Commercial Property Insurance Market Research, 2032

The global commercial property insurance market was valued at $254.9 billion in 2022, and is projected to reach $724 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Commercial property insurance coverage is customized to meet the individual demands of various industries and businesses, ranging from small firms to major organizations. These insurances often cover a wide range of property types, such as office buildings, retail spaces, warehouses, and manufacturing facilities. Moreover, they cover business interruption losses, compensating for income losses and operating expenditures when the property is temporarily rendered inoperable owing to covered dangers.

Furthermore, the commercial property insurance market is influenced by factors such as geographic location of the property, the type of business being performed, the value of assets, and the level of risk connected with the surrounding environment. Insurers use these elements while determining premium prices and coverage terms. The industry has evolved to offer specialized coverage alternatives and risk management solutions to satisfy the distinct needs of various industries and to limit potential losses that could interrupt business operations. The commercial property insurance market thus performs a critical role in assisting businesses by providing a financial safety net against unforeseen property-related hazards, allowing them to focus on their core activities with confidence and resilience.

Strong financial backing and adequate reserves for claim payouts are crucial drivers of the commercial property insurance market growth. These criteria build trust in businesses and property owners, assuring them that the insurance company has the financial capacity to satisfy its claim commitments even in the face of large-scale losses or catastrophic occurrences. When insurance companies exhibit financial soundness, businesses are more willing to obtain commercial property insurance because they know they can rely on the insurer to pay claims swiftly and equitably.

Furthermore, tailoring solutions to address specific industry risks for targeted client are drive the growth of commercial property insurance market. However, high premiums of commercial insurance must restrict the market growth for organization particularly small and medium-sized firms (SMEs). Affordability becomes a major worry for businesses operating on limited budgets, prompting some to decline insurance entirely or settle for lesser coverage levels, leaving them more vulnerable to dangers. In addition, high rates may cause firms to self-insure or accept larger deductibles to save money, as this decreased demand for commercial property insurance may result in market stagnation or decline.

Moreover, economic recession or downturns are major factors that hampers the growth of commercial property insurance market share. On the contrary, growing infrastructure projects present significant opportunities for the commercial property insurance market due to the increasing demand for insurance coverage to protect these large-scale developments. As infrastructure projects grow in size, the necessity for comprehensive insurance solutions to protect important assets during the building and operational phases grows. Builder's risk insurance, a type of specialized coverage, is required to cover property damage and losses during construction. Thus, it will provide major lucrative opportunities for the growth of commercial property insurance market size.

The report focuses on growth prospects, restraints, and trends of the commercial property insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the commercial property insurance market outlook.

Segment Review

The commercial property insurance market is segmented on the basis of coverage, distribution channel, enterprise size, industry vertical, and region. Based on coverage, the market is segmented into open perils, and named perils. By distribution channel it is segmented into agents and brokers, direct response, and others. By enterprise size it is segmented into large enterprises, and small and medium-sized enterprises. On the basis of industry vertical, it is segmented into manufacturing, construction, IT & Telecom, healthcare, energy and utilities, transportation & logistics, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

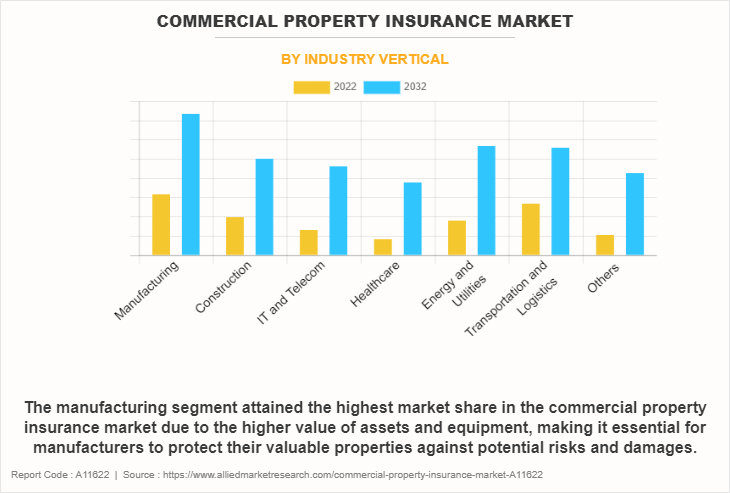

On the basis of industry vertical, the manufacturing segment attained the highest market share in 2022 in the commercial property insurance market. This can be attributed to the substantial investment in infrastructure, equipment, and facilities within the manufacturing industry. The sector's intricate network of machinery and valuable assets necessitates comprehensive insurance coverage, driving the demand for commercial property insurance.

Meanwhile, the healthcare segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the increasing complexity and value of medical equipment, coupled with the expansion of healthcare facilities, highlight the need for robust insurance coverage to mitigate potential financial risks. In addition, advancements in medical technology and the growing focus on patient care have spurred investment in healthcare infrastructure, further augmenting the demand for property insurance in this vertical.

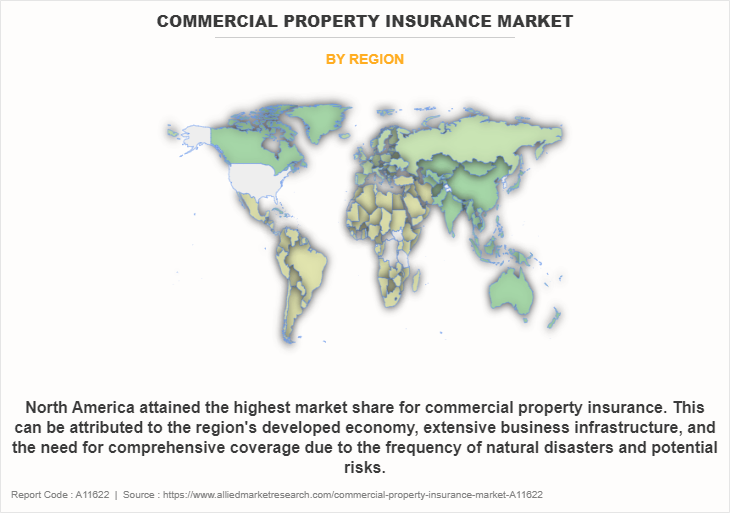

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the commercial property insurance market. This is attributed to a combination of economic, technological, and regulatory reasons. The powerful and diverse economy of this region, which is characterized by a huge number of enterprises in a variety of sectors, has greatly raised the demand for commercial property insurance. The need to protect valuable assets from potential hazards and calamities becomes more important, increasing the adoption of commercial property insurance coverage as industries grow and commercial operations develop.

On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the commercial property insurance market during the forecast period. This growth is attributed to the fact that convergence of variables has accelerated economic expansion, urbanization, and improved knowledge of risk management practices. Businesses have expanded as economies experience rapid expansion and industrialization in the region, and demand for commercial property insurance has increased. The development of new commercial buildings, industrial facilities, and infrastructure projects has resulted in a substantial demand for commercial property insurance coverage to minimize various risks such as property damage, business disruption, and liability.

The report analyzes the profiles of key players operating in the commercial property insurance market such as Allianz, Allstate Insurance Company, American International Group, Inc., AXA, Berkshire Hathaway Homestate Companies (BHHC), Chubb, Liberty, Mutual Insurance Company, Progressive, The Travelers Indemnity Company, Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the commercial property insurance market.

Market Landscape and Trends

In recent years, the commercial property insurance industry is experiencing an increase in insurance rates. This is due to a variety of factors, including an increase in natural disasters such as, storms, wildfires, and floods which resulted in greater claim payouts, as well as rising reinsurance costs and the impact of low-interest rates on insurers' investment income. Furthermore, insurers are putting a higher emphasis on risk assessment and underwriting practices. They are using advanced data analytics, satellite photography, and other technology to better assess the hazards connected with commercial properties. This enables insurers to more properly price insurance and make educated underwriting decisions.

Moreover, climate change is affecting the commercial property insurance industry by increasing the frequency and severity of natural disasters. To account for the changing situation of risks posed by climate-related disasters, insurers are examining their risk models and tactics. In addition, the necessity of cyber insurance for commercial property is steadily increasing. As businesses become more reliant on digital operations and data storage, the risk of cyberattacks and data breaches increase. Cyber insurance is evolving to cover a greater range of potential damages, such as business interruption, reputational damage, and regulatory fines.

Top Impacting Factors

Strong Financial Backing and Adequate Reserves for Claim Payouts

Commercial property insurance firms require strong financial support and significant reserves since commercial property insurance protects high-value assets and properties of firms. Commercial properties are frequently valued higher than residential ones, implying that potential claims are large. These firms have adequate financial reserves guarantees that are used by the insurance business in managing significant claim settlements. Furthermore, commercial properties can be exposed to various disasters, including fires, floods, earthquakes, and storms. In a broad disaster that affects numerous insured properties, the insurance company is required to have the financial resources to cover all affected claims.

Moreover, commercial property insurance must contain coverage for business interruption, which compensates the policyholder for the loss of their income during property repairs. Such claims are complicated and require considerable financial obligations from the insurer. In addition, claims involving commercial premises require to be subject to long-tail liability, which means that the insurance company may need to set aside funds for prospective claims that may come years after the policy is issued. Thus, large claims, catastrophic events, and long-term liability have strong financial backing and reserves for claim payouts in the commercial property insurance market.

Customized Solutions for Specific Industry Risks for Specific Client

The commercial property insurance market tailors its solutions to handle specific sector risks for targeted clientele by taking a more specialized and customized approach. Furthermore, commercial property insurers create insurance solutions that are tailored to the specific industry risks that exist in certain businesses. For instance, a hotel could need coverage for guest liability and business interruption, whereas a manufacturing firm might need coverage for equipment breakdown and product liability. Moreover, commercial property insurance providers implement detailed risk evaluations for enterprises in certain industries. They examine the activities, risks, and vulnerabilities of clients in order to create complete insurance packages that effectively handle their specific needs. In addition, risk management and loss prevention services targeted to individual sectors are provided by commercial property insurance. These kinds of services may include security instruction, site inspections, and risk mitigation methods to lower the chance of claims. Industry-specific coverage, loss prevention services, and risk assessment and consultation have thus significantly enhanced tailoring solutions to address specific industry risks for targeted clientele in the commercial property insurance market.

Expanding Customer base and Risk Diversification through International Presence

Commercial property insurance businesses use important methods such as client expansion and risk diversification through worldwide presence to grow and strengthen their market positions. Furthermore, commercial property insurers contact customers in various parts of the world by establishing a global network of offices, subsidiaries, and partners. They use local experience and distribution channels to provide customized insurance solutions to businesses across the globe.

Moreover, many organizations conduct business in numerous countries and prefer insurance options that cover all of their sites under a single policy. Commercial property insurance companies with an international presence provide transnational coverage, giving such global businesses convenience and uniformity. In addition, commercial property insurers with global reach frequently specialize in supporting sectors with a global footprint. This enables them to manage industry-specific risks while also attracting multinational clients in those industries. Therefore, industry specialization, multinational coverage, and global networks & distribution channels have expanded customer base and risk diversification through international presence in commercial property insurance market.

High Premiums of Commercial Insurance

Commercial property insurance coverage becomes more expensive for businesses as premiums grow, particularly for small and medium-sized organizations (SMEs). Affordability becomes a major worry for businesses operating on limited budgets, prompting some to decline insurance altogether or choose lesser coverage limits, leaving them more vulnerable to dangers. Furthermore, when premiums become unacceptably expensive, employers may prefer to self-insure or accept higher deductibles to save money. This decreased demand for commercial property insurance may result in market growth stagnation or decline. In addition, businesses in high-insurance-premium locations or industries may find it difficult to compete with rivals in lower-premium areas. This difference creates an unequal playing field, limiting the growth potential of enterprises in more affluent areas.

Moreover, there are chances of high commercial property insurance premiums to discourage firms from purchasing insurance, resulting in reduced market penetration. As a result, insurers may have a smaller customer base, which is expected to have an influence on revenue growth and market share. Thus, affordability, reduced demand, and limited market penetration of high commercial insurance premiums restrict the growth of commercial property insurance market.

Economic Recessions or Downturns

Businesses restrict their operations during economic downturns, resulting in lower demand for commercial property insurance, as businesses downsize or close, the requirement for insurance coverage reduces, limiting development prospects of the insurers. Furthermore, property values, including commercial properties, fall during economic downturns. Insured values may fall as well, as property prices fall, leading to lower premiums and lesser revenue for insurers. In addition, Commercial property insurance firms frequently invest in premiums to earn additional revenue. Interest rates and investment returns tend to be lower during an economic downturn, lowering the overall income gained from investments. Moreover, economic downturns increase commercial property vacancy rates, rendering them more vulnerable to threats such as vandalism, theft, and fire. This increased risk exposure led to higher claims expenses for insurers. Therefore, reduced business activity, declining property values, and increased risk exposure are major factors of economic recessions or downturns that hamper the growth of the commercial property market.

Growing Infrastructure Projects

Growth in infrastructure developments gives the commercial property insurance sector tremendous scope and prospects. Infrastructure projects involve the building and development of large-scale facilities such as roads, bridges, airports, trains, power plants, and other public and private assets. Furthermore, as infrastructure projects increase, there is a rise in the demand for commercial property insurance coverage to protect these valuable assets during the building and operational phases. Moreover, infrastructure projects frequently necessitate risk insurance of builders to cover property damage and losses during construction. This specialized insurance provides coverage for on-site property and materials and can be a lucrative market for insurers.

In addition, commercial property insurers can provide performance bonds and assurance solutions to ensure that infrastructure projects are completed in accordance with contractual commitments. This helps project owners and stakeholders feel assured that the project is expected to be completed on time. Therefore, increased demand for coverage through risk insurance of builder, performance bonds, and surety solutions for growing infrastructure projects are opportunities for the growth of the commercial property insurance market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial property insurance market forecast from 2022 to 2032 to identify the prevailing commercial property insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial property insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial property insurance market trends, key players, market segments, application areas, and market growth strategies.

Commercial Property Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 724 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 495 |

| By Coverage |

|

| By Distribution Channels |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Liberty Mutual Insurance Company, Zurich Insurance Group, Chubb Limited, Progressive, The Travelers Indemnity Company, AXA Group, Allstate Insurance Company, Allianz SE, Berkshire Hathaway Homestate Companies (BHHC), American International Group, Inc. |

Analyst Review

The commercial property insurance market has witnessed increased demand for coverage as businesses and infrastructure projects expand globally. The necessity for risk management and financial protection encourages businesses to seek insurance solutions to protect their properties and assets from numerous risks as economies grow. Furthermore, commercial property insurance companies have increasingly provided customized insurance solutions to handle specific sector risks. They understand that various firms have distinct vulnerabilities, and by providing specialized coverage, insurers improve customer satisfaction, close coverage gaps, and attract more enterprises looking for comprehensive protection. In addition, the commercial property insurance market has been transformed by the application of technology such as data analytics and artificial intelligence. Advanced risk modeling and underwriting technologies allow insurers to effectively analyze risks, improve pricing strategies, and improve decision-making processes.

Moreover, the surge in cyber hazards has raised demand in the commercial property insurance market for cyber insurance coverage. Businesses understand the significance of protecting their digital assets and data from cyberattacks, which has resulted in cyber insurance becoming a rapidly increasing market. Furthermore, the commercial property insurance market is impacted by changes in regulatory frameworks. New legislation necessitates the purchase of specific forms of insurance, such as liability coverage, creating demand for corresponding insurance products.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in May 2022, according to PR newswire Liberty Mutual Insurance expanded its commercial property loan offerings by using technology to remotely adjust commercial property claims. Furthermore, it allows customers to transmit video from the damaged property to commercial property claims professionals of Liberty Mutual, allowing them to better understand the damage and respond more promptly. For instance, in July 2023, AXA XL Insurance expanded its commercial property insurance services offerings by adding mid-market generalists to its newly launched U.S mid-market business. This helped in providing multi-line property/casualty insurance for mid-sized generalist businesses across the U.S. These strategies by the market players operating at a global and regional level is expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include Allianz SE, Allstate Insurance Company, American International Group, Inc., AXA Group, Berkshire Hathaway Homestate Companies (BHHC), Chubb Limited, Liberty Mutual Insurance Company, Progressive, The Travelers Indemnity Company, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the commercial property insurance market.

In recent years, the commercial property insurance sector is experiencing an increase in insurance rates. This is due to a variety of factors, including an increase in natural disasters such as, storms, wildfires, and floods which resulted in greater claim payouts, as well as rising reinsurance costs and the impact of low-interest rates on insurers' investment income.

North America the largest regional market for Commercial Property Insurance

The global commercial property insurance market was valued at $254.93 billion in 2022, and is projected to reach $723.99 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

Allianz, Allstate Insurance Company, American International Group, Inc., AXA, Berkshire Hathaway Homestate Companies (BHHC), Chubb, Liberty, Mutual Insurance Company, Progressive, The Travelers Indemnity Company, Zurich

Loading Table Of Content...

Loading Research Methodology...