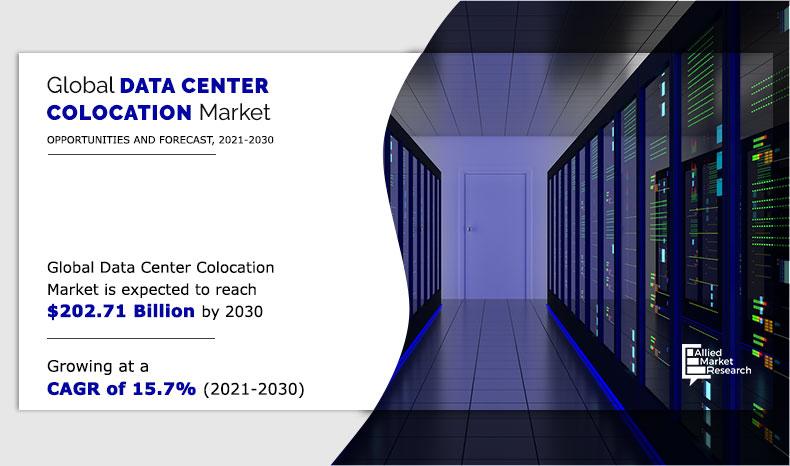

Data Center Colocation Market Size & Share:

The global data center colocation market size was valued at USD 46.08 billion in 2020, and is projected to reach at USD 202.71 billion by 2030, growing at a CAGR of 15.7% from 2021 to 2030.

The data center colocation market shows bullish trend with the rapid adoption of data center across all industry verticals. With the availability of solutions such as retail colocation and wholesale colocation, the market offers flexibility in terms of fulfilling the capacity requirement of individual organization. Data center colocation is process of renting of large physical space , internet bandwidth and network by service provider within an existing data center to deploy its own data center to store huge data and manage server operation of large companies. It allows sharing of the existing infrastructure of data center resources for data center colocation.

Depending on type, retail colocation dominated the data center colocation market share in 2020, and is expected to continue this trend during the forecast period. The growth of the segment is attributed to numerous benefits provided by this type such as managed service which results in lower costs of maintenance of data center, high security of data and others. However, the wholesale colocation segment is expected to witness highest growth in the upcoming years, as the wholesale colocation allows organizations to deploy thousands of server at one location and provide high-density computing, which notably provides data center colocation market opportunity.

By Type

Wholesale Colocation segment is projected as one of the most lucrative segments.

On the basis of enterprise size, large scale organization dominated the data center colocation market share and is expected to continue this growth during the forecast period. This growth is attributed to heavy investment of large scale organization in the data centers. Also, the growing requirement of heavy data storage in large scale organizations drives the data center colocation market globally. However the small and medium scale organization recorded highest growing segment due to major shift of small and medium scale business toward digitization and adoption of internet of things in the regular operation which creates the high amount of data, which drives the market globally.

By Organization Size

Small and Mediun Scale enterprise segment is projected as one of the most lucrative segments.

On the basis of region, North America is dominating data center colocation market in year 2020 and it will continue this trends during forecast period. This growth is attributed due to heavy presence of large scale IT companies such as Amazon.com, Google LLC and Facebook in the region which need huge space to store data and increases requirement of colocation data center. However, the Asia-Pacific is expected to exhibit highest growth in 2020 and continue this trend during the data center colocation market forecast period, owing to strong economic growth along with the ongoing development in the IT and telecom sector, which drives organizations to invest heavily in data center colocation to sustain growth and improve productivity.

By Region

Asia-Pacific is projected as one of the most significant region.

In addition, factors such as major shift toward digital transformation, rise in cloud deployment and technological advancement among small & medium businesses, and ongoing modernization of data center and use of big data analytics in the organization drives heavy investment in data center colocation in emerging economies. Furthermore, enterprises in Asia-Pacific are focusing on enhancing their operations and increasing their overall efficiency to stay competitive in the market, which is expected to provide lucrative opportunities for the growth of the market during the forecast period.

The report focuses on the growth prospects, restraints, and data center colocation market analysis. The study provides Porter’s five forces analysis of data center colocation industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the data center colocation market trends.

Segment Review:

The data center colocation industry is segmented on the basis of type, enterprise size, industry vertical, and region. By type, it is bifurcated into retail colocation and wholesale colocation. By enterprise size, the market is bifurcated into small and medium scale enterprise and large scale enterprise. By industry vertical, it is classified into BFSI, IT & Telecommunication, Manufacturing, Energy and Utilities, Healthcare, Retail & E-commerce, Media & Entertainment, Government & Defense, and Others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors:

Numerous factors such as cost affordable IT operations of server colocation, increasing requirement of security, reliability and scalability of infrastructure and growing data centers complexities drives market globally. However, high initial & setup cost and network bandwidth issue is the major restraint for the market globally. Furthermore, increasing security concern for the business and increasing adoption of the hybrid cloud and virtualization creates opportunities for the market globally during forecast period

Cost Affordable IT Operation of Colocation Data Center

Shrinking IT budgets compel the companies to consider leasing services for their data center requirements as compared to installing in house data center facilities. Setting up an in-house data center cost proves to be a costly affair for companies, especially, during the initial phase of installation. In addition to the installation, an in-house data center requires regular operating expenditure and a high degree of care for data security and integrity. The installation and maintenance of an in-house data center represents a huge liability of financial and physical security for companies. This challenge is effectively addressed by colocation service providers who supply rack space, power, cooling, networking, bandwidth availability, firewalls and other such facilities in exchange for monthly rent, which thereby eliminates the capital cost for companies.

Regional Insights:

North America:

North America dominates the data center colocation market, driven by high demand for cloud services, big data analytics, and the growing adoption of IoT. The United States is the largest contributor, with major cities like Ashburn (Virginia), Dallas (Texas), and Silicon Valley serving as key hubs. The rise of hyperscale data centers from cloud giants such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continues to push market growth. Additionally, the adoption of AI, machine learning, and 5G technologies is driving demand for colocation facilities capable of supporting high-performance computing.

Europe:

Europe is another leading market for data center colocation, with countries like Germany, the UK, the Netherlands, and France being key players. Germany and the Netherlands benefit from strong IT infrastructure, favorable regulatory environments, and proximity to major financial and industrial hubs. The UK, despite Brexit, remains a major hub due to London’s status as a global financial center. The European Union’s focus on data sovereignty and privacy, particularly in light of GDPR regulations, has driven demand for secure colocation services that comply with stringent data protection standards.

Asia-Pacific:

The Asia-Pacific region is experiencing the fastest growth in the data center colocation market, driven by increased digitalization, mobile internet usage, and cloud adoption. Countries like China, Japan, India, and Singapore are key players. China leads the region, with tech giants like Alibaba and Tencent investing heavily in data center infrastructure. India is witnessing significant growth in colocation services due to rising demand for cloud services and the government’s push for digital transformation through initiatives like Digital India. Singapore serves as a data center hub for the Asia-Pacific region, thanks to its strategic location, stable political environment, and strong connectivity infrastructure.

Latin America:

In Latin America, the data center colocation market is growing, particularly in countries like Brazil and Mexico. Brazil’s large population and growing demand for cloud services and IoT solutions are driving the expansion of data centers. Mexico’s proximity to the United States and growing tech sector make it a key market for colocation services. Despite challenges such as energy availability and infrastructure constraints, the region is poised for steady growth due to increased digitalization and investments in cloud computing by multinational companies.

Middle East & Africa:

The Middle East & Africa region is gradually catching up in the data center colocation market, with significant growth driven by countries like the UAE, Saudi Arabia, and South Africa. The Middle East is seeing rising investments in colocation due to the increasing adoption of cloud computing, digital services, and IoT, particularly in sectors like finance, telecom, and government. In Africa, South Africa is the leading market for colocation services, with an increasing number of enterprises outsourcing data management to colocation providers. Energy challenges and infrastructure limitations still affect the growth rate, but government initiatives to promote digital infrastructure are expected to boost the market.

Key Industry Developments:

March 2024: Equinix announced its expansion into the Middle East by opening its first data center in Dubai, aiming to cater to the growing demand for colocation and cloud services in the region. This expansion aligns with increasing cloud adoption and smart city initiatives in the UAE.

January 2024: Digital Realty unveiled plans to build its largest data center campus in Singapore. The facility will cater to growing demand from enterprises in Southeast Asia for hybrid IT environments and enhanced data security capabilities.

November 2023: Iron Mountain expanded its colocation services in India with the acquisition of a new data center facility in Mumbai, capitalizing on the growing digital economy and increased data sovereignty concerns in the country.

September 2023: CyrusOne completed the expansion of its London colocation facility to support the increasing demand for data services in the UK. This expansion is aimed at catering to businesses undergoing digital transformation and adopting hybrid cloud environments.

July 2023: Alibaba Cloud opened a new data center in Indonesia, strengthening its position in the Asia-Pacific region. The facility is designed to support local businesses in their digital transformation efforts and provide scalable colocation services to meet rising cloud adoption.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the data center colocation market along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the data center colocation market size is provided.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the data center colocation market.

- The quantitative analysis of the data center colocation market from 2020 to 2028 is provided to determine the data center colocation market potential.

Data Center Colocation Market Report Highlights

| Aspects | Details |

| By Type |

|

| By ENTERPRISE SIZE |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | GLOBAL SWITCH, DIGITAL REALTY TRUST, INC., NTT COMMUNICATIONS CORPORATION-, CYRUSONE, INC., VERIZON ENTERPRISE SOLUTIONS, INC., CHINA TELECOM CORPORATION LIMITED, CYXTERA TECHNOLOGIES, INC., KDDI CORPORATION, EQUINIX, INC., CORESITE REALTY CORPORATION |

Analyst Review

The adoption of data center colocation has increased over the period to provide reliable and consistent experiences for their subscribers. In addition, the ability of data center colocation to provide various opportunities for businesses to gain new insights to run the business efficiently is increasing its popularity among end users. Furthermore, many healthcare, retail & e-commerce, BFSI, IT & telecom, and tourism industries are investing in data center colocation to increase security and reduce the datacenter expences among the organizations, which in turn fuels the growth of the market.

Furthermore, the market is expected to witness significant growth in the future, due to increase in use of low latency networks such as long-term evolution, LTE micro stations, and 5G networks in domestic user and rise in adoption of artificial intelligence-oriented business models among organizations. For instance, organizations such as Amazon.com , IBM Corporation, and Google LLC massively use data center colocation to enhance customer experience. The adoption of data center colocation helps them to implement better communication network to bring positive transformation, which results in high-quality customer service, cost saving, global reach, and diverse server load. Moreover, rise in investments in artificial intelligence & tools among every industry vertical boosts the revenue growth.

Global colocation market has been witnessing a steady growth worldwide due to the ever increasing volumes of data generated by different industry verticals. Increased usage of internet-based services along with cloud computing services among organizations have significantly fuelled the demand for colocation data centers across the world. With such extensive data, enterprises have shown interest in outsourcing the data center services to third-party colocation service providers to save cost and effectively manage the data center tasks. Enterprises of all sizes have keenly resorted to colocation data centers services to manage the data center services efficiently at minimal costs.

The presence of a large number of providers in the global data center colocation market increases the competitive rivalry among key players. Therefore, data center colocation providers are differentiating themselves from competitors and driving revenue growth by incorporating new digital business technologies such as artificial intelligence, machine learning, 5G networks their offerings to gain a competitive edge, and retain their market position. The market is considerably concentrated with major players consuming significant market share. The degree of concentration will remain the same during the forecast period. The vendors operating in the market are taking several initiatives such as new product launches and partnership to stay competitive in the market and to strengthen their foothold in the market. In addition, companies are heavily investing in R&D activities to develop advanced data center colocation service, which is opportunistic for the market. For instance, in April 2020, KDDI America launch its new data center colocation product which offers single-source colocation, cloud migration, connectivity services for enterprises.

Loading Table Of Content...