Comprehensive Metabolic Panel Testing Market Research, 2032

The global comprehensive metabolic panel testing market size was valued at $10.1 billion in 2022, and is projected to reach $16.1 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032. The growth of the comprehensive metabolic panel testing market is driven by an increase in prevalence of chronic diseases such as diabetes, and cardiovascular diseases. For instance, according to the World Heart Federation, more than half a billion people across the globe were affected by cardiovascular diseases in 2021. In addition, the International Diabetes Federation estimated that by 2045, 1 in 8 adults, approximately 783 million individuals are expected to be living with diabetes. According to National Association of Chronic Disease Directors, about 40% of American adults had multiple chronic conditions (MCC).

A comprehensive metabolic panel is a diagnostic blood test designed to provide a comprehensive overview of an individual's metabolic health and the functioning of key organs. Typically conducted as part of routine health check-ups or when assessing specific health concerns, the CMP measures a variety of substances in the blood to evaluate the status of vital organs such as the liver, kidneys, and pancreas. It includes a set of blood tests that assess key markers such as electrolyte levels, kidney and liver function, blood glucose, and protein levels.

Key Takeaways

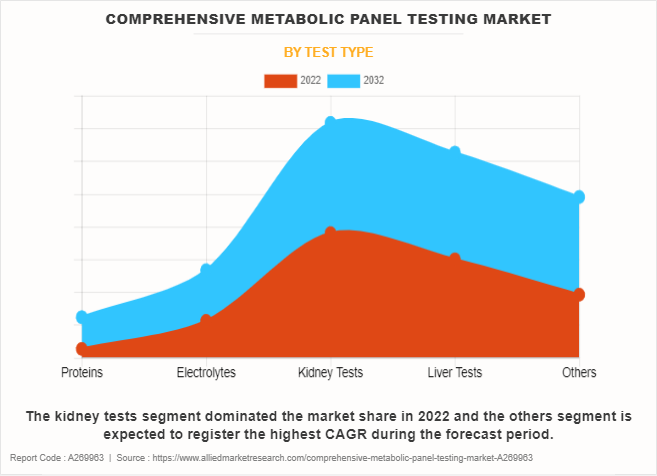

- By test type, the kidney tests segment dominated the global market in terms of revenue in 2022. However, the others segment is expected to register the highest CAGR during the forecast period.

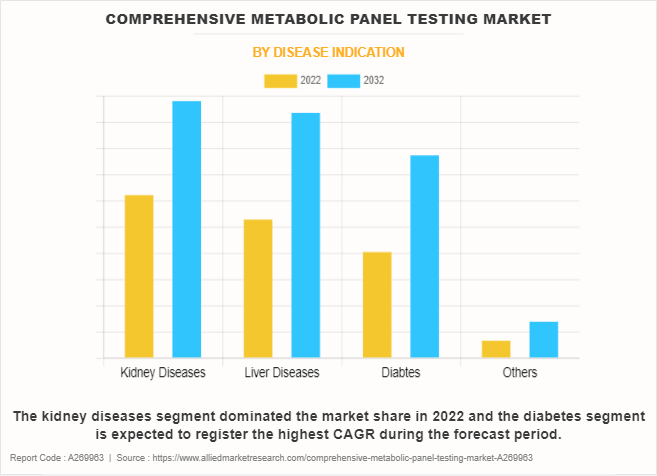

- By disease indication, the kidney diseases segment dominated the global market in terms of revenue in 2022. However, the diabetes segment is expected to register the highest CAGR during the forecast period.

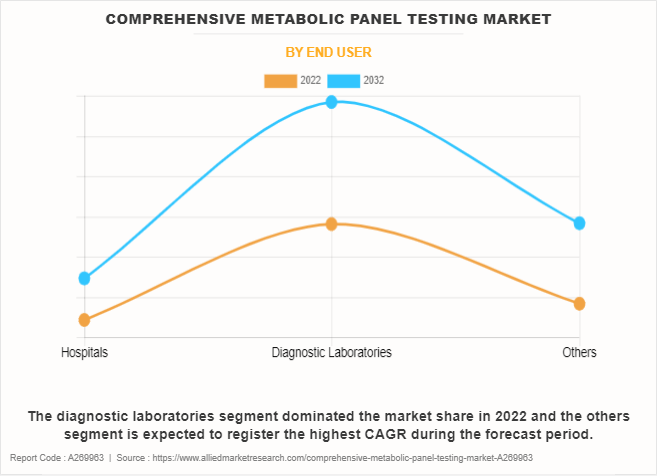

- By end user, the diagnostic laboratories segment dominated the market in terms of revenue in 2022. However, the others segment is expected to register the highest CAGR during the forecast period.

- By region, North America dominated the comprehensive metabolic panel testing market share in terms of revenue in 2022. However, Asia-Pacific is expected to register the highest CAGR during the forecast period.

Market Dynamics

The increase in prevalence of significant chronic diseases has led to a consistent escalation in the demand for comprehensive metabolic panel testing methods. In addition, technological advancements in diagnostic methodologies and laboratory equipment play a pivotal role in propelling the comprehensive metabolic panel testing market growth. Continuous innovations in the field of diagnostics enhance the accuracy, efficiency, and accessibility of metabolic testing. Automated laboratory systems, improved assay methodologies, and the integration of sophisticated technologies contribute to the precision of CMP tests, providing healthcare professionals with reliable and comprehensive information about a patient's metabolic profile. These technological advancements not only improve the diagnostic capabilities of CMP testing but also streamline the testing process, making it more efficient and convenient for both healthcare providers and patients.

The comprehensive nature of the CMP, which encompasses multiple kidney function markers alongside other metabolic indicators, positions it as a holistic diagnostic tool. Healthcare providers benefit from obtaining a comprehensive overview of metabolic health, including kidney function, facilitating more informed diagnoses and treatment decisions. This integrated approach reinforces the significance of kidney diseases and drives market growth. Furthermore, growing awareness among individuals about the importance of routine health check-ups and early disease detection further supports market growth. As a cornerstone of preventive healthcare, CMP testing provides a holistic evaluation of metabolic health, allowing for the identification of risk factors before they escalate into more severe health issues. This emphasis on preventive care aligns with the broader trend of proactive health management, driving the adoption of CMP testing as a valuable tool for comprehensive health assessments.

Moreover, the rise in aging population is another compelling factor contributing to the growth of the comprehensive metabolic panel testing market. With a higher proportion of elderly individuals, there is an associated increase in age-related health issues. For instance, according to the National Council on Aging, in 2023, nearly 95% of adults 60 and older had at least one chronic condition, while nearly 80% have two or more. The CMP test becomes an essential tool in managing the health of the aging population by providing insights into metabolic functions, kidney health, and liver function. Regular assessments through CMP testing aid healthcare professionals in identifying and addressing age-related health concerns, contributing to improved overall health outcomes in the elderly.

However, the advanced comprehensive metabolic panel testing technologies are not readily available or accessible in certain developing regions due to lack of infrastructure, lack of resources, and insufficient training facilities. This hinders the widespread adoption of sophisticated methods in such areas that restrain the market growth. On the other hand, the rise in technological advancements in diagnostic and rise in demand for point of care testing provide lucrative comprehensive metabolic panel testing market opportunity to market growth.

Furthermore, the increasing adoption of POC testing in various healthcare settings, including primary care offices, urgent care clinics, and community health centers, contributes to the segment's anticipated high growth rate. POC testing allows for immediate diagnostics at the point of patient interaction, reducing the need for sample transportation and central laboratory processing. This streamlined approach aligns with the preferences of both healthcare providers and patients, further driving the growth of comprehensive metabolic testing market growth.

Segments Overview

Comprehensive metabolic panel testing market analysis is segmented into test type, disease indication, end user, and region. By test type, the market is categorized into proteins, electrolytes, kidney tests, liver test, and others. By disease indication, the market is categorized into kidney diseases, liver diseases, diabetes, and others. By end user, it is segregated into hospitals, diagnostic laboratories, hospitals, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA.

By Test Type

The kidney tests segment dominated the global comprehensive metabolic panel testing market size in 2022, owing to emphasis on early diagnosis and management of kidney diseases has fueled the demand for CMP testing. In addition, the comprehensive nature of the CMP testing, which includes multiple kidney function markers alongside other metabolic indicators, positions it as a holistic diagnostic tool for healthcare providers which further supports the segment growth. However, the others segment is expected to register the highest CAGR of 5.8% during the forecast period, owing to the increase in prevalence of diabetes, the growing awareness of preventive healthcare, and rise in technological advancements enhancing the accuracy of these assessments. In addition, innovations in blood glucose monitoring devices and improved calcium testing methods contribute to the segment's growth.

By Disease Indication

The kidney diseases segment dominated the global comprehensive metabolic panel testing market share in 2022, owing to the increase in prevalence of kidney diseases, rise in aging population, the link between kidney function and other prevalent health conditions, and the comprehensive diagnostic capabilities of the CMP. However, the diabetes segment is expected to register the highest CAGR of 5.7% during the forecast period, owing to the rise in sedentary lifestyles, unhealthy dietary habits, and the aging population contributing to the surge in diabetes cases worldwide. In addition, the increase in awareness and education surrounding diabetes, coupled with the importance of lifestyle modifications, contribute to a more proactive approach to managing the condition which supports the segment growth.

By End User

The diagnostic laboratories segment held the largest market share in 2022, owing to its pivotal role in conducting accurate and comprehensive metabolic assessments. The widespread accessibility of diagnostic laboratories, their proficiency in handling a high volume of tests, advancements in laboratory technology, and collaborative efforts within healthcare networks collectively contribute to the dominance of this segment in delivering CMP testing services. However, the hospitals segment is expected to register the highest CAGR during the comprehensive metabolic panel testing market forecast period, owing to advancements in POC testing technologies, innovations in portable and user-friendly diagnostic devices, as well as improvements in the accuracy and reliability of POC tests, contribute to the expanding scope of services offered at these centers. In addition, the emphasis on timely and efficient healthcare delivery further drives the growth of POC testing.

By Region

The comprehensive metabolic panel testing industry is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. North America has accounted for the largest share in the comprehensive metabolic panel testing market and is expected to remain dominant during the forecast period. This dominance is attributed to the advanced healthcare infrastructure, well-established healthcare practices, and a rise in prevalence of chronic diseases. The robust healthcare system in North America supports the widespread adoption of CMP testing as a routine diagnostic tool, favorable government initiatives and reimbursement policies contribute to its sustained growth. In addition, the proactive approach to preventive healthcare and continuous technological advancements further solidifies its leading position in the comprehensive metabolic panel testing market.

However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to the rapid economic development, rise in aging population, increase in prevalence of lifestyle-related diseases such as diabetes, and growing awareness of preventive healthcare practices. As countries in the Asia-Pacific region invest in healthcare infrastructure and technology, the demand for comprehensive metabolic panels is expected to rise, creating significant opportunities for market expansion.

Competitive Analysis

Key player such as Quest Diagnostics have adopted product launch and acqusiition as key developmental strategies to improve the product portfolio of the comprehensive metabolic panel testing market. For instance, in January 2022, Quest Diagnostics launced virtual preventive care service through QuestDirect to help individuals take control of their health. The Comprehensive Health Profile combines many of the tests and biometric screenings that a physician order as part of an annual physical, such as a complete blood count, comprehensive metabolic panel.

Recent Developments in the Comprehensive Metabolic Panel Testing Industry

In December 2021, Quest Diagnostics the nation's leading provider of diagnostic information services announced that it has acquired substantially all assets of Labtech Diagnostics, an independent clinical diagnostic laboratory provider serving physicians and patients primarily in South and North Carolina, Georgia and Florida. With the acquisition, Quest broadens access to diagnostic innovation and insights empowering better health for more communities in the Southeast.

In April 2020, Nova Biomedical announced the U.S. Food and Drug Administration (FDA) has cleared its Stat Profile Prime Plus critical care blood gas analyzer for point-of-care (POC) use. This clearance allows POC personnel to perform bedside critical care testing with lab-quality results in as little as one minute. Prime Plus features maintenance-free sensor technology to provide 19 essential critical care tests including blood gases, electrolytes, metabolites, hematology, and co-oximetry, providing clinicians with a rapid, detailed diagnostic profile, including a comprehensive metabolic panel.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the comprehensive metabolic panel testing market analysis from 2022 to 2032 to identify the prevailing comprehensive metabolic panel testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the comprehensive metabolic panel testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global comprehensive metabolic panel testing market trends, key players, market segments, application areas, and market growth strategies.

Comprehensive Metabolic Panel Testing Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 266 |

| By Test Type |

|

| By Disease Indication |

|

| By End User |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche Ltd., Walk-In Lab, LLC., Blueprint Genetics, Scion Lab Services, LLC, Applied InGENuity Diagnostics, ARUP Laboratories, Quest Diagnostics, Laboratory Corporation of America Holdings, My Care Labs, Baptist Health |

Analyst Review

This section provides various opinions of global comprehensive metabolic panel testing market. The comprehensive metabolic panel testing market is expected to witness a significant growth in the future, owing to a rise in prevalence of chronic diseases, and rise in aging population. However, a lack of awareness among both individuals and healthcare providers about the benefits of comprehensive metabolic panel testing in developing regions restricts market growth.

In addition, advancements in diagnostic technologies and shift towards a preventive healthcare approach is expected to fuel the growth of the comprehensive metabolic panel testing market. The ongoing integration of information technology in healthcare systems also contributes to the positive outlook for market growth. Electronic health records (EHRs), data analytics, and improved connectivity streamline the testing process, making it more efficient and accessible. This integration supports healthcare professionals in making informed decisions based on comprehensive metabolic data, further driving the market growth.

Furthermore, North America accounted for the largest share in 2022 and is expected to remain dominant during the forecast period. This is attributed to the advanced healthcare infrastructure, a well-established system that supports the widespread adoption of diagnostic services, including comprehensive metabolic testing and availability of skilled healthcare workforce enhances the efficiency and accuracy of CMP testing.

However, Asia-Pacific is anticipated to witness notable growth owing to growing healthcare infrastructure, rise in aging population and increased accessibility to medical services. In addition, rise in incidence of lifestyle-related diseases in the Asia-Pacific region, such as diabetes and cardiovascular disorders, is driving the demand for routine metabolic monitoring.

The total market value of comprehensive metabolic panel testing market is $10.1 billion in 2022.

The market value of comprehensive metabolic panel testing market in 2032 is $16.1 billion.

The forecast period for comprehensive metabolic panel testing market is 2023 to 2032.

The base year is 2022 in comprehensive metabolic panel testing market.

North America is accounted for the largest market share in 2022 owing to well established healthcare infrastructure, rise in prevalence of chronic diseases and rise in technological advancements.

Increasing prevalence of chronic diseases, aging population requiring regular health monitoring, and advancements in testing technologies are key drivers fueling the market expansion.

A comprehensive metabolic panel (CMP) is a blood test that measures various substances in the blood to provide information about the functioning of several organ systems, including the liver, kidneys, and cardiovascular system.

Quest Diagnostics, Laboratory Corporation of America Holdings, F. Hoffmann-La Roche Ltd, and Walk-In Lab, LLC. held a high market position in 2022.

Loading Table Of Content...

Loading Research Methodology...