Collision Avoidance System Market Overview, 2030

The Global Collision Avoidance System Market size was valued at $47.8 billion in 2020, and is projected to reach $114.5 billion by 2030, growing at a CAGR of 9.1% from 2021 to 2030. Collision avoidance system is a safety awareness or a warning system designed to reduce the severity of a collision. Such systems are widely used in automobile and mining sectors to avoid accidents. It is also known as the pre-crash system, forward collision warning system, or collision mitigating system.

This system helps detect the imminent strike, alerting the driver about any collision. These systems are interpolated within the vehicle to enable semi-autonomous and autonomous decision-making. Moreover, such systems automatically take action without any input from the driver.

The growth of the global collision avoidance system market is anticipated to be driven by factors, such as surge in sales of sports utility vehicles (SUVs) and high-end luxury vehicles & utility vehicles, and increase in demand for automated vehicles. In addition, improved visibility and enhanced safety supplements for various applications such as blind spot collision avoidance assist and others boost the overall market growth. However, cyclic nature of automotive sales and production, and high installation cost act as major restraints of the global collision avoidance system market. On the contrary, rise in the automotive safety norms, electronic integration in automotive, and installation of advanced driver assistance system in passenger cars are expected to create lucrative opportunities for the collision avoidance system industry.

Segment overview

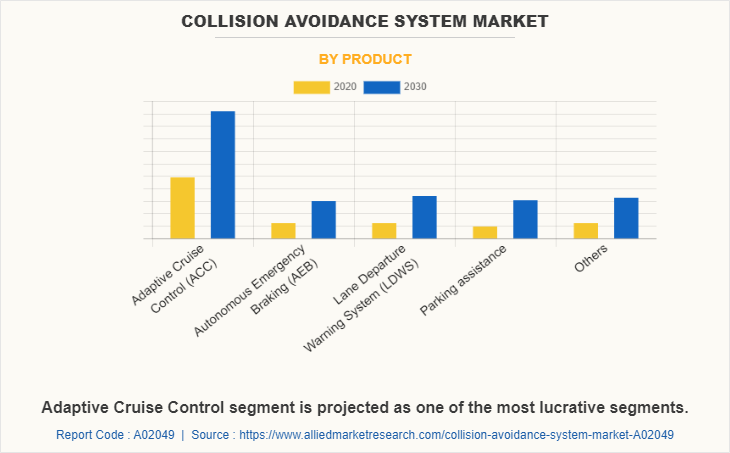

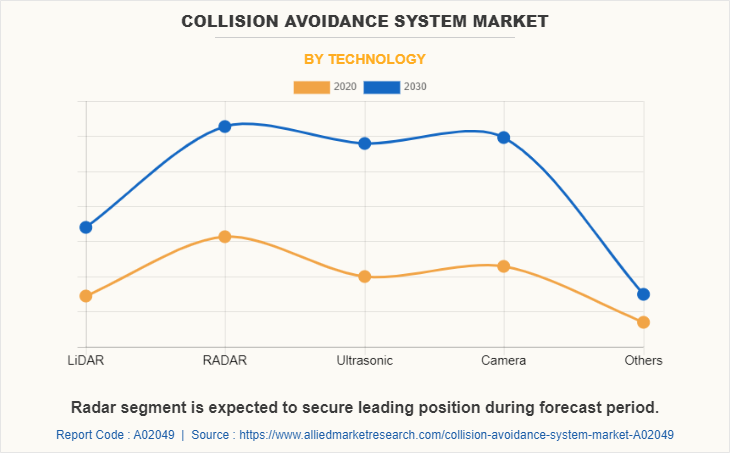

The collision avoidance system market outlook is provided on the basis of type, technology, application, and region. By type, the market is segmented into adaptive cruise control, autonomous emergency braking (AEB), lane departure warning system, parking assistance, and others. By technology, the market is classified into LiDAR, RADAR, ultrasonic, camera, and others. On the basis of application, the market is divided into automotive, aerospace & defense, marine, and rail.

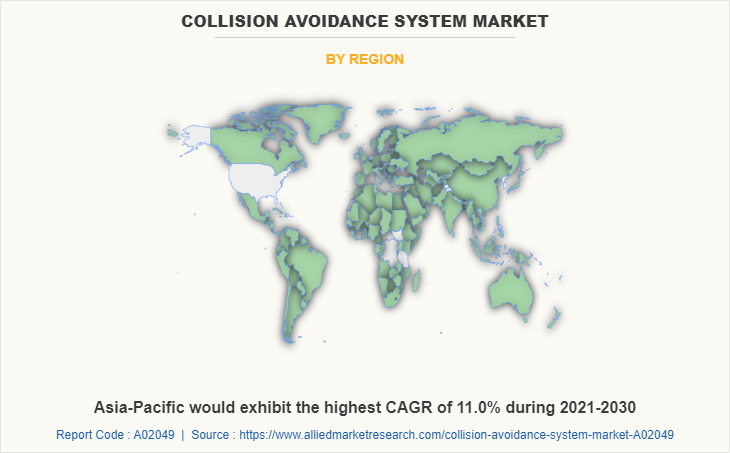

Region-wise, the collision avoidance system market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Europe dominated the collision avoidance system market in 2020, and is projected to register significant growth rate during the forecast period, owing to growth of the aerospace & defense sector. However, Asia-Pacific is expected to witness significant growth rate by the end of the forecast period, followed by LAMEA.

Top Impacting Factors

The prominent factors that impact the collision avoidance system market growth are increase in demand for automated vehicles, collision warning system, and improved visibility and enhanced safety. In addition, growth in electronic integration in the transportation sector for collision prevention drives the collision avoidance system market growth. However, high installation cost restricts the market growth. On the contrary, increase in automotive safety norms and electronic integration in automotive are expected to create collision avoidance system market opportunity.

Competitive Analysis

Competitive analysis and profiles of the major collision avoidance system market players, such as Alstom SA, Autoliv, Inc., Delphi Automotive PLC (APTIV), DENSO Corporation, General Electric Company, Honeywell International Inc., Robert Bosch GmbH, Collins Aerospace, and Siemens AG, and Wabtec Corporation. are covered in the report. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the global collision avoidance system industry.

Key Benefits For Stakeholders

- This study comprises analytical depiction of the global collision avoidance system market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall collision avoidance system market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current collision avoidance system market forecast is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and the collision avoidance system market share of key vendors.

- The report includes the market trends and the market share of key vendors.

Collision Avoidance System Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Wabtec Corporation, Honeywell International Inc., Denso Corporation, Collins Aerospace, Alstom SA, General Electric Company, Siemens AG, Robert Bosch GmbH, Autoliv Inc., Delphi Automotive PLC (Aptiv) |

Analyst Review

The global collision avoidance systems market is expected to witness high growth rate due to increase in demand for the automated vehicles, improvement of visibility, and enhanced safety. However, high installation cost impedes the market growth.

The collision avoidance system market signifies a promising picture for the automotive industry. The current business scenario has witnessed increase in demand for the collision avoidance system, particularly in developing regions. Companies adopt innovative techniques in an effort to provide customers with advanced and innovative product offerings.

The major factor responsible for collision avoidance systems market growth is the rise in technological advances. In spite of the recent advancements, there exists further scope for improvement. For instance, systems such as autonomous emergency braking system still have difficulty in identifying objects when a vehicle is at high speed. Collision avoidance system seeks for cost-effective system solutions, which is fully integrated with other sensors.

Among North America, Asia-Pacific, Europe, and LAMEA, Europe accounted for a major share of the market in 2020, owing to the presence of major players in the region. However, Asia-Pacific is expected to witness growth at the highest CAGR, owing to rise in adoption of collision avoidance systems in a variety of fields.

Alstom SA, Autoliv, Inc., Delphi Automotive PLC (Aptiv), Denso Corporation, General Electric Company, Honeywell International Inc., Robert Bosch GmbH, Collins Aerospace, and Siemens AG, and Wabtec Corporation are key market players that occupy a significant revenue share in the collision avoidance systems market.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Product launch, partnership, collaboration, acquisition, expansion, and product development are expected to be the prominent strategies adopted by the market players.

By application, the automotive segment is expected to secure leading position in global collision avoidance system market.

Europe is largest regional market for collision avoidance system market.

The global collision avoidance system market size was valued at $47.8 billion in 2020.

The key players operating in the market include Alstom SA, Autoliv, Inc., Delphi Automotive PLC (Aptiv), Denso Corporation, General Electric Company, Honeywell International Inc., Robert Bosch GmbH, Collins Aerospace, and Siemens AG, and Wabtec Corporation.

The global collision avoidance system market is expected to grow at a CAGR of 9.1% from 2021 to 2030.

The growth of the global collision avoidance system market is anticipated to be driven by factors, such as surge in sales of sports utility vehicles (SUVs) and high-end luxury vehicles & utility vehicles, and increase in demand for automated vehicles.

The collision avoidance system market is segmented on the basis of type, technology, application, and region.

The key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their position in the global collision avoidance system market.

Loading Table Of Content...