Cloud-based Database Market Research, 2032

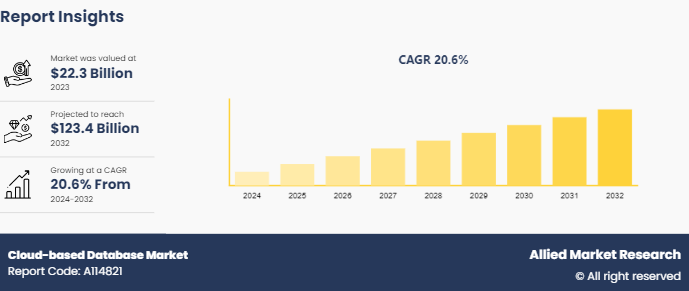

The global cloud-based database market was valued at $22.3 billion in 2023 and is projected to reach $123.4 billion by 2032, growing at a CAGR of 20.6% from 2024 to 2032. As organizations increasingly adopt cloud-based solutions to modernize their IT infrastructure and enhance data management capabilities, the cloud-based database market is expected to continue its growth trajectory, driven by the demand for scalable, agile, and cost-effective data storage and management solutions in the digital age.

Market Introduction and Definition

The cloud-based database market encompasses a rapidly growing sector within the technology industry that provides database services through cloud computing infrastructure. This market offers organizations the ability to store, manage, and access their data remotely over the internet, without the need for on-premises hardware or infrastructure. Cloud-based databases leverage the scalability, flexibility, and cost-effectiveness of cloud computing to meet the evolving data management needs of businesses across various sectors. Providers in the cloud-based database market offer a range of services, including relational databases, NoSQL databases, and data warehousing solutions, personalized to meet the diverse requirements of different organizations. These services enable businesses to efficiently store and analyze large volumes of data, improve data accessibility and security, and streamline data management processes.

Key Takeaways

The cloud-based databases market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected cloud-based database market forecast period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major cloud-based database industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and cloud-based database market size.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets during the cloud-based database market forecast period and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in demand for scalable and flexible data storage solutions. Cloud-based databases offer organizations the ability to scale their storage capacity based on their needs, enabling them to efficiently manage growing volumes of data without the constraints of traditional on-premises infrastructure. Also, the cost-effectiveness of cloud-based databases, with pay-as-you-go pricing models and reduced upfront investment in hardware, is driving their adoption among businesses seeking to optimize their IT spending. In addition, the rise of data-driven decision-making and the need for real-time data access are driving organizations to leverage cloud-based databases to enhance their data analytics capabilities and gain valuable insights from their data.

However, data security and privacy concerns are associated with storing sensitive information in the cloud. Organizations need to ensure robust security measures and compliance with data protection regulations to mitigate the risks of data breaches and unauthorized access. In addition, concerns around data sovereignty and data residency requirements may pose challenges for organizations operating in regions with strict data localization laws, impacting their ability to leverage cloud-based database services across geographies. Furthermore, there is a growing opportunity for cloud-based database providers to offer innovative solutions that cater to the evolving data management needs of organizations, with the increasing adoption of cloud computing and digital transformation initiatives across industries. The market also presents opportunities for collaboration and partnerships between cloud service providers, database vendors, and industry-specific solution providers to deliver integrated offerings that address the unique requirements of different sectors. Furthermore, the emergence of technologies such as artificial intelligence, machine learning, and Internet of Things (IoT) is creating new use cases for cloud-based databases, opening up avenues for innovation and differentiation in the market.

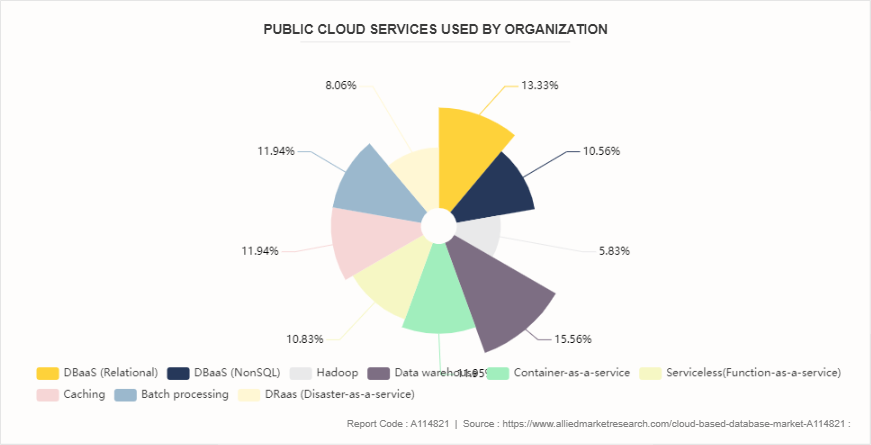

Public Cloud Service Used by Organization

Organizations are increasingly relying on public cloud services for their database needs, leveraging the scalability, flexibility, and cost-effectiveness offered by cloud-based solutions. Cloud-based databases, such as Database as a Service (DBaaS) , provide organizations with the ability to store and manage their data in a secure and efficient manner. These services offer features like automatic backups, high availability, and seamless scalability, allowing organizations to focus on utilizing their data rather than managing infrastructure. In addition, cloud-based databases support both relational and non-relational data models, catering to diverse data requirements. Organizations are turning to cloud-based databases for real-time analytics, business intelligence, and data warehousing capabilities with the growth of data-driven decision-making.

Market Segmentation

The cloud-based database market is segmented into type, deployment mode, enterprise size, and region. On the basis of deployment, the market is divided into public, private and hybrid. On the basis of enterprise size, the market is divided into large enterprise and small and medium-sized enterprise. On the basis of type, the market is divided into relational database and non-relational database. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The cloud-based database market in the U.S. and UK is experiencing significant growth due to the increase in adoption of cloud technology by businesses of all sizes. In the U.S., the market is driven by the presence of major cloud service providers such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform. These companies offer a wide range of cloud-based database solutions that cater to diverse business needs. In addition, the U.S. market benefits from a strong focus on data security and compliance regulations. In the UK, the cloud-based database market is also expanding rapidly, with businesses leveraging cloud technology to improve scalability, flexibility, and cost-efficiency. The market is characterized by a growing number of cloud service providers offering innovative database solutions tailored to the unique requirements of UK businesses. Overall, both the U.S. and UK cloud-based database markets are poised for continued growth as organizations increasingly embrace cloud technology for their data management needs.

In March 2024, Hitachi, Ltd. partnered with Amazon Web Services Japan G. K. ("AWS") to strengthen hybrid cloud solutions in Japan. Based on this partnership, Hitachi and AWS strengthen the development of hybrid cloud solutions that we have co-created for the purpose of promoting system modernization and cloud migration for customers over a three-year period starting in April 2024.Company also accelerate the deployment of these solutions with the technical support of AWS.

In January 2024, Amazon Web Services (AWS) announced its plans to invest 2.26 trillion yen into its existing cloud infrastructure in Tokyo and Osaka by 2027 to meet growing customer demand for cloud services in Japan. According to the new AWS Economic Impact Study (EIS) for Japan, this planned investment is estimated to contribute 5.57 trillion yen to Japan’s Gross Domestic Product (GDP) , and support an estimated average of 30, 500 full-time equivalent (FTE) jobs in local Japanese businesses each year.

In August 2023, The Directorate General of Training (DGT) collaborated with Amazon Web Services (AWS) India to upskill students in cloud computing, data annotation, artificial intelligence (AI) and machine learning. AWS India, a subsidiary of Amazon that provides scalable and affordable cloud computing solutions, will offer free self-paced online learning programs on emerging technologies. As part of this collaboration, AWS India will use Amazon Sage Maker Ground Truth, which aids in creating accurate training data sets for machine learning, to help DGT in training individuals in data annotation and labelling.

Industry Trends:

- Many organizations are adopting hybrid cloud solutions to combine the benefits of private and public clouds. This allows companies to have greater flexibility and scalability while maintaining control over sensitive data. For instance, in November 2023, Microsoft Ignite, launched a broad set of new features for Azure Database for PostgreSQL - Flexible Server, Microsoft’s fully managed Postgres service built on open-source Postgres and engineered for enterprises and developers alike. The new Flexible Server features enhance the performance, security, and availability of the PostgreSQL database service and also enable to bring the power of Azure OpenAI directly to the database to simplify the development of new AI-powered apps using the latest version of Postgres.

- In February 2020, Oracle DataFox has expanded its pool of AI-sourced and managed data. Since being acquired by Oracle in 2018, Oracle DataFox has extended its global coverage by more than 70% with rapid growth in Europe, where Oracle DataFox coverage has increased by 135% to cover more than one million businesses in the region.

- Serverless computing allows businesses to run applications and services without the need to manage servers, enabling them to focus on developing and deploying code rather than worrying about infrastructure maintenance. In the context of cloud-based databases, serverless computing offers scalability, flexibility, and reduced operational overhead, making it an attractive option for companies looking to streamline their data management processes. This trend is expected to continue growing as more businesses recognize the benefits of serverless computing in optimizing their cloud-based database operations. For instance in July 2021, Amazon Web Services (AWS) introduced new serverless capabilities, including Amazon Aurora Serverless v2 for MySQL and PostgreSQL databases. For instance, in July 2020, Microsoft acquired the Metaswitch Networks. The convergence of cloud and communication networks presents a unique opportunity for Microsoft to serve operators globally via continued investment in Azure, adding additional depth to our hyperscale cloud infrastructure with the specialized software required to run virtualized communication functions, applications and networks.

Competitive Landscape

The major players operating in the cloud-based database industry include Amazon Web Services, Google, IBM, Microsoft, Oracle, Salesforce, SAP, Teradata, Alibaba, Tencent and others.

Recent Key Strategies and Developments

In November 2023, IBM collaborated Amazon Web Services (AWS) on the general availability of Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to make it easier for database customers to manage data for artificial intelligence (AI) workloads across hybrid cloud environments. Amazon RDS for Db2 customers now have the option to modernize on premises, on AWS, or to deploy a hybrid cloud architecture, to optimize AI workloads. For customers moving to AWS, Amazon RDS for Db2 can help them to migrate their existing, self-managed Db2 databases to the cloud-helping to automate time consuming database administrative tasks such as provisioning, backups, software patching, and monitoring.

In February 2023, S&P Global and Amazon Web Services (AWS) , an Amazon Inc. company announced a new multi-year strategic collaboration agreement. With AWS as its preferred cloud provider, S&P Global enhanced its cloud infrastructure, accelerate business growth, engineer new innovations for key industry segments, and help their customers navigate rapidly changing market conditions.

In June 2021, Amazon Web Services, Inc. (AWS) , an Amazon.com Inc. company and Salesforce announced a significant expansion of their global strategic partnership that make it easy for customers to use the full set of Salesforce and AWS capabilities together to quickly build and deploy powerful new business applications that accelerate digital transformation.

Key Sources Referred

flexera.com

Cloudzero.com

solutionsreview.com

bluexp.netapp.com

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cloud-based database market analysis from 2024 to 2032 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cloud-based database market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global cloud-based database market size.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and cloud-based database market share.

The report includes the analysis of the regional as well as global cloud-based database market trends, key players, market segments, application areas, and cloud-based database market growth strategies.

Cloud-based Database Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 123.4 Billion |

| Growth Rate | CAGR of 20.6% |

| Forecast period | 2024 - 2032 |

| Report Pages | 234 |

| By Type |

|

| By Deployment |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Salesforce, Inc., Teradata, Tencent, Alphabet (Google Inc.), alibaba.com, IBM, Oracle Corporation, Amazon Web Services, SAP SE, Microsoft |

The cloud-based database market was valued at $22.3 billion in 2023 and is estimated to reach $123.4 billion by 2032, exhibiting a CAGR of 20.6% from 2024 to 2032.

The rise in the need for flexibility and Scalability and the increase in demand for remote accessibility are the upcoming trends of Cloud-based Database Market in the globe.

Rise in data integration and analysis is the leading application of the Cloud-based Database Market.

North America is the largest regional market for Cloud-based databases.

Amazon Web Services, Google, IBM, Microsoft, Oracle, Salesforce, SAP, Teradata, Alibaba.com, Tencent are the top companies to hold the market share in Cloud-based Database.

Loading Table Of Content...