The global compression stockings market size was valued at $1.9 billion in 2022, and is projected to reach $3.4 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

The compression stockings industry refers to the industry involved in the production, distribution, and sale of specialized garments designed to improve leg circulation and provide therapeutic benefits. This market includes manufacturers, suppliers, retailers, and healthcare professionals who cater to individuals seeking relief from conditions such as varicose veins, edema, or deep vein thrombosis. With increasing awareness and demand for leg health products, the compression stockings industry offers a range of options to meet various needs and preferences.

The compression stockings market is witnessing substantial growth, driven by a multitude of industry trends and growth drivers. A prominent factor propelling the market is the escalating occurrence of venous disorders, including varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency (CVI). This surge in prevalence has fostered a heightened demand for compression stockings, recognized as an efficacious means of managing and treating these conditions.

The aging population represents another compelling growth driver. As the global demographic landscape skews towards older individuals, the propensity for circulatory issues and venous disorders escalates. Compression stockings emerge as a highly recommended solution for the elderly, as they aid in symptom alleviation and bolster leg health. Furthermore, the augmenting awareness of the multifarious benefits of compression stockings has contributed to market growth. Increasingly informed consumers seek preventive measures and treatment options, resulting in heightened adoption rates.

Technological breakthroughs pertaining to fabric materials and garment design have indisputably propelled the expansion of the compression stockings market. Pioneering manufacturers continually strive to engineer materials that offer enhanced comfort, breathability, and aesthetic appeal. These advancements have significantly augmented the appeal of compression stockings, dispelling social stigma and fostering market growth.

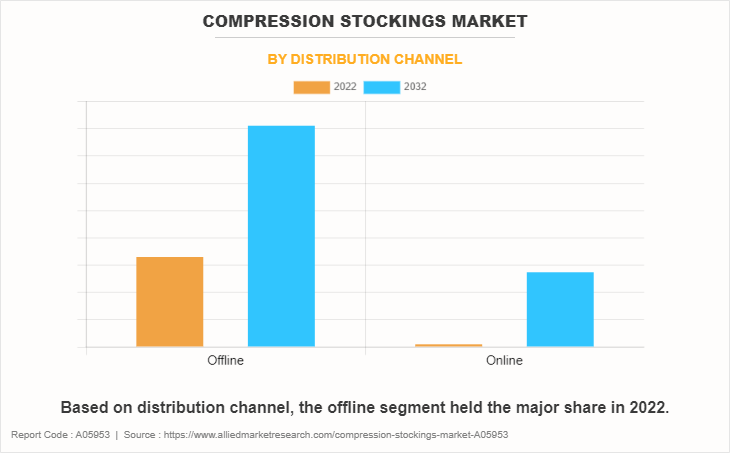

The burgeoning realm of e-commerce represents a profound avenue of business opportunity within the compression stockings market. Online retail platforms have revolutionized accessibility by providing convenient and comprehensive access to an extensive array of compression stockings. Consumers can effortlessly compare products, scrutinize reviews, and consummate purchases from the solace of their own abodes. The proliferation of e-commerce has facilitated the dissemination of compression stockings to regions with limited physical retail access, thereby expanding market reach and unlocking new growth prospects.

Despite the positive trajectory, the compression stockings market confronts certain challenges. Chief among them is the dearth of awareness among potential consumers. While consciousness is increasing, a considerable number of individuals remain unaware of the benefits associated with compression stockings and their potential to enhance leg health. Addressing this challenge necessitates robust consumer education initiatives to underscore the significance of compression therapy and its manifold applications.

Additionally, the relatively high cost of compression stockings poses a hurdle to Compression Stockings Market Growth. Premium-quality compression stockings often carry a substantial price tag, thereby limiting accessibility within certain consumer segments. Mitigating this challenge entails exploring avenues for cost reduction through economies of scale and heightened competition, thereby enhancing affordability and widening the consumer base.

In summation, the compression stockings market is poised for significant growth, fueled by an amalgamation of industry trends and growth drivers. The escalating prevalence of venous disorders, the burgeoning aging population, advances in fabric technology and garment design, and the proliferation of e-commerce platforms collectively underpin market expansion. Nevertheless, challenges such as limited awareness and cost constraints warrant concerted efforts. All in all, the compression stockings market presents a compelling landscape of business opportunities for manufacturers, retailers, and healthcare professionals alike as they endeavor to cater to the burgeoning Compression Stockings Market Demand for leg health solutions.

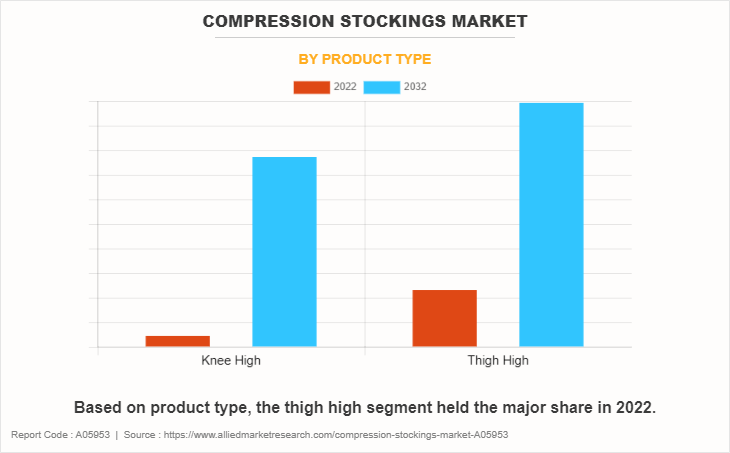

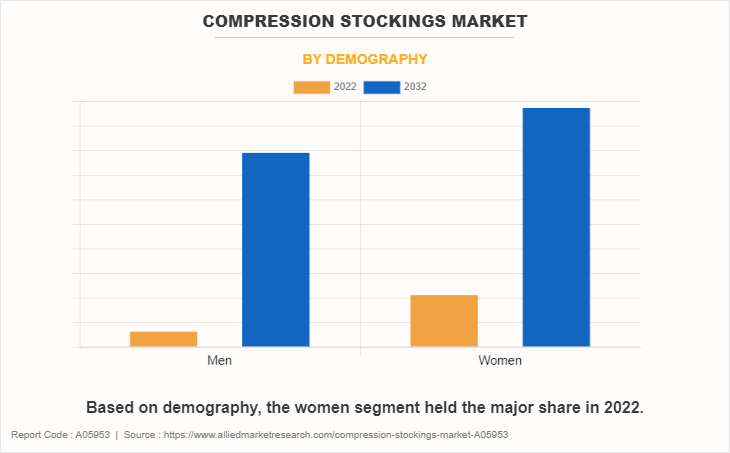

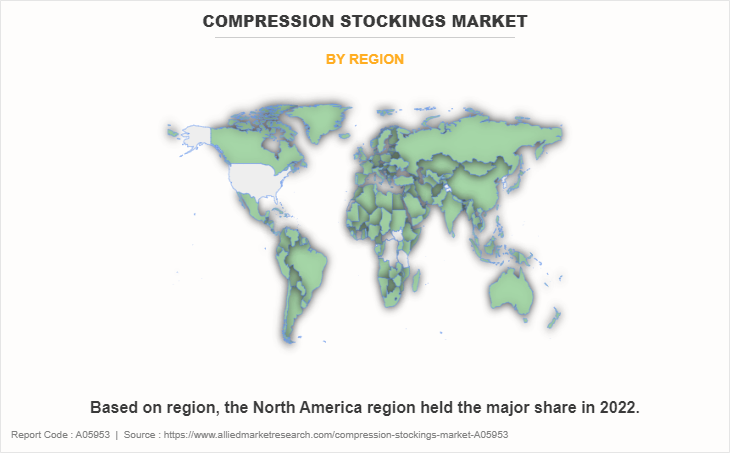

The compression stockings market forecast is segmented on the basis of type, demography, distribution channel, and region. By type, the market is classified into Knee High and Thigh High. By demography, the market is classified into Men and Women. By distribution channel, the market is classified into departmental stores and E-Commerce. Region-wise, it is analyzed across North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, New Zealand, and Rest of Asia-Pacific), And LAMEA (Latin America, Middle East, Africa).

On the basis of type, the compression stockings market is segmented into knee-high and thigh-high. The thigh-high segment accounted for a major Compression Stockings Market Share in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for thigh-high compression stockings is rising in the compression stockings market due to several factors. Thigh-high stockings provide compression and support not only to the lower leg but also extend up to the thigh region.

On the basis of demography, the market is classified into Men and Women. The Women segment accounted for a major share of the compression stockings market in 2022 and is expected to grow at a significant CAGR during the forecast period. In the compression stockings market, the women segment refers to the specific demographic group of female consumers. Women form a significant portion of the target market for compression stockings due to various factors.

On the basis of distribution channel, the market is classified into departmental stores and E-Commerce. The departmental stores segment accounted for a major share of the compression stockings market in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for compression stockings in the departmental stores segment is rising in the market due to several reasons. Departmental stores offer a wide range of products, including compression stockings, making them a convenient one-stop destination for customers.

Region-wise, it is analyzed across North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, New Zealand, and Rest of Asia-Pacific), And LAMEA (Latin America, Middle East, Africa). The North America region accounted for a major share of the compression stockings market in 2022 and is expected to grow at a significant CAGR during the forecast period. The demand for compression stockings in North America is rising due to several factors. Firstly, an aging population and increasing prevalence of venous disorders contribute to the growing need for compression therapy.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. They have been also focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the compression stockings market include Spanx Inc., Triumph International Corporation, 2xu Pty Ltd., Leonisa, Ann Chery, Colfax Corporation (DJO Global), I-Runner, European Lingerie Group, Creswell Sock Mills, and Zhende Medical Group.

Key Market Developments:

- In October of 2020, 3M unveiled the PREVENT RESTOR AXIO FORM™ Incision Management System, designed to assist in the care of post-surgery incisions, as well as the adjacent soft tissue surrounding them, after orthopedic procedures aimed at repairing lower extremity fractures.

- In April 2016, BSN Medical introduced a trio of novel, all-inclusive therapeutic solutions tailored for the treatment of venous leg ulcers, diabetic foot ulcers, and postoperative surgical sites.

- In 2015, BSN Medical completed the acquisition of Wright Therapy Products, Inc., a company renowned for its production of compression therapy systems.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the compression stockings market analysis from 2022 to 2032 to identify the prevailing compression stockings market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the compression stockings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global compression stockings market trends, key players, market segments, application areas, and market growth strategies.

Compression Stockings Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.4 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 444 |

| By Demography |

|

| By Distribution Channel |

|

| By Product Type |

|

| By Region |

|

| Key Market Players | Spanx, LLC, Triumph Home Health Supplies, Creswell Sock Mills, Zensah, Enovis Corporation, FIGS, Inc., Swiftwick, European Lingerie Group AB, 2XU Pty Ltd., Away |

Analyst Review

According to the insights of the CXOs, the global compression stockings market is expected to witness robust growth during the forecast period. The increasing prevalence of venous disorders is a significant driver behind the compression stockings market growth. Venous disorders such as varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency (CVI) are becoming more common, affecting a substantial portion of the population. These conditions can cause pain, discomfort, swelling, and other complications, leading individuals to seek effective solutions like compression stockings. Compression stockings are specifically designed to apply pressure to the legs, promoting healthy blood circulation and preventing blood pooling or stagnation.

However, the surge in awareness regarding the potential side effects of compression garments is impeding the growth of the market. As individuals become more informed, they are increasingly cautious about the potential risks associated with prolonged or improper use of compression garments. Concerns such as skin irritation, discomfort, restricted mobility, and muscle atrophy have been raised, leading to hesitancy in adopting compression garments. Such factors are restraining the market growth.

The Compression Stockings market size was valued at $1,871.4 million in 2022 and is expected to reach $3,362.5 billion by 2032, registering a CAGR of 6.1% from 2023 to 2032.

The global Compression Stockings market registered a CAGR of 6.1% from 2023 to 2032.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the Compression Stockings market report is from 2023 to 2032.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships. Further, they have been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the compression stockings market include Spanx Inc., Triumph International Corporation, 2xu Pty Ltd., Leonisa, Ann Chery, Colfax Corporation (DJO Global), I-Runner, European Lingerie Group, Creswell Sock Mills, and Zhende Medical Group.

Loading Table Of Content...

Loading Research Methodology...