Cobblestone Market Research - 2031

The global cobblestone market size was valued at $7.64 billion in 2021 and is projected to reach $12.44 billion by 2031, growing at a CAGR of 5% from 2022 to 2031.

A natural building material called cobblestone is made up of little round stones that are used to pave roads, streets, and structures. These stones are joined together using mortar, a paste. These stones are employed in the construction of cemeteries, churches, schools, industries, smokehouses, stagecoach taverns, businesses, and churches. The use of natural building materials is increasing popularity as the construction industry becomes more sustainable.

Market Dynamics

The construction industries in the U.S. and India are anticipated to develop more quickly than those in China, according to the Global Construction Perspectives and Oxford Economics research on Global Construction 2030. By 2030, the number of construction building globally is anticipated to increase by almost 85% by 2030. The greatest consumer of cobblestone and marble is the building and construction sector. The use of these commodities in emerging nations has dramatically increased as a result of rapid urbanization and industrialization. The two countries with the largest exports of these goods are China and India. The majority of the imported granite is processed in China, and the finished goods are then exported to other countries.

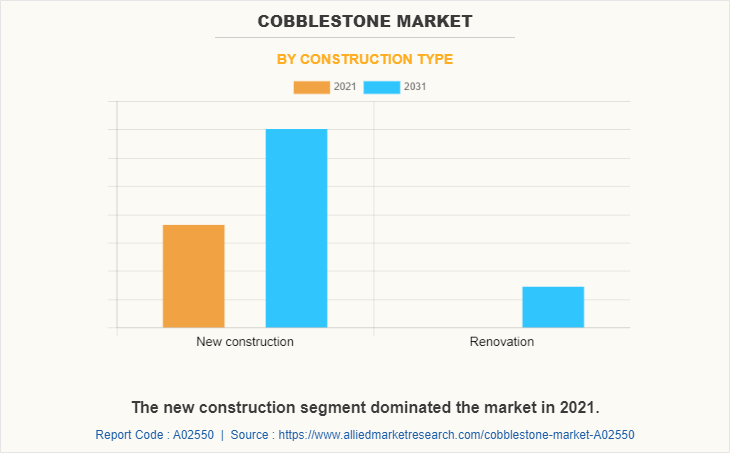

Moreover, increase in the construction sector such as residential and non-residential buildings, is expected to drive the cobblestone market. In addition, government investments in renovation and new construction is another factor to drive the cobblestone market growth.

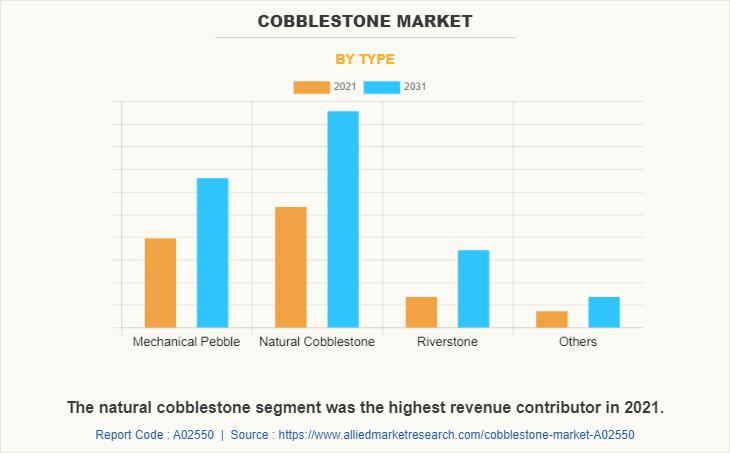

On the basis of type, the natural cobblestone segment generated the largest revenue in 2021, due to increase in consumption of exterior and interior materials in the building and rise in demand from the construction industry. Globally, India is the largest producer of natural stones and has long been leading in granite production and granite exports over the decades. Rise in demand for natural stone such as cobblestone from residential and commercial sectors drives the market growth.

On the basis of construction, the new construction segment accounted for the highest revenue in the global market in 2021 owing to the rise in demand for cobblestones for flooring in commercial buildings, such as shopping centers and big complexes. Cobblestones are available in a variety of textures and colors. Thus, these stones provide an esthetic and appealing look to the buildings.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted production of many products in the cobblestone market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 in the market. This has led to the reopening of indoor flooring companies at their full-scale capacities. This is expected to help the market recover by mid of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

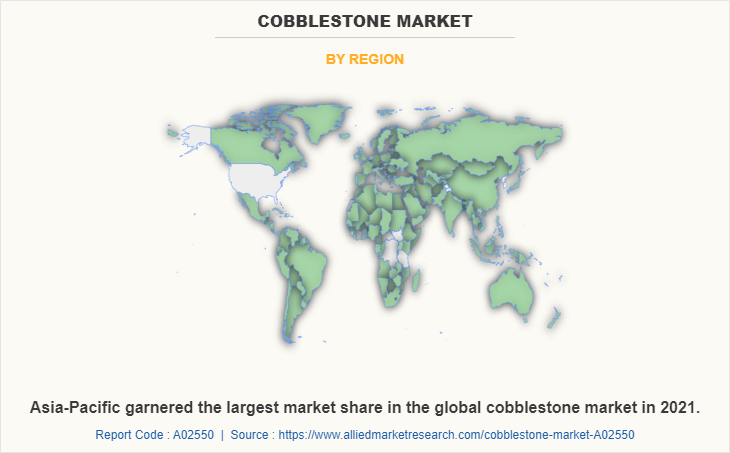

On the basis of region, Asia-Pacific registered the highest revenue in 2021, owning to a rise in infrastructure activity in the region. Moreover, growing construction activities owing to rapid urbanization & industrialization is estimated to boost the demand for natural stones for flooring, wall cladding, memorial arts, civil works, and others. Government initiatives in China in the expanding construction sector are expected to provide growth opportunities in this country. For instance, in November 2020, the central government of China has set a goal of having 70% of new safe building construction by 2022 according to its own standards. Hence, these investments in the construction sector are expected to increase the demand for cobblestone due to its scratch-resistant, and water-resistant feature, and therefore is expected to surge the market growth.

Segmental Overview

The cobblestone market is segmented into type, construction type, application, and region.

On the basis of type, the market is divided into mechanical pebble, natural cobblestone, riverstone, and other.

On the basis of construction type, the market is divided into new construction and renovation.

On the basis of application, the market is divided into roading, architecture, and other.

Region-wise, the global cobblestone market share analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

Competition Analysis

The key players that operate in the cobblestone industry are Aaren Stones & Granites Pvt. Ltd, Agarsen Granite & Stones, Ajmera Marbles Industries, Akrolithos, Cosentino, Dakota Granites, Dal-Tile, Environmental Stone Works, Elegant Natural Stones Pvt. Ltd., Granite Setts UK Ltd., Leeca Ltd., Maharaja Stones, Paving International, Precision Countertops, Inc., Style Earth, U.S. Stone Works Inc., and Vangura.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the cobblestone market trends, segments, current trends, estimations, and dynamics of the cobblestone market analysis from 2021 to 2031 to identify the prevailing cobblestone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- The cobblestone market analysis of the segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The global cobblestone market forecast analysis from 2022 to 2031 is included in the report

- The report includes the analysis of the regional as well as market trends, key players, market segments, application area, cobblestone market opportunity, and growth strategies

Cobblestone Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Construction Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Precision Countertops, Inc, Akrolithos, vangura surfacing products, Style Earth, Dal-Tile, Elegant Natural Stones Pvt. Ltd, Leeca Ltd, Granite Setts UK Ltd, Aaren Stones & Granites Pvt. Ltd, Dakota Granites, Maharaja Stones, Environmental StoneWorks, Ajmera Marbles Industries, Paving International, U.S. Stone Works Inc, Cosentino, Agarsen Granite & Stones |

Analyst Review

The cobblestone market has observed huge demand in North America, Asia-Pacific, and Europe. Asia-Pacific is projected to remain the major revenue generating region of the market in the near future. This growth can be attributed to the rapid expansion of the residential and non-residential construction sectors, mainly across the developing economies, including China, India, Indonesia, South Korea, and others. In addition, rise in consumer purchasing power in these nations is expected to probably fuel the building sector, boosting industrial expansion. The cobblestone market is expected to increase as more people become aware of the advantages of cobblestone slabs, such as greater strength, extended lifespan, and resistance to wear and slipping.

Various market players have adopted strategies, such as product launch, business expansion, acquisition, and agreement to expand its business and strengthen its market position. For instance, in April 2021, Polycor planned to be carbon neutral by end of 2025. It is the first natural stone quarrier to pledge to carbon neutrality and one of the first companies to occupy a leading position in the critical work of decarbonization. As a result, such strategic moves are expected to provide lucrative growth in the global cobblestone market.

The Cobblestone Market size was valued at $7,635.2 million in 2021.

Based on type, the natural cobblestone holds the maximum market share of the cobblestone market in 2021.

The Cobblestone market is projected to reach $12,436.9 million by 2031

Rapid urbanization in emerging economies and growth in the construction sector are the upcoming trends in the Cobblestone Market in the world.

The roading segment is the leading application of the Cobblestone Market.

Asia-Pacific is the largest regional market for Cobblestone Market.

Increase in emphasis toward utilization of artificial materials and fluctuation in foreign currencies are the Cobblestone market effecting factors

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...