Cleanroom Disposable Gloves Market Research, 2032

The global cleanroom disposable gloves market was valued at $2.2 billion in 2022, and is projected to reach $4.6 billion by 2032, growing at a CAGR of 8% from 2023 to 2032.

Report Key Highlighters:

- The cleanroom disposable gloves market is highly fragmented, with several players including Adventa Berhad, Semperit AG Holding, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd, Rubberex Corporation (M) Berhad, Dynarex Corporation., Top Glove Corporation Bhd, Kimberly-Clark Corporation, Cardinal Health, Ansell Ltd., Supermax Corporation Berhad, and Riverstone Holdings Limited.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the market report.

- Global Level Factory Selling Price and Average Selling Pricing Analysis of types of cleanroom disposable gloves are also included in the report.

Cleanroom disposable gloves are specialized gloves designed for use in cleanroom environments, which are controlled environments with low levels of particulate contamination. Cleanrooms are commonly found in industries such as pharmaceuticals, electronics manufacturing, biotechnology, and aerospace, where even small contaminants have significant impacts on the quality of products being produced. These gloves help maintain the cleanliness and integrity of the cleanroom by preventing contamination from human skin, oils, and other particles.

Surge in demand for cleanroom disposable gloves from electronics industry is bolstering the cleanroom disposable gloves market growth.

The electronics industry is a significant driver of the cleanroom disposable gloves market due to its stringent cleanliness requirements and the critical need to prevent contamination during the manufacturing of sensitive electronic components and devices.

The electronics industry produces a wide range of sensitive components such as semiconductors, microchips, integrated circuits, and display screens. Even the smallest particle or trace of contamination can result in defects or malfunctioning, making cleanroom environments and cleanroom gloves essential. Furthermore, electronics manufacturing facilities often adhere to strict cleanroom classifications, such as ISO 14644, to maintain specific cleanliness levels. Cleanroom disposable gloves are an integral part of contamination control measures, ensuring that personnel do not introduce contaminants into these environments.

Moreover, the electronics industry is a global industry with manufacturing facilities across the globe. This global presence contributes to the widespread use of cleanroom gloves in various regions. However, the high cost associated with cleanroom disposable gloves is expected to act as a major restraint for market growth. Nevertheless, technological advancements are anticipated to offer many opportunities for market growth in the coming years.

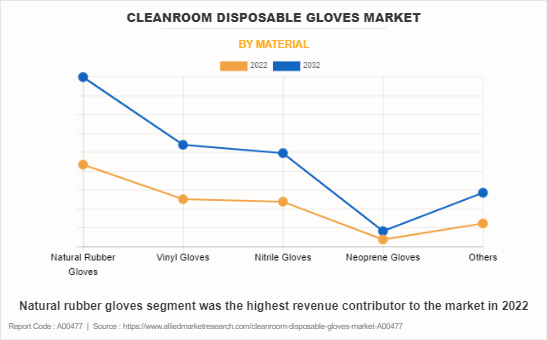

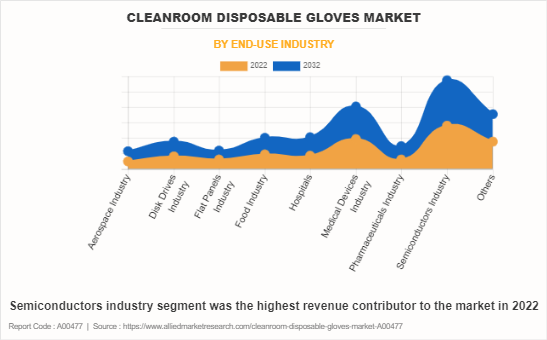

The cleanroom disposable gloves market is segmented on the basis of material, end-use industry, and region. On the basis of material, the market is categorized into natural rubber gloves, vinyl gloves, nitrile gloves, neoprene gloves, and others. On the basis of end-use industry, the cleanroom disposable gloves market is classified into aerospace industry, disk drives industry, flat panels industry, food industry, hospitals, medical devices industry, pharmaceuticals industry, semiconductors industry, and others. On the basis of region, the cleanroom disposable gloves market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players in the cleanroom disposable gloves industry include Adventa Berhad, Cardinal Health, Inc., Dynarex Corporation, Semperit AG Holding, Ansell Healthcare Europe NV, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Ltd., Rubberex Corporation (M) Berhad, Top Glove Corporation Berhad, Riverstone Holdings Limited, and Kimberly-Clark Worldwide, Inc. Nowadays, the key manufacturers operating in the cleanroom disposable gloves market have adopted strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration to increase their market share.

Asia-Pacific dominated the market in 2022. The growth in population and increase in healthcare expenditure in Asia-Pacific countries have led to rise in demand for healthcare services and pharmaceutical products. Cleanrooms are critical for pharmaceutical manufacturing and healthcare applications, driving the demand for cleanroom gloves. In addition, the biotechnology sector in the Asia-Pacific region has been expanding at a rapid pace. Biotech companies require cleanroom environments for research, development, and manufacturing of biopharmaceuticals and biotechnology products.

Furthermore, countries such as China, Japan, South Korea, and Taiwan are global hubs for electronics manufacturing. Cleanrooms are essential in semiconductor fabrication and electronic component assembly, creating a significant demand for cleanroom gloves. The Asia-Pacific region has a growth in consumer electronics market, leading to higher production volumes. This drives the need for cleanrooms and cleanroom gloves in the electronics supply chain. All these factors are anticipated to drive the cleanroom disposable gloves market growth in the region during the forecast period.

Natural rubber gloves segment was the highest revenue contributor to the market in 2022. Natural rubber cleanroom disposable gloves are made from latex, a milky fluid harvested from rubber trees (Hevea brasiliensis). This material provides the gloves with elasticity and flexibility. Latex gloves are highly elastic, allowing them to stretch and conform to the shape of the hand. This elasticity provides a snug fit and reduces the risk of tears or rips during use. These gloves are known for their comfort, making them suitable for prolonged wear. They offer good sensitivity and dexterity, which is essential for tasks that require precision and fine motor skills.

Moreover, these gloves serve as an effective barrier against a wide range of liquids, chemicals, and microorganisms. They are commonly used in healthcare settings, laboratories, and industries where protection against biological or chemical hazards is necessary. Natural rubber cleanroom disposable gloves are widely used in medical and healthcare settings for procedures such as surgeries, examinations, and patient care. They help prevent the transmission of infections and protect healthcare workers and patients.

Semiconductors industry segment was the highest revenue contributor to the market in 2022. Semiconductor manufacturing has become more advanced with the development of smaller and more intricate devices. This trend demands cleanroom disposable gloves that provide better dexterity, tactile sensitivity, and precision to handle delicate components. In addition, as the demand for smaller and more powerful electronic devices increases, semiconductor manufacturers need gloves that offer a higher degree of precision and cleanliness to handle the intricate components used in these devices.

The growth in demand for microelectronic devices and components in various applications, such as consumer electronics, automotive, and healthcare, drives the semiconductor industry. This growth creates an increased demand for cleanroom disposable gloves to maintain product cleanliness. Moreover, the rise in demand for microelectronics in applications such as smartphones, IoT devices, automotive electronics, and healthcare technology offers opportunities for glove suppliers to meet the increase in need for cleanroom disposable gloves. All these factors create new growth opportunities for the cleanroom disposable gloves market in the semiconductors industry during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cleanroom disposable gloves market analysis from 2022 to 2032 to identify the prevailing cleanroom disposable gloves market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cleanroom disposable gloves market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cleanroom disposable gloves market trends, key players, market segments, application areas, and market growth strategies.

Cleanroom Disposable Gloves Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.6 billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 292 |

| By Material |

|

| By End-use Industry |

|

| By Region |

|

| Key Market Players | Rubberex Corporation (M) Berhad, ANSELL LTD., Kimberly-Clark Corporation, Dynarex Corporation., Riverstone Holdings Limited., Kossan Rubber Industries Bhd, Supermax Corporation Berhad., Hartalega Holdings Berhad, Top Glove Corporation Bhd, Adventa Berhad, Cardinal Health, Semperit AG Holding |

Analyst Review

According to the opinions of various CXOs of leading companies, the cleanroom disposable gloves market is expected to witness increased demand during the forecast period. The use of cleanroom disposable gloves is driven by several key factors, primarily related to the need for contamination control and maintaining product quality and safety in controlled environments.

The primary driver for using cleanroom gloves is to prevent the introduction of contaminants, particles, and microorganisms into cleanroom environments. Even small contaminants can have significant negative impacts on product quality and safety in industries such as pharmaceuticals, electronics manufacturing, biotechnology, and aerospace.

Furthermore, innovations in cleanroom disposable gloves continue to evolve to meet the ever-growing demands of cleanroom environments and the specific requirements of industries such as pharmaceuticals, electronics manufacturing, biotechnology, and healthcare. These innovations aim to improve contamination control, user comfort, and overall safety, while also considering sustainability and environmental impact.

The global cleanroom disposable gloves market size was valued at $2.2 billion in 2022, and is projected to reach $4.6 billion by 2032, growing at a CAGR of 8% from 2023 to 2032.

Key players in the cleanroom disposable gloves industry include Adventa Berhad, Cardinal Health, Inc., Dynarex Corporation, Semperit AG Holding, Ansell Healthcare Europe NV, Hartalega Holdings Berhad, Supermax Corporation Berhad, Kossan Rubber Industries Ltd., Rubberex Corporation (M) Berhad, Top Glove Corporation Berhad, Riverstone Holdings Limited, and Kimberly-Clark Worldwide, Inc.

Growth in biotechnology and pharmaceutical sectors is the key factor driving the cleanroom disposable gloves market.

Semiconductors is the leading application of Cleanroom Disposable Gloves Market.

Asia-Pacific is the largest regional market for Cleanroom Disposable Gloves.

Loading Table Of Content...

Loading Research Methodology...