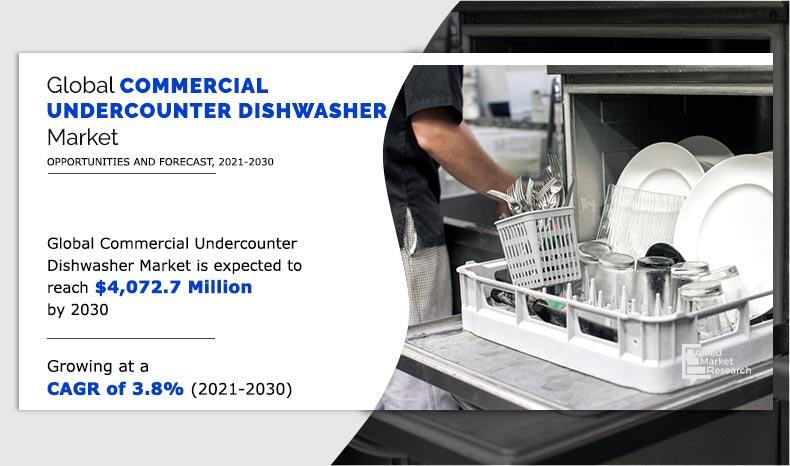

The global commercial undercounter dishwasher market size was valued at $2,864.0 million in 2020, and is estimated to reach $4,072.7 million by 2030, registering a CAGR of 3.8% from 2021 to 2030.

A commercial undercounter dishwasher is a compact designed dishwasher made to operate in a commercial environment. It has become an essential part of any commercial kitchen that significantly reduces the time required for washing cutlery, plates, and dishes. Undercounter dishwasher is considered to be an ideal option for small facilities such as bars and cafes. It serves small facilities better due to its compact design that occupies less space in the kitchen.

The growth of the global foodservice entities such as restaurants, hotels, catering units, and cafes has significantly contributed toward the commercial undercounter dishwasher market growth, especially in the developed markets such as North America and Europe. The emerging markets such as Asia-Pacific and LAMEA are offering lucrative growth opportunities to market players due to rapid urbanization, increase in penetration of foodservice entities, and rise in trend eating-out culture.

Hotels play an important part in the growth of the commercial undercounter dishwasher market demand across the globe. The growth of the hotel industry is majorly attributed to the rapid expansion of the global travel and tourism industry. Travel & tourism is a trillion-dollar industry, and a major portion of the revenue is generated from the food & lodging in the tourism industry. Therefore, the development of the tourism sector is boosting the growth of the hotel industry, which, in turn, is notably contributing toward the growth of the commercial undercounter dishwasher market.

Commercial undercounter dishwasher is an essential part of any small- and medium-sized food serving business unit that has limited space and tight budgets. It helps to reduce the cost of labor and offer efficient cleaning of plates at minimal costs. Moreover, rise in health consciousness and surge in awareness regarding hygiene have necessitated the commercial spaces to install efficient dish cleaning systems in their premises. The rapid penetration of bars, cafes, and bakeries in the emerging markets such as China, India, and Brazil is further expected to foster the growth of the commercial undercounter dishwasher market in the foreseeable future.

The outbreak of COVID-19 has negatively impacted the growth of the commercial undercounter dishwasher market in 2020. The lockdown and ban on travel imposed by the government resulted in the closure of restaurants and hotel for an extended time period. Moreover, the production of commercial undercounter dishwasher hampered as the manufacturing units were either partially or fully closed.

By Product

Low Temperature segment helds the major share of 66.7% in 2020

The global commercial undercounter dishwasher market is segmented into product, end user, distribution channel, and region. On the basis of product, the commercial undercounter dishwasher market is bifurcated into high temperature and low temperature. By end user, it is segregated into hotels, restaurants, and others. Depending on distribution channel, it is fragmented into supermarket/hypermarket, specialty stores, and online sales channel. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

According to the global commercial undercounter dishwasher market forecast, on the basis of product, the low temperature segment was the highest contributor to the market, accounting for $1,912.8 million in 2020, and is expected to sustain its significance during the forecast period, owing to the presence of high number of small- and medium-sized foodservice entities, which face space and budget restrictions.

By End-user

Restaurants segment helds the major share of 55.5% in 2020

Depending on end user, the restaurants segment exhibited a large market share of around 55.5% in 2020, due to the rapid penetration of restaurants across the globe, especially in North America and Europe, where the restaurants sector highly influences the GDP of the region.

By distribution channel, the online sales channel is expected to show the highest growth rate, due rise in penetration of internet and increase in popularity of online retailers such as Amazon, Flipkart, and Walmart.

By Distribution Channel

Specialty Stores segment helds the major share of 58.5% in 2020

According to the global commercial undercounter dishwasher market analysis, in 2020, Europe dominated the market, garnering around 41.2% of the total commercial undercounter dishwasher market share, followed by North America. The European economy is significantly influenced by the presence of large number of family-run small- and medium-sized hotels and restaurants.

Players operating in the global commercial undercounter dishwasher market have adopted various developmental strategies to expand their market share, exploit the commercial undercounter dishwasher market opportunities, and increase profitability in the market. The key players profiled in this report include AB Electrolux, Ali Group SRL, CMA Dishmachine, Fisher & Paykel Appliances, Inc., Illinois Tool Works, Inc., JLA Ltd., Jacksons WWS, Inc., Miele & Cie KG, the Clarke Associates Co., and Winterhalter Gastronom GmbH.

By Region

Europe region helds the higest market share of 41.2% in 2020

Benefits For Stakeholders

- The report provides a quantitative analysis of the current commercial undercounter dishwasher market trends, estimations, and dynamics of the market size from 2020 to 2030 to identify the prevailing commercial undercounter dishwasher market opportunity.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis and the market size and segmentation assist to determine the prevailing commercial undercounter dishwasher market opportunities.

- The major countries in each region are mapped according to their revenue contribution to the market.

- The market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players in the commercial undercounter dishwasher industry.

Commercial Undercounter Dishwasher Market Report Highlights

| Aspects | Details |

| By PRODUCT |

|

| By END USER |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | AB Electrolux, Winterhalter Gastronom GmbH, Jackson WWS, Inc., JLA Ltd., Miele & Cie. KG, The Clark Associates Co., Ali Group S.r.L., CMA dishmachine, Illinois Tool Works Inc, Fisher & Paykel Appliances, Inc. |

Analyst Review

According to the insights of the top-level CXOs, Asia-Pacific is projected to witness a significant growth during the forecast period, owing to increase in penetration of restaurants, bars, hotels, and cafes. The major emerging markets include India, China, Indonesia, and Hong Kong. Exponential rise in population along with upsurge in demand for food, surge in number of working women, rise in disposable income, rapid urbanization, increase in awareness regarding hygiene are the key factors that favor the growth of the foodservice entities in emerging markets. Moreover, emerging markets are highly influenced by the western culture, and hence dining out is gradually becoming a part of the culture in the emerging economies such as India and Brazil. Furthermore, Asia-Pacific is the leading destination for tourists, food and lodging are the highest revenue generators in the tourism industry. Therefore, increase in penetration of foodservice establishments is expected to fuel the growth of the commercial undercounter dishwasher market in emerging nations.

The CXOs further added that commercial undercounter dishwashers have long replacement cycle, i.e., at least 7 to 9 years. A quality commercial dishwasher with proper and regular maintenance goes on for years, and are easily repaired. However, it has long replacement cycle, which hampers the growth of the market. This is attributed to the fact that if a customer buys a commercial dishwasher, it will go on for years, therefore eliminating the need for buying frequently.

The global commercial undercounter dishwasher was valued at $2,864.0 million in 2020, and is projected to reach $4,072.7 million by 2030, registering a CAGR of 3.8% from 2021 to 2030. The eating-out culture is gaining high traction across the globe. This factor will drive the market in the upcoming years.

The global commercial undercounter dishwasher market is expected to witness a CAGR of 3.8% from 2021 to 2030. Rise in number of foodservice entities such as restaurants, catering units, hotels, cafeterias, and similar units is fueling the commercial undercounter dishwasher demand, thereby driving the growth of the market.

https://www.alliedmarketresearch.com/request-sample/14109

Players operating in the global commercial undercounter dishwasher market have adopted various developmental strategies to expand their market share, exploit the commercial undercounter dishwasher market opportunities, and increase profitability in the market. The key players profiled in this report include AB Electrolux, Ali Group SRL, CMA Dishmachine, Fisher & Paykel Appliances, Inc., Illinois Tool Works, Inc., JLA Ltd., Jacksons WWS, Inc., Miele & Cie KG, The Clarke Associates Co., and Winterhalter Gastronom GmbH.

The global commercial undercounter dishwasher market is segmented on the basis of product, end-user, distribution channel, and region. On the basis of product the commercial undercounter dishwasher market is bifurcated into high temperature and low temperature. By end-user, it is segregated into hotels, restaurants, and others. On the basis of distribution channel, it is segregated into supermarket/hypermarket, specialty stores, and online sales channel.

The base year calculated in the report is 2020. The year 2020 was an exceptional year due to the outbreak of the COVID-19 pandemic. The outbreak of COVID-19 has negatively impacted the growth of the commercial undercounter dishwasher market in 2020. The lockdown and ban on travel imposed by the government resulted in the closure of restaurants and hotel for an extended time period. Moreover, the production of commercial undercounter dishwasher hampered as the manufacturing units were either partially or fully closed.

The major trends such as popularity of eating-out culture, rise in the number of hotels, cafes, and other food service entities, growth of tourism, growing number of small-sized restaurants are boosting the growth of the market. Further, the introduction of smart dishwashers is expected to augment market demand in the upcoming years.

According to the global commercial undercounter dishwasher market analysis, in 2020, Europe dominated the market, garnering around 41.2% of the total commercial undercounter dishwasher market share, followed by North America. The European economy is significantly influenced by the presence large number of family run small and medium-sized hotels and restaurants.

The major factors influencing the market includes popularity of eating-out culture, rise in the number of hotels, cafes, and other food service entities, growth of tourism, growing number of small-sized restaurants are boosting the growth of the market. Further, the introduction of smart dishwashers is expected to augment market demand in the upcoming years.

The outbreak of COVID-19 has negatively impacted the growth of the commercial undercounter dishwasher market in 2020. The lockdown and ban on travel imposed by the government resulted in the closure of restaurants and hotel for an extended time period. Moreover, the production of commercial undercounter dishwasher hampered as the manufacturing units were either partially or fully closed.

Loading Table Of Content...