Commercial Aircraft Market Research, 2033

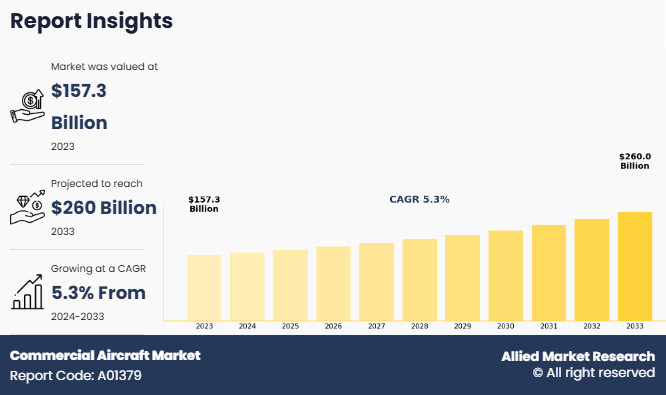

The global commercial aircraft market size was valued at $157.3 billion in 2023, and is projected to reach $260 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

Report Key Highlighters:

- The commercial aircraft industry study covers 14 countries. The research includes regional and segment analysis of each country for the projected period 2024-2033.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the commercial aircraft market are Boeing, Airbus, COMAC, Embraer, Lockheed Martin, ATR, Bombardier, Textron, PJSC Yakovlev, and Leonardo S.p.A. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A commercial aircraft is an airplane designed and manufactured for transporting passengers or cargo as part of an airline’s operations. These aircraft are used by both full-service and low-cost carriers to operate scheduled and charter flights across domestic, regional, and international routes. Commercial aircraft come in various sizes, ranging from small regional jets with fewer than 100 seats to large wide-body aircraft that can accommodate over 500 passengers.

The demand for small commercial aircraft is driven by the need for enhanced regional connectivity and improved access to remote areas. These aircraft, typically seating up to 100 passengers, are essential for linking smaller cities and rural destinations to major aviation hubs. Many emerging markets, particularly in Asia-Pacific, Africa, and Latin America, are investing in regional aviation to support economic growth and tourism.

For instance, in April 2024, IndiGo announced discussions with aircraft manufacturers to acquire up to 100 small planes as part of its strategy to expand regional operations, according to a source. The airline, which recently ordered 30 wide-body Airbus A350 aircraft, is increasing both domestic and international services. Talks are ongoing with ATR and Embraer, among other manufacturers, regarding the potential purchase. Moreover, growth in the presence of low-cost regional carriers and rise of short haul travel due to changing consumer preferences are further driving the growth of the small aircraft segment.

In addition, the Boeing 737 MAX and 787 Dreamliner continue to see strong demand as airlines replace older aircraft to enhance fleet efficiency. For instance, in Q4 2024, Allegiant Air received more Boeing 737 MAX aircraft than expected, joining other U.S. carriers like American Airlines and Southwest Airlines in fleet expansion. During the airline’s Q4 2024 earnings call on February 4, 2025, Gregory Anderson, President and CEO of Allegiant Air, announced that the airline ended the year with four in-service 737 MAX 8-200 aircraft. These additions helped address operational inefficiencies caused by earlier delivery delays. These additions helped address operational inefficiencies caused by earlier delivery delays, reinforcing the commercial aircraft market forecast, which anticipates continued fleet modernization and rising aircraft deliveries to meet growing passenger demand and operational efficiency goals.

Rise in air passenger traffic, growing orders of new aircraft from developing countries, and the growth of low-cost carriers and the tourism industry are expected to drive the global commercial aircraft market growth during the forecast period. However, supply chain disruptions, aircraft delivery delays, and stringent regulatory and safety standards are anticipated to hamper the growth of the market during the forecast period. Moreover, advancements in electric and hybrid aircraft and the expansion of e-commerce and air cargo operations are expected to offer lucrative opportunities for the market in the future.

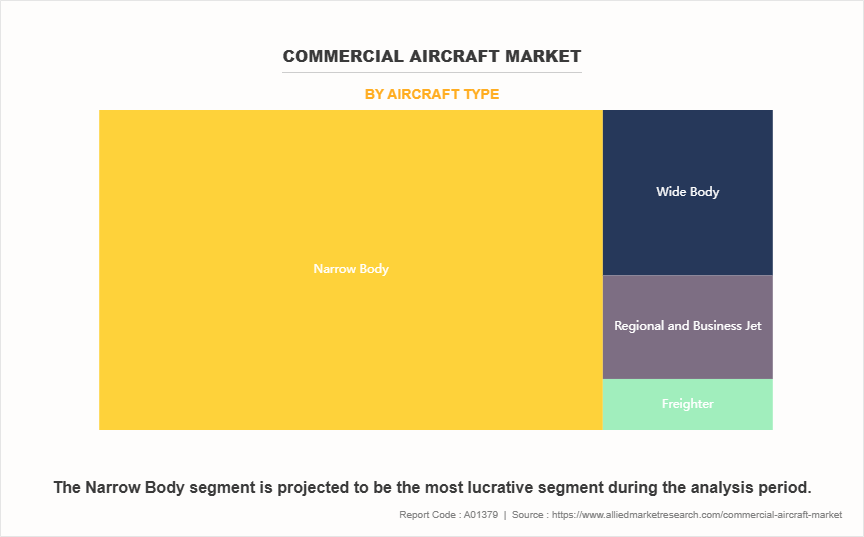

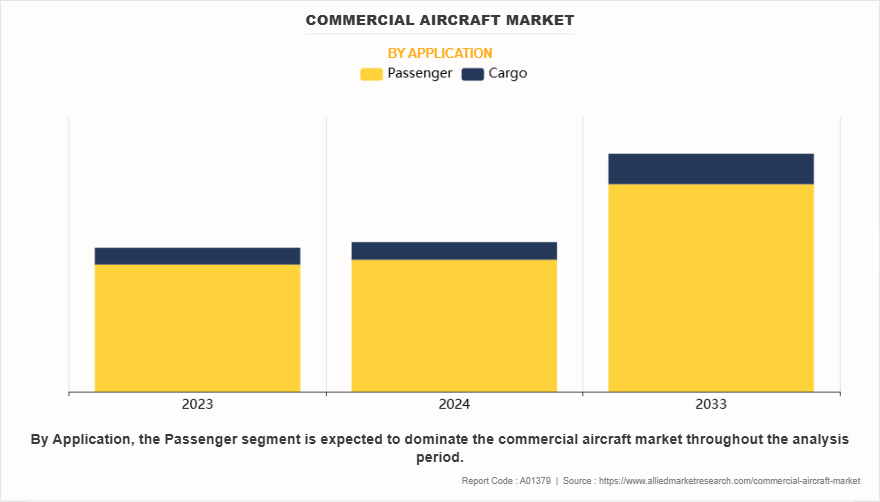

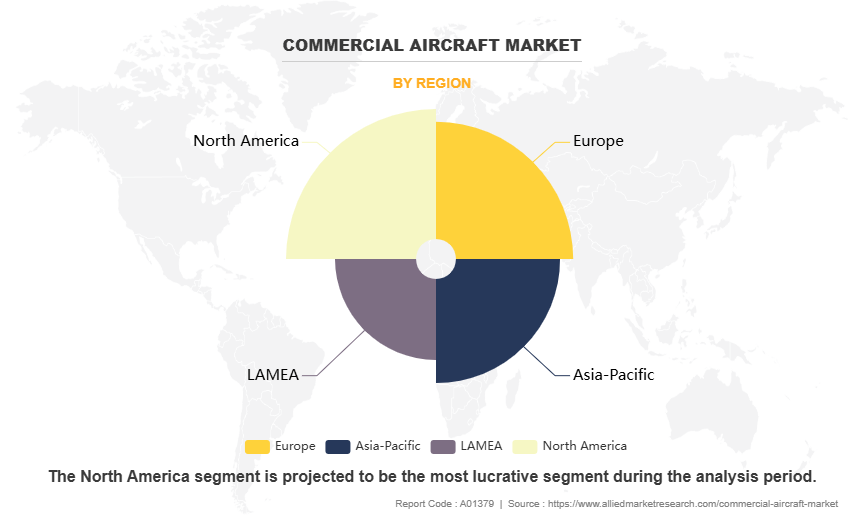

The commercial aircraft industry is segmented into aircraft type, size, application, and region. On the basis of aircraft type, the market is divided into narrow body, wide body, regional & business jets, and freighters. As per size, the market is categorized into small, medium, and large aircraft. On the basis of application, the market is bifurcated into passenger and cargo. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Leading players and their key business strategies have been analyzed in the report to gain a competitive insight into the market. Key players covered in the report include Boeing, Airbus, COMAC, Embraer, Lockheed Martin, ATR, Bombardier, Textron, PJSC Yakovlev, and Leonardo S.p.A., highlighting their role in shaping the commercial aircraft market players through innovation, strategic partnerships, and fleet expansion.

Key Developments

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In January 2025, Airbus delivered 766 commercial aircraft to 86 customers worldwide in 2024. The commercial aircraft includes the A321XLR as well as the A330neo and A350 Aircraft.

- In October 2024, Commercial Aircraft Corporation of China, Ltd. ((COMAC) partnered with FDH Aero for the C919 single-aisle jetliner. Furthermore, it also signed a contract with Shanghai Aircraft Manufacturing (SAMC), a subsidiary company of (COMAC) to support the development of the C919 passenger jet. The COMAC C919 is a narrow-body, twin-engine commercial airliner developed by COMAC.

- In December 2023, Commercial Aircraft Corporation of China, Ltd. signed an agreement with Tibet Airlines to develop a narrowbody passenger jet suitable for high-altitude areas. This strategy helps to reduce its reliance on overseas suppliers for aviation products.

Segmental analysis

The commercial aircraft market is segmented into aircraft type, size, application, and region. On the basis of aircraft type, the market is divided into narrow body, wide body, regional & business jets, and freighters. As per size, the market is categorized into small, medium, and large aircraft. On the basis of application, the market is bifurcated into passenger and cargo. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Aircraft Type

By aircraft type, the global commercial aircraft market is divided into narrow-body, wide-body, regional & business jets, and freighters. The narrow body segment accounted for the largest market share in 2023. This is due to the increasing demand for cost-effective air travel and the expansion of low-cost carriers (LCCs). Airlines are focusing on maximizing profitability on short- and medium haul routes, making single-aisle aircraft such as the Boeing 737 and Airbus A320 highly preferred. One key trend in this segment is the shift toward fuel-efficient models with advanced aerodynamics and improved operational range.

By Size

By size, the global commercial aircraft market is categorized into small aircraft, medium aircraft, and large aircraft. The medium aircraft segment accounted for the largest market share in 2023, due to the increasing demand for domestic and short-to-medium-haul international travel. This category, which includes aircraft with seating capacities ranging from 100 to 250 passengers, is dominated by popular models such as the Boeing 737 and Airbus A320 families. Airlines favor these aircraft because they provide a balance between capacity, fuel efficiency, and operational flexibility, allowing them to serve both high-density and emerging routes efficiently.

By Application

By application, the global commercial aircraft market is bifurcated into passenger and cargo. The passenger segment accounted for a dominant market share in 2023, driven by the increasing affordability of air travel and expanding airline networks. The rise of middle-class travelers, particularly in developing regions like Asia-Pacific and Latin America, is significantly boosting air passenger traffic. This growing demand is pushing airlines to expand their fleets, upgrade aircraft technology, and optimize operational efficiency.

By Region

Region wise, North America held the largest commercial aircraft market share in 2023. The presence of leading aircraft manufacturers, rising e-commerce shipments, and increasing low-cost carrier activity continue to drive the region’s commercial aviation growth. The U.S. is home to Boeing, one of the world’s largest aircraft manufacturers, and has a mature aviation industry with continuous demand for fleet expansion and modernization. Airlines in North America are investing heavily in fuel efficient aircraft to reduce operational costs and meet stringent environmental regulations.

Rise in air passenger traffic

The increasing number of air travelers worldwide is a key factor driving the growth of the commercial aircraft market. Several factors contribute to this rise in passenger traffic, including economic growth, higher disposable incomes, and the expanding middle class, particularly in emerging markets like India, China, and Southeast Asia.

For instance, in January 2025, India's domestic air passenger traffic grew by 6.12% in 2024, reaching 161.3 million passengers, as per data from the Directorate General of Civil Aviation (DGCA). In 2023, domestic air travel recorded 152 million passengers, showing a strong recovery from the pandemic with a higher year-on-year (Y-o-Y) growth of 23.36%. IndiGo, the country's largest airline, increased its market share from 60.5% in 2023 to 61.9% in 2024, carrying 99.9 million domestic passengers. As more people can afford air travel, both for business and leisure purposes, airlines are expanding their fleets to accommodate the growing demand.

Another major reason for rising air passenger traffic is the post-pandemic recovery in the travel and tourism industry. As travel restrictions have been lifted, there has been a strong rebound in both domestic and international flights. This trend is expected to continue as more countries work on improving connectivity and making air travel more accessible. In addition, low-cost carriers (LCCs) have played a significant role in increasing air travel by offering affordable ticket prices, encouraging more first-time and budget-conscious travelers to fly. Urbanization and infrastructure development are also contributing to this trend, as highlighted in the commercial aircraft market report, which emphasizes the growing demand for new aircraft, fleet expansion, and the increasing role of LCCs in shaping the global aviation landscape.

Governments worldwide are investing in airport expansion projects, improving air traffic management, and launching regional connectivity programs. These initiatives support the growth of air travel and encourage airlines to purchase more aircraft to meet increasing demand. Overall, the steady rise in air passenger traffic is fueling airline expansion plans, leading to increased orders for new aircraft, thereby driving the growth of the commercial aircraft market.

Growing orders of new aircraft from developing countries

The growth in air travel and fleet modernization programs in the developing countries has resulted in increased demand for new aircraft. The demand for new aircraft is particularly driven by economic growth, expanding middle-class populations, and a growing focus on improving regional and international connectivity. Similarly, the governments in the countries are also focusing on developing new airports and modernization of older airports, which can handle more flights. The growing demand for new aircraft is influencing the growth of aircraft propulsion system market.

For instance, in December 2024, Air India announced its agreement with Airbus SE for the orders of 10 A350 widebody, and 90 A320 narrowbody family of newer aircraft to be added to its fleet. Also, in 2023, Air India announced the order of 470 aircraft, out of which 250 were with Airbus SE. The latest order will increase the total number of aircraft that Air India ordered from Airbus SE in 2023 from 250 aircraft to 350 currently. Air India has also announced that it has done an agreement with Airbus SE for services and component to support the maintenance requirements of its growing A350 fleet. Such instances further fuel the commercial aircraft market growth.

Supply chain disruptions and aircraft delivery delays

The commercial aircraft market faces significant challenges due to disruptions in the supply chain and delays in aircraft deliveries. The production of aircraft involves a complex network of suppliers providing key components such as engines, avionics, landing gear, and composite materials. Any disruption in this network, whether due to raw material shortages, labor strikes, or geopolitical conflicts, can slow down manufacturing and delay aircraft deliveries to airlines.

In recent years, global supply chain issues have affected the availability of critical parts, leading to increased production costs and extended delivery timelines. Aircraft manufacturers often depend on multiple suppliers worldwide, and delays in any one component can halt the entire assembly process. For example, shortages of semiconductors and aerospace-grade aluminum have impacted aircraft production schedules, causing airlines to wait longer for new aircraft. These delays affect airline expansion plans, increase maintenance costs for older fleets, and reduce operational efficiency.

Growing advancement in electric and hybrid aircraft

In recent years, there has been growing advancement in the electric and hybrid aircrafts technology as they have lower operational costs, and improved fuel efficiency. Moreover, government and regulatory bodies are further promoting the use of electric and hybrid aircraft. In addition, as the aviation industry focuses more on sustainability, advancements in electric propulsion systems and the increased use of lightweight materials are helping manufacturers develop aircraft with lower environmental impact. Growing research, increasing financial investments, and industry collaborations foster continuous innovation, thus expanding the frontiers of electric and hybrid aviation technologies. For instance, in October 2023, Japan provided a $205 million subsidy to support the development of hydrogen fuel cell systems and other equipment for electric aircraft. This initiative aims to reduce carbon dioxide emissions from the aviation sector, a significant contributor to climate change. Such initiative aims to support the progress of components essential for electric aircraft. Moreover, in June 2023, Airbus SE and STMicroelectronics signed an agreement to develop technologies for hybrid and electric aircraft. The collaboration is expected to focus on advancing research in next-generation semiconductors, which is expected to play a key role in hybrid and fully electric aircraft, including the ZEROe demonstrator and CityAirbus NextGen. Similarly, in June 2022, Honeywell International Inc. conducted successful tests on a one-megawatt generator tailored for hybrid electric aircraft. The generator is 280 pounds and gives 97% efficiency, which can power an entire neighborhood block. The new generator offers compact design, low weight, and increased fuel efficiency. In addition, electric and hybrid aircraft demand effective energy storage solutions such as advanced batteries or hybrid power systems. Therefore, there is a surge in the development of state-of-the-art energy storage technologies specifically designed to meet the distinct needs of the electric aviation industry. Such developments are further expected to drive the commercial aircraft market growth during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial aircraft market analysis from 2023 to 2033 to identify the prevailing commercial aircraft market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial aircraft market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial aircraft market trends, key players, market segments, application areas, and market growth strategies.

Commercial Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 260 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 341 |

| By Aircraft Type |

|

| By Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | PJSC Yakovlev, Boeing, Embraer, Bombardier Inc., ATR, Airbus, Commercial Aircraft Corporation of China, Ltd., Textron, Inc., Lockheed Martin Corporation, Leonardo S.p.A. |

Analyst Review

Commercial aircraft transport passengers and cargo from one location to another. Fuselage, landing gear, wing, tail, and power plant are major components of an aircraft. Currently, the world commercial aircraft market is on the rise, having significant acceptance in most geographical regions. The market is expected to reach $209 billion by 2022 owing to technological advancement, falling fuel prices, increase in number of passengers, improvement in commercial aviation, and developing economies.

Currently, Asia-Pacific has the highest share in this market and is expected to grow at an even faster rate, owing to the heavy investments in aerospace industry, rising standards of living, and significant GDP growth in the region. Furthermore, key players in the market, especially in Asia-Pacific region are anticipated to invest in wide-body commercial aircraft due to expected growth in the number of fleet deliveries in near future.

Taking engine type into consideration, commercial aircraft with turbofan engines will probably be in high demand during the forecast period on account of their innovative designs that significantly reduce noise and CO2 emission. Also, governments will continue to dominate as the key contributor to the market revenue as compared to the private sector, owing to the significant investments on development and improvement of domestic as well as international air transport.

The key players in the commercial aircraft market are Boeing, Airbus, COMAC, Embraer, Lockheed Martin, ATR, Bombardier, Textron, PJSC Yakovlev, and Leonardo S.p.A.

The upcoming trends of Commercial Aircraft Market in the globe are advancements in electric and hybrid aircraft and the expansion of e-commerce and air cargo operations.

The leading application of Commercial Aircraft Market is passenger.

The global commercial aircraft market was valued at $157.3 billion in 2023, and is projected to reach $260 billion by 2033, growing at a CAGR of 5.3% from 2024 to 2033.

The largest regional market for Commercial Aircraft is North America.

Loading Table Of Content...

Loading Research Methodology...