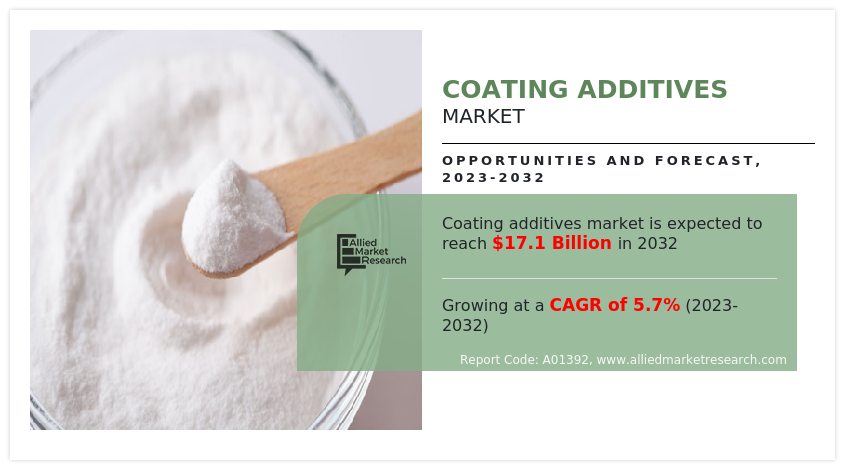

Coating Additives Market Outlook - 2032

The global coating additives market size was valued at $10.0 billion in 2022, and is projected to reach $17.1 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032. The increasing demand for high-performance coatings across industries, such as automotive, construction, and aerospace, is a significant driver of the coating additives market. These coatings offer enhanced durability, superior aesthetics, and resistance to environmental factors, meeting the stringent quality requirements of various applications. As a result, there is expected to be a rise in demand for the coating additives market.

Key Report Highlighters:

- The coating additive has been analyzed in both value and volume. The value of the coating additive is analyzed in millions.

- Global coating additive is fragmented in nature with many players such as Arkema, BASF, Ashland, Clariant, Dow Chemical Co., Eastman Chemical Co., Evonik, Lanxess, Momentive Performance Materials Inc., and Solvay. Also tracked key strategies such as product launches, acquisitions, mergers, expansion etc. of various manufacturers of coating additives.

- Included more than 20 countries in the report which covers market volume as well as market value for all the countries of the coating additive.

- Conducted primary interviews with raw material suppliers, wholesalers, suppliers, and manufacturers of coating additive to understand the market trends, growth factors, pricing, and key players competitive strategies.

Introduction

Coating additives are specialized chemical substances incorporated into coatings to enhance their performance, durability, and application properties. They play a crucial role in addressing specific challenges encountered in various coating applications, such as improving surface adhesion, providing resistance to environmental factors, or altering the appearance of the final product. These additives are used in minute quantities but significantly influence the properties of coatings such as paints, varnishes, and lacquers.

Coating additives are substances mixed into coatings, paints, or other surface treatments to enhance their performance or provide specific properties. These additives can modify various characteristics of the coating, such as its appearance, durability, adhesion, rheology, and resistance to factors such as UV radiation, corrosion, or abrasion. Coating additives are added to paints and coatings to improve their quality, impact resistance, viscosity, and surface effectiveness. These coating additives also improve dispersion of solids, wetting, foam-reduction, anti-catering, gloss control, anti-chipping, and UV protection of coatings. Polymers, silicates, chemicals, and various gases are used as additives in coatings to augment properties of coating and paints.

Coating additives can be either liquids or solids, and they serve different functions based on their chemical composition and properties. Rheology modifiers additives help control the flow and consistency of the coating, ensuring proper application and desired leveling and sag resistance. Pigments and colorants additives provide color or opacity to the coating, allowing it to achieve the desired aesthetic appearance. Furthermore, fillers are solid additives that improve the coating's properties by increasing its volume, reducing cost, improving mechanical strength, or enhancing other performance attributes. Moreover, solvents are additives used to dissolve or disperse other components of the coating formulation. They facilitate proper mixing and application of the coating and evaporate during the drying or curing process.

UV stabilizers additives protect the coating from the harmful effects of UV radiation, preventing degradation, fading, or discoloration caused by exposure to sunlight. Selection and combination of coating additives depend on the desired performance requirements and the type of coating application. The global coating additives market is anticipated to register substantial growth in the future, owing to increase in demand from various sectors such as architectural, industrial, automotive, wood, and furniture.

Growth in demand for multifunctional additives, strict environmental regulations, and increase in awareness among users and formulators about benefits of coating additives are the major factors that drive the market growth. Rise in automotive and construction industries is expected to drive the coating additives industry growth during the forecast period. Furthermore, growing demand for high-performance coatings offer improved functionality, durability, and environmental sustainability, which is expected to drive the coating additive market forecast period. Coating additives play a crucial role in enhancing these properties and meeting the evolving needs of various industries such as automotive, construction, aerospace, and industrial manufacturing.

However, industrial discharges or solid wastes of paint and coatings materials interfere with local sanitary sewers that lead to the discharge of pollutants into local waterways. This hinders the growth of the coating additives market, owing to rise in environmental concerns.

Increase in demand for water-borne and powder-based coating additives in green construction.

The growing interest in sustainability, which manifests in the form of stricter environmental regulations and a rise in consumer demand for more environmentally friendly products, is the key driver for the adoption of waterborne paints and coatings as well as advancements of resin, additives, and pigment technologies used in their formulation. Apart from environmental benefits, there are a number of other advantages of using waterborne coatings over solvent-based systems.

Reduced explosion risk and cheaper insurance costs are major factors in industrial applications. In China, use of waterborne coatings has led to reduced waste-removal costs as waste streams for waterborne are lower than those for dangerous solvent-containing wastes. In architectural applications, low odor levels of water-based paints is a major driver for their use as building occupants and industry operators become more concerned about solvent odors. Water-borne epoxy coatings are usually used in several applications including transportation, building & construction, and industrial.

This is attributed to people’s health, environmental, and safety benefits. In specialty applications, there is a trend away from solvent-borne epoxy coatings more toward water-borne epoxy coatings. Therefore, water-borne epoxy coatings account for a major share in the coating additives market.. Water-borne epoxy coatings exhibit properties such as high mechanical strength and toughness with electrical and thermal properties, which enables extensive use of water-borne epoxy coatings in various industries, thus expected to boost the growth of the market.

Rise in demand for water-borne epoxy resin composites from aerospace and wind energy industries is expected to drive the growth of the market during the forecast period. In addition, water-borne epoxy coatings are gaining popularity, owing to reduced content of VOCs in comparison to solvent-based coatings. It is required to meet stringent environmental standards and offer sustainable protective coatings. Thus, increase in demand for water-borne and powder-based coating additives in green construction is expected to drive the coating additives market growth during the forecast period.

The global coating additives market is segmented on the basis of function, type, formulation, end-use industry, and region. On the basis of function, the market is segmented into anti-foaming, wetting & dispersion, and rheology modification. By type, it is divided into acrylic, fluoropolymers, urethanes, and others. On the basis of formulation, it is segmented into water-borne coatings, solvent-borne coatings, solventless coatings, powder-based coatings, and radiation curable coatings. On the basis of end-use industry, it is segmented into automotive, architectural, industrial, wood & furniture, industrial, and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Major players operating in the global coating additives market include, Arkema, BASF, Ashland, Clariant, Dow Chemical Co., Eastman Chemical Co., Evonik, Lanxess, Momentive Performance Materials Inc., and Solvay. These players have adopted product launch as their key strategy to strengthen their presence in the market.

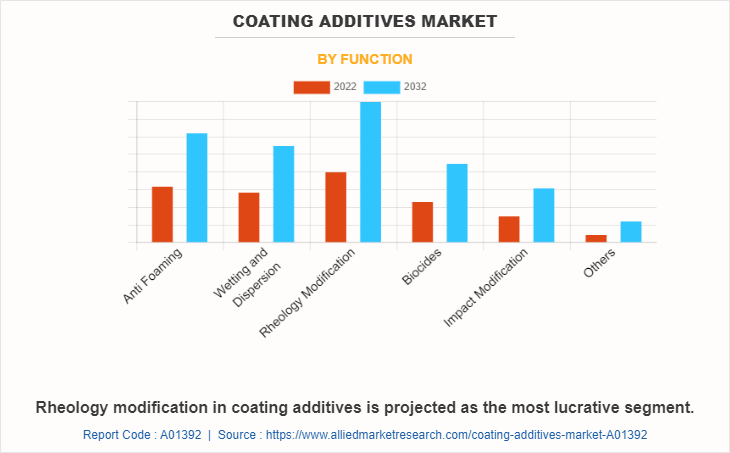

Coating Additives Market By Function

On the basis of function, the rheology modification segment dominated the market in 2022, and is expected to maintain its dominance during the forecast period, owing to increase in usage of rheology additives as it provides film thickness, increases viscosity of finished products, and improves elastic properties of coatings.

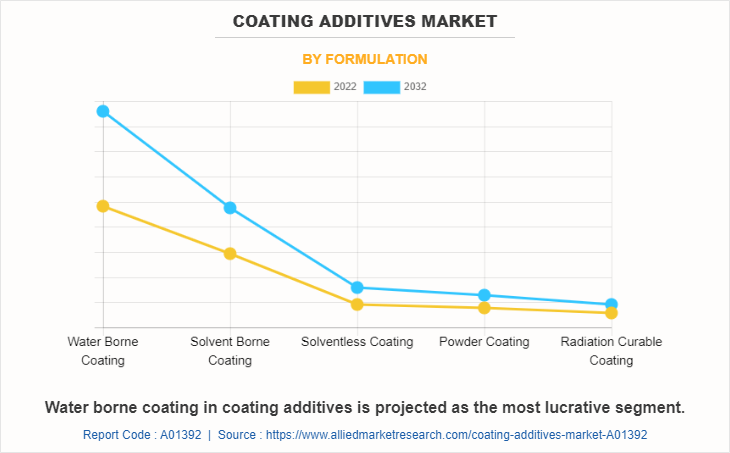

Agricultural Textile Market By Formulation

On the basis of formulation, the water-borne coating segment dominated the market in 2022, and is expected to maintain its dominance during the forecast period, owing to increase in usage of water-borne as water borne technology possess excellent durability, fewer odors, quick drying, less frequent repainting requirement, flexible finish, stable color, and low VOCs availability.

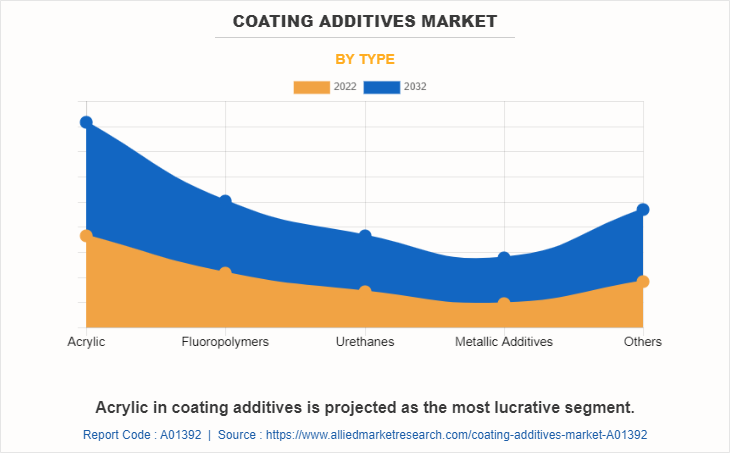

Coating Additives Market By Type

On the basis of type, the acrylic segment dominated the market, in terms of revenue, in 2022, owing to increase in demand for acrylic material for coating additives. Acrylic coatings are commonly used in the construction industry for various applications, such as exterior and interior paints, sealants, and waterproofing solutions. As construction and infrastructure projects continue to rise globally, the demand for acrylic coating additives also increases.

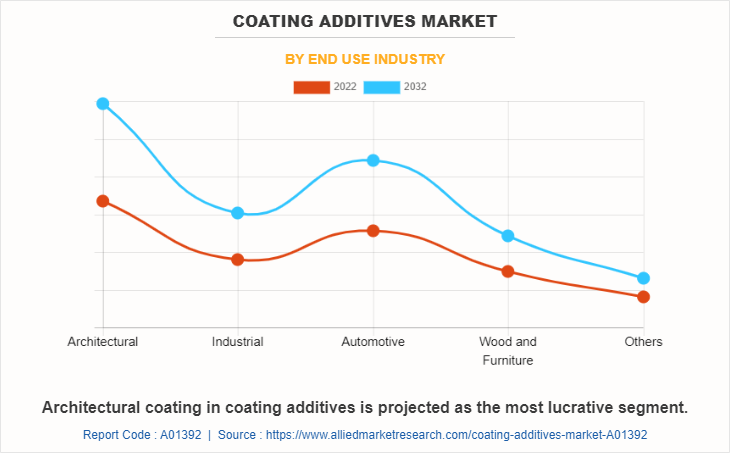

Coating Additives Market By End Use Industry

On the basis of the end-use industry, the architectural segment dominated the market in terms of revenue, in 2022, as economic development in emerging countries of Asia-Pacific and LAMEA has led to infrastructural growth, which results in rise in demand for coating additives in the architectural segment.

Coating Additives Market By Region

On the basis of region, the Asia-Pacific region has the highest coating additive market share in 2022, as economic development in emerging countries of Asia-Pacific. Moreover, The Asia-Pacific region has been witnessing rapid economic development, leading to increased industrialization and urbanization. As the region's economies grow, there is a rising demand for infrastructure development, residential and commercial construction, and automotive production. These industries are major consumers of coating additives, driving market growth.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coating additives market analysis from 2022 to 2032 to identify the prevailing coating additives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coating additives market segmentation assists to determine the prevailing coating additives market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coating additives market trends, key players, market segments, application areas, and coating additives market growth strategies.

Coating Additives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.1 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 469 |

| By End Use Industry |

|

| By Formulation |

|

| By Function |

|

| By Type |

|

| By Region |

|

| Key Market Players | BASF SE, Eastman Chemical Company, CLARIANT, Ashland, LANXESS, Dow, Momentive, Solvay, Arkema, Evonik Industries AG |

| OTHER COMPANIES ACTIVE IN VALUE CHAIN INCLUDE | Elementis PLC, The Lubrizol Corporation, Michelman, Inc., Croda International Plc, Cytec Industries Inc. |

Analyst Review

According to the opinions of various CXOs of leading companies, growth in demand for coating additives from aerospace, automotive, commercial, and consumer electronics, and other miniaturized electronics majorly drives the market. There is rise in demand for coatings, which are environmentally friendly, low in volatile organic compounds (VOCs), and adhere to strict regulatory standards. This presents an opportunity for coating additives manufacturers to develop and provide eco-friendly additives that help reduce emissions, enhance durability, and improve the sustainability profile of coatings.

Furthermore, nanotechnology offers opportunities for the development of advanced coating additives with unique functionalities and properties. Nanoscale additives provide enhanced performance, such as improved barrier properties, self-cleaning capabilities, antimicrobial effects, or tailored optical properties. As the field of nanotechnology continues to advance, there is a growing opportunity for coating additives manufacturers to develop and commercialize innovative nanoscale additives.

Moreover, the automotive and aerospace industries require high-performance coatings to protect surfaces from corrosion, wear, and extreme environments. Coating additives that enhance durability, adhesion, scratch resistance, and UV protection can find significant opportunities in these industries. As the demand for high-performance coatings continues to grow, coating additives manufacturers are expected to capitalize on this market by providing additives that meet the stringent requirements of these sectors.

The increased demand for coating additives in the construction industry is expected to drive the market growth during the forecast period.

Architectural is the leading end use industry of Coating Additives Market.

Asia-Pacific is the largest regional market for Coating Additives

The coating additives market was valued for $10.0 billion in 2022 and is estimated to reach $17.1 billion by 2032, exhibiting a CAGR of 5.7% from 2023 to 2032.

Major players operating in the global coating additives market include, Arkema, BASF, Ashland, Clariant, Dow Chemical Co., Eastman Chemical Co., Evonik, Lanxess, Momentive Performance Materials Inc., and. These players have adopted product launch as their key strategy to strengthen their presence in the market.

Loading Table Of Content...

Loading Research Methodology...