Compressed Natural Gas Market Overview

The global compressed natural gas market size was valued at USD 9.9 billion in 2020, and is projected to reach USD 22.3 billion by 2030, growing at a CAGR of 8.2% from 2021 to 2030. Cost-effective CNG is preferred in many countries, owing to increasing oil prices. In addition, growth in energy requirement by various nations leads to use of CNG, which drives growth of the market during the forecast period. Furthermore, surge in stringent government regulations in pollution control and increase in financial health of many countries across the globe fuels the compressed natural gas market growth during the forecast period. However, initial investment cost, installation costs, and high cost of CNG storage tanks in automobiles with limited number of CNG fueling stations hinder the growth of compressed natural gas market in the future.

Key Market Trends & Insights

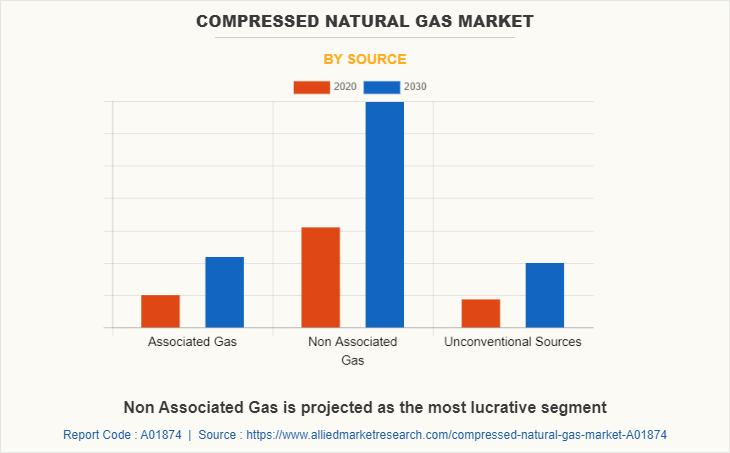

- Non-associated gas segment dominated the global CNG market with 62.4% share in 2020 and is expected to maintain dominance.

- Associated gas segment accounted for 20.2% in 2020 and is projected to grow at 7.9% CAGR.

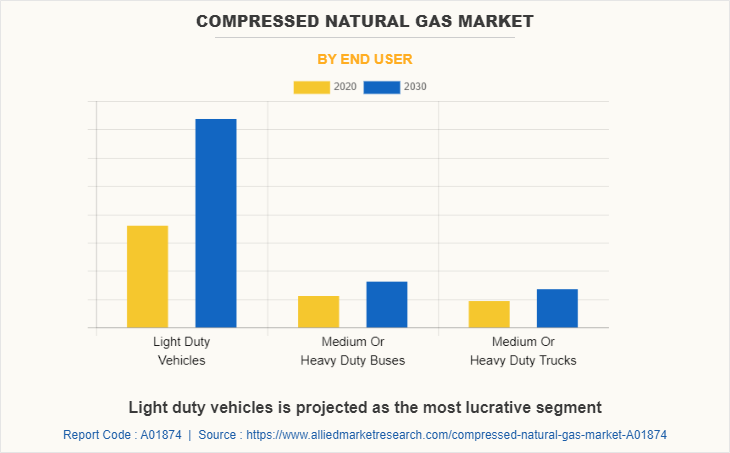

- Light-duty vehicles held 86.6% market share in 2020 and are expected to grow at 8.3% CAGR.

- Medium/Heavy-duty buses are the fastest-growing segment, projected at 8.5% CAGR (2021–2030).

- North America is expected to register the highest growth with 8.7% CAGR during the forecast period.

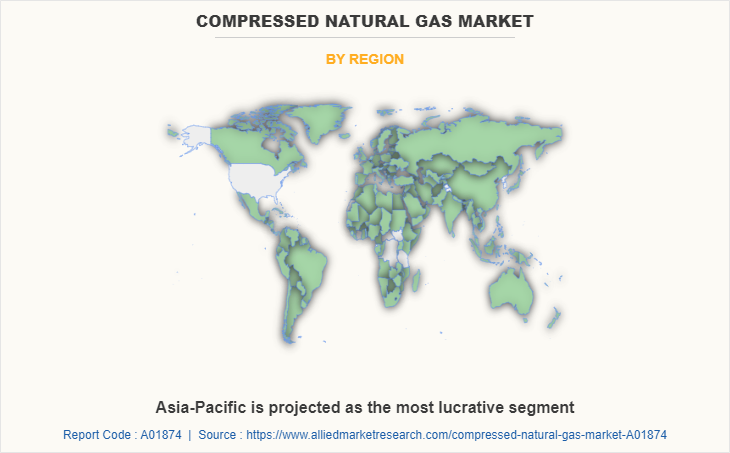

- Asia-Pacific dominated the market in 2020 with over 68.13% revenue share.

Market Size & Forecast

- 2030 Projected Market Size: USD 22.3 Billion

- 2020 Market Size: USD 9.9 billion

- Compound Annual Growth Rate (CAGR) (2021-2030): 8.2%

Introduction

Compressed natural gas (CNG) is a mixture of methane and trace quantities of light hydrocarbons, nitrogen, and CO2, which are generated during geological transformation from peat to anthracite coal. It is important for sustainable growth of industrial sector, owing to depletion in oil and coal reserves and limitation in emission properties of gas fuel. Specific CNG is designed for customized end use in various applications that require higher performance or stability.

Market Segmentation

Compressed natural gas market is segmented on the basis of source, end user, and region. Depending on source, it is categorized into associated gas, non-associated gas, and unconventional sources. According to end user, it is segregated into light duty vehicles, medium/heavy duty buses, medium/heavy duty trucks, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on source, non associated gas segment dominated the market in 2020, owing to rise in demand for CNG and emergence of non-associated gas reservoir for CNG production across the globe. In addition, rise in exploration and production activities in non-associated gas reservoirs are anticipated to fuel the growth of the global compressed natural gas market in the future.

By end user, the light duty vehicles segment dominated the global market in 2020, in terms of share, owing to rise in demand for light duty vehicles with increase in consumer expenditure across the developing regions, including Asia-Pacific and LAMEA. In addition, rise in awareness toward air pollution and reduction in price of CNG compared to other fossil fuels fuel the global compressed natural gas market growth in future.

Asia-Pacific garnered the highest compressed natural gas market share in the year 2020, in terms of revenue, and is anticipated to maintain its dominance throughout the compressed natural gas market forecast period. This is attributed to presence of huge consumer base, rapid development of transportation sector, and existence of key players in the region. Moreover, presence of countries, including China, Japan, India, South Korea, and Australia contribute toward the growth of the compressed natural gas market in Asia-Pacific.

The CNG market is analyzed in accordance with the impacts of the drivers, restraints, and opportunities. The period studied in this report is 2021–2030. The report includes the study of the CNG market with respect to the growth prospects and restraints based on the regional analysis. The study includes Porter’s five forces analysis of the compressed natural gas industry to determine the impact of suppliers, competitors, new entrants, substitutes, and buyers on the market growth.

Which are the Top Compressed Natural Gas companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the compressed natural gas industry.

- Chevron Corporation

- Eni

- Royal Dutch Shell Plc.

- EOG Resources, Inc.

- Trillium CNG

- Occidental Petroleum Corporation

- Phillips 66 Company

- JW Power Company

- Total Energies

- Indraprastha Gas Limited

- Neogas, Inc.

- Gazprom Neft

- BP Plc.

- GNVERT

- ANGI Energy Systems Inc.

- Exxon Mobil Corporation

- Lukoil

- Rosneft

- National Iranian Gas Company

- Mahanagar Gas Limited

- China Natural Gas, Inc.

What are the Recent Developments in the Compressed Natural Gas Market

- For instance, in September 2021, Chevron U.S.A., Inc. signed an agreement to form joint venture with Mercuria Energy Trading (Integrated energy and commodities company). This joint venture aimed at increasing the natural gas value chain of Chevron in opening more than 30 Chevron-branded CNG stations by 2025. This strategy will strengthen the presence of company in the region.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the compressed natural gas market analysis from 2020 to 2030 to identify the prevailing compressed natural gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the compressed natural gas market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global compressed natural gas market trends, key players, market segments, application areas, and market growth strategies.

Compressed Natural Gas Market Report Highlights

| Aspects | Details |

| By Source |

|

| By End User |

|

| By Region |

|

| Key Market Players | Indraprastha Gas Limited, Royal Dutch Shell Plc, Chevron Corporation, EOG Resources, Inc., Occidental Petroleum Corporation, Eni, Trillium Energy, JW Power Company, Phillips 66 Company, Total Energies |

Analyst Review

Urbanization and growth of transportation sector are the key factors attributed to the leading position of Asia-Pacific in compressed natural gas market. Huge potential in Asia-Pacific to set up transportation infrastructure and compressed natural gas (CNG) are expected to provide lucrative growth opportunities to leading synchronous condenser manufacturers.

Recovering oil prices during last year and warning by the International Energy Agency (IEA) that there might be a relative shortage of liquid fuels by 2020 prompts governments and transport industries to opt for alternative fuels/technologies. This reduced the dependence of transport sector on liquid fossil fuels, decreasing the economic risks associated with the price volatility of conventional oil-derived fuels and thereby, driving the growth of the CNG market. Low price and high efficiency of CNG drive the growth of the market. In addition, rise in awareness and increase in stringent government regulations toward carbon emissions fuel the growth of the market during the forecast period.

Among the analyzed regions, Asia-Pacific is likely to account for the highest revenue in the market throughout the forecast period, followed by Europe, LAMEA and North America.

Light duty vehicles is the potential customer of Compressed Natural Gas industry

Rise in demand for CNG from transportation industry, stringent government regulations towards environmental pollution caused by pollutant emissions and rise in investment in CNG infrastructure are expected to be the upcoming trends of Compressed Natural Gas Market in the world

Asia-Pacific is the largest regional market for Compressed Natural Gas

Agreement, investment, and business expansion are the key growth strategies of Compressed Natural Gas Market players.

Key benefits of the compressed natural gas market report include detailed analysis on global trends, key players, competitive scenario, opportunities, market size & forecast, and segmental & regional analysis.

Chevron Corporation, Eni, Royal Dutch Shell Plc., EOG Resources, Inc., Trillium CNG, Occidental Petroleum Corporation, Phillips 66 Company, JW Power Company, Total Energies, and Indraprastha Gas Limited are the top companies to hold the market share in Compressed Natural Gas market.

The global compressed natural gas market was valued at $9.9 billion in 2020, and is projected to reach $22.3 billion by 2030, growing at a CAGR of 8.2% from 2021 to 2030.

On the basis of source, non associated gas segment held the largest market share in the CNG market. By end user, the light duty vehicles segment held the largest market share in the CNG market.

Loading Table Of Content...