Cognitive Computing Market Insights, 2032

The global cognitive computing market was valued at $32.2 billion in 2022, and is projected to reach $476.8 billion by 2032, growing at a CAGR of 31.3% from 2023 to 2032.

Cognitive computing is majorly used in BFSI, healthcare, energy & power, retail, e-commerce, and other sectors. Increase in volume of unstructured data and advancements in technology are the major driving forces of the cognitive computing market. Cloud-based technological advancements, development of innovative hardware & software systems and cognitive experience interfaces are the factors expected to foster the cognitive computing market growth. In addition, the use of digital technologies help to improve data management and analytics, as well as providing enterprises with a better knowledge of their product portfolio. Such aforementioned factors are expected to provide lucrative opportunities for market growth during the forecast period.

In addition, growing digitalization and rising need for intelligent data processing solutions and increase in adoption of advanced technologies are positively impacting the cognitive computing market trends. Moreover, the growing need for personalization and improving customer experience is also anticipated for creating lucrative opportunities for market growth. Furthermore, the rise in internet tools for processing data is also arising, which is expected to provide lucrative growth opportunities for the market in the forecast period.

Cognitive computing helps process volumes of complex data, thereby inadvertently enhancing the enterprise's productivity levels. Cognitive computing is considered as the next generation system that converses in human language and helps experts to make better decisions by understanding the complexities of big data. In the current scenario, most of the data received is unstructured such as images, videos, natural language, and symbols. Cognitive computing, with the help of different technologies such as natural language processing, machine learning, and automated reasoning, translates unstructured data to sense, infer, and predict the best solution.

Moreover, advancement in enabling technology and increase in volume of large complex data, which positively impacts the growth of the market in the future. In addition, evolutions in computing platforms expected to drive global market growth. However, the high cost of deploying cognitive computing systems, and lack of awareness are expected to hamper market growth. Furthermore, impact on business application is expected to create numerous opportunities for cognitive computing solutions.

Segment Review

The cognitive computing market is segmented into technology, deployment type, enterprise size, industry vertical, and region. By technology, it is categorized into natural language processing, machine learning, automated reasoning, and others. On the basis of deployment type, it is divided into on-premise and cloud. Further, on the basis of enterprise size, it is classified into large enterprises and small and medium enterprises. Depending on industry vertical, it is segregated into healthcare, BFSI, retail, government & defense, IT & telecom, energy & power, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

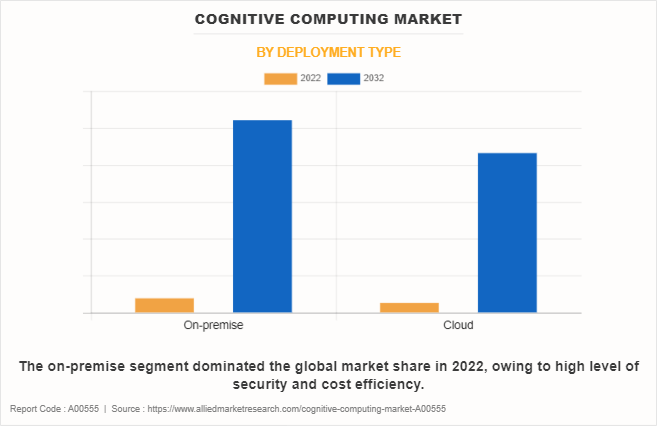

On the basis of deployment type, the global cognitive computing market share was dominated by the on-premise segment in 2022 and is expected to maintain its dominance in the upcoming years, owing to high level of security and cost efficiency provided by the on-premise solutions. However, the cloud segment is expected to witness the highest growth, as businesses intending to implement cognitive computing technologies find cloud computing's benefits, such as scalability, flexibility, and lower infrastructure costs, compelling.

By region, North America dominated the cognitive computing market size in 2022. The region has a strong foothold for numerous large enterprises, government agencies, and organizations with a huge focus on data protection and compliance are anticipated to propel the growth of the email encryption software market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. Several companies in this region have embraced cognitive computing to improve their business operations, which in turn contributes to the rising growth of the market.

Top Impacting Factors

Advancement in enabling technology:

The rising trend of advanced technologies such as IoT and other technologies is directly influencing the growth of the global cognitive computing market. Radical advancements in several industries, enabled through communication technologies, are the major factor driving the global market demand. Consequently, cognitive computing solutions are gaining significant adoption to increase the use of IT and control systems among several business operators. Increased use of digital solutions helps business managers to improve network availability and empower technical staff to efficiently do maintenance. These factors are likely to contribute to the increased installation of cognitive computing market, globally.

Furthermore, the need for a system that analyze this information into digital form and provide meaningful insights enabling technology to be used. Among which cognitive technology has proliferated its adoption in R&D organizations at a significant rate owing to its ability to forestalling every possible solution needed to solve situation which is a major factor that drives the growth of the market.

In addition, cognitive computing systems are developed with natural language processing (NLP) and machine learning algorithms to analyze, predict, and conclude a situation. Hence, these multiple benefits offered by digital technologies will boost the demand for cognitive computing market. For instance, in December 2020, the Indian Institute of Technology (IIT), Kanpur launched a new department of Cognitive Science, which will focus on integrating the knowledge of the human mind with new-age technology. Such innovations pooling in the digitalization of computing solutions will fuel the demand for cognitive computing solutions, which in turn, augment the market growth on a global scale.

Increase in volume of large complex data:

There is an increase in the large complex data owing to surge in volume of digitalization. Nowadays, enormous data present with business organizations is in the form of human language, videos, and pictures. Hence, modern computing systems are crucial for processing this enormous volume of data. This, in turn, has increased the demand for cognitive computing in recent years. Several regional governments are making strategic investments in expanding cognitive computing solutions. This is attributed to cognitive computing capability that integrates diversified data sources and provides a platform that accumulates unified environment seamlessly. Therefore, cognitive computing solutions gained wider traction among end-users, which in turn augmented the cognitive computing market forecast.

Moreover, several businesses in the global industry are adopting various strategies such as partnership, product launch and others to provide better user experience. For instance, in February 2023, Entropik Tech launched its new conversational intelligence platform namely, Decode, which is ready to be integrated with the existing conferencing and collaboration ecosystem. It seamlessly gathers conversation data and creates a layer of intelligence on top to turn conversations into actionable insights that will increase the efficiency and productivity of organizations. Such innovations and advancements in cognitive computing will eventually contribute to the growth of the cognitive computing industry.

COVID-19 Impact Analysis

The cognitive computing market witnessed stable growth during the COVID-19 pandemic, owing to the dramatically increased dependence on digital devices. The surge in online presence of people during the period of COVID-19-induced lockdowns and social distancing policies fueled the need for cognitive computing solutions. This was critical for many businesses during the period as effective cognitive computing solutions helped businesses to come up with effective plans to cope with the evolving business landscape post the outbreak of the COVID-19 pandemic.

For instance, in December 2021, Arqit partnered with NEOM, to build and trial the ‘Cognitive City’ quantum security system. This trial will see the two organizations develop new software capable of defending cognitive cities against cyber-attacks from the most advanced computers to emerge in the forecast period. Similar trends were being noticed all across the world, which supported the growth of the global cognitive computing market during the period. Moreover, the growing demand for automation and remote work tools during the social distancing phase of the pandemic further fueled the dependence on cognitive computing solutions during the period.

Key Benefits for Stakeholders

- The study provides an in-depth cognitive computing market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the cognitive computing market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the cognitive computing industry.

- The quantitative analysis of the global cognitive computing market for the period 2022–2032 is provided to determine the cognitive computing market potential.

Cognitive Computing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 476.8 billion |

| Growth Rate | CAGR of 31.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 285 |

| By Deployment Type |

|

| By Technology |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Tibco Software Inc., IBM Corporation, 3M, Google LLC, SAS Institute Inc., Hewlett Packard Enterprise Development LP, Microsoft Corporation, TATA Consultancy Services Limited, Oracle Corporation, SAP SE |

Analyst Review

As the cognitive computing market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. the current business scenario, has exhibited an upsurge in the usage of cognitive computing across various applications such as healthcare, banking & financial, research & education, defense, IT& telecom, energy & power, research & education, and travel & tourism. This market is gaining significant acceptance from commercial users and large enterprises for improvising business performance and meeting customers’ expectations by analyzing unstructured data. The increased use of cognitive computing in healthcare and other applications in North America and Europe drives its adoption in the Asia-Pacific and LAMEA regions. The cognitive computing market is expected to grow at a faster pace with an overall rise in big data analytics, and impact on business applications and cloud-based services. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, natural language processing is the most prominent technology used in the cognitive system owing to its inherent capacity to process natural language interactions. At present, automated reasoning and information retrieval technologies have limited applications; thereby restricting the growth of the technologies. However, these technologies are seeking new trends in artificial intelligence (AI), probabilistic logic, and query searching that would further accelerate the growth in the forecast period. Use of cognitive computing systems in healthcare and BFSI constitutes major market size by value.

Furthermore, increase in solution for large volumes of unstructured data, rise in usage of cloud-based services, big data analytics, and impact of cognitive computing on the business applications are some of the key factors expected to boost the growth of the global market. This is anticipated to allow the emerging markets to evolve as the largest revenue generators during the forecast period, both from the demand and the supply end. For instance, in May 2023, IBM launched IBM watsonx, a new AI and data platform, that may enable enterprises to scale and accelerate the impact of the most advanced AI with trusted data. Enterprises turning to AI, need access to a full technology stack that enables them to train, tune and deploy AI models, including foundation models and machine learning capabilities, across their organization with trusted data, speed, and governance.

The North America is the largest market for the Cognitive Computing.

Factors such as the increase in the demand for cognitive computing solutions in large and medium-sized organizations is likely to increase global market growth.

Cognitive Computing Market to reach $476,777.64 Billion, by 2032

The key growth strategies for Cognitive Computing include product portfolio expansion, acquisition, partnership, merger, and others.

3M, Google LLC, Hewlett Packard Enterprise Development LP, IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Tibco Software Inc. and TATA Consultancy Services Limited (TCS).

Loading Table Of Content...

Loading Research Methodology...