Commercial Auto Insurance Market Research, 2033

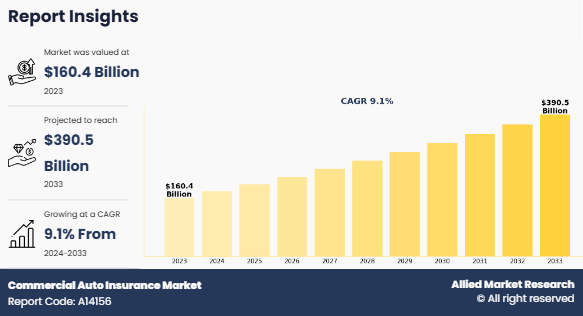

The global commercial auto insurance market size was valued at $160.4 billion in 2023, and is projected to reach $390.5 billion by 2033, growing at a CAGR of 9.1% from 2024 to 2033. A commercial auto insurance usually provides a customized motor insurance policy to cover for damages and losses caused to or by a commercial vehicle and the respective owner-driver. This insurance is largely purchased by businesses for their motor vehicles such as trucks, pick-up vans, cabs, auto-rickshaws, tractors, commercial vans, school buses, amongst others. Commercial auto insurance includes damages and losses in situations such as accidents, collisions, natural calamities, fires, and others by covering only business-owned vehicles.

Demand for commercial auto insurance continue to rise in the market by providing financial security in the form of medical injury or any other damages to the vehicle owner. In addition, stringent government guidelines regarding commercial auto insurance and increasing number of road accidents propel the commercial auto insurance market growth. However, as vehicles used in business purposes are heavy & expensive and therefore, it incurs huge commercial auto insurance premium which as a result limiting growth of the commercial auto insurance market. On the contrary, developing economies offer significant opportunities for commercial auto insurance companies to expand their offerings, owing to factors such as growth in the local businesses, rapid urbanization, rise in online e-commerce purchases which further accelerates demand for commercial auto insurance market opportunity. Moreover, increased developments & initiatives toward commercial vehicle insurance by implementing technologies such as telematics, artificial intelligence (AI), GPS, data analytics, blockchain, and big data is anticipated to provide a potential growth opportunity for the commercial auto insurance market forecast.

The report focuses on growth prospects, restraints, and trends of the commercial auto insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the commercial auto insurance market outlook.

Segment review

The commercial auto insurance market is segmented into distribution channel, coverage type, vehicle type, and region. By distribution channel, the commercial auto insurance market is segmented into broker and non-broker. By coverage type, it is bifurcated into third party liability coverage and collision/comprehensive/optional coverage. By vehicle type, the commercial auto insurance market is segmented into light commercial vehicle and medium and heavy commercial vehicle. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report analyzes the top commercial auto insurance companies operating in the market such as Aviva, AXA S.A., Chubb Limited, Willis Towers Watson PLC., Berkshire Hathaway Inc., Allianz SE, Aon plc., Zurich Insurance Company Ltd., Liberty Mutual Insurance Company, American International Group Inc., Progressive Casualty Insurance Company, The Hartford, Farmers Insurance Group, Nationwide Mutual Insurance Company, Allstate Insurance Company, The Travelers Companies, Inc., The New India Assurance Company Ltd., HDFC ERGO General Insurance Company Limited, Tata AIG General Insurance Company Limited, and state farm. These players have adopted various strategies to increase their commercial auto insurance market penetration and strengthen their position in the commercial auto insurance industry.

Top impacting factors

Increasing number of road accidents

There is a significant growth in demand for commercial auto insurance market due to rise in cases of accidents such as traffic collision, physical damage or bodily injury, theft, and others. Commercial auto insurance provides financial security in the form of medical injury or any other damage to the vehicle owner. In the recent years, there has been an increase in the number of road accidents, in terms of road crashes, traffic injuries, drunk driving, and distracted driving for speeding, which resulted in need for commercial auto insurance. Majority of the commercial vehicle users depend on commercial auto insurance to prevent themselves from future financial losses such as injuries to drivers, passengers, or pedestrians. This drives the growth of the commercial auto insurance market.

Expensive commercial auto insurance policies

Commercial auto insurance premiums are an additional cost along the existing costs of maintaining a commercial vehicle, and it makes the decision to buy a commercial vehicle difficult for many people. Moreover, for running a business in many cities and suburban areas, having a commercial vehicle is a necessity. However, vehicle owner is not able to afford a vehicle due to expensive fleet insurance premiums. Therefore, this, is one of the major factors that hampers the commercial auto insurance market growth.

Implementation of technology in the field of commercial auto insurance

Increase in penetration of technologies such as GPS, telematics, artificial intelligence (AI), data analytics, blockchain, and big data is providing innovative opportunities for insurers. With these technological developments, commercial auto insurance distribution platforms are expected to enhance productivity for providing coverage seamlessly at the point-of-purchase. Moreover, digital transformation enables commercial auto insurance companies to create highly personalized user experiences to their customers. Furthermore, insurance companies rely on digital technologies for claim resolutions such as photo estimating tools and mobile telematics solutions. Thus, implementation of these technologies is expected to offer remunerative opportunities for the commercial auto insurance market growth in the upcoming years.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the commercial auto insurance market share, current trends, estimations, and dynamics of the commercial auto insurance market analysis from 2023 to 2033 to identify the prevailing commercial auto insurance market opportunities.

The commercial auto insurance industry research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the commercial auto insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global commercial auto insurance market trends, key players, market segments, application areas, and market growth strategies.

Commercial Auto Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 390.5 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 395 |

| By Distribution Channel |

|

| By Coverage Type |

|

| By Vehicle Type |

|

| By Region |

|

Analyst Review

Commercial automobile coverage protects the company against financial consequences of accidents, injuries and fatalities involving company-owned or leased vehicles as well as employees’ vehicles when used on business. Commercial auto insurance providers are looking forward to implementing advanced technologies such as artificial intelligence (AI) and machine learning in order to enhance products and services according to vehicles used in businesses. Increase in economic strength of the developing nations such as China and India is expected to provide lucrative opportunities for the commercial auto insurance market growth. North America occupied a major share in the auto insurance market in 2023, owing to the presence of major market players such as Allstate and Liberty Mutual Insurance Company. They are offering advanced coverage such as comprehensive, underinsured, and uninsured motorist due to the extensive adoption of heavy vehicles.

The increasing adoption of telematics-based policies. Telematics refers to the integration of GPS (Global Positioning System) technology, onboard diagnostics, and real-time data tracking to monitor vehicle usage, driver behavior, and accident risks. Insurers are leveraging this technology to offer usage-based insurance (UBI) and behavior-based pricing models, which can help businesses optimize their insurance costs. For fleet operators and businesses with multiple vehicles, telematics enables insurers to assess driving habits such as speed, braking patterns, idle time, and mileage. Safe driving behaviors can lead to premium discounts, while risky behaviors may result in higher rates. This trend benefits both insurers and policyholders—insurers gain better risk assessment tools, while businesses can reduce costs by improving driver safety and operational efficiency. Additionally, telematics helps in claims processing and fraud prevention by providing real-time accident data. Insurers can use crash analytics to determine fault accurately, speeding up settlements and reducing fraudulent claims. With regulatory support and advancements in AI-driven analytics, telematics adoption in commercial auto insurance is expected to grow, making policies more dynamic and cost-effective for businesses. This trend aligns with the broader shift towards data-driven insurance solutions.

The commercial auto insurance market is fragmented with the presence of regional vendors such as Aon plc., Berkshire Hathaway Inc., and Willis Towers Watson. Some of the key players profiled in the commercial auto insurance market report include Allianz, American International Group Inc., Aviva, AXA, Chubb, Liberty Mutual Insurance Company, and Zurich. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players are collaborating their product portfolio to provide differentiated and innovative products with increase in awareness & demand for commercial auto insurance across the globe.

The Commercial auto insurance Market is estimated to grow at a CAGR of 9.1% from 2024 to 2033.

The Commercial auto insurance Market is projected to reach $390.5 billion by 2033.

The Commercial auto insurance Market is expected to witness notable growth, including demand for commercial auto insurance due to the rise in cases of accidents such as traffic collisions.

The key players profiled in the report include Aviva, AXA S.A., Chubb Limited, Willis Towers Watson PLC., Berkshire Hathaway Inc., Allianz SE, Aon plc., Zurich Insurance Company Ltd., Liberty Mutual Insurance Company, American International Group Inc., Progressive Casualty Insurance Company, The Hartford, Farmers Insurance Group, Nationwide Mutual Insurance Company, Allstate Insurance Company, The Travelers Companies, Inc., The New India Assurance Company Ltd., HDFC ERGO General Insurance Company Limited, Tata AIG General Insurance Company Limited, and state farm.

The key growth strategies of commercial auto insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...