Moreover, building infrastructure to support safe transmission and storage of the product is expected to enable clean hydrogen production. Furthermore, scaling up clean hydrogen production capacities and capabilities of the supply chain also drives the clean hydrogen industry growth. However, the lack of a policy framework and the high cost of clean hydrogen production compared to conventional methods hampers the market growth. Meanwhile, a proper regulatory framework for boosting investments in the sector will open wide opportunities for industry growth in the future

The estimated industry size of Clean Hydrogen is $18.3 billion by 2031.

Increased commercial viability, growth in the application of hydrogen, rise in demand for hydrogen as alternative fuel, and net zero targets and aim to decarbonize the economy are the upcoming trends of Clean Hydrogen Market in the world.

Industrial application is the leading application of Clean Hydrogen Market.

North America is the largest regional market for Clean Hydrogen

Saudi ARAMCO, Iberdrola, S.A., China Petroleum & Chemical Corporation (Sinopec), Linde plc, Exxon Mobil Corporation, FuelCell Energy, Inc., Air Products and Chemicals, Inc., Plug Power Inc., Orsted A/S, and Enel Green Power Spa are the top companies to hold the market share in Clean Hydrogen.

Loading Table Of Content...

Loading Research Methodology...