Compound Semiconductor Market Research, 2031

The Global Compound Semiconductor Market was valued at $90.7 billion in 2019 and is projected to reach $347 billion by 2031, growing at a CAGR of 11.6% from 2022 to 2031. Semiconductors composed of two or more elements are known as compound semiconductors. Group III and Group V elements from the Periodic Table of the Elements are combined to make the majority of compound semiconductors (GaAs, GaP, InP, and others). Using Groups II and VI, other compound semiconductors are produced, such as CdTe, ZnSe, and others. It is also feasible to create compound semiconductor devices like Silicon Carbide (SiC) by combining other elements from the same group (IV).

The market is driven to a certain extent by factors such as the advantages of compound semiconductor wafers over silicon-based wafers, the rise in demand for compound semiconductor epitaxial wafers in consumer electronics, and the emergence of wafer-related trends in the automobile industry. However, the global market for compound semiconductor epitaxial wafers is anticipated to face significant threats from rising wafer production costs. In contrast, the growing IoT adoption in wafers and the use of compound semiconductors in smart technologies are predicted to offer attractive potential for market expansion globally during the forecast period.

![]()

Segment Overview

The compound semiconductor market growth is segmented into Type, Product, Deposition Technology, Application, and Region.

Compound semiconductors' significant performance enhancements are crucial for a wide range of technological applications. Silicon cannot operate at speeds that are greater than compound semiconductors like GaAs and InP. Compound semiconductors can also produce and receive a wide range of electromagnetic radiation, from long-wavelength infrared light to high-frequency ultraviolet and visible light. Compound semiconductor materials also have the sensor capacity and emit light in the form of communications and general lighting, such as light-emitting diodes (LEDs), lasers, and receivers for fiber optics.

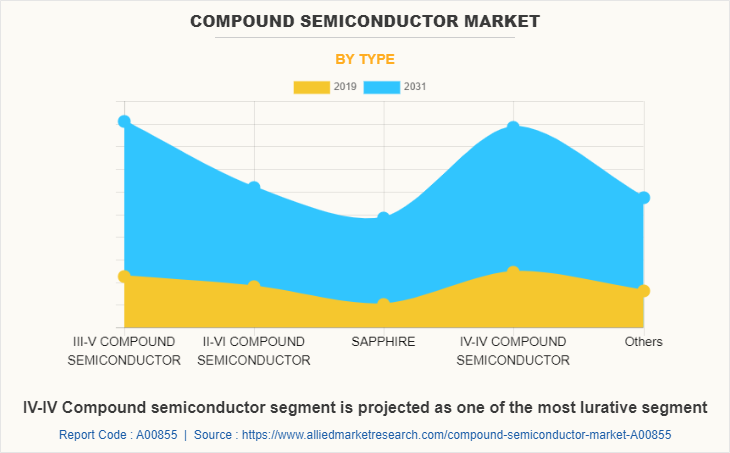

Based on type, the market is categorized into III–V compound semiconductors, II-VI compound semiconductors, sapphire, IV–IV compound semiconductors, and others. The III–V compound semiconductors segment is further divided into gallium nitride (GAN), gallium phosphide (GAP), gallium arsenide (GAAS), indium phosphide (INP), and indium antimonide (INSB). The II-VI compound semiconductors segment is classified into cadmium selenide (CDSE), cadmium telluride (CDTE), and zinc selenide (ZNSE). The IV-IV compound semiconductors segment is bifurcated into silicon carbide (SIC) and silicon germanium (SIGE). The others segment includes aluminum gallium arsenide (ALGAAS), aluminum indium arsenide (ALINAS), aluminum gallium nitride (ALGAN), aluminum gallium phosphide (ALGAP), indium gallium nitride (INGAN), cadmium zinc telluride (CDZNTE), and mercury cadmium telluride (HGCDTE). In 2021, the IV-IV compound semiconductor segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

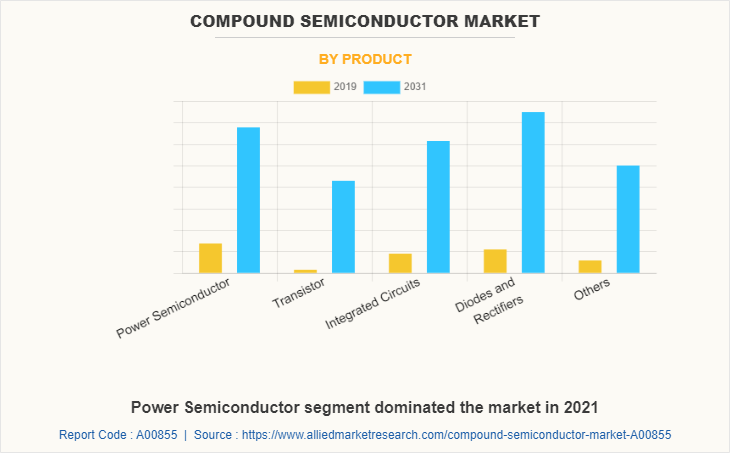

Based on product, compound semiconductors are categorized into power semiconductors, transistors, integrated circuits (ICs), diodes & rectifiers, and others. The transistor segment is further classified into high electron mobility transistors (HEMTs), metal oxide semiconductor field effect transistors (MOSFETs), and metal-semiconductor field effect transistors (MESFETs). The integrated circuit is bifurcated into monolithic microwave integrated circuits (MMICs) and radio frequency integrated circuits (RFICs). The diode & rectifiers segment is further segmented into PIN diode, Zener diode, Schottky diode, and light-emitting diode. In 2021, the power semiconductor segment dominated the market in terms of revenue, and diodes and rectifiers are expected to follow the same trend during the forecast period.

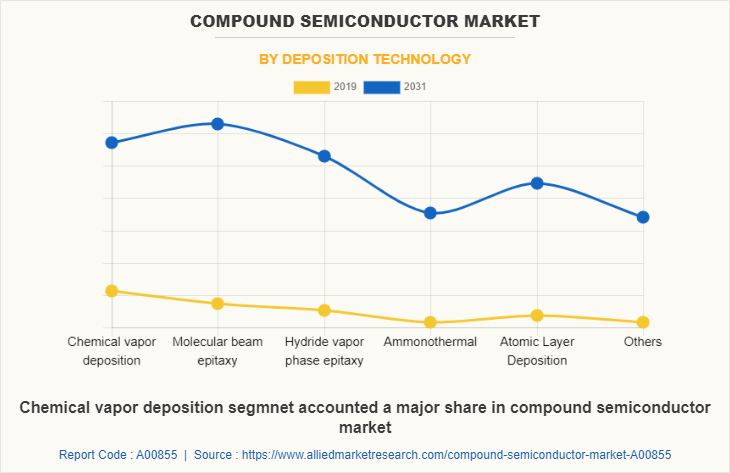

By deposition technology, the market is segmented into chemical vapor deposition (CVD), molecular beam epitaxy (MBE), hydride vapor phase epitaxy (HVPE), ammonothermal, liquid phase epitaxy (LPE), atomic layer deposition (ALD), and others. In 2021, the chemical vapor deposition segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

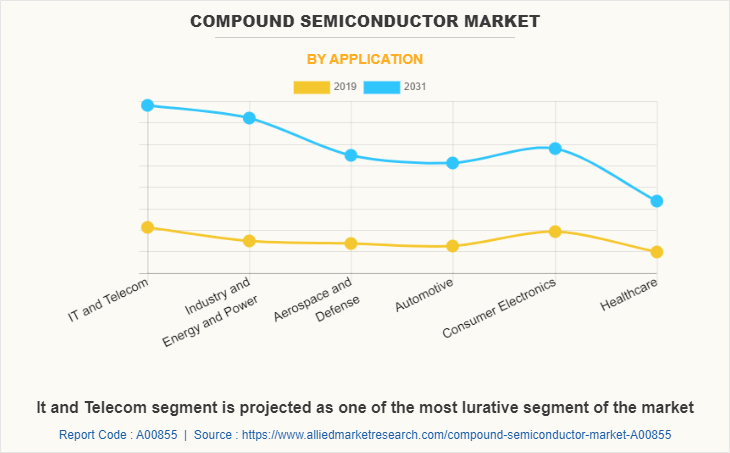

Based on applications, the compound semiconductor market size is studied across IT & telecom, industrial and energy & power, aerospace & defense, automotive, consumer electronics, and healthcare. IT & telecom is further segmented into signal amplifiers & switching systems, satellite communication applications, radar applications, and RF. Aerospace & defense is classified into combat vehicles, ships & vessels, and microwave radiation. Industrial and energy & power are further segmented into wind turbines and wind power systems. Consumer electronics are further segmented into inverters, LED lighting, and switch-mode consumer power supply systems. The automotive segment is further divided into electric vehicles & hybrid electric vehicles, automotive braking systems, rail traction, and automobile motor drives. The healthcare segment is further bifurcated into implantable medical devices and biomedical electronics. In 2021, the IT and Telecom segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

Region-wise, the compound semiconductor market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, specifically China, remains a significant participant in the global compound semiconductor industry. Major organizations and government institutions in the country are intensely putting resources into wafer technology to develop and deploy advanced technology solutions in the automotive, IT, telecom, and consumer electronics applications during the forecast period.

Competitive Analysis

Competitive analysis and profiles of the major global compound semiconductor market forecast players that have been provided in the report include Cree Inc., Infineon Technologies AG, Nichia Corporation, NXP Semiconductor N.V., Qorvo, Renesas Electronics Corporation, Samsung Electronics, STMicroelectronics NV, Taiwan Semiconductor Manufacturing Company Ltd., and Texas Instruments Inc.

Country Analysis

Country-wise, the U.S. acquired a prime share in the compound semiconductor market opportunity in the North American region and is expected to grow at a significant CAGR during the forecast period of 2019-2031. The U.S. holds a dominant position in the compound semiconductor market, owing to the rise in investment by prime vendors to boost the smart compound semiconductor solutions for consumer electronics and IT, and telecom applications.

In Europe, the UK dominated the compound semiconductor market share, in terms of revenue, in 2021 and is expected to follow the same trend during the forecast period. However, Germany is expected to emerge as the fastest-growing country in Europe's compound semiconductor market with a notable CAGR, due to advancements in the automotive industry,y which drives the usage of microelectronics in the country and thus creates lucrative growth opportunities for the compound semiconductor market in Germany.

In Asia-Pacific, China is expected to emerge as a significant market for the compound semiconductor industry, owing to a significant rise in investment by prime players and government institutions in semiconductor research and chip startup development, to boost smart infrastructure across industrial and manufacturing sectors.

By LAMEA region, the Latin American countries garnered significant market share in 2021 due to the adoption of new technologies, digital transformation, and connectivity are reshaping the future of the automotive and consumer electronics industry in Latin America. Moreover, the Middle East region is expected to grow at a significant CAGR from 2022 to 2031, owing to shifts in artificial intelligence, industry 4.0, and smart technological changes in recent years, which is expected to reshape the growth of the compound semiconductor market outlook in the Middle East.

Top Impacting Factors

The significant factors impacting the growth of the global compound semiconductor market include the advantage of compound semiconductor wafers over silicon-based wafers, the increase in demand for compound semiconductor epitaxial wafers in consumer electronics, and emerging trends toward wafers in the automotive industry. However, an increase in the cost of wafer manufacturing acts as the major barrier to early adoption, thereby hampering the growth of the market. On the contrary, the emerging usage of compound semiconductors in smart technologies and the increase in popularity of IoT in wafers are the factors anticipated to provide lucrative opportunities for the growth of the compound semiconductor epitaxial wafer market during the forecast period.

Historical Data & Information

The global compound semiconductor market is highly competitive, owing to the strong presence of existing vendors. Vendors of the compound semiconductor market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Qorvo, Inc., Infineon Technologies AG, Taiwan Semiconductor Manufacturing Company Limited, Samsung Electronics Co., Ltd, and NXP Semiconductors are the top 5 companies holding a prime share in the compound semiconductor market. Top market players have adopted various strategies, such as product launches, contracts, and others, to expand their foothold in the compound semiconductor market.

In August 2022, Qorvo, Inc. announced the release of the highest gain 100-watt L-band (1.2–1.4 GHz) compact solution: a GaN-on-SiC PAM aimed for commercial and defense radar applications. The QPA2511 GaN-on-SiC PAM provides an integrated two-stage amplifier solution with 60% power-added efficiency in a circuit footprint 70% lower than analogous two-stage solutions. This exceptional performance cuts total system power usage dramatically.

In August 2022, Infineon Technologies AG and II-VI Incorporated signed a multi-year supply deal for wafers. The former firm is acquiring additional access to this important semiconductor material to fulfill the significant rise in customer demand in this sector. The arrangement also helps Infineon Technologies AG's multi-sourcing strategy and strengthens its supply chain resiliency.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the compound semiconductor market from 2019 to 2031 to identify the prevailing compound semiconductor market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights buyers' and suppliers' potency to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the compound semiconductor market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional and global compound semiconductor market trends, key players, market segments, application areas, and market growth strategies.

Compound Semiconductor Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 347 billion |

| Growth Rate | CAGR of 11.6% |

| Forecast period | 2019 - 2031 |

| Report Pages | 336 |

| By Type |

|

| By Product |

|

| By Deposition Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | WOLFSPEED, INC., Taiwan Semiconductor Manufacturing Company Limited, NXP Semiconductors., Qorvo, Inc, Renesas Electronics Corporation., STMicroelectronics, Texas Instruments Inc., Infineon Technologies AG, NICHIA CORPORATION, Samsung Electronics Co Ltd |

Analyst Review

The compound semiconductor market is anticipated to register substantial growth in the near future owing to high investment in R&D activities by market players and an increase in focus on the Internet of Things (IoT). In addition, the surge in demand for automobile & consumer electronics and the development of smart devices are anticipated to drive the market growth during the forecast period.

GaN solutions play a crucial role in providing better qualities of 5G RF solutions for 5G wireless base stations. The technology used in 5G wireless base stations must combine efficiency, performance, and value. GaN-on-SiC delivers considerable gains in 5G base station performance and efficiency over Laterally Diffused Metal-Oxide Semiconductors (LDMOS).

Greater thermal conductivity, strong robustness & reliability, improved efficiency at higher frequencies, and comparable performance in a lower-size MIMO array are further advantages of GaN-on-SiC. GaN is anticipated to enhance power amplifiers for all transmission cells in the network (micro, macro, pico, and femto/home routers), which might substantially impact the rollout of fifth-generation (5G) networks.

For instance, in May 2022, AMS OSRAM AG introduced the OSLON Optimal series of LEDs for horticulture illumination, which are based on the newest AMS OSRAM 1mm2 chip and offer an amazing mix of high efficiency, consistent performance, and immense value.

In terms of revenue production, North America is the second-largest region in the world market for compound semiconductors. In North America, the telecommunications sector is well-established, which has prompted a rise in the use of compound semiconductors. In addition, the market expansion is complemented by the rapid growth in consumer electronics purchases. Moreover, the rise in defense spending and extensive use of compound semiconductors in the healthcare, consumer electronics, and automotive sectors propel the market's expansion.

Asia-Pacific, specifically China, remains a significant participant in the global compound semiconductor industry.

The significant factors impacting the growth of the global compound semiconductor market include the advantage of compound semiconductor wafers over silicon-based wafers, the increase in demand for compound semiconductor epitaxial wafers in consumer electronics, and emerging trends toward wafers in the automotive industry.

Qorvo, Inc, Infineon Technologies AG, Taiwan Semiconductor Manufacturing Company Limited, Samsung Electronics Co. Ltd, and NXP Semiconductors are the top 5 companies holding a prime share in the compound semiconductor market.

In 2021, the IT and Telecom segment dominated the market, in terms of revenue, and is expected to follow the same trend during the forecast period.

The compound semiconductor market was valued at $90,712.4 million in 2019 and is projected to reach $346,936.4 million by 2031, registering a CAGR of 11.61% from 2022 to 2031.

Loading Table Of Content...