Cloud Computing Banking Market Research, 2032

The global cloud computing banking market was valued at $67.9 billion in 2022, and is projected to reach $301 billion by 2032, growing at a CAGR of 16.3% from 2023 to 2032.

The term “cloud computing” refers to the on-demand availability of computer system resources, most notably data storage (also known as “cloud storage”) and computing power, without the need for the user to manage these resources directly and actively. Large clouds typically have functions that are dispersed across multiple locations, with each location functioning as a data center. Cloud computing is dependent on the sharing of resources to achieve coherence. It also typically uses a “pay-as-you-go” model, which can assist in the reduction of capital expenses but may also result in unexpected operating expenses for users who are unaware of the potential risk.

The advantages of using cloud computing in the banking industry are extensive. It can help companies modernize infrastructure, scale operations, reduce costs, improve resiliency, and build new revenue streams and services. Cloud-based systems have helped banks adapt to the rise in remote working, increased customer app use, and associated security and fraud risks.

The increase in adoption of cloud-based fintech solutions by banks and rising popularity of advanced technologies is boosting the growth of the global cloud computing banking market. in addition, increase in use of digital transformation technology the positively impacts growth of the market. However, lack of technical proficiency for implementing cloud computing solutions and increasing security concerns is hampering the cloud computing banking market growth. On the contrary, increase in adoption of Artificial Intelligence based banking system is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Segment Review

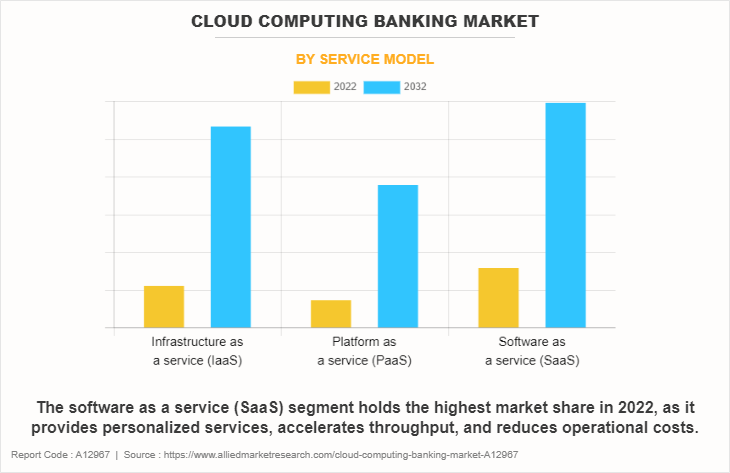

The cloud computing banking market is segmented on the basis of service model, deployment mode, application, and region. On the basis of service model, the market is categorized into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). On the basis of deployment mode, the market is fragmented into public cloud, private cloud, and hybrid cloud. By application, it is classified into fraud detection & prevention, customer relationship management (CRM), human resource management, core banking, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of service model, the software as a service (SaaS) segment holds the highest cloud computing banking market size as it provides personalized services, accelerates throughput, and reduces operational costs. However, the platform as a service (PaaS) segment is expected to grow at the highest rate during the forecast period. These services reduce management concerns efficiently with personalized assistance and optimized performance development.

Region wise, the cloud computing banking market share was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rise in adoption of cloud computing banking in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of banking.

The key players that operate in the market are Amazon Web Services, Microsoft Corporation, IBM Corporation, Google LLC, Oracle Corporation, Salesforce.com Inc., Alibaba Cloud Computing Ltd., VMware, SAP SE, and Dell Technologies. These players have adopted various strategies to increase their market penetration and strengthen their position in the cloud computing banking industry.

Competition Analysis

Recent Partnerships in the Cloud Computing Banking Market

September 12, 2023: Temenos partnered with Varo Bank, N.A. Temenos Banking Cloud enables Varo to scale based on customer demands, deploy new products quickly, and drive down operational costs substantially. This has helped the bank to bring innovative products to market faster and at scale to meet the surge in digital banking.

Recent Product Launches in the Cloud Computing Banking Market

In November 01, 2021, Kyndryl, a technology infrastructure services provider launched banking and financial industry services for Google Cloud Customers to safely store and protect their confidential and sensitive data. Moreover, it also helps financial services organizations to plan and implement their data and application environment in Google Cloud.

Recent Collaboration in the Cloud Computing Banking Market

On March 10, 2020, Lloyds Banking Group, collaborated with Google Cloud to accelerate digital transformation. The collaboration has add Google Cloud to the Group’s portfolio of technologies, accelerating its ambition to deploy smarter technology and better experiences to its customers across the UK.

Top Impacting Factors

Increase in Adoption of Cloud-based Fintech Solutions by Banks

Adoption of cloud-based fintech solutions by banks to improve operational efficiency, automate processes, and addresses security concern are driving the market expansion. In addition, governments in many developing nations are investing in cloud computing delivery models due to cloud computing's ability to stream technological operations and boost government productivity. For instance, in June 2023, The Ministry of Economy (MoE), of the UAE, partnered with Amazon Web Services, Inc., a provider of cloud computing platforms, to launch the AWS Connected Community initiative which supports the digitization of small banks in the UAE.

The initiative would help SMEs expand and grow in local and international markets. Through the initiative, virtual workshops and sessions for entrepreneurs and SMEs will be conducted to enhance digital economy and technology capabilities, such as cloud computing, IoT, digital media, smart applications, Blockchain, robots, digital databases, and storage. Such demands are driving the growth of the cloud computing banking industry.

Rising popularity of Advanced Technologies

The rising popularity of the latest novel technologies like artificial intelligence (AI) and machine learning (ML) and its rapid adoption in cloud computing is empowering the growth of the global cloud computing banking market. There has been a rapid increase in technological advancements since the outbreak of the COVID-19 pandemic across the developed and the developing economies. Cloud computation is enabling the banking industry to sustain its business functions amid the rising adoption of work from a work-from-home model. Cloud computing technology enables enterprises to efficiently store, access, and manage critical data. With the rising adoption of smartphones, laptops, and the internet, the need for storing and processing huge volumes of data has significantly increased enabling enterprises to offer customer-centric services to their customers and clients.

The rising focus on customer satisfaction, the increasing need for controlling operational expenditure, and the need for controlling capital expenditure are some of the most prominent factors that are significantly driving the growth of the global cloud computing market. Data security, compliance requirements, and quick data recovery are major factors that boost the demand for cloud computing banking services across the globe.

Restraints

Lack of Technical Proficiency for Implementing Cloud Computing Solutions

Rapid innovation in telecom service has created a technical gap for end users, as they need to adapt to new technology infrastructures and improve their operations and business processes. In addition, the lack of skilled workforce is making it difficult for companies to plan, build, and deploy new infrastructures and focus on their core competencies, which, in turn, is hindering the growth of the cloud computing banking market. Moreover, a lack of technical proficiency while implementing cloud solutions in the telecom industry leads to reduced work efficiency & data corruption, and privacy security concerns, thus restraining the growth of the global market. In addition, the key factor challenging the growth of the market is the unavailability of skilled personnel.

Increasing Security Concerns

The surge in cyber-attacks on financial consulting software for gaining the personal data of clients hampers market growth. Moreover, the increasing adoption of public networks supporting endpoints running on public servers without proper cybersecurity is posing a huge threat to the end users. Moreover, data security and privacy are the primary concerns of organizations, wherein storage, use, and transmission of information must be digitally protected. For instance, according to a survey by EmergingEd, about 60% of the business-sensitive information on hard drives is held insecurely. Data encryption, authorization management, access control, cloud integration, communication security, monitoring & and auditing, and business continuity services are some of the important security services offered by the vendors. For instance, vendors such as Google LLP, Microsoft Corporation, and Amazon.com Inc. provide 99.9% uptime, which relieves organizations from the burden of creating and maintaining recovery facilities and backup infrastructure, hampering the growth of the market.

Opportunities

Integration of Specialized Computing Solution

The integration of specialized computing solutions as per the industry’s requirements presents a significant opportunity for the market to grow. The integration of such solutions enables more efficient and tailored processing of specific tasks. Cloud solutions providers offer specialized hardware and accelerate as services, allowing customers to access these resources without the need for large investments in hardware infrastructure. With specialized solutions, the workload be managed, and cost be optimized. Thus, as industries start focusing on integrating specialized computing solutions, the market for cloud computing solutions is expected to grow. RCH Solutions, based in the U.S. is one of the most prominent providers of specialized computing solutions. The company offers specialized solutions to help research and development teams accelerate the delivery of scientific breakthroughs, which in turn is expected to provide lucrative opportunities for the growth of the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cloud computing banking market analysis from 2023 to 2032 to identify the prevailing cloud computing banking market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cloud computing banking market segmentation assists to determine the prevailing cloud computing banking market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global cloud computing banking market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the cloud computing banking industry market players.

- The report includes the analysis of the regional as well as global cloud computing banking market trends, key players, market segments, application areas, and market growth strategies.

Cloud Computing Banking Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 301 billion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Service Model |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAP SE, Google LLC, VMware, IBM Corporation, Alibaba Cloud Computing Ltd., Microsoft Corporation, Oracle Corporation, Amazon Web Services, Dell Technologies, Salesforce.com Inc. |

Analyst Review

Cloud computing banking consists of financial applications that include automated tools to satiate the needs of the banking sector. Moreover, cloud computing banking provides tailored solutions to meet the particular needs of potential customers. Worldwide, mid and large-size institutions can access cutting-edge technology and cost-effective banking solutions owing to cloud computing banking.

Key providers in the cloud computing banking market are Oracle Corporation, SAP SE, and Microsoft Corporation. With the growth in demand for cloud computing banking solutions, various companies have established partnership strategies to increase their solutions offerings in AI solutions. For instance, in September 2023, Varo Bank partnered with Temenos. This has helped the bank to bring innovative products to market faster and at scale to meet the surge in digital banking. Further, such strategies drive market growth.

In addition, with the surge in demand for cloud computing banking, several companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in July 2022, Huawei Intelligent launched a Cloud Native Core Banking solution as it provides capabilities such as unified storage and metadata so that a copy of data can be transferred between engines quickly and consistently.

For instance, in May 2023, CaixaBank partnered Google Cloud to accelerate the bank’s transition to the cloud and drive innovation using data and analytics technologies.

The upcoming trends of cloud computing banking market is the adoption of edge computing in banking will enable real-time processing of transactions and data at the network edge, reducing latency and improving the customer experience.

Fraud Detection and Prevention is the leading application of Cloud Computing Banking Market.

North America is the largest regional market for Cloud Computing Banking.

$30.1 billion is the estimated industry size of Cloud Computing Banking.

Amazon Web Services, Microsoft Corporation, IBM Corporation, Google LLC, Oracle Corporation, Salesforce.com Inc., Alibaba Cloud Computing Ltd., VMware, SAP SE, and Dell Technologies are the top companies to hold the market share in Cloud Computing Banking.

Loading Table Of Content...

Loading Research Methodology...