Coal Power Generation Market Research, 2032

The global coal power generation market was valued at $361.1 billion in 2022 and is projected to reach $440.5 billion by 2032, growing at a CAGR of 2.1% from 2023 to 2032.

Key Report Highlighters:

- The coal power generation market has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 12 market players.

Coal power generation refers to the process of producing electricity from coal as a fuel source. It involves the combustion of coal in power plants to generate heat, which is subsequently used to produce steam. The steam drives a turbine connected to a generator, converting mechanical energy into electrical energy. Coal is pulverized into a fine powder and then burnt in power plants to produce heat. It is a readily available and relatively inexpensive fuel source, making coal power generation economically viable in many regions.

The combustion of coal releases heat energy, which is used to convert water into steam, which is then directed to a turbine. The high-pressure steam from the boiler is directed onto the blades of a steam turbine. The force of the steam causes the turbine blades to rotate. As the turbine blades rotate, they turn on a generator, which produces electricity through electromagnetic induction. The generated electricity is then transmitted through power lines for distribution to consumers. Coal power generation has significant environmental impacts due to the emission of greenhouse gases, such as carbon dioxide and other air pollutants, which contribute to climate change and air pollution, leading to environmental and health concerns. To mitigate the environmental impact of coal power generation, various emission control technologies are being employed such as electrostatic precipitators, flue gas desulfurization (FGD) systems, and selective catalytic reduction (SCR) systems, which aim to reduce the release of particulate matter, sulfur dioxide, and nitrogen oxide emissions.

Several advancements and research are being carried out to improve the efficiency of coal power plants and to reduce fuel consumption and emissions. Advanced technologies such as supercritical and ultra-supercritical boilers allow for higher steam temperatures and pressures, resulting in improved efficiency. However, the global trend toward reducing reliance on coal power generation due to rise in concerns about climate change and air pollution hampers the growth of the market. Many countries are transitioning to cleaner and more sustainable energy sources, such as natural gas, renewables (solar, wind, and hydroelectric), and nuclear power.

Current Scenario

Due to the ongoing conflict and infrastructure damage, some coal-fired power plants in Ukraine were forced to shut down or operate at reduced capacity. This led to a decrease in electricity generation from coal, resulting in energy shortages and increased reliance on alternative sources of power. The disruptions in coal supply and damage to infrastructure increased the cost of coal power generation in Ukraine. The country had to import coal from alternative sources, which incurred higher transportation costs. Additionally, the need to repair and rebuild damaged infrastructure added to the financial burden. The challenges faced in coal power generation due to the war encouraged Ukraine to accelerate its transition towards renewable energy sources. The country increased its focus on developing and deploying renewable energy projects, such as solar and wind power, to diversify its energy mix and reduce dependence on coal.

Market Dynamics

Coal is a widely available fossil fuel, and many countries have a substantial number of coal reserves. The abundance and accessibility of coal make it an ideal option for power generation, particularly in regions with limited access to other energy sources. Coal power plants can provide reliable and continuous baseload power. Unlike intermittent renewable energy sources, coal power plants can operate continuously, ensuring a stable supply of electricity to meet the increasing demand. In some regions, coal remains a cost-effective option for electricity generation. This is attributed to the relatively low cost of coal as well as well-established infrastructure and operational expertise, which make coal power generation economically viable.

In addition, countries with significant domestic coal reserves may use coal power generation as a means to enhance energy security. Reducing dependence on imported energy sources and utilizing domestic coal reserves can provide a sense of energy self-sufficiency. Coal power generation has historically been associated with industrial growth and economic development. Countries with emerging economies may rely on coal to support their growing energy needs, fuel industries, and create jobs.

Coal power generation is a significant contributor to air pollution, greenhouse gas emissions, and climate change. The combustion of coal releases pollutants such as sulfur dioxide, nitrogen oxides, mercury, and particulate matter, which have adverse effects on air quality and human health. In addition, an increase in concerns about environmental impact and the need to reduce greenhouse gas emissions have led to the implementation of stricter environmental regulations and a shift toward cleaner energy alternatives.

This is attributed to the fact that coal power generation is a major source of carbon dioxide emissions, which is the primary greenhouse gas responsible for climate change. Furthermore, international commitments, such as the Paris Agreement, aim to limit global warming and reduce reliance on fossil fuels, including coal. As a result, many countries are adopting policies to transition to low-carbon or carbon-neutral energy sources, which acts as a potential restraint of the coal power generation market. The declining costs of renewable energy technologies, such as solar and wind power, have made them increasingly competitive with coal power generation.

Moreover, rapid growth and advancements in renewable energy have made clean energy sources economically viable alternatives to coal. As a result, many regions are shifting toward renewable energy to meet their electricity needs, reducing the demand for coal. The declining costs of renewable energy, natural gas, and energy storage technologies coupled with the increasing costs of coal extraction and emissions controls are making coal less economically competitive in many regions.

In addition, governments and regulatory bodies are implementing stricter emission standards and regulations to control air pollution and limit the environmental impact of coal power generation. These regulations require power plants to invest in costly emission control technologies, such as flue gas desulfurization (FGD) systems and selective catalytic reduction (SCR) systems, which can increase the operational costs of coal power plants. Communities near coal mines and coal-fired power plants often face adverse environmental and health impacts, leading to public opposition and social concerns. Environmental activists and local communities advocate for cleaner energy options and a transition away from coal, putting pressure on governments and utilities to reduce or phase out coal power generation.

The global coal power generation market size is studied based on technology, application, and region.

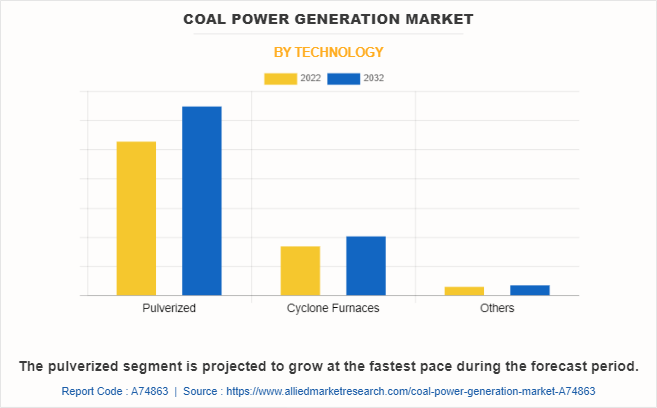

Depending on the technology, the market is segregated into pulverized, cyclone furnaces, and others. The pulverized segment dominated the coal power generation market share for 2022. The same is expected to grow and maintain its dominance during the coal power generation market forecast. Pulverized coal power plants can be designed and built to produce electricity on a large scale, making them suitable for meeting significant power demands. These power plants can operate continuously, providing a stable and reliable source of electricity to support industrial, residential, and commercial needs. These factors act as driving forces of the coal power generation market growth.

Coal power generation using the pulverized coal method is a common technique employed in many coal-fired power plants worldwide. It involves the combustion of pulverized coal to produce steam, which drives a turbine connected to a generator, ultimately generating electricity. Raw coal obtained from mines undergoes initial processing, which involves crushing, grinding, and screening to achieve a consistent particle size suitable for combustion. Coal is then pulverized into a fine powder in a pulverizer, such as a ball mill or vertical mill. Pulverizing coal increases its surface area, facilitating efficient combustion. The pulverized coal is injected into a furnace or boiler, where it is mixed with preheated combustion air and ignited. The combustion releases the energy stored in the coal, producing high-temperature flue gases.

The cyclone furnace method is an alternative approach to coal power generation that utilizes cyclone combustion chambers instead of traditional boilers. This method is primarily used in smaller scale coal-fired power plants and industrial facilities. The coal used in cyclone furnaces undergoes initial processing, including crushing, grinding, and screening to achieve a consistent particle size suitable for combustion. Instead of a conventional boiler, the cyclone furnace employs one or more cyclone combustion chambers. These chambers are cylindrical or conical in shape and arranged in a vertical configuration.

The coal injection creates a swirling motion within the chamber, promoting the mixing of coal particles with combustion air. The heat generated by combustion is transferred to heat exchanger surfaces affixed within the cyclone chamber. The heat transfer fluid is converted into high-pressure steam using a steam generator or boiler. This steam is subsequently directed to a steam turbine, similar to the process in pulverized coal power plants. The high-pressure steam drives a turbine connected to a generator, producing electricity.

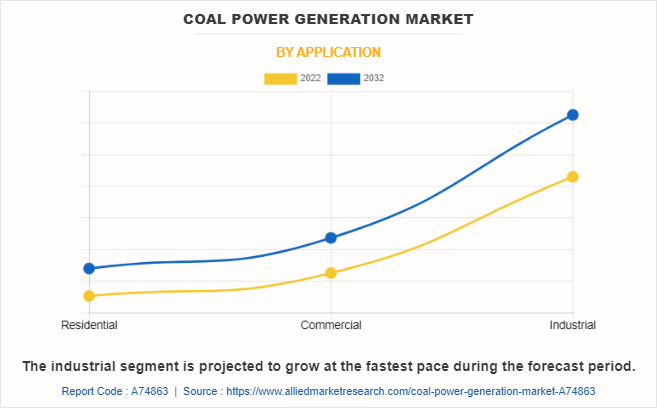

By application, it is fragmented into residential, commercial, and industrial. The coal power generation market was dominated by the industrial segment and the same is expected to grow at the fastest CAGR during the projection period. Coal-fired furnaces provide the high temperatures necessary for steel production, cement manufacturing, paper mills, and chemical plants. Coal power generation has been widely used in various industrial applications due to its ability to provide a reliable and cost-effective source of electricity and heat. Coal power generation plays a significant role in supporting industrial manufacturing processes. The industries such as steel production, cement manufacturing, paper mills, and chemical plants often rely on coal-fired power plants to provide a stable and cost-effective source of electricity and process heat. The mining industry, which involves the extraction of various minerals and resources, often requires substantial energy inputs. Coal power generation is utilized in mining operations to provide the necessary electricity for drilling, excavation, ore processing, and other mining activities.

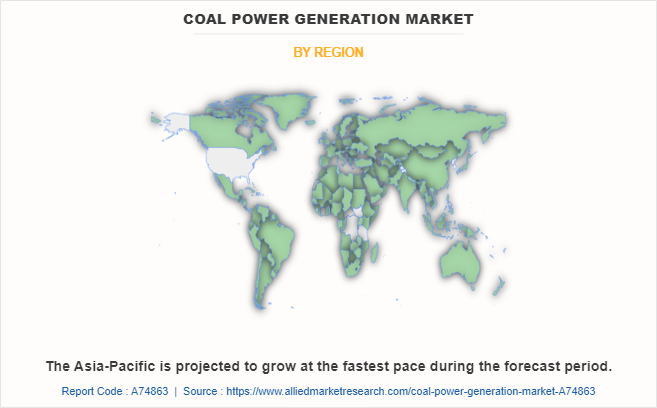

Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region dominated the coal power generation market in 2022 and is projected to grow at a higher CAGR during the projection period. Countries such as China and India have seen a substantial increase in coal power capacity in recent decades. This growth has been driven by rapid industrialization, urbanization, and the need to meet rising electricity demand. China and India are the largest consumers of coal for power generation in the region. Both countries heavily rely on coal as a primary source of electricity due to its availability, affordability, and the need to support their growing economies. The use of coal for power generation in Asia-Pacific has raised significant environmental concerns due to the emissions of greenhouse gases, air pollutants, and the impact on air quality.

The region has faced challenges in addressing the environmental impacts associated with coal power generation. Some countries in the region have implemented policy measures to address the environmental impact of coal power generation. For instance, China has implemented stricter emission standards, imposed caps on coal consumption, and promoted renewable energy development to reduce reliance on coal. It is important to note that the state of coal power generation varies across Asia-Pacific. While the countries such as China and India have a significant reliance on coal, the countries like Japan, South Korea, and Australia are taking steps to diversify their energy mix and reduce coal dependency. Coal power generation continues to play a prominent role in Asia-Pacific, particularly in China and India. However, there is a growing recognition of the need to address environmental concerns and transition toward cleaner and more sustainable energy sources, including renewable energy.

The key players operating in the coal power generation industry are Adani Power Limited, China Huadian Corporation LTD., Dominion Energy, NTPC Limited, KEPCO E&C, Jindal India Thermal Power Ltd., Uniper SE, China Shenhua Energy Company Limited, Saudi Electricity Company, China Huaneng Group Co., Ltd., American Electric Power Company, Inc., and Duke Energy Corporation. These players have been adopting various strategies to gain a higher share or to retain leading positions in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coal power generation market analysis from 2022 to 2032 to identify the prevailing coal power generation market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coal power generation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coal power generation market trends, key players, market segments, application areas, and market growth strategies.

Coal Power Generation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 440.5 billion |

| Growth Rate | CAGR of 2.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 227 |

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Duke Energy Corporation, China Huaneng Group Co., Ltd., Korea Electric Power Corporation KEPCO, Adani Power Ltd, China Huadian Corporation Ltd., Jindal India Thermal Power Limited, Dominion Energy, Inc., Uniper SE., NTPC Ltd, Saudi Electricity Company, American Electric Power Company, Inc., China Shenhua Energy Company Limited |

Analyst Review

According to insights from the CXOs, the coal power generation market trends clearly indicate the slowing down of coal consumption in the power generation sector. This is attributed to the rise in the share of renewable sources in the primary energy mix. In addition, coal serves as a reliable power generation source due to lower costs, which contributes toward the growth of the market. Moreover, many developing economies are largely dependent on coal and have a large share in the primary energy mix such as China and India, which are the major consumers of fossil fuel. However, the rise in environmental concerns regarding the emissions and carbon footprint has hampered the growth of the coal power generation industry.

The CXOs further added that the advent of high-efficiency, low-emission (HELE) power plants and implementation of extensive measures for decarbonization such as carbon capture, utilization, and storage (CCUS—a potential solution employed for decarbonization—make coal power generation cleaner and more sustainable. Thus, these factors are anticipated to offer lucrative opportunities for the expansion of the global market during the forecast period.

$440.5 billion is the estimated industry size of Coal Power Generation.

The abundance and accessibility of coal and its cost-effectiveness of coal are the upcoming trends of Coal Power Generation Market in the world.

Industrial application is the leading application of Coal Power Generation Market.

Asia-Pacific is the largest regional market for Coal Power Generation.

Adani Power Limited, China Huadian Corporation LTD., Dominion Energy, NTPC Limited, KEPCO E&C, Jindal India Thermal Power Ltd., Uniper SE, China Shenhua Energy Company Limited, Saudi Electricity Company, China Huaneng Group Co., Ltd., American Electric Power Company, Inc., and Duke Energy Corporation are the top companies to hold the market share in Coal Power Generation.

Loading Table Of Content...

Loading Research Methodology...