Collateralized Debt Obligation Market Research, 2033

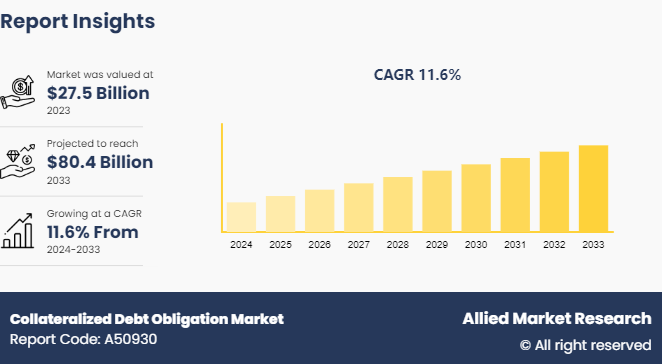

The global collateralized debt obligation market was valued at $27.5 billion in 2023, and is projected to reach $80.4 billion by 2033, growing at a CAGR of 11.6% from 2024 to 2033. Collateralized debt obligations (CDOs) show a shift towards more stringent regulatory oversight and enhanced risk assessment models to prevent the pitfalls seen during the 2008 financial crisis. Additionally, there's a growing focus on creating more transparent and simpler CDO structures to attract cautious investors while addressing concerns about complexity and risk.

Market Introduction and Definition

A Collateralized Debt Obligation (CDO) is a sophisticated financial instrument that aggregates various types of debt, including loans, bonds, and mortgages, and then divides this pool into distinct tranches, each with varying levels of risk and return. The goal is to redistribute the credit risk associated with the underlying debt. Investors can choose tranches that match their risk tolerance, with senior tranches offering lower risk and lower returns, and equity tranches offering higher risk and higher returns. The cash flows from the underlying debt instruments are distributed to investors according to the priority of the tranches, with senior tranches paid first. CDOs aim to provide higher yields compared to traditional debt instruments and allow financial institutions to transfer credit risk off their balance sheets.

Moreover, diversification, as CDOs pool a variety of debt instruments, such as loans, bonds, and mortgages, reducing the risk associated with any single asset. This pooling allows investors to gain exposure to a diversified portfolio, potentially lowering the overall risk of their investment. Additionally, CDOs are structured into tranches with different risk and return profiles, enabling investors to choose tranches that match their specific risk tolerance and investment goals. Senior tranches are lower risk and offer stable returns, while junior tranches provide higher returns for those willing to take on more risk.

Key Takeaways

The collateralized debt obligation industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major collateralized debt obligation industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global collateralized debt obligation market forecast and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

Collateralized Debt Obligations (CDOs) are complex financial instruments that pool together cash-flow-generating assets and repackages them into tranches that can be sold to investors. The market dynamics of CDOs are influenced by various factors, including interest rates, credit quality of the underlying assets, investor demand, and regulatory environment. When interest rates are low, CDOs become more attractive to investors seeking higher returns compared to traditional fixed-income securities. The credit quality of the underlying assets, such as mortgages, loans, or bonds, plays a critical role in the perceived risk and pricing of CDO tranches. Higher credit quality assets result in lower yields but attract risk-averse investors, while lower quality assets offer higher yields but come with increased risk. Investor demand for CDOs can be driven by diversification benefits and the structured nature of tranches, which cater to varying risk appetites. Regulatory changes, particularly those implemented after the 2008 financial crisis, have significantly impacted the market by imposing stricter requirements on transparency, risk retention, and capital adequacy. These regulations aim to mitigate systemic risk and protect investors, thus influencing the structure, issuance, and trading of CDOs.

Public Policies of Global Collateralized Debt Obligation Market

Public policies regarding Collateralized Debt Obligations (CDOs) primarily focus on enhancing transparency, reducing systemic risk, and protecting investors. In the wake of the 2008 financial crisis, which was exacerbated by the collapse of the CDO market, regulators implemented stringent measures to address the flaws exposed by the crisis. Key policies include the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States, which mandates increased disclosure requirements, higher capital and liquidity standards, and risk retention rules. These rules require issuers of CDOs to retain a portion of the credit risk, aligning their interests with those of investors. Additionally, the Volcker Rule, part of Dodd-Frank, restricts banks from engaging in proprietary trading of certain high-risk securities, including CDOs. Globally, the Basel III framework sets stricter capital requirements for banks holding CDOs, promoting greater financial stability. The European Union's similar regulatory frameworks, such as the Capital Requirements Directive IV (CRD IV) , also impose rigorous standards on banks and financial institutions involved in the CDO market. Collectively, these public policies aim to create a more resilient financial system by fostering greater accountability, improving market practices, and ensuring that the risks associated with CDOs are more carefully managed and understood.

Market Segmentation

The collateralized debt obligation market size is segmented into type, application, and region. On the basis of type, the market is divided into collateralized loan obligations (CLOs) , collateralized bond obligations (CBOs) , collateralized synthetic obligations (CSOs) , and structured finance CDOs (SFCDOs) . As per application, the market is segregated into asset management company, fund company, and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The regional outlook for Collateralized Debt Obligations (CDOs) varies significantly across different markets, influenced by local economic conditions, regulatory environments, and investor demand. In the United States, the CDO market has seen a resurgence after the 2008 financial crisis, driven by a robust economic recovery and investor appetite for yield in a low-interest-rate environment. However, stringent regulatory frameworks like the Dodd-Frank Act continue to shape the market, emphasizing transparency and risk management. In Europe, the market for CDOs is more cautious, shaped by regulatory measures such as the EU's Capital Requirements Directive IV (CRD IV) and ongoing economic challenges in the region. European investors tend to prefer higher-quality tranches and are more risk-averse due to the lingering effects of the Eurozone crisis. In contrast, emerging markets in Asia, particularly China and India, are experiencing growing interest in structured financial products, including CDOs, as these markets mature and seek to diversify their financial instruments. However, these regions face their own regulatory and economic challenges, which can affect the pace of collateralized debt obligation market share development.

On March 2022, Bruhat Bengaluru Mahangara Palike (BBMP) School in Bangalore imparted innovative learning by adding 60 digital classrooms and seven computer labs with 20 computers in each lab. This initiative would help teachers teach students through 3D digital models, improving education and a better understanding of the concepts.

On March 2022, Lenovo, which had launched its Lenovo EdVisions program, updated it to provide a hybrid classroom experience that would offer Lenovo smart education. The curriculum has been upgraded to provide students with a more exciting learning experience. It also creates a forum for educators to share their hybrid classroom experiences and techniques.

On March 2021, the Canadian Government created a Digital Charter where every individual would have control over their personal information. The digital charter has a few principles to be maintained and followed for the privacy of the data.

On January 2023, Creative Galileo, an ed-tech startup announced the release of Toondemy, an educational learning app. The app offers a complete educational journey for students aged 3-10 years in line with NEP, NCERT, and CBSE to construct cognitive capabilities, and strong foundational concepts, learn phonics, and conceive new innovative skills.

Industry Trends

In U.S., Private credit firms are raising billions of dollars to grab a share of the $5.2 trillion market that includes US consumer debt, seizing on a growth opportunity while the industry’s traditional lenders are in disarray.

On January 2024, Bayview Opportunity Master Fund VII Trust is preparing to issue $143.3 million in collateralized debt obligations (CDO) , where motor vehicle retail installment loans and sale contracts secure other underlying securities. Series CAR1F of the transaction will issue just one tranche of class A notes, which are ultimately secured by four classes of previously issued notes that were packaged in the BVABS 2023-CAR2 and BVABS 2023-CAR3 issuances, according to Moody's Investors Service. Moody's rates the notes Baa2.

Competitive Landscape

The major players operating in the collateralized debt obligation market include Deutsche Bank AG, Citigroup Inc., RBC Dominion Securities Inc., UBS AG, Goldman Sachs Ayco, Jefferies Financial Group Inc., Natixis, Wells Fargo and Co, The GreensLedge Group LLC, and Morgan Stanley

Recent Key Strategies and Developments

In April 2024, Deerpath Capital Management, LP announced the closing of Deerpath CLO 2024-1, a $452.61 million collateralized loan obligation (CLO) . This marks Deerpath's first new issuance CLO in 2024. Including a CLO reset and upsize in July 2023 and CLO 2023-2, this transaction represents the firm's tenth CLO over the past 6 years. Deerpath Capital is one of the largest providers of customized, cash-flow based senior debt financing to lower-middle market companies across North America.

In January 2024, Churchill Asset Management LLC, an investment specialist of Nuveen that provides customized financing solutions to U.S middle market-focused private equity sponsors and their portfolio companies, announced the closing of a $400 million middle market collateralized loan obligation (“CLO”) , Churchill MMSLF CLO III.

Key Sources Referred

Churchill Asset Management LLC

Deerpath Capital Management, LC

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the collateralized debt obligation market analysis from 2024 to 2033 to identify the prevailing collateralized debt obligation market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the collateralized debt obligation market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global collateralized debt obligation market size.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global collateralized debt obligation market trends, key players, market segments, application areas, and collateralized debt obligation market growth strategies.

Collateralized Debt Obligation Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 80.4 Billion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | UBS AG, Morgan Stanley, Citigroup Inc., The GreensLedge Group LLC, RBC Dominion Securities Inc., Wells Fargo and Co, Jefferies Financial Group Inc., Natixis, Goldman Sachs Ayco, Deutsche Bank AG |

The collateralized debt obligation market was valued at $27.5 billion in 2023, and is estimated to reach $80.4 billion by 2033, growing at a CAGR of 11.6% from 2024 to 2033.

North America is the largest regional market for Collateralized Debt Obligation.

The major players operating in the collateralized debt obligation market include Deutsche Bank AG, Citigroup Inc., RBC Dominion Securities Inc., UBS AG, Goldman Sachs Ayco, Jefferies Financial Group Inc., Natixis, Wells Fargo and Co, The GreensLedge Group LLC, and Morgan Stanley.

Diversification by pooling various debt instruments is the leading application of Collateralized Debt Obligation Market.

Demand for alternative investment products and rise in volume of foreign exchange trade are the upcoming trends of Collateralized Debt Obligation Market in the globe.

Loading Table Of Content...