Commercial Vehicle Ancillaries’ Products Market Research, 2033

The global commercial vehicle ancillaries products market size was valued at $6.0 Billion in 2023, and is projected to reach $10.7 Billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

Market Introduction and Definition

Commercial vehicle ancillaries products market cover a wide range of items and constituents that are essential for running, maintaining, and upgrading commercial vehicles. These vehicles are used to carry goods, people or to do specific tasks for business purposes. Commercial vehicle ancillaries market is vast and diverse with various products meant to enhance performance, safety, comfort, and efficiency of commercial vehicles. It is essential in facilitating the operation, maintenance, and development of commercial vehicles, thus affecting their durability, performance as well as competitiveness in the market.

Key Takeaways

The commercial vehicle ancillaries products market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major commercial vehicle ancillaries’ products industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In September 2023, Denso Corporation unveiled Everycool, an innovative cooling system designed to deliver both comfort and energy efficiency when a commercial vehicle's engine is idle. The product is expected to be available for purchase in Japan through Denso Solution Corporation.

In October 2023, Cummins Inc. completed its acquisition of two Faurecia commercial vehicle manufacturing plants and associated operations. Two manufacturing plants bought by it are situated at Columbus, Indiana (U.S.) and Roermond, Netherlands. Faurecia is one of the major car technology companies within FORVIA Group globally.

Key Market Dynamics

The global commercial vehicle ancillaries products industry has grown due to several factors such as increase in demand for efficient & reliable transportation solutions and focus on sustainability & environmental consciousness. However, compliance with stringent regulatory standards & emissions requirements and integration challenges restrain the expansion of the market. In addition, surge in demand for electric & hybrid vehicles and advancements in safety & connectivity solutions are expected to provide ample opportunities for commercial vehicle ancillaries products market growth during the forecast period.

One of the major drivers is rise in demand for efficient and reliable transport solutions fueled by the growth of e-commerce and logistic sectors. Consequently, there is an increased need for commercial vehicles equipped with special features as online shopping and home deliveries continue to increase significantly. Therefore, there is a greater need for commercial vehicles equipped with specialized ancillary products, such as advanced cargo management systems, telematics solutions, and safety features. These ancillary products enhance the efficiency & productivity of delivery operations and ensure the safe & secure transportation of goods. The increasing focus on vehicle safety presents a significant commercial vehicle ancillaries products market opportunity.

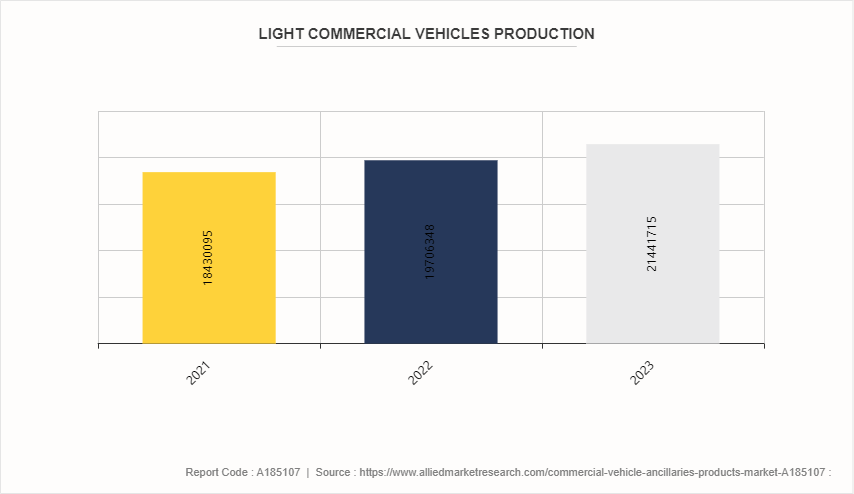

In addition, the growth of the commercial vehicle industry itself is a primary driver of the ancillaries market. As the demand for commercial vehicles increases due to factors such as economic growth, urbanization, and infrastructure development, there is a corresponding rise in the demand for ancillary products. This includes components, spare parts, accessories, and aftermarket solutions needed to support & maintain commercial vehicle fleets. The recent commercial vehicle ancillaries products market analysis highlights the impact of stringent emission norms on product development.

Moreover, continuous technological advancements in automotive engineering drive the development of new ancillary products and solutions. Innovations in areas such as electric propulsion systems, advanced driver assistance systems (ADAS) , connectivity solutions, and telematics drive the demand for ancillary products that support these technologies. Manufacturers must adapt to evolving technological trends to remain competitive in the market. Shifts in consumer preferences and market trends influence the demand for ancillary products in the commercial vehicle sector. Consumers increasingly prioritize factors such as sustainability, safety, and connectivity, driving demand for eco-friendly components, advanced safety features, and telematics solutions. Manufacturers must align their product offerings with evolving consumer preferences to meet market demand effectively.

In addition, the shift toward electric and hybrid commercial vehicles presents significant opportunities for ancillary product manufacturers. In addition, there is increase in demand for ancillary products such as batteries, charging infrastructure, electric drivetrain components, and software solutions to support the electrification of commercial vehicle fleets.

Market Segmentation

The commercial vehicle ancillaries products market is segmented into vehicle type, end user, and region. On the basis of vehicle type, the market is divided into LCV, truck, and bus. By end user, the market is segregated into transportation & logistics, construction, agriculture, public transportation, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

Regional/Country Market Outlook

The North American market for commercial vehicle ancillaries’ products is well established and mature, with the U.S. and Canada being the key contributors. The U.S. mainly dominates in this area, given its strong logistics and transport industry. The rise of e-commerce and the demand for efficient last-mile delivery solutions are driving the need for light commercial vehicles and their associated products such as specialized cargo spaces, storage solutions, and telematics systems. Furthermore, construction and agriculture sectors in the U.S. are important markets needing special commercial vehicles such as heavy duty truck bodies, off-road accessories as well as equipment-specific attachments. Moreover, Asia-Pacific is a rapidly growing market for commercial vehicle ancillaries, driven by urbanization, industrialization, and the expansion of transportation networks. Rise in demand for safety features, such as anti-lock braking systems (ABS) and electronic stability control (ESC) , in response to increasing road traffic and congestion, underscores the importance of prioritizing vehicle safety for both drivers and passengers. Lightweight and durable materials are among the key commercial vehicle ancillaries products market trends. Growth of the e-commerce sector drives demand for last-mile delivery vehicles and ancillary products such as GPS tracking systems and cargo management solutions. Rapid urbanization, infrastructure development projects, and government initiatives promote clean energy and electric mobility, such as subsidies for electric vehicles and charging infrastructure. Increasing emphasis on sustainability, environmental regulations, and corporate responsibility drives demand for eco-friendly ancillary products and solutions. Manufacturers have opportunities to develop fuel-efficient components, emission control systems, and recycling initiatives to meet the growing demand for sustainable transportation solutions. Factors such as increasing commercial vehicle production are contributing to the expanding commercial vehicle ancillaries products market size.

In addition, Latin America presents opportunities for commercial vehicle ancillaries, supported by economic growth, infrastructure development, and investments in transportation infrastructure. Surge in demand for aftermarket products and services, including spare parts and maintenance solutions, supports the region's aging commercial vehicle fleet. Increase in adoption of telematics and fleet management solutions improve operational efficiency and reduce operating costs. Expanding construction and agricultural sectors, urbanization trends, and government investments in public transportation projects, such as bus rapid transit (BRT) systems and metro expansions, highlight the growing need for robust and efficient transportation infrastructure to support economic development and mobility in urban areas. The commercial vehicle ancillaries products market forecast predicts steady growth over the next decade.

In November 2023, ASK Automotive, major Indian auto ancillary firm, announced the launch of its Initial Public Offering (IPO) . ASK Automotive is headquartered at Gurugram. Its brake-shoe business ranks first in terms of sales/production volume with 50 % market share in 2023; it also has a business segment providing aluminum lightweight precision parts & SCC products across a wide range of vehicles.

Competitive Landscape

The major players operating in the commercial vehicle ancillaries products market include Magna International Inc., Denso Corporation, Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Valeo SA, Lear Corporation, Hyundai Mobis, Faurecia and Cummins Inc. Other players in commercial vehicle ancillaries products industry includes Delphi Technologies (UK) , Webasto Group, Meritor, Inc., and WABCO. Innovative product offerings are helping newer entrants gain commercial vehicle ancillaries products market share.

Industry Trends:

In July 2023, Toyota, Japan’s renowned automaker, announced plans to establish an auto ancillary manufacturing unit in India. This move reflects the increasing importance attached to India as a manufacturing destination especially given global efforts at diversifying supply chains away from overreliance on China. In October 2023, Asahi Kasei expanded its production capacity for lithium-ion battery separators, aiming to meet the surge in demand for electric vehicles. The company is expected to invest in new equipment for coating Hippore LIB separators to enable it to supply enough coated separators for batteries that power about 1.7 million electric vehicles. This growth involves the setting up of new coating lines at Asahi Kasei’s existing LIB separator facilities in the U.S., Japan, and South Korea as from around the first half of fiscal year 2026.

In September 2023, Mecho Autotech, a startup specializing in automotive spare parts, vehicle repairs, and maintenance services, successfully secured a pre-Series A funding round of $2.4 million. The company focuses on Nigeria where over 12 million registered cars that are largely second-hand must be regularly maintained so as to avoid frequent breakdowns. Since its inception in 2021, Mecho Autotech has worked on over six thousand (6, 000) automobiles both for B2B and B2C clients through a network comprising of more than one hundred and ten garages with three being owned by Mecho Autotech itself. The main sources of income for the company include fees charged on vehicle repairs and additional money derived from maintenance subscriptions.

Key Sources Referred

International Organization of Motor Vehicle Manufacturers (OICA)

European Automobile Manufacturers Association (ACEA)

Automotive Component Manufacturers Association of India (ACMA)

Motor & Equipment Manufacturers Association (MEMA)

Truck and Engine Manufacturers Association (EMA)

Society of Automotive Engineers (SAE)

American Trucking Associations (ATA)

International Road Transport Union (IRU)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial vehicle ancillaries’ products market analysis from 2024 to 2033 to identify the prevailing commercial vehicle ancillaries’ products market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial vehicle ancillaries’ products market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial vehicle ancillaries’ products market trends, key players, market segments, application areas, and market growth strategies.

Commercial Vehicle Ancillaries’ Products Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.7 Billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Vehicle Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Valeo S.A., AISIN SEIKI Co., Ltd., Faurecia, Continental AG, ZF Friedrichshafen AG, Robert Bosch GmbH, Lear Corporation, DENSO CORPORATION, Cummins Inc., Hyundai Mobis, Magna International Inc |

The global commercial vehicle ancillaries’ products market was valued at $6.0 Billion in 2023, and is projected to reach $10.7 Billion by 2033, growing at a CAGR of 6.2% from 2024 to 2033.

The major players operating in the commercial vehicle ancillaries’ products market include Magna International Inc., Denso Corporation, Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Valeo SA, Lear Corporation, Hyundai Mobis, Faurecia and Cummins Inc.

Asia-Pacific is the largest regional market for Commercial Vehicle Ancillaries’ Products.

Transportation and logistics is the leading application of Commercial Vehicle Ancillaries’ Products Market.

Growing demand for electric and hybrid vehicles and advancements in safety and connectivity solutions are the upcoming trends of global Commercial Vehicle Ancillaries’ Products Market.

Loading Table Of Content...