Co-Working Space Market Overview

The global co-working space market was valued at USD 9.2 billion in 2022, and is projected to reach USD 34.5 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032.

The major factors driving the growth of the co-working space market increase in the number of people working from home or remotely and the development of sustainable co-working spaces. Many businesses and professionals are looking for alternatives to traditional workspaces, and co-working spaces offers a flexible solution. The shift to remote work accelerated by the COVID-19 pandemic has made co-working spaces a preferred option for individuals and businesses. In addition, increase in number of startups and freelancers is considered an important factor to boost the co-working space industry. However, limited space and availability of limited equipment are expected to hamper market growth. Limited space in coworking spaces creates a hindrance to requirements such as privacy, creativity and innovative ideas, and one-on-one discussions.

Introduction

Co-working spaces is a setting where workers of various firms share the same office space, which allows minimum cost and better convenience by the use of the same infrastructure, such as equipment, utilities and other such services. This type of setting is attractive to lone contractors, remote workers and freelancers.

The lack of privacy in such spaces leads to employee dissatisfaction and unproductivity. Contrarily, partnership between real estate players and open space providers contribute significantly to the growth of the co-working space industry. Real estate players have access to well-located properties, including office buildings, commercial spaces, and mixed-use developments. Partnering with open space providers allows co-working operators to secure prime locations in desirable areas, which is crucial for attracting professionals and businesses.

The report focuses on growth prospects, restraints, and trends of the co-working space market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the coworking space market.

Segment Review

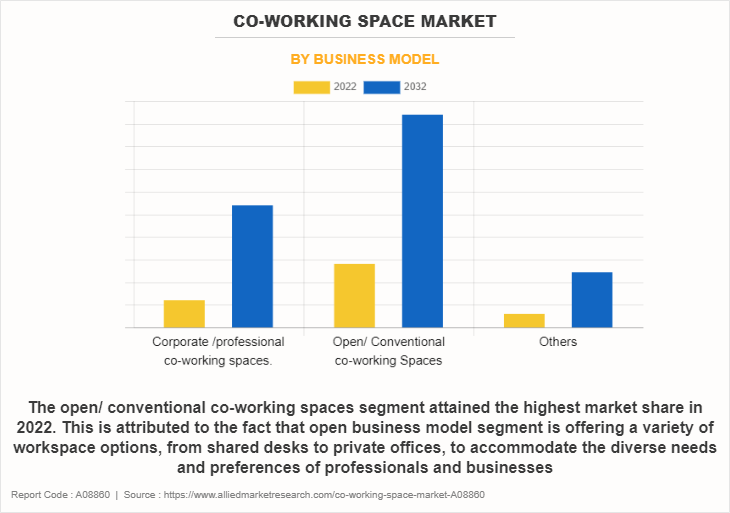

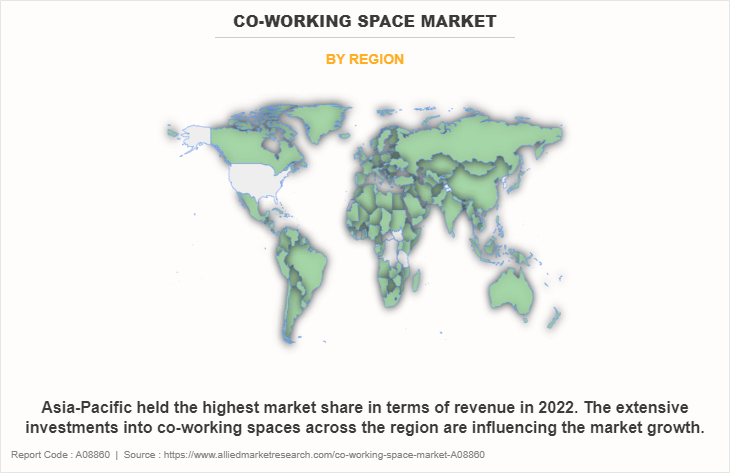

The co-working space market is segmented on the basis of business model, end users, industry vertical, and region. On the basis of business model, the market is categorized into corporate/professional co-working spaces, open/conventional co-working spaces, and others. On the basis of end users, the market is divided into freelancers, large enterprises and small and medium sized enterprises. On the basis of industry vertical, it is divided into IT and Telecom, BFSI, mobile and entertainment, travel and hospitality, healthcare and life sciences, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of business model, the corporate/professional co-working spaces segment attained the highest coworking space market size in 2022, because co-working providers are offering specialized spaces tailored to specific industries or professional communities. This trend caters to professionals looking for work environments that are optimized for their specific needs, such as healthcare, fintech, or creative arts.

On the basis of region, Asia-Pacific held the highest co-working space market share in 2022. This growth is attributed to the number of single entrepreneurs & Micro SMEs and growing need for socializing within North America is very high compared to another regions.

Key Market Players

Co-working space key players such as Awfis Space Solutions Pvt Ltd, Industrious LLC, Newmark Group, Inc., Impact Hub GmbH, LiquidSpace Inc, Techspace Group Ltd, Soho China Ltd, The Office Group Ltd, Ucommune (Beijing) Venture Capital Co., Ltd, and Wework Companies Inc. These players have adopted various marketing strategies to increase their market penetration and strengthen their position in the coworking sector.

Top Impacting Factors

Increasing Number of Startups and Freelancers

The rise of startups is driven by a strong entrepreneurial spirit. More individuals are inclined to pursue their business ideas and passions, and they often require flexible and affordable workspace solutions to get started. Co-working spaces provide startups with essential amenities such as high-speed internet, meeting rooms, office equipment, and administrative support. These amenities help startups focus on their core business activities while leaving operational details to the co-working space operator. In addition, some co-working operators offer startup-focused programs and resources, such as incubators or accelerator partnerships. These programs provide startups with mentoring, access to funding, and tailored support. These factors are driving the growth of coworking market.

Partnership Between Real Estate Players and Open Space Providers

Real estate players have access to well-located properties, including office buildings, commercial spaces, and mixed-use developments. Partnering with open space providers allows co-working operators to secure prime locations in desirable areas, which is crucial for attracting professionals and businesses. Moreover, co-working operators can reduce their capital expenditures by partnering with real estate players. Instead of purchasing or leasing properties independently, they can leverage the real estate partner's investment, reducing their upfront costs and improving their financial stability.

Further, real estate players and co-working operators can jointly adapt to changing market dynamics and evolving workplace needs, ensuring that the co-working spaces remain relevant and appealing to a wide range of users. Thus, all these factors will provide lucrative opportunities for the growth of the market.

Integration of Advanced Technology

Integrating advanced technology into co-working spaces presents substantial opportunities for the industry's growth and innovation. Technology integration enhances user experience, improves operational efficiency, and improves the competitive edge for co-working space providers. Internet of Things (IoT) technology enables intelligent collaboration spaces. This includes smart lighting, heating, ventilation, air conditioning (HVAC) systems and energy management. Such features increase energy efficiency, reduce operating costs and improve user comfort.

In addition, VR and AR technologies can be integrated to provide virtual tours of co-working spaces, allowing potential members to explore the facilities before signing up. AR can also assist in wayfinding within the space. Furthermore, integrating technology to track and reduce energy consumption and monitor environmental sustainability can align co-working spaces with green initiatives, attracting eco-conscious members.

Key Industry Development

Recent Product Launches in the Co-working space Market

In February 2023, co-working major, WeWork India has started a new center in Pune with 1,500 desks and 96,000 square feet area amid rise in demand for flexible office space from corporates. The new facility is located at Raheja Woods IT Tower developed by K Raheja Corp. Similarly, in in March 2022, Newmark Group, Inc. announced the launch of Optality, a dynamic portfolio optimization solution to enable enterprises to add flexibility to their office space in real time by providing the agility to quickly adjust workspace provisions, globally.

Recent Partnerships in the Co-working space Market

In May 2023, WeWork, and Business France, a government agency with the mission to foster business relations of France worldwide, announced a partnership to establish WeWork as a space provider for Business France’s trade missions. Similarly, in February 2022, WeWork Inc., a leading flexible space provider, announced strategic and exclusive partnership with Upflex, a co-working aggregator and global flexible workplace startup. This exclusive partnership established a combined global network of over 5,500 locations and provided WeWork and Upflex’s clients with enhanced flexibility as they adopted hybrid work strategies.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the co-working space market growth segments, current trends, estimations, and dynamics of the co-working space market forecast from 2022 to 2032 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of coworking space market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the co-working space market segmentation assists in determining the prevailing co-working space market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global coworking space market trends, key players, market segments, application areas, and market growth strategies.

Co-Working Space Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.5 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Business Model |

|

| By End Users |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | LiquidSpace Inc., Awfis Space Solutions Pvt Ltd., WeWork Companies Inc., Impact Hub GmbH, Industrious LLC, Newmark Group, Inc., Soho China Ltd., The Office Group Ltd., Ucommune (Beijing) Venture Capital Co., Ltd., Techspace Group Ltd. |

Analyst Review

Increase in remote work arrangements and growth of the gig economy have led to a higher demand for flexible workspaces. Co-working spaces provide remote workers and freelancers with a professional, collaborative, and productive environment. Moreover, co-working spaces provide flexible work arrangements that adapt to the changing needs of professionals. Businesses can easily scale up or down, adjusting their office space to accommodate growth or contraction. In addition, co-working spaces offer cost-effective solutions, eliminating the need for businesses to invest in office infrastructure, maintenance, and utilities. This affordability attracts small and medium-sized businesses. Therefore, these factors are expected to provide lucrative opportunities for the co-working space market growth.

The CXOs further added that market players have adopted strategies such as product launch for enhancing their services in the market and improving customer satisfaction. For instance, in March 2022, Newmark Group, Inc. announced the launch of Optality, a dynamic portfolio optimization solution to enable enterprises to add flexibility to their office space in real time by providing the agility to quickly adjust workspace provisions, globally. Through Optality's innovative technology platform, corporate real estate leaders advanced real estate goals and managed associated costs to meet shifting market demands, such as those of hybrid office models. Such strategies are anticipated to boost the growth of the co-working space market.

Moreover, some of the key players profiled in the report are Awfis Space Solutions Pvt Ltd, Industrious LLC, Newmark Group, Inc., Impact Hub GmbH, LiquidSpace Inc, Techspace Group Ltd, Soho China Ltd, The Office Group Ltd, Ucommune (Beijing) Venture Capital Co., Ltd, and Wework Companies Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The estimated industry size of Co-Working Space is projected to reach $34,456.97 million by 2032.

The Co-Working Space market is projected to grow at a compound annual growth rate of 14.6% from 2023 to 2032.

Awfis Space Solutions Pvt Ltd, Industrious LLC, Newmark Group, Inc., Impact Hub GmbH, and LiquidSpace Inc are the top companies to hold the market share in Co-Working Space.

Asia-Pacific is the largest regional market for Co-Working Space.

Increase in remote work arrangements is one of the major trends of Co-Working Space Market in the world

Loading Table Of Content...

Loading Research Methodology...