Cloud Retail Market Overview

The global cloud retail market was valued at USD 40.8 billion in 2022, and is projected to reach USDD 216.2 billion by 2032, growing at a CAGR of 18.3% from 2023 to 2032.

The key factors that drive the growth of the cloud retail market include increase in adoption of multi-cloud architecture and increase in focus on the omni-channel experience. Multi-cloud environments permit vendors to optimize their IT infrastructure to fulfill their unique needs and reduce the hazard of downtime, information loss and safety breaches. Moreover, multi-cloud architecture enhances the reliability and flexibility of applications and services. Businesses can reduce the risk of outages and ensure maximum availability, even if one cloud provider experiences an outage by distributing work across cloud data centers of cloud providers. In addition, cost-effective benefits of cloud products in retail are considered an important factor to boost the cloud retail market.

However, increase in complexity and data security concerns are expected to hamper market growth. Integrating cloud solutions with existing on-premises systems and legacy software can be complex and require significant effort. Retailers may encounter compatibility issues, data migration challenges, and the need for custom integration solutions. On the contrary, rapid improvements in disruptive technologies contribute significantly to the growth of the cloud retail industry. These disruptive technologies provide retailers with novel solutions that improve operational efficiency, customer experience, and company agility. In addition, retailers can use IoT technology to connect physical objects, sensors, and systems, forming a network that collects and exchanges data.

Intoduction

Cloud retail refers to the part of the retail industry that involves cloud computing technologies and services that adopt and use them to enhance aspects of retail operations. Cloud retail allows retailers to leverage the benefits of cloud-based solutions to improve efficiency, scalability, data management, customer experience, and overall business agility.

The report focuses on growth prospects, restraints, and trends of the cloud retail market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the cloud retail market.

Segment Review

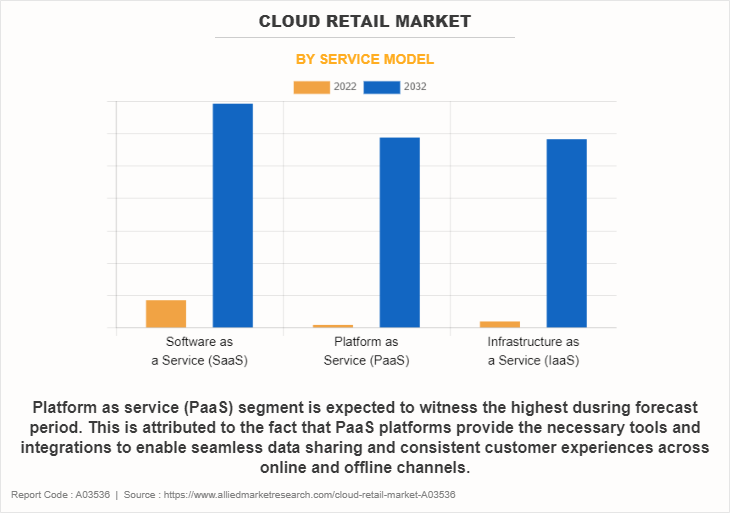

The cloud retail market is segmented on the basis of solution, deployment model, enterprise size, service model, and region. On the basis of solution, the market is categorized into supply chain management, customer management, workforce management, reporting and analytics, data security, and others. On the basis of deployment model, the market is divided into public cloud, private cloud, and hybrid cloud. On the basis enterprise size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of service model, it is divided into software as a service (SaaS), platform as service (PaaS), and infrastructure as a service (IaaS). On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of service model, the software as a service (SaaS) segment attained the highest cloud retail market size in 2022, because SaaS providers handle software updates, maintenance, and security patches, relieving retailers of the burden of managing these tasks. This ensures that retailers always have access to the latest features and enhancements without any downtime or disruption.

On the basis of region, North America held the highest cloud retail market share in 2022. This is due to the adoption of cloud-based solutions in the retail sector in developed nations like the U.S. and Canada, as well as increased investment in new and mobile technology in the U.S. and the growth of the e-commerce sector in the country is expected to play a significant role in the adoption of cloud solutions.

Market Landscape and Trends

A rapid penetration of smartphones is being noted globally, with these devices serving as efficient point-of-sale (POS) systems and supporting the management of the payment, handling of the inventory, and tracking of the location. Moreover, the integration of smartphones and cloud technology enables retailers to capture real-time information to adjust their product and service offerings as per the preferences of consumers and take advantage of new growth opportunities. In addition, cloud retail is being adopted for edge-to-edge compliance lifecycle management due to the high demand for compliance and collaboration from retailers. It offers provides detailed product information during the sourcing and selection of various suppliers and the product manufacturing process and offers consistent customer service support. Advantages such s these continue to drive the retail cloud market on a global level by increasing adoption of solutions.

Furthermore, digital demographics in the retail industry have increasingly become essential to understand consumers. Retailers across the globe have focused extensively on offering customization, with the rise in the adoption of omni-channel services, which is expected to fuel the market growth during the forecast period.

Key Market Players

cloud retail key players such as Amazon Web Services, Inc., Fujitsu, Microsoft Corporation, Cisco Systems, Inc., EPICOR SOFTWARE CORPORATION, Oracle Corporation, SAP SE, Infor Inc., IBM Corporation, Google LLC

Top Impacting Factors

Increase in Adoption of Multi-cloud Architecture

Multi-cloud deployments have become prevalent in retail as businesses seek the benefits of using multiple cloud service companies. The retail industry has particular needs, along with the need for flexible, robust, and stable IT infrastructure to guide brick-and-mortar operations online. Multi-cloud environments permit vendors to optimize their IT infrastructure to fulfil their unique needs and reduce the hazard of downtime, information loss, and safety breaches.

Moreover, multi-cloud architecture enhances the reliability and flexibility of applications and services. Businesses reduce the risk of outages and ensure maximum availability, even if one cloud provider experiences an outage by distributing work across data centers of cloud providers. Furthermore, multi-cloud architecture allows businesses to burst workloads from one cloud to another during periods of high demand. This scalability help maintain performance and optimize costs during peak usage times. All these trends drive the growth of the cloud retail industry.

Increase in Focus on the Omni-channel Experience

Omni-channel retailing describes a communication model that enables customers to interact with multiple sales and media channels. Omni-channel links all communication channels between the enterprise and the customers to create a single unified experience. According to a sales force study, 73% of shoppers opt for multiple channels during their shopping journeys. This drives the retailers to focus on enhancing the omni-channel experience. The Brightpearl MCM Omni Study states that out of ten eight companies say that the company has omni channel strategy.

Furthermore, the omni-channel approach generates vast amounts of data from different customer interactions. Retailers have leveraged this data to gain valuable insights into customer behavior, preferences, and pain points, which help them to enable better-informed decision-making and targeted marketing efforts. For instance, in February 2023, Guitar Center Inc., which sells musical instruments in the U.S., redeployed its data centers to cloud platform of Oracle Corporation for better support of its increase in online and in-store demand for instruments and services, including lessons and repairs. The strategies are projected to further boost the cloud retail market growth.

Cost-effective Benefits of Cloud Products in Retail

One of the main benefits of using the cloud for e-commerce companies is scalability. For e-commerce companies, cloud offers a scalable and flexible solution to meet evolving business needs. The cloud enables businesses to quickly and easily scale their resources up or down as needed rather than purchasing and managing physical infrastructure to store and manage data and applications.

Furthermore, cloud computing in retail provides retailers with a competitive edge over their e-commerce rivals by allowing them to have greater agility. The legacy systems used by offline retailers come with baggage that includes difficulty in integrating them with modern-day technologies and a costly affair to run the same. Retailers no longer have to worry about their legacy in-house systems with cloud computing. In addition, cloud technology empowers e-commerce companies to innovate and stay ahead of the competition. E-commerce companies quickly and easily implement new technologies and services with access to a wide range of tools and services.

Increase in Complexity and Data Security Concerns

Retailers deal with sensitive customer data, including personal information, payment details, and purchase history. Storing this data in the cloud raises concerns about data security and potential breaches. Retailers must ensure that they select reputable and secure cloud service providers with robust security measures and compliance certifications to protect customer data. In addition, integrating cloud solutions with existing on-premises systems and legacy software are often complex and require significant effort. Retailers encounter compatibility issues, data migration challenges, and the need for custom integration solutions.

Furthermore, one of the biggest challenges with widely adopted cloud computing systems in retail has integrated cloud technology with legacy systems. Over time, many vendors have invested in legacy systems that often manage core tasks such as ordering, payments, and in inventory management. Integrating legacy systems with cloud-based systems can be challenging, but enterprises are required to be able to take advantage of cloud computing while maintaining their current systems. Compared to other cloud-based systems, legacy systems are often built using older technologies. These challenges while integrating cloud-based and legacy systems are expected to hamper the market growth.

Rapid Improvements in Disruptive Technologies

Rapid improvements in disruptive technologies contribute significantly to the growth of the cloud retail market. These disruptive technologies provide retailers with novel solutions that improve operational efficiency, customer experience, and company agility. In addition, retailers can use IoT technology to connect physical objects, sensors, and systems, forming a network that collects and exchanges data. A cloud-based platform provides the infrastructure to process and analyze real-time data streams of IoT devices. This information can manage inventories, optimize supply chains, personalize marketing, and improve in-store experiences.

Furthermore, blockchain technology provides safe, transparent, and decentralized data storage and transaction capabilities. Blockchain is often used in retail for supply chain traceability, product authenticity verification, and secure customer transactions. Cloud-based blockchain systems provide the infrastructure required for merchants to efficiently install and manage blockchain-based solutions.

Growth in Sustainable Cloud Solutions

Retailers that prioritize sustainability by using green cloud solutions improve their brand image and reputation. Environmentally conscious customers are more inclined to support and remain loyal to brands that demonstrate a commitment to sustainability. Moreover, sustainable cloud solutions often lead to improved energy efficiency and resource optimization, resulting in potential cost savings for retailers. Lower energy consumption and efficient resource allocation can translate into reduced operational expenses.

In addition, sustainable cloud solutions offer the same scalability and flexibility as traditional cloud services. This enables retailers to efficiently manage fluctuations in demand and optimize resources while maintaining their sustainability goals. Therefore, retailers are expected to strengthen their position in the market, attract environmentally conscious customers, and contribute to a more sustainable and eco-friendly retail industry by capitalizing on these opportunities.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cloud retail market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of cloud retail market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cloud retail market segmentation assists in determining the prevailing cloud retail market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global cloud retail market trends, key players, market segments, application areas, and market growth strategies.

Cloud Retail Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 216.2 billion |

| Growth Rate | CAGR of 18.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 309 |

| By Service Model |

|

| By Solution |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Cisco Systems, Inc., IBM Corporation, Fujitsu, Google LLC, Amazon Web Services, Inc., EPICOR SOFTWARE CORPORATION, SAP SE, Oracle Corporation, Microsoft Corporation, Infor Inc. |

Analyst Review

As per the insights of the top-level CXOs, the growth of e-commerce remained a dominant trend in the retail industry. Cloud retail solutions supported the scalability and reliability required to handle the increase in volume of online transactions. In addition, cloud-based analytics allowed retailers to gather and analyze customer data, enabling personalized recommendations and tailored shopping experiences to enhance customer satisfaction and loyalty. Furthermore, with the introduction of advanced technology, the retail industry has adopted advanced solutions. Retail industry has moved their business applications and infrastructure resources to different service architectures of cloud which include platform as a service, software as a service, and infrastructure as a service. The retail industry is in the revolution stage where power has shifted from retailers to consumers. Moreover, the growth in adoption of smartphones and social media platform power has shifted from retailers to consumers. Consumers are influenced product trends through social media platforms and reviews from all over other websites.

The CXOs further added that market players have adopted strategies such as collaboration for enhancing their services in the market and improving customer satisfaction. For instance, in June 2021, IBM Corporation collaborated with GK Software to enhance customer experience by offering omni-channel experience and accelerating retail innovation with hybrid cloud technology. CLOUD4RETAIL solution of GK software is accessible via IBM cloud, which accelerates the adoption of hybrid cloud within the retail industry with this partnership. Such strategies are anticipated to boost the growth of the cloud retail market.

Moreover, some of the key players profiled in the report are SAP SE, Fujitsu, Oracle, Infor Inc., Amazon Web Services, Inc., Cisco Systems, Inc., IBM, Epicor Software Corporation, Microsoft, Google LLC. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Increase in adoption of multi-cloud architecture, increase in focus on the omni-channel experience, and cost-effective benefits of cloud products in retail contribute towards the growth of the market.

The cloud retail market is projected to reach $216.17 billion by 2032.

The cloud retail market is estimated to grow at a CAGR of 18.3% from 2023 to 2032.

The key players profiled in the report include cloud retail market analysis includes top companies operating in the market such as SAP SE, Fujitsu, Oracle, Infor Inc., Amazon Web Services, Inc., Cisco Systems, Inc., IBM, Epicor Software Corporation, Microsoft, and Google LLC.

The key growth strategies of cloud retail players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...