Coffee Concentrates Market Research, 2032

The global coffee concentrates market was valued at $2.2 billion in 2022, and is projected to reach $3.6 billion by 2032, growing at a CAGR of 5.0% from 2023 to 2032. The rise in demand for rapid and convenient caffeine option owing to the fast paced and busy lifestyle of individuals has boosted the demand for coffee concentrates market in recent years.

Coffee concentrates, also known as cold brew concentrates, is a highly concentrated form of coffee that is typically used as a base for preparing various coffee beverages. Coffee concentrates is made by steeping coarsely ground coffee beans in cold water for an extended period, usually 12 to 24 hours, to extract the flavor compounds and caffeine. The resulting liquid is strained to remove the coffee grounds, leaving behind a strong concentrate that gets diluted with water or milk to prepare a cup of coffee instantly. Coffee concentrates is known for its smooth, low-acid profile, and versatility in both hot & cold coffee drinks.

Recent Developments in Coffee Concentrate Market

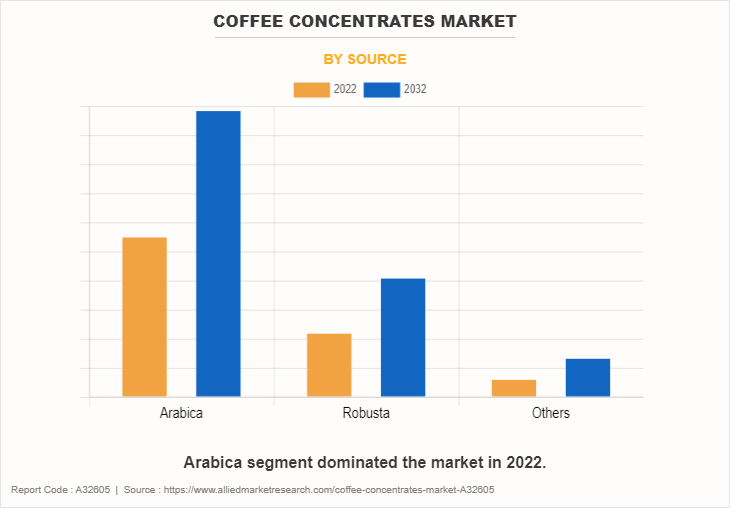

- By source, the Arabica segment was the highest revenue contributor to the market in 2022 owing to the lower levels of caffeine content compared to Robusta and other coffee beans.

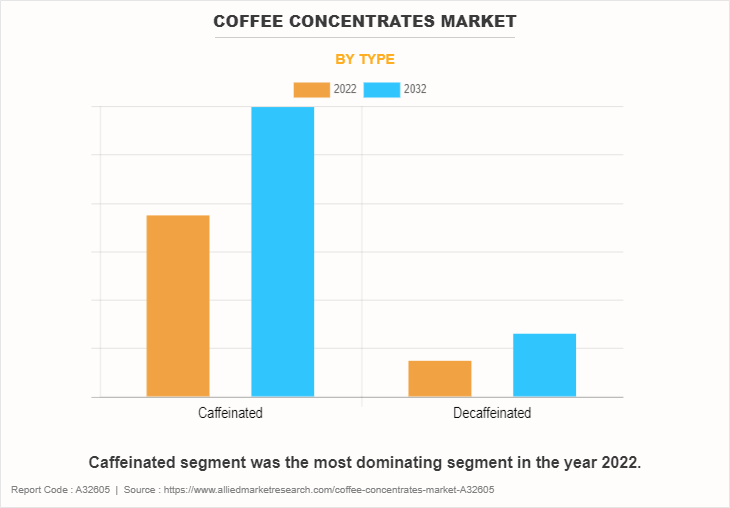

- By type, the caffeinated segment was the largest segment in the global coffee concentrates market during the forecast period.

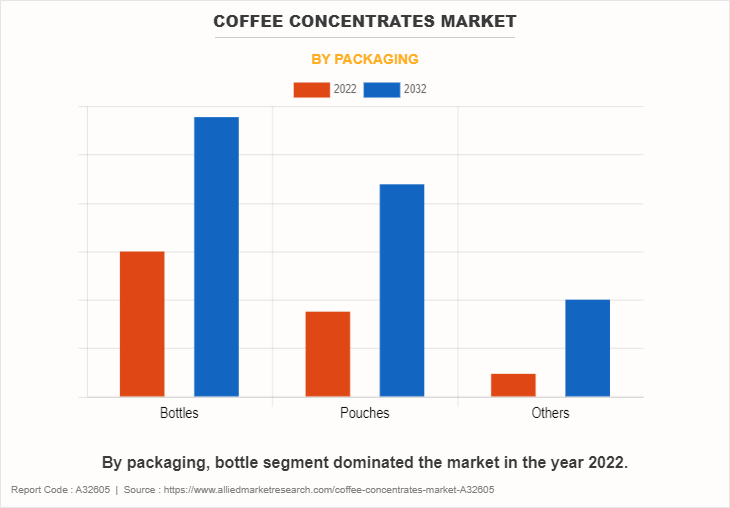

- By packaging, the bottle segment was the largest segment in 2022.

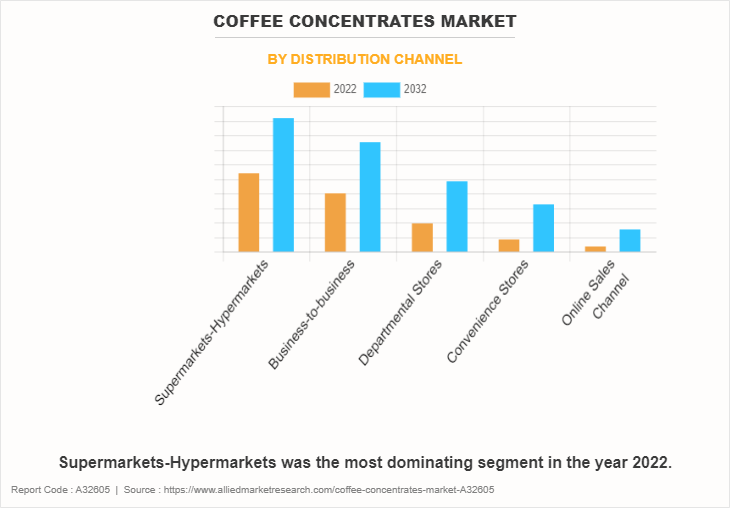

- Depending on distribution channel, the supermarkets/hypermarkets segment was the largest segment in 2022.

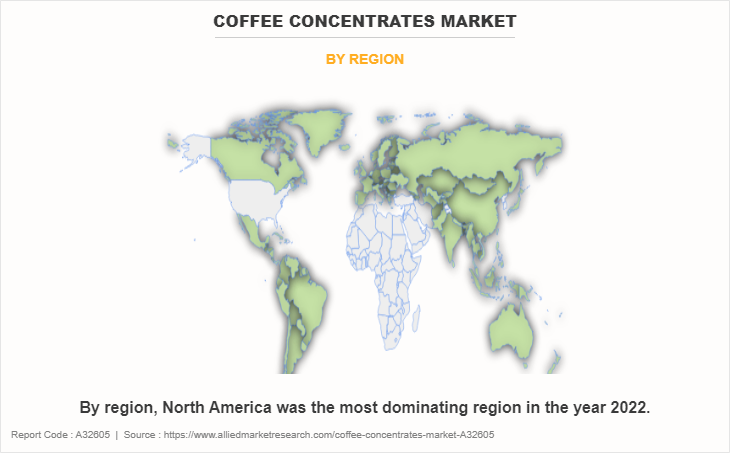

- Region-wise, North America was the highest revenue contributor in 2022 due to the strong coffee culture and demand for diverse coffee products in the region.

MARKET DYNAMICS

Increase in demand for rapid and convenient caffeine option

The demand from busy professionals for rapid and convenient caffeine options has been a significant driver to boost the market demand for coffee concentrates. In today's fast-paced work environment, professionals often find themselves limited with time, seeking efficient solutions to stay energized throughout their hectic schedules. Coffee concentrates offers an attractive solution, providing a convenient and time-saving alternative to traditional brewing methods. With just a simple dilution with water or milk, busy professionals experience a flavorful cup of coffee without the need for extensive preparation or waiting in long queues at cafes.

Moreover, coffee concentration aligns well with the on-the-go lifestyle of busy professionals, allowing them to easily carry it to work, meetings, or travel destinations. Furthermore, longer shelf life of coffee concentrates compared to brewed coffee enhances its appeal, ensuring that individuals always have access to their favorite caffeine fix whenever they need it. As the desire for efficiency and convenience continues to rise among professionals, the coffee concentrates market demand is expected to growth rapidly. Manufacturers and retailers are capitalizing on the trend of easy and instant coffee options by offering a diverse range of coffee concentrates products tailored to meet the unique preferences and lifestyle needs of busy professionals, thereby driving the expansion in the coffee concentrates market.

Fluctuation in coffee bean prices to restrain the market growth

Although the coffee concentrates market share has increased, it still has certain challenges due to fluctuation in raw material prices. Coffee concentrates is made from processed coffee beans, and any fluctuations in the prices of raw coffee beans directly affect the production cost of coffee concentrates. Extreme weather changes such as drought, frosts, and pests significantly damage coffee crops, which reduces production and disrupts timely supply of coffee beans to the market. For instance, in November 2021, global coffee prices surged due to challenging conditions in Brazil, including drought, frost, and unusual weather patterns. This trend continued in 2022, with a 14.8% increase in coffee product prices observed in grocery stores.

Moreover, the return of El Nino weather condition has been officially confirmed by the U.S. Climate Prediction Center, and forecasters anticipate it to be possibly even a strong weather event. This weather phenomenon is expected to bring about hotter and drier conditions, particularly in key Robusta coffee-growing regions such as Vietnam and Indonesia, which is anticipated to have a negative impact on the coffee concentrates market size. The increased risk of adverse weather conditions poses a threat to crucial coffee supplies from these areas, thus contributing to supply shortages and fluctuations in prices of coffee beans used in coffee concentrates production.

As per the data provided by the International Monetary Fund (IMF), the global price of coffee exhibited fluctuations throughout the year 2022, ranging from a high of $6.17 per kg in February to a low of $4.63 per kg in December. Manufacturers of coffee concentrates often operate with tight profit margins. Rapid or unpredictable increases in raw material prices erode these margins, affecting the overall profitability of the business operating in the coffee concentrates market. The competitive landscape of the coffee concentrates market increases this challenge, with manufacturers hesitant to raise prices for fear of losing market share to competitors. These uncertainties affect the quality of coffee concentrates and hinder potential investments and expansion efforts in the industry, thereby impeding the overall coffee concentrates market growth.

Introduction of single-serve coffee concentrates options

The introduction of single-serve coffee concentrates options has created numerous opportunities in the coffee concentrates market. Single-serve formats cater to the growing demand for convenience and on-the-go consumption among consumers. These individualized portions eliminate the need for measuring or brewing equipment, offering rapid and hassle-free way to enjoy coffee concentrates anytime, anywhere. By providing pre-portioned servings, single-serve options such coffee concentrates pods, appeal to busy individuals seeking a convenient caffeine boost without sacrificing quality or flavor.

Moreover, single-serve coffee concentrates options have the potential to open new distribution channels and market segments for manufacturers. These products are well-suited for sale in vending machines, convenience stores, and office environments, expanding the reach of coffee concentrates beyond traditional retail outlets and cafes. In addition, single-serve formats enable brands to capitalize on the growing trend of subscription-based services, offering customizable delivery options for regular consumers. Thus, the introduction of single-serve coffee concentrates options enhances convenience and accessibility for consumers along with driving innovation and market expansion for manufacturers in the competitive coffee concentrates industry.

SEGMENTAL OVERVIEW

The coffee concentrates market is segmented into source, type, packaging, distribution channel, and region.

By Source

By source, the Arabica segment dominated the global coffee concentrates market in 2022 and is anticipated to maintain its dominance during the forecast period. Arabica beans are well known for their superior flavor profile, characterized by a smooth, mild taste with subtle acidity, and refined aromas. These beans typically contain lower levels of caffeine compared to Robusta and other coffee beans, making them a favorable choice for those seeking a milder caffeine boost without sacrificing flavor. In addition, arabica beans are often associated with higher quality and are grown at higher altitudes in selected regions, contributing to their perceived premium status among consumers. Furthermore, the ability of arabica beans to retain its distinctive flavor characteristics even when brewed at low temperatures makes it an ideal choice for concentrates production, resulting in a product that captures the essence of premium coffee in a convenient and concentrated form.

By Type

By type, the caffeinated segment dominated the global coffee concentrates market in 2022 and is anticipated to maintain its dominance during the forecast period. Caffeine, known for its ability to enhance alertness and focus, remains a key factor driving consumer choice. The current fast-paced lifestyles make individuals to often rely on caffeine to kickstart their day or power through busy schedules. Coffee concentrates offers a concentrated dose of caffeine, providing a rapid and convenient solution for those in need of a caffeine boost. Moreover, versatility of coffee concentrating allows consumers to customize their caffeine intake by adjusting the concentration or mixing it with other beverages, catering to varying preferences and consumption habits. As a result, the caffeinated segment continues to dominate the coffee concentrates market, meeting the demand for a convenient and energizing beverage option.

By Packaging

By packaging, the bottle segment dominated the global coffee concentrates market in 2022 and is anticipated to maintain its dominance during the forecast period. The bottled packaging segment is the most preferred option among consumers in the coffee concentrates market owing to rise in convenience, portability, and preservation of freshness. Bottled coffee concentrates offers ready-to-use convenience, allowing consumers to have their favorite coffee beverages rapidly and easily without the need for additional equipment or preparation. The portability of bottled coffee concentrates makes it ideal for on-the-go consumption, catering to busy lifestyles where convenience is of utmost importance. In addition, bottled packaging helps preserve the freshness and flavor of the coffee concentrates for longer periods, ensuring consistent quality with each use. This convenience factor, coupled with its ability to maintain freshness, makes bottled packaging the preferred choice for consumers seeking hassle-free experience of their coffee throughout the coffee concentrates market forecast.

By Distribution Channel

By distribution channel, the supermarkets/hypermarkets segment dominated the global coffee concentrates market in 2022. Consumers prefer purchasing coffee concentrates from supermarkets and hypermarkets owing to convenience, variety, and accessibility, these retail environments offer in recent times. Supermarkets and hypermarkets typically provide a one-stop shopping experience, allowing consumers to easily find a diverse selection of coffee concentrates coffee brands, flavors, and formulations in one location. The extensive shelf space and strategic product placement in these stores enhance visibility, enabling consumers to explore different options. Furthermore, ability to compare prices, read product labels, and take advantage of promotional offers contributes to the appeal of purchasing coffee concentrates coffee in supermarkets and hypermarkets, making it a convenient and efficient choice for consumers seeking rapid and accessible coffee solutions.

By Region

Region wise, North America is anticipated to dominate the market with the largest share during the forecast period. The region benefits from a deeply ingrained coffee culture and a strong demand for diverse coffee products. Despite the widespread presence of coffee shops and cafes across North America, many people still prefer coffee concentrates owing to convenience and versatility of coffee concentrates products. Coffee concentrates offers the flexibility to experience a high-quality coffee beverage at home or on the go, without the need to visit a cafe. In addition, coffee concentrates provide a longer shelf life compared to freshly brewed coffee, making it a convenient option for busy individuals who may not have time to visit cafes regularly.

Moreover, the fast-paced lifestyle prevalent in the region fuels the demand for convenient, ready-to-drink coffee options, such as coffee concentrates. Furthermore, the presence of major coffee concentrates manufacturers and ongoing product innovations drives the North America coffee concentrates market growth.

Competitive Analysis

Key players include Nestle SA, Starbucks Corporation, The J.M. Smucker Company, All American Coffee LLC, Califia Farms, LLC, Javo Beverage Company, Inc., Javy Coffee Company, Grady’s Cold Brew, Kohana Coffee, and Climpson & Sons. Several well-known and upcoming brands are vying for market dominance in the expanding coffee concentrates industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Large conglomerates, however, control most of the market and often buy creative start-ups to broaden their product lines.

Key Developments in Coffee Concentrate Market

- In June 2023, Monin revealed its plans to strengthen its product lineup by introduction a series of seasonal coffee concentrates offerings such as maple pumpkin cold brew coffee concentrates to meet the increasing consumer demand for diverse options and response to the evolving market trends and preferences.

- In August 2022, Finlay's expanded its market presence in the B2B coffee concentrates sector by announcing the establishment of a state-of-the-art manufacturing facility. This facility, funded with a multi-million-dollar investment, was strategically positioned to meet the rise in demand for cold brew coffee concentrates.

- In August 2022, Pop & Bottle broadened its market reach by exclusively launching its new product range at Walmart stores across the U.S. The product launch was driven by Walmart's extensive market penetration, offering Pop & Bottle a platform to access a wider consumer base and capitalize on the retailer's expansive reach.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coffee concentrates market analysis from 2022 to 2032 to identify the prevailing coffee concentrates market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coffee concentrates market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coffee concentrates market trends, key players, market segments, application areas, and market growth strategies.

Coffee Concentrates Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 291 |

| By Type |

|

| By Packaging |

|

| By Source |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Javy Coffee Company, Grady’s Cold Brew, Climpson & Sons, Javo Beverage Company, Inc., Kohana Coffee LLC., Califia Farms, LLC, Nestle SA, The J.M. Smucker Company, All American Coffee LLC, Starbucks Corporation |

Analyst Review

The perspectives of leading CXOs in the coffee concentrates market are presented in this section. CXOs have highlighted the shift in consumer preferences toward convenience and on-the-go consumption have fueled the demand for coffee concentrate products, offering a convenient solution for busy lifestyles. The rising popularity of specialty coffee beverages, including cold brews, has led to increased adoption of coffee concentrates, catering to various consumers seeking unique flavor profiles and premium experiences. In addition, versatility of coffee concentrated as a base for various beverages, from iced coffees to cocktails, presents opportunities for market expansion and product diversification.

Moreover, rise in the awareness of sustainability and eco-friendly practices among consumers has prompted companies to invest in sustainable packaging solutions, driving the market growth. Furthermore, strategic partnerships and collaborations within the industry, coupled with innovative marketing strategies and product launches, are major factors in capturing new market segments and enhancing brand visibility.

In addition, the coffee concentrates market has witnessed a digital transition, with e-commerce being a key factor. Online platforms provide wider reach and access to a global consumer base, bypassing traditional distribution channels. Consumers now acquire a variety of coffee concentrate more easily due to online sales channels, and other e-commerce sites. Social media sites are developed into effective marketing tools that enable firms to interact directly with their target audience. Thus, all such factors are expected to boost the coffee concentrate market growth.

The global coffee concentrates market size was valued at USD 2.2 billion in 2022, and is projected to reach USD 3.6 billion by 2032.

The global coffee concentrates market is projected to grow at a compound annual growth rate of 5.0% from 2023-2032 to reach USD 3.6 billion by 2032.

The key players profiled in the reports includes All American Coffee LLC, Kohana Coffee LLC., Javo Beverage Company, Inc., The J.M. Smucker Company, Nestle SA, Starbucks Corporation, Javy Coffee Company, Grady’s Cold Brew, Califia Farms, LLC, Climpson & Sons.

North America dominated and is projected to maintain its leading position throughout the forecast period.

Increase in demand for rapid and convenient caffeine option, Fluctuation in coffee bean prices to restrain the market growth, Introduction of single-serve coffee concentrates options majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...