Commercial Refrigeration Market Research, 2035

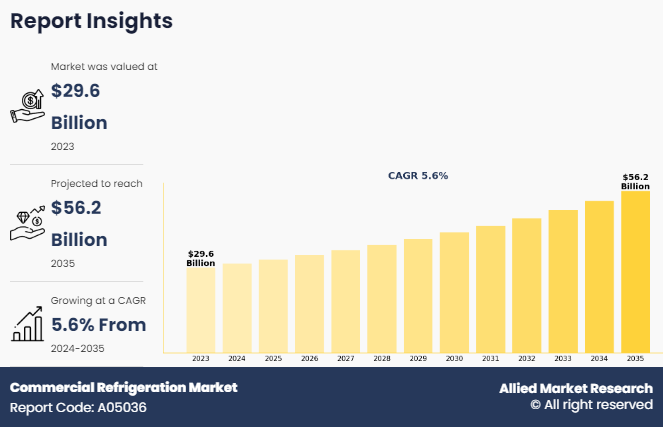

The global commercial refrigeration market size was valued at $29.6 billion in 2023, and is projected to reach $56.2 billion by 2035, growing at a CAGR of 5.6% from 2024 to 2035. Commercial refrigeration is the process of removing excess heat from a source or a material to maintain a temperature lower than its surroundings. Commercial refrigeration equipment is used for preserving food such as vegetables, fruits, meat, and other similar products by maintaining a specific temperature to increase the shelf life of a product. A large portion of the market for refrigerators is expected to grow in the near future due to the replacement of existing equipment with energy-efficient and sustainable technology equipment. Some refrigeration equipment are specially designed to rapidly reduce the temperature of food from around 90°C to as low as 30°C, in a short time to eliminate the threat of bacterial growth. The demand for packaged food is anticipated to increase at a moderate rate globally during the commercial refrigeration market forecast period, which is expected to increase the commercial refrigeration market demand in the near future. In addition, rise in food safety regulations is expected to boost the demand for commercial refrigeration during the forecast period.

The market is driven by increase in demand for frozen & chilled products among consumers due to changes in lifestyle and rapid urbanization. In addition, rapid growth in the organized retail sector, such as increase in the number of hypermarkets and supermarkets, further boosts the overall sales of commercial refrigerators; thereby leading to the growth of the market. However, the need for frequent maintenance and potential technical issues arising due to lack of proper maintenance acts as a major restraint for the market. Conversely, advancements in technology and a rise in the number of quick-service restaurants, especially in the growing economies, are expected to provide numerous opportunities for market growth.

KEY TAKEAWAYS FROM THE COMMERCIAL REFRIGERATION MARKET REPORT

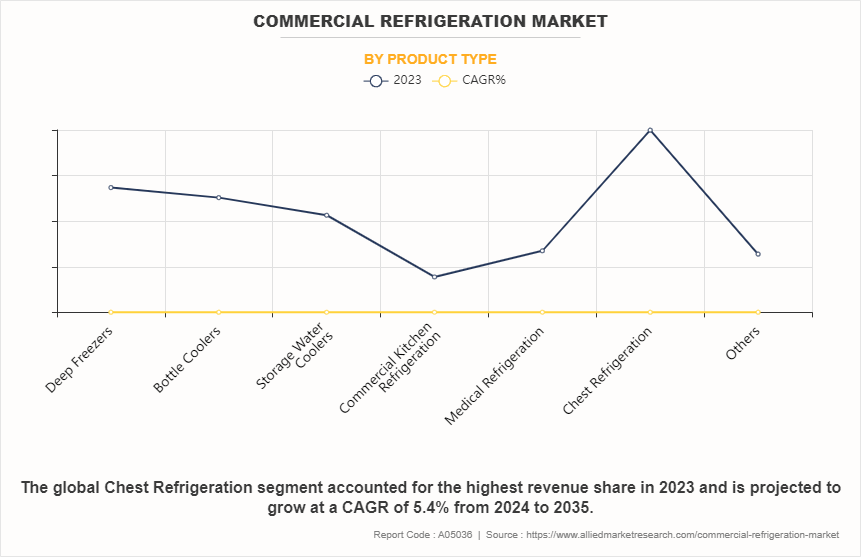

- On the basis of product type, the others segment is the fastest-growing segment with a 6.4% CAGR.

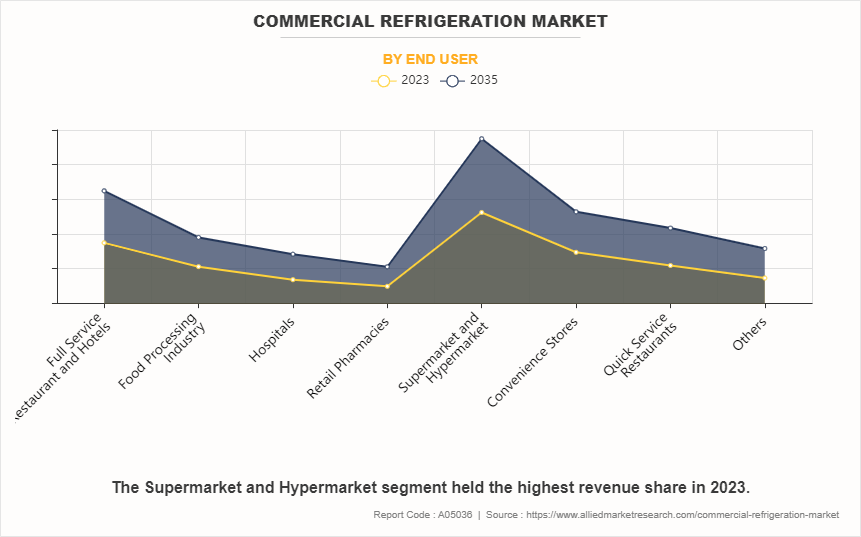

- On the basis of end user, the supermarket and hypermarket segment was the largest in the market in 2023.

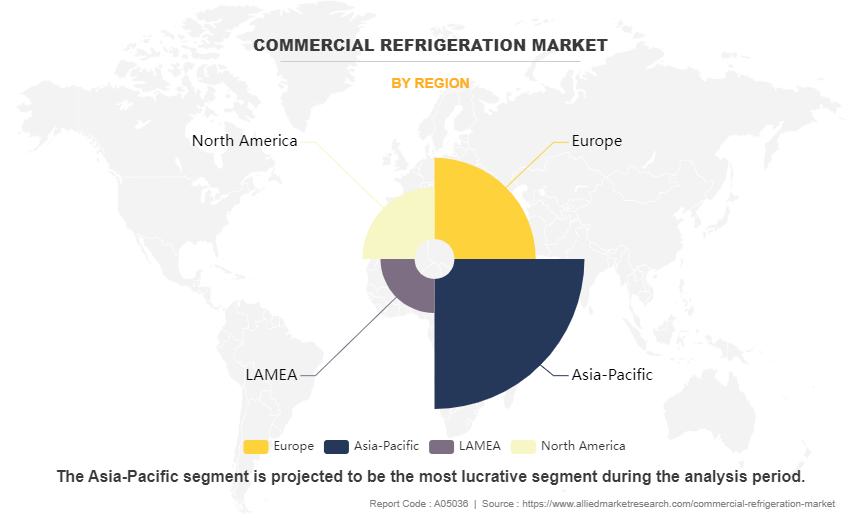

- Region-wise, Asia-Pacific was the highest revenue contributor to the market in 2023.

MARKET DYNAMICS

The growing need for environmentally friendly and energy-efficient solutions is one of the main factors influencing the market. Adopting refrigeration systems that use eco-friendly refrigerants and consume as little energy as possible is becoming more and more important as awareness of climate change and the need to cut greenhouse gas emissions grow. To satisfy these expectations, manufacturers are devoting resources to R&D to create novel technologies such as enhanced insulating materials, variable-speed compressors, and natural refrigerants such as hydrocarbons and CO2.

The shift towards greener alternatives is also being fueled by strict regulatory requirements and phase-out plans for high-GWP refrigerants. Global regulatory agencies are taking action to reduce the use of synthetic refrigerants with a high potential for global warming and ozone-depleting chemicals. Manufacturers are being forced by the current regulatory environment to reorganize their product lines and create compliant refrigeration systems that satisfy the most recent sustainability standards.

Digitization and integration of Internet of Things (IoT) technologies into refrigeration systems is a noteworthy trend that is influencing the market. Refrigeration equipment is capable of being remotely managed, with predictive maintenance and real-time monitoring made possible by the use of smart sensors, data analytics, and connection technologies. IoT-enabled refrigeration systems help organizations cut expenses and downtime while improving food safety and quality assurance by providing advantages such as enhanced energy efficiency, proactive problem detection, and optimal performance.

In addition, the market has experienced surge in innovation and customization due to shifting consumer tastes and dietary habits. Specialized refrigeration methods designed to maintain the nutritional content and freshness of perishable commodities have been developed owing to the growing demand for natural, organic, and fresh foods. A wide range of temperature-controlled storage units, walk-in coolers, and refrigerated display cases are available from manufacturers, all of which have been customized to satisfy the unique needs of various food categories and retail settings.

Furthermore, the need for cold chain logistics and refrigerated transport solutions is being driven by the expansion of e-commerce and online grocery delivery services. Since perishable commodities must be reliably stored and transported at a consistent temperature, sophisticated refrigeration systems that can preserve temperature integrity during travel have been developed. By utilizing technology, cold chain logistics companies are tracking and monitoring temperature-sensitive shipments in real time, guaranteeing product quality and safety through the supply chain.

Furthermore, the pharmaceutical and healthcare industries have become important final consumers of commercial refrigeration equipment. With rise in importance of vaccine distribution, pharmaceutical storage, and biomedical research, the need for ultra-low temperature freezers, vaccine storage units, and temperature-controlled cabinets is expected to increase. To satisfy the temperature requirements and legal requirements and guidelines of the pharmaceutical and healthcare sectors, manufacturers are developing specialized refrigeration systems through innovation.

Thus, advancements in technology, industry-specific demands, consumer preferences, and regulatory compliance are the driving forces for the growth of the market. In a market that is changing quickly, manufacturers and other stakeholders need to keep up with these advancements and modify their strategies to take advantage of new opportunities and satisfy changing demands from consumers.

SEGMENTAL OVERVIEW

The commercial refrigeration market is analyzed on the basis of product, end user, and region. By product type, the market is divided into deep freezers, bottle coolers, storage water coolers, commercial kitchen refrigeration, medical refrigeration, chest refrigeration, and others. The others segment includes ice cubes, bottled water dispenser, visi coolers, refrigerated display cases, and beer dispensers. On the basis of end user, it is classified into full-service restaurant & hotels, food processing industry, hospitals, retail pharmacies, supermarket/hypermarket, convenience stores, quick service restaurants, and others. The others segment comprises catering services, institutional catering, event services, bakery, bars, and pubs. Region-wise, the commercial refrigeration is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

BY PRODUCT TYPE

By product type, the chest refrigeration segment is expected to maintain its dominance in the global market during the forecast period, according to commercial refrigeration market statistics. However, the medical refrigeration segment is anticipated to gain traction in the near future, owing to increase in demand for commercial refrigeration in hospitals and various other medical facilities, especially in emerging countries. The commercial refrigeration and medical refrigeration segments collectively accounted for approximately one-fourth of the total global commercial refrigeration market share in 2023.

BY END USER

By end user, the supermarket/hypermarket segment accounted for a maximum share in the global market in 2023 and is expected to remain dominant during the forecast period. However, the retail pharmacies segment is expected to experience rapid growth with a CAGR of 5.2% from 2024 to 2035.

BY REGION

Region-wise, the commercial refrigeration market is studied across North America, Europe, Asia-Pacific, and LAMEA. Increase in demand for commercial refrigeration equipment in Asia-Pacific and LAMEA is expected in the near future, owing to rise in industrialization and high degree of implementation of automation in the regions. Moreover, rise in the number of food outlets coupled with increase in the number of retail pharmacies and experience centers such as supermarkets and hypermarkets are expected to provide opportunities for growth for the market. Asia-Pacific accounted for approximately two-fifths share of the total commercial refrigeration market in 2023 and is expected to remain dominant during the forecast period, with major growth expected in China, India, and other developing countries. Rise in the number of full-service restaurants, and quick-service restaurants and increase in the adoption of frozen food and confections are the major drivers fueling the commercial refrigeration market growth in these countries.

COMPETITION ANALYSIS

The major players analyzed for the commercial refrigeration market are United Technologies Corporation, Daikin Industries Ltd., Illinois Tool Works Inc. (ITW), Johnson Controls International Plc, Dover Corporation, AB Electrolux, Panasonic Corporation, Ali Group Srl, Frigoglass S.A.I.C., and Haier Electronics Group Co., Ltd. Players in the commercial refrigeration industry have adopted acquisition as their key strategy to increase their market share and to remain competitive in the market. The leading players in the commercial refrigeration market have also focused on product launches, partnerships, and collaboration as a key strategy to gain significant market share globally.

RECENT DEVELOPMENT IN THE COMMERCIAL REFRIGERATION MARKET

- In September 2020, Carrier announced the introduction of their OptiClean Dual-Mode Air Scrubber & Negative Air Machine to improve indoor air quality in commercial areas. This device is intended to help reduce airborne pollutants, including viruses.

- In 2020, Hussmann introduced the microDS Multi-Deck Self-Contained Refrigeration System, designed to supply small-format retailers with refrigeration options.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial refrigeration market analysis from 2023 to 2035 to identify the prevailing commercial refrigeration market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial refrigeration market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial refrigeration market trends, key players, market segments, application areas, and market growth strategies.

Commercial Refrigeration Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 250 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | DAIKIN INDUSTRIES LTD., HAIER ELECTRONICS GROUP CO., LTD., Dover Corporation, Panasonic Corporation, ALI GROUP S.R.L., Illinois Tool Works Inc., AB Electrolux, FRIGOGLASS S.A.I.C., United Technologies Corporation, Johnson Controls International PLC |

Analyst Review

According to CXOs, the global commercial refrigeration market is witnessing a moderate growth rate, due to rise in demand for frozen products among consumers. Rapid development of the organized retail sector, such as increase in the number of hypermarkets and supermarkets, further boosts the overall sales of commercial refrigerators.

Asia-Pacific is anticipated to garner the maximum share in the global commercial refrigeration market, owing to rise in full-service restaurants & quick service restaurants as well as a shift in preference toward frozen food & confectioneries.

However, the need for frequent maintenance and potential technical issues arising due to lack of proper maintenance limit the adoption of commercial refrigerators, thereby hampering the growth of the market, globally.

The global commercial refrigeration market was valued at $29,572.8 million in 2023, and is projected to reach $56,212.3 million by 2035, registering a CAGR of 5.6% from 2024 to 2035.

The forecast period in the Commercial refrigeration market report is 2024 to 2035.

The base year calculated in the Commercial refrigeration market report is 2023.

The top companies analyzed for the Commercial refrigeration market report are United Technologies Corporation, Daikin Industries Ltd., Illinois Tool Works Inc. (ITW), Johnson Controls International Plc, Dover Corporation, AB Electrolux, Panasonic Corporation, Ali Group Srl, Frigoglass S.A.I.C., and Haier Electronics Group Co., Ltd.

The chest refrigeration segment is the most influential segment in the Commercial refrigeration market report.

Asia-Pacific holds the maximum market share of the Commercial refrigeration market.

The company profile has been selected on the basis of key developments such as partnerships, mergers, and acquisitions.

The market value of the Commercial refrigeration market in 2023 was $29,572.8 million.

Loading Table Of Content...

Loading Research Methodology...