Commercial Cooking Equipment Market Research, 2034

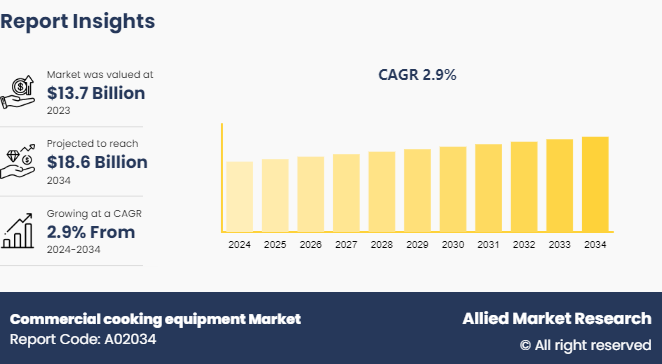

The global commercial cooking equipment market size was valued at $13.7 billion in 2023, and is projected to reach $18.6 billion by 2034, growing at a CAGR of 2.9% from 2024 to 2034. Commercial cooking equipment refers to the specialized appliances and tools designed for use in professional kitchens, such as those found in restaurants, hotels, catering businesses, and institutional food service operations. Commercial cooking equipment includes ovens, stoves, grills, fryers, steamers, mixers, and refrigerators, engineered to handle high-volume cooking and rigorous daily use.

Key features of commercial cooking equipment often include durability, energy efficiency, precise temperature controls, and compliance with health and safety regulations. The equipment is typically constructed from robust materials such as stainless steel to withstand heavy usage and frequent cleaning. Advanced models may also incorporate smart technology for automation, connectivity, and improved operational efficiency, which helps chefs and kitchen staff to maintain high standards of food quality and service while optimizing workflow and reducing waste.

Key Takeaways

The commercial cooking equipment market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major commercial cooking equipment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in adoption of smart kitchen equipment has significantly boosted the market demand for commercial cooking equipment. Smart appliances, such as connected ovens, smart refrigerators, and automated cooking systems, offer enhanced efficiency, precision, and convenience. For instance, smart ovens with remote monitoring and control capabilities allow chefs to manage cooking processes more efficiently, reducing labor costs and minimizing errors. Advanced refrigeration units with IoT connectivity provide real-time temperature monitoring and alerts, ensuring food safety and compliance with regulations.

In addition, smart kitchen equipment often features energy-saving functions and predictive maintenance alerts, which leads to lower operational costs and increased lifespan of appliances. The integration of artificial intelligence and machine learning enables these appliances to adapt to cooking patterns and optimize performance, further driving the commercial cooking equipment market demand. Thus, technological advancement appeals to modern commercial kitchens seeking to improve productivity, reduce waste, and deliver consistent food quality, thereby propelling commercial cooking equipment market share.

However, high initial investment costs significantly restrain market demand for commercial cooking equipment, particularly for small and medium-sized enterprises (SMEs) and startups with limited capital. Purchasing advanced, high-quality equipment such as industrial-grade ovens, refrigerators, and smart kitchen appliances requires substantial upfront expenditure. The initial financial barrier is anticipated to deter many businesses from upgrading or expanding their kitchen facilities, despite the long-term benefits of improved efficiency and energy savings.

Moreover, the cost of installation, training, and potential retrofitting of existing kitchen layouts further adds to the initial financial burden. As a result, many smaller foodservice operators opt for cheaper, less efficient alternatives or delay investments, which limits commercial cooking equipment market growth.

Furthermore, the demand for customized and multifunctional equipment has created significant opportunities in the commercial cooking equipment market by addressing the specific needs of diverse food service operations. Customizable equipment allows businesses to tailor appliances to their unique kitchen layouts and operational requirements, enhancing efficiency and workflow.

For instance, multifunctional ovens that combine baking, roasting, and steaming capabilities enable chefs to perform multiple cooking processes with a single appliance, saving space and reducing costs. The flexibility offered by multifunctional equipment is particularly valuable in small or specialized kitchens, such as food trucks and boutique restaurants, where space and efficiency are crucial.

Moreover, the ability to customize equipment to specific culinary techniques or menu items helps businesses differentiate themselves in a competitive market. Manufacturers responding to the demand for customized and multifunctional equipment by offering modular designs and bespoke solutions, which is expected to attract a broader customer base, driving innovation and growth within the commercial cooking equipment market size.

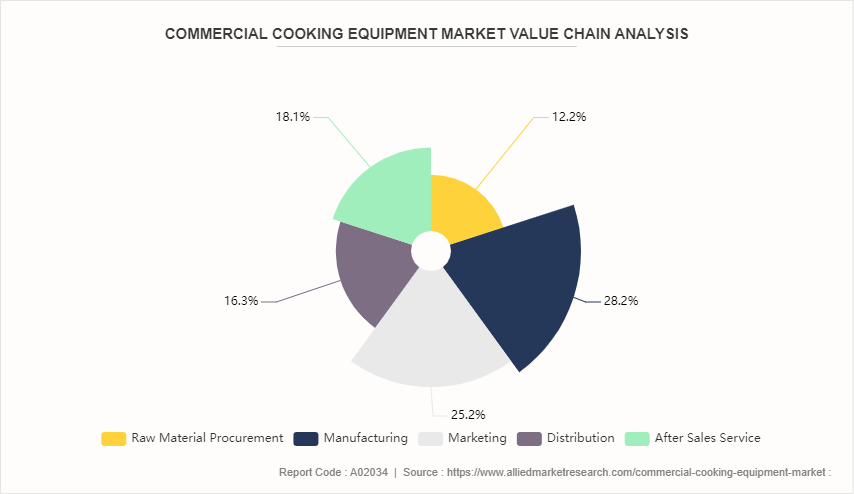

Value Chain of Global Commercial Cooking Equipment Market

The commercial cooking equipment market value chain begins with research and development, where manufacturers design innovative and efficient products to meet evolving industry needs. Raw material procurement follows, sourcing metals, electronic components, and specialized materials. Manufacturing involves production of individual components and assembly of complete units, with quality control measures implemented throughout.

Distribution networks include wholesalers, dealers, and direct sales channels, supported by logistics and warehousing operations. Installation and maintenance services form a crucial link, often provided by manufacturers or authorized partners. End-users range from restaurants and hotels to institutions and catering services. After-sales support, including warranty services and spare parts supply, extends the chain. Marketing and branding efforts target decision-makers in the foodservice industry.

Increasingly, the value chain incorporates sustainability initiatives, energy-efficient designs, and smart technology integration. Regulatory compliance and certification processes are integral at various stages in the global commercial cooking equipment market. As the industry evolves, the value chain adapts to new trends such as ghost kitchens and automated cooking systems, which ensures that the market remains relevant and competitive.

Market Segmentation

The commercial cooking equipment market segments are categorized into product type, end use, and region. By product type, it is classified into braising pans/tilting skillets, broilers/charbroilers/grills/griddles, cook-chill systems, fryers, cookers, ranges, kettles, steamers, ovens, and others. Depending on end use, it is divided into full-service restaurants, quick service restaurants, and catering. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In North America, the demand for commercial cooking equipment has grown rapidly, driven by a thriving food service industry and stringent regulatory standards. The U.S. accounts for a significant portion of the demand, with key factors including a high concentration of restaurants, hotels, and catering services necessitating efficient and durable kitchen solutions.

Moreover, the trend toward health-conscious dining options and the rise of delivery services have further driven the demand for versatile and hygienic cooking equipment. Manufacturers in North America continue to innovate to meet these evolving needs, focusing on sustainability, productivity, and compliance with food safety regulations.

In Europe, the demand for commercial cooking equipment is driven by a thriving hospitality sector and stringent regulatory standards. Cities such as London, Paris, Berlin, and Barcelona are key hubs where demand for advanced kitchen appliances is high owing to the concentration of restaurants, hotels, and catering services. These cities attract tourists and also cater to a diverse local population with varying culinary preferences, necessitating a wide range of cooking equipment from traditional ovens to modern combi-steamers and energy-efficient equipment.

Moreover, the shift toward sustainable practices and energy-efficient appliances further boosts demand, as businesses in cities such as Copenhagen and Amsterdam prioritize eco-friendly solutions to meet environmental regulations and consumer preferences. The emphasis of the Europe market on quality, innovation, and compliance drives manufacturers to continually innovate and tailor products to meet the unique needs of these dynamic urban centers.

Industry Trends:

The increase in demand for energy-efficient appliances has become a major industry trend in the global commercial cooking equipment market. As businesses strive to reduce operating costs and meet sustainability goals, energy efficiency has emerged as a critical factor influencing purchasing decisions. Energy-efficient appliances help lower utility bills and also minimize environmental impact by reducing carbon emissions and resource consumption.

Manufacturers are responding by innovating technologies such as improved insulation, advanced heat recovery systems, and energy-efficient heating elements in their products. These innovations strictly comply with stringent energy regulations, which appeal to environmentally conscious consumers and businesses aiming for green certifications. Moreover, governments and regulatory bodies worldwide are incentivizing the adoption of energy-efficient equipment through rebates and tax incentives, further driving market growth.

The integration of IoT and AI in cooking equipment has revolutionized the global commercial cooking equipment market by enabling remote monitoring, predictive maintenance, and automated cooking processes. Smart appliances such as ovens and refrigerators equipped with IoT sensors can adjust settings in real-time, optimizing cooking efficiency and reducing energy consumption.

AI algorithms analyze data to enhance cooking precision and consistency, minimizing food waste and operational costs. Kitchen management systems powered by AI streamline tasks such as recipe management and inventory tracking, improving overall workflow efficiency. These advancements cater to a growing demand for connected kitchens that offer enhanced control, productivity, and sustainability, driving manufacturers to innovate and meet evolving market demands effectively.

Competitive Landscape

The major players operating in the commercial cooking equipment market include Duke Manufacturing Co. Inc., Electrolux, Dover Corporation, Illinois Tool Works (ITW) , Inc., Ali Group S.r.l., Welbilt, Inc., Middleby Corporation, Alto-Shaam, Inc., Comstock-Castle Stove Co., Inc., and Atosa USA. Inc.

Other players in commercial cooking equipment market include Rational AG, Hoshizaki Corporation, Hobart Corporation, Vulcan Equipment, True Manufacturing Co., Manitowoc Foodservice, Inc., Unified Brands, Standex International Corporation, Vollrath Company, LLC, Blodgett Corporation, Imperial Commercial Cooking Equipment, Garland Group, Southbend, Globe Food Equipment Company, and so on.

Recent Key Strategies and Developments

In March 2024, Garland introduced the XPress Grill to reduce energy consumption and enhance productivity in busy commercial kitchens. Its modular design allows for easy cleaning and maintenance, making it a valuable addition to any food service operation.

In January 2024, Henny Penny launched the latest generation of FlexFusion Combi Ovens. These ovens come with advanced humidity control and precision cooking capabilities, designed to optimize food quality and consistency. The new FlexFusion models are also equipped with enhanced data logging and remote monitoring features to help kitchen managers maintain peak performance.

In September 2023, Rational AG expanded its iCombi Pro line to offer products with features such as enhanced energy efficiency and more intuitive controls. The iCombi Pro ovens are known for their versatility and ability to adapt to various cooking methods, making them a staple in modern commercial kitchens. The new models also include improved self-cleaning functions and connectivity for smart kitchen integration.

In March 2023, Electrolux Professional introduced the SkyLine Cook and Chill system, which seamlessly integrates combi ovens and blast chillers. The system is designed to improve efficiency and food safety in professional kitchens by automating cooking and cooling processes.

In August 2022, Vulcan, a leading provider of commercial kitchen equipment, launched its K series heavy duty ranges to withstand the rigors of high-volume kitchens, offering precise temperature control and robust construction. The series includes multiple configurations to suit various cooking styles and kitchen layouts.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial cooking equipment market analysis from 2024 to 2034 to identify the prevailing commercial cooking equipment market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the commercial cooking equipment market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global commercial cooking equipment market trends, key players, market segments, application areas, and market growth strategies.

Commercial cooking equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 18.6 Billion |

| Growth Rate | CAGR of 2.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 306 |

| By Product Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Middleby Corporation, Alto-Shaam, Inc., Atosa USA. Inc., Electrolux AB, Duke Manufacturing Co. Inc., Dover Corporation, Illinois Tool Works Inc., Ali Group S.r.l., Comstock-Castle Stove Co., Inc., Welbilt, Inc. |

Analyst Review

The global commercial cooking equipment market has constantly evolved in the recent years. It presents potential opportunities for market players. Several companies have focused on launching newer, innovative energy-efficient equipment to expand their market shares and acquire new markets. At present, advanced energy-efficient commercial cooking equipment, such as combi ovens, have gained momentum in the global commercial cooking equipment market, owing to the better safety, time & labor efficiency, and reliability offered by these ovens as compared to conventional ovens.

In the recent years, numerous changes have been observed in the commercial cooking equipment installed in various commercial kitchens. The adoption of automated foodservice solutions replaces traditional cooking equipment in large kitchens. The introduction of electricity-based stoves and burners would provide energy-efficient solutions to hotels and restaurants. At present, there is a notable increase in the demand for processed/frozen fast food due to the rise in demand for readymade food, change in lifestyles, and surge in disposable incomes, which further boost the demand of commercial cooking equipment.

Upcoming trends in the global commercial cooking equipment market include the integration of smart technology for enhanced efficiency and control, increased focus on energy-efficient and eco-friendly appliances, the rise of multifunctional equipment to optimize kitchen space, growing demand for automation to reduce labor costs, and the adoption of connected devices for real-time monitoring and maintenance. Additionally, there is a trend toward customization and modular designs to meet specific c

The leading application of the commercial cooking equipment market is in restaurants and food service establishments. These settings require reliable, efficient, and high-capacity cooking equipment to meet the demands of large-scale food preparation and service.

By region, North America held the highest market share in terms of revenue in 2023.

The global commercial cooking equipment market was valued at $13.7 billion in 2023.

The major players operating in the commercial cooking equipment market include Duke Manufacturing Co. Inc., Electrolux, Dover Corporation, Illinois Tool Works (ITW), Inc., Ali Group S.r.l., Welbilt, Inc., Middleby Corporation, Alto-Shaam, Inc., Comstock-Castle Stove Co., Inc., and Atosa USA. Inc.

Loading Table Of Content...