Commercial Lending Market Overview

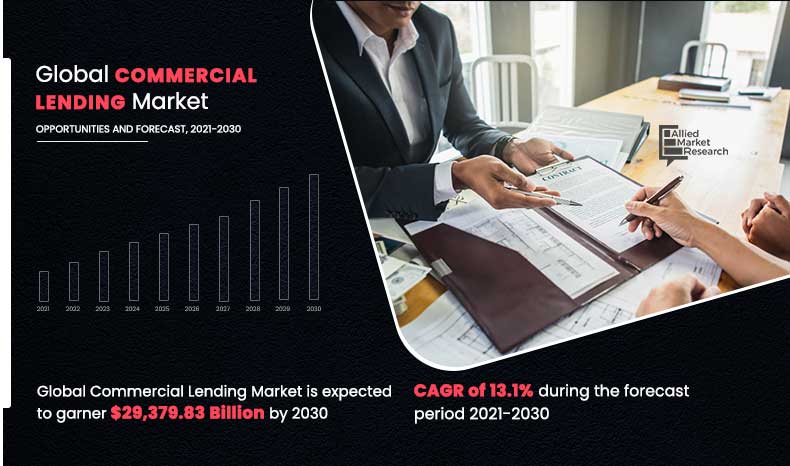

The commercial lending market size was valued at $8,823.53 billion in 2020, and is projected to reach $29,379.83 billion by 2030, growing at a CAGR of 13.1% from 2021 to 2030. Lower interest rates, quick loan approvals, and access to large funds, supported by technological advancements and efforts to enhance rural banking services through institutional collaboration, contribute to the growth of the market.

Market Dynamics & Insights

- The commercial lending industry in Asia-Pacific held a significant share in 2020.

- By type, the secured lending segment accounted for the largest market share in 2020.

- By enterprise size, the small & medium sized enterprises segment accounted for the largest market share in 2020.

Market Size & Future Outlook

- 2020 Market Size: $8,823.53 Billion

- 2030 Market Size: $29,379.83 Billion

- CAGR (2021-2030): 13.1%

- Asia-Pacific: Dominated market share in 2020

What is Meant by Commercial Lending

When a company borrows money to cover operating costs, real estate purchases, or equipment purchases, it is known as commercial lending. In addition, short-term loans to long-term real estate loans with repayment terms of up to 30 years are available in commercial lending.

Moreover, to secure a loan, borrower can be required to provide collateral. This provides banks with an asset in the event that the loan is defaulted on. In addition, a bank checks applicant’s credit score for approving a loan. However, it will not be the sole criterion to secure loans as commercial loans are valuable.

Flexible long-term lending offered by commercial lending options acts as a major driver in the market. In addition, the market is expected to increase collaborations between digital lending organizations and FinTech companies for payment collection. However, rise in number of non-performing assets (NPA), especially during the pandemic has hampered growth of the market.

On the contrary, developing economies are increasingly digitizing various banking operations, owing to tech savvy generation. In addition, advancements in smartphones have enabled many companies to provide commercial and industrial lending services on applications. Moreover, growing adoption of digital lending services are expected to provide lucrative opportunities for the commercial lending market growth.

The report focuses on growth prospects, restraints, and trends of the commercial lending market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the commercial lending market outlook.

By Type

Secured Lending segment accounted for the highest market share during 2021 - 2030

Commercial Lending Market Segment Overview

The commercial lending market is segmented into type, enterprise size, provider, and region. By type, the market is categorized into unsecured lending and secured lending. Depending on enterprise size, it is segregated into large enterprises and small & medium sized enterprises. The providers covered in the study includes banks and NBFCs. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Enterprise Size

Small & Medium Sized Enterprises segment will grow at a highest CAGR of 15.4% during 2021 - 2030

Competitive Analysis

The key players operating in the commercial lending market include American Express Company, Credit Suisse, Fundation Group LLC, Fundbox, Funding Circle, Goldman Sachs, Kabbage, LoanBuilder, Merchant Capital and OnDeck. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

By Provider

NBFC's segment will dominate the market by the end of 2030 with a highest CAGR of 16.1%

COVID-19 Impact Analysis

COVID-19 pandemic has a significant impact on the commercial lending industry, owing to increase in commercial and industrial loans as most of the businesses went bankrupt. Additionally, small-business participation in commercial lending was a key factor in this increased development. Many banks reported being overburdened by the increase in commercial loans during the pandemic as firms continued to seek financing. Due to the closure of bank offices and significant wait times for phone help, even previously hesitant internet users have turned to these channels for commercial loans during the pandemic. This, in turn, has become one of the major growth factors for the commercial lending market during the global health crisis.

By Region

Asia-Pacific region will lead the market with a highest CAGR of 15.1% during 2021 - 2030

Market landscape and trends

The commercial lending market is characterized by a dynamic landscape and notable trends. Intensified competition emerged among traditional banks, non-bank lenders, and alternative lending platforms, fostering a wide range of options for borrowers while pressuring lenders to differentiate themselves. The sector witnessed a significant digital transformation, with online lending platforms and alternative finance models gaining traction, facilitating faster and more convenient access to capital.

Moreover, technology-driven underwriting processes and data analytics became increasingly prevalent, enabling lenders to make more informed lending decisions. There was a growing focus on serving the financing needs of small and medium-sized enterprises (SMEs), leading to the development of specialized products and tailored solutions for this market segment. Alternative lending models like marketplace lending and crowdfunding gained popularity, connecting borrowers directly with investors and bypassing traditional financial institutions. Compliance with regulations, such as the Dodd-Frank Act, impacted the lending landscape by imposing stricter requirements on lenders. The Dodd-Frank Act is a comprehensive financial reform law enacted in 2010 in response to the global financial crisis. It aimed to enhance financial stability and consumer protection by imposing regulations on various aspects of the financial industry. In the commercial lending market, the Dodd-Frank Act introduced stricter lending standards and increased regulatory oversight, particularly for banks and other financial institutions. It imposed additional compliance requirements, raised capital requirements, and restricted certain lending practices. These measures had the effect of tightening credit availability and making it more challenging for some businesses to access loans, especially smaller businesses, and those with higher risk profiles. In addition, lenders explored non-traditional collateral options, while sustainability factors gained prominence, prompting lenders to consider environmental, social, and governance (ESG) criteria in their lending decisions.

Moreover, borrowers' preferences and expectations have evolved, they seek streamlined application processes, quick loan approvals, and transparent terms. As a result, lenders are investing in digital platforms, user-friendly interfaces, and seamless online experiences to cater to these changing borrower preferences. In addition, innovative financing models, such as revenue-based financing and asset-based lending, gain popularity. These models offer flexible repayment terms and collateral options tailored to the specific needs of borrowers. Non-traditional financing models have provided additional options for businesses that may not meet traditional lending criteria.

What are the Top Impacting Factors in Commercial Lending Market

Lowest Interest Rates of For All Loan Options

Commercial lending offers lowest interest rates on all loan options, enabling business owners to access critical funding while maintaining lower overhead costs. Moreover, commercial lending typically has lower interest rates than other unsecured borrowing. Choosing to have fixed monthly repayments means borrowers can accurately use them in their business planning and forecasting, enabling them to structure finance of their business with a bit more certainty. In addition, commercial lending payment plans usually extend for a number of years, which allows a business to focus on other important business matters such as sales, monitoring overheads, and training staff. Therefore, this is a major driving factor for the commercial lending market.

Access to Large Sums of Money

Small business owners often do not have the financial capability to raise funding in the debt or equity markets. This can make starting a business extremely expensive and risky. However, with a commercial lending, it is possible to cover all business startup expenses with availing commercial loan. This also makes it significantly less intimidating for business owners without extensive resources to obtain a relatively large amount of funding. In addition, by consolidating all financing on one loan, commercial lending helps to access large sum of money for small businesses. Therefore, this is a major driving factor for the commercial lending market.

Technological Advancement in Commercial Lending

Technological advancements in the field of commercial lending has increased and the online lending industry has been growing over the last couple of years at an incredible pace. Whether for business or personal, more loans are originated online than before. As the demand for commercial loans grew, online lenders are adopting technologies such as artificial intelligence, block chain, and machine learning to enhance customer experience in taking commercial loans and making the process faster and more effective.

Technology and innovation are the main contributors that boom online commercial lending. If the growth trajectory continues, there are chances that online lenders will replace banks as the go-to source for commercial loans. Therefore, with technological innovations in the field of commercial lending, it will provide major lucrative opportunities for growth of the commercial lending market in the upcoming years.

What are the Key Benefits for Stakeholders

- The study provides in-depth analysis of the commercial lending market share along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the commercial lending market size are provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the commercial lending market.

- An extensive analysis of the key segments of the industry helps to understand the commercial lending market trends.

- The quantitative analysis of the commercial lending market forecast from 2021 to 2030 is provided to determine the market potential.

Commercial Lending Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Enterprise Size |

|

| By Provider |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

With advancements in technologies in the banking sector, commercial lending processes have been hassle-free and swift, owing to which businesses can conveniently take loans. In addition, consumers demand for tracking status of their loans, mortgages, and credit cards, compare & find lower rates, and distinguish & regulate access to their financial information. These advancements in technologies propel growth of the market.

The COVID-19 outbreak has a significant impact on the commercial lending market and has increased in commercial lending market, owing to bankruptcy of various businesses due to lockdown. Moreover, during this global health crisis, technological advancements in the commercial lending industry have automated long and hectic processes. This, as a result promoted demand for commercial lending, thereby accelerating the revenue growth.

The commercial lending market is fragmented with the presence of regional vendors such as American Express Company, Credit Suisse, Fundation Group LLC, Fundbox, Funding Circle, Goldman Sachs, Kabbage, LoanBuilder, Merchant Capital, and OnDeck. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for commercial lending across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Commercial Lending Market is estimated to grow at a CAGR of 13.1% from 2021 to 2030.

The Commercial Lending Market is projected to reach $29,379.83 billion by 2030.

To get the latest version of sample report

Flexible long-term lending offered by commercial lending options etc. boost the market growth.

The key players profiled in the report include American Express Company, Credit Suisse, Fundbox, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Commercial Lending Market is segmented on the basis of type, enterprise size, provider, and region.

The key growth strategies of Commercial Lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Asia-Pacific region would grow at a highest CAGR of 15.1% during the forecast period.

Secured Lending segment will dominate the market during 2021 - 2030.

Loading Table Of Content...