Cloud Enterprise Application Software Market Outlook: 2023

The global cloud enterprise application software market was valued at $55,988 million in 2016, and is expected to reach $144,111 million by 2023, growing at a CAGR of 14.6% from 2017 to 2023. Enterprise application is a business application, which is useful for enterprises to integrate their business functionalities to achieve high efficiency and productivity. Cloud-based deployment platform has given a significant boost to the enterprise application software during last few years. The report encompasses study of different cloud enterprise application software by solutions such as CRM, ERP, SCM, BI, BPM, CMS, EAM, Web conferencing, and others. Furthermore, it focuses on adoption of cloud-based enterprise application software in various industry verticals such as manufacturing, healthcare, retail, oil & gas, BFSI, telecom, and others.

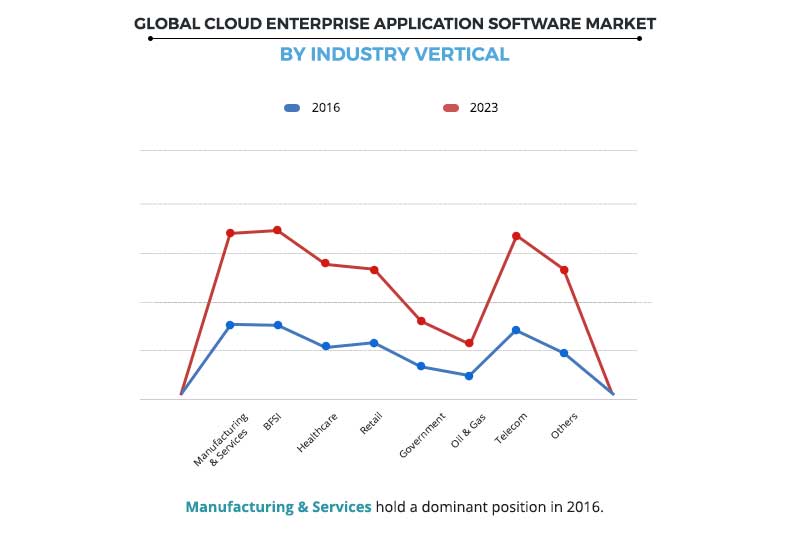

The global cloud enterprise application software market is segmented on the basis of solution, industry vertical, and geography. Based on solution, the market is segmented into customer relationship management (CRM), enterprise resource planning (ERP), supply chain management (SCM), Web conferencing, business intelligence (BI), business process management (BPM), content management system (CMS), enterprise asset management (EAM), and others. By industry vertical, it is classified into manufacturing & services, BFSI, healthcare, retail, government, oil & gas, telecom, and others. Geographically, cloud enterprise application software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major factors that drive the growth of the global cloud enterprise application software market are increase in adoption of cloud-based solutions, inclination of companies towards customer-centric approach, and realization of competitive advantages achieved through implementation of enterprise application software, rapid changes in business models, and emerging trends of cloud.

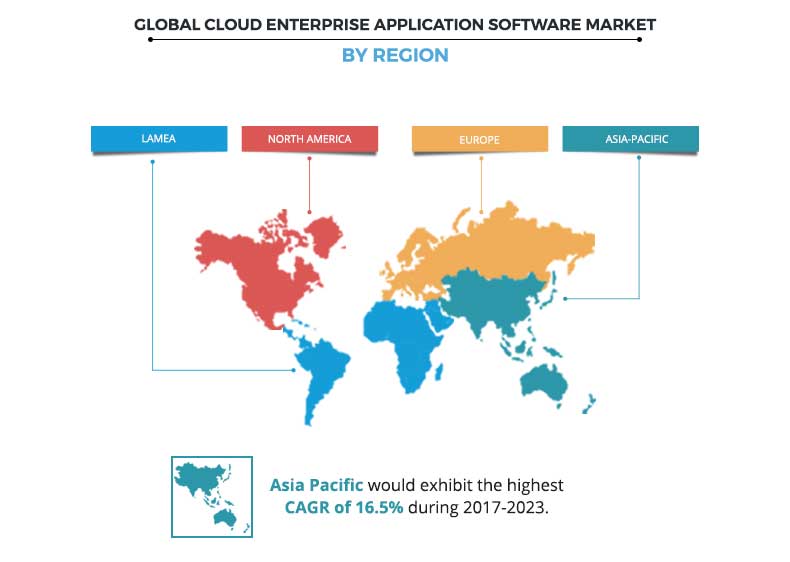

The North American cloud enterprise application software market generated the highest revenue in 2016, owing to increase in adoption of cloud-based solutions, presence of a large number of enterprises, and rise in adoption of IoT. The Asia-Pacific cloud enterprise application software market is expected to grow at the highest CAGR, owing to increase in penetration of internet and surge in adoption of ERP application in the government agencies. Furthermore, SMEs in the region have developing technological infrastructure, which fosters the adoption of cloud-based enterprise applications.

The key players operating in the cloud enterprise application software industry include Oracle, IBM, Microsoft, SAP, HP, QAD Inc., IFS AB, Epicor Software Corp., Infor, and Salesforce.com. These players have expanded their market presence by adopting various business strategies such as acquisition, geographical expansion, product development, strategic alliance, and collaboration.

Top Investment Pockets

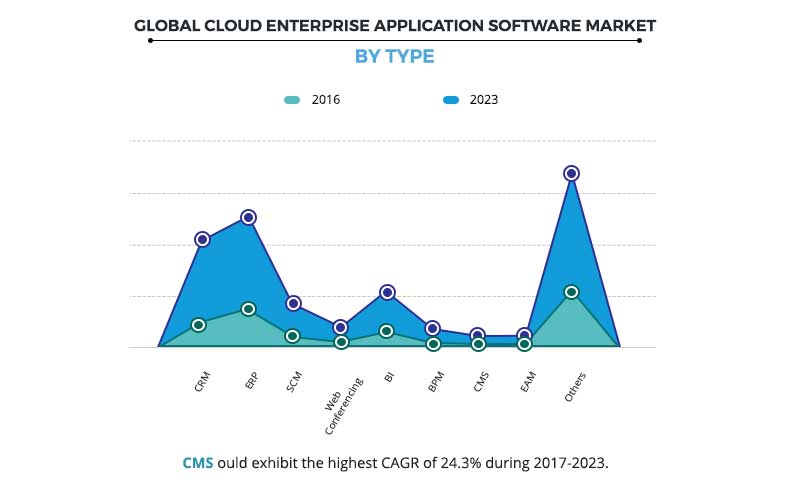

The following graph signifies the growth potential of the global cloud enterprise application software market by solution. It is observed that the market growth is driven by the others segment (includes human resource management, environmental resources management, management information system, decision support system, Business continuity planning, collaboration, IT service management, enterprise application integration, and enterprise forms automation), which occupied the largest market share in 2016. However, major growth is observed in the content management system (CMS) sector where cloud enterprise application software solutions are expected to witness considerable adoption in the near future.

Segmentation

By Solution

Large number of companies operating in the global cloud enterprise application software market offer specific enterprise application solutions as per the requirements of end-user industries. Selection of enterprise application depends upon factors such as need of enterprise, business size, functional areas, and expected benefits to organizations. Major enterprise application available in the market are CRM, ERP, SCM, BI, BPM, CMS, EAM, and Web conferencing.

Enterprise Resource Planning (ERP)

Companies are adopting cloud ERP applications to optimize their business functions and IT process. Social media and its integration with cloud ERP application are expected to provide potential growth opportunities for ERP vendors. Employees in the organization use smart phones and tablets, leading to a higher demand for smartphone enabled ERP solutions, which are being deployed on cloud-based platform. Numerous companies are expanding their global presence, which is further anticipated to provide growth opportunity for the cloud ERP solution vendors to cater to the increasing demands for ERP from end-user industries.

By Geography

North America

Companies are increasingly investing in the IT sector to implement enterprise application for proper work process. Adoption of enterprise application leads to enhanced business performance. However, adoption of enterprise application depends on business requirement, as it reduces operational costs and helps the organization to perform multiple tasks at a time. Cloud-based enterprise application has witnessed high adoption in North America, owing to established telecommunication infrastructure in the country such as the U.S. In addition, to leverage the businesses and to enhance the customer experience, enterprises have adopted enterprise application, which fueled the market growth.

Key Benefits:

- In-depth analysis of the global cloud enterprise application software market and dynamics is provided to understand the market scenario.

- Quantitative analysis of the current trends and future estimations from 2017 to 2023 is provided to assist strategists and stakeholders to capitalize on prevailing opportunities.

- Porters Five Forces analysis examines the competitive structure of the cloud enterprise application software market and provides a clear understanding of the factors that influence the market expansion.

- A detailed analysis of the geographical segments enables identification of profitable segments for market players in the cloud enterprise application software industry.

- Comprehensive analyses of the trends, subsegments, and key revenue pockets are provided.

- Detailed analyses of the key players operating in the cloud enterprise application software industry and their business strategies are anticipated to assist stakeholders to take informed business decisions.

Cloud Enterprise Application Software Market Report Highlights

| Aspects | Details |

| By Solution |

|

| By Industry Vertical |

|

| By Geography |

|

| Key Market Players | HP, IBM CORPORATION, MICROSOFT CORPORATION, EPICOR SOFTWARE CORP., IFS AB, SAP SE, SALESFORCE.COM, QAD INC., INFOR, ORACLE CORPORATION |

Analyst Review

Cloud enterprise application software is used to meet the needs of an organization as an entity rather than individual users. Such organizations include businesses, clubs, charities, schools, governments, and others. Adoption of cloud deployment has gained significant acceptance among end users owing to various factors such as cost, customization, and integration with third-party application. Cloud-based enterprise applications are preferred by end users when they have low budget and less in-house IT infrastructure. Organizations implement cloud enterprise application software to ensure higher profitability and increase their working capital. Adoption of enterprise application allows the companies to integrate their operations with suppliers, channel partners, and customers. However, selection of appropriate enterprise application differs in accordance to business outfits and process. Cloud-enabled enterprise application (SaaS model) has witnessed high adoption as compared to the conventional on-premise enterprise application, owing to cost-effective advantages of SaaS model such as salability, flexibility, customization, and long-term viability.

The global cloud enterprise application software market size is expected to reach $80,849 million by 2023, owing high adoption of cloud-based solutions, change in organization structure & work management, and introduction of novel solutions by the key players. In addition, increase in demand for service outsourcing, high internet penetration in Asia-Pacific, and rise in demand for IoT among end use are expected to offer significant growth opportunities for the cloud enterprise application software market.

In 2016, North America cloud enterprise application software market generated the highest revenue, owing to its technologically advanced infrastructure and presence of the large number of organizations well equipped to adopt cloud enterprise application software. Asia-Pacific cloud enterprise application software market is expected to grow at the highest CAGR during the forecast period, owing to developing technological infrastructure, higher ICT spending, and high internet penetration in the region.

Manufacturing & services is the largest consumer of cloud enterprise application software products, followed by BFSI segment. Furthermore, the others (aerospace & defense, travel & hospitality, chemicals, media & entertainment) segment is expected to witness the highest growth rate. As per solutions, others segment contributed highest share of the overall revenue followed by enterprise resource planning (ERP). However, content management system (CMS) segment is expected to register highest CAGR in the cloud enterprise application software market during the forecast period.

The key market players in the global cloud enterprise application software industry have adopted various strategies, such as product launches, partnerships, business expansions, promotional activities, and strategic alliances to increase awareness about newer technologies and increase their presence across various verticals.

Loading Table Of Content...