Connected Car Market Insights, 2033

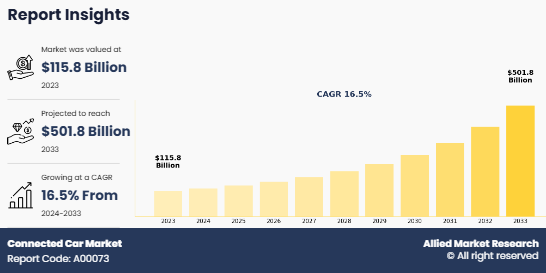

The global connected car market size was valued at $115.8 billion in 2023, and is projected to reach $501.8 billion by 2033, growing at a CAGR of 16.5% from 2024 to 2033.

A connected car is a vehicle that is equipped with internet connectivity and communication systems that enable it to interact with devices, services, and networks outside of the car. These cars can communicate with other vehicles (V2V), infrastructure (V2I), and the cloud (V2C) to enhance the driving experience, provide real-time updates, improve safety, and offer advanced functionalities like navigation, infotainment, and remote diagnostics. Connected cars are essential in supporting technologies such as autonomous driving, smart transportation systems, and fleet management, enabling features like remote vehicle monitoring, over-the-air updates, driver assistance, and improved traffic management.

Key Developments

February 2024: HARMAN International collaborated with Qualcomm to Drive Automotive Innovation with New Ready Connect 5G TCU for Connected Cars. The Ready Connect 5G TCU, powered by the Snapdragon Modem-RF Gen 2 system, delivers outstanding connectivity performance, ensuring upgradability, scalability, and usability to meet the automotive market's evolving needs.

January 2024: Ford Motor Company and its subsidiary Lincoln launched Updated Connected Car Services that includes Apple CarPlay and Android Auto. Through this technology, the driver can access the system through a touchscreen control panel and buttons on the steering wheel. Furthermore, drivers can place apps and services where they want them on the screen and can see information like media, weather and fuel economy via widgets

September 2022: Ford Motor Company collaborated with Qualcomm Technologies to developed Next Generation Connected Vehicle Innovation with 5G Connectivity Powered by Snapdragon 5G Modem-RF. The Snapdragon 5G Modem-RF help to unlock the 5G capabilities needed to support connected and intelligent driving experiences.

July 2021: AUDI AG partnered with Mobileum Inc. to deploy Mobileum’s Connected Car Testing solution to test & monitor the end-to-end quality of service (QoS) of connected cars and to ensure the highest standards of service assurance and control over customer experience. This technology helps to provide quality assurance for eCall, IoT Telemetry, eSIM remote provisioning, and business applications availability.

Market Dynamics

Increase in demand for ADAS (Advanced Driver Assistance Systems)

The rising demand for advanced driver assistance systems is significantly contributing to the growth of connected car industry. As consumers become increasingly safety-conscious, the appeal of vehicles equipped with ADAS features is undeniable. These systems offer functionalities such as adaptive cruise control, lane departure warnings, and automatic emergency braking, all of which enhance driver safety and convenience. Manufacturers are responding to this trend by integrating ADAS into a broader range of vehicles, not just luxury models. This shift is making advanced safety features more accessible to the average consumer, thereby expanding the market.

Moreover, as regulatory bodies around the world implement stricter safety standards, the inclusion of ADAS has become essential for compliance. This regulatory push is driving automakers to invest heavily in connected technologies that support these advanced systems, ultimately leading to a surge in sales. Additionally, the synergy between ADAS and connectivity technologies enhances the overall driving experience. Vehicles equipped with ADAS can share data with other vehicles and infrastructure, improving traffic management and safety on the roads. This interconnectedness not only boosts consumer confidence in technology but also solidifies the position of connected car industry as the future of automotive mobility.

Growth of 5G network infrastructure is expected to increase sales of connected cars

The expansion of 5G network infrastructure is poised to play a pivotal role in boosting the sales of connected cars. With its higher data transfer speeds, lower latency, and enhanced reliability, 5G technology enables seamless communication between vehicles, other road users, and smart infrastructure. This advanced connectivity is essential for supporting a wide range of applications that enhance both safety and convenience.

As the automotive industry increasingly embraces features like vehicle-to-everything (V2X) communication, the need for robust network connectivity becomes paramount. 5G allows for real-time updates and interactions, facilitating functionalities such as traffic management, collision avoidance, and remote diagnostics. Such features not only improve the driving experience but also increase the appeal of connected cars to consumers seeking the latest technological advancements.

Moreover, as cities evolve into smart environments, the integration of 5G networks with connected car systems will enable efficient traffic flow and enhanced safety measures. Automakers are recognizing the potential of 5G to unlock new revenue streams through services such as in-car entertainment, navigation, and software updates. As these capabilities become standard, consumer demand for connected vehicles is expected to rise, ultimately driving significant growth in the market for connected cars.

High cost of connected car technology to limit sales of connected car

Despite the growing interest in connected cars, the high cost associated with the technology can pose a significant barrier to sales. Integrating advanced features such as sophisticated infotainment systems, sensors for vehicle-to-everything (V2X) communication, and autonomous driving capabilities require substantial investment in research, development, and manufacturing. These expenses often translate into higher vehicle prices, making connected cars less accessible to a broader consumer base.

Additionally, the ongoing costs of maintaining and updating connected systems can deter potential buyers. Consumers may be hesitant to commit to vehicles that not only carry a premium price tag but also require ongoing subscriptions or service fees for software updates, navigation, and other connected services. This can lead to apprehension about the overall long-term value of purchasing a connected vehicle.

Moreover, the perception that connected car technology is primarily a luxury feature can limit its appeal to budget-conscious consumers. As a result, automakers may struggle to penetrate mass markets where affordability is a key consideration. While the benefits of connected technology are clear, the associated costs could hinder widespread adoption and connected car market growth, ultimately impacting overall sales figures in the industry.

Partnerships between automakers and tech companies to create lucrative opportunities in the market

Partnerships between automakers and technology companies are creating lucrative opportunities in the connected car market share, driving innovation and enhancing product offerings. As vehicles become increasingly sophisticated, automakers recognize the need for expertise beyond traditional automotive engineering. Collaborating with tech companies enables them to leverage cutting-edge advancements in artificial intelligence, data analytics, and connectivity solution.

These alliances facilitate the development of advanced features such as real-time navigation, predictive maintenance, and enhanced infotainment systems, which significantly improve the driving experience. By combining automotive knowledge with technological prowess, companies can create vehicles that not only meet consumer demands but also exceed expectations in safety and convenience.

Additionally, such partnerships can accelerate the pace of research and development, enabling quicker implementation of new technologies. This agility allows automakers to stay competitive in a rapidly evolving market where consumer preferences are shifting towards more connected and autonomous vehicles. Moreover, these collaborations can open new revenue streams through subscription services, data monetization, and shared mobility solutions. As both industries continue to evolve, the synergy between automakers and tech firms is expected to drive significant growth in the connected car market forecast, creating a win-win situation for both parties and ultimately benefiting consumers.

Segmentation

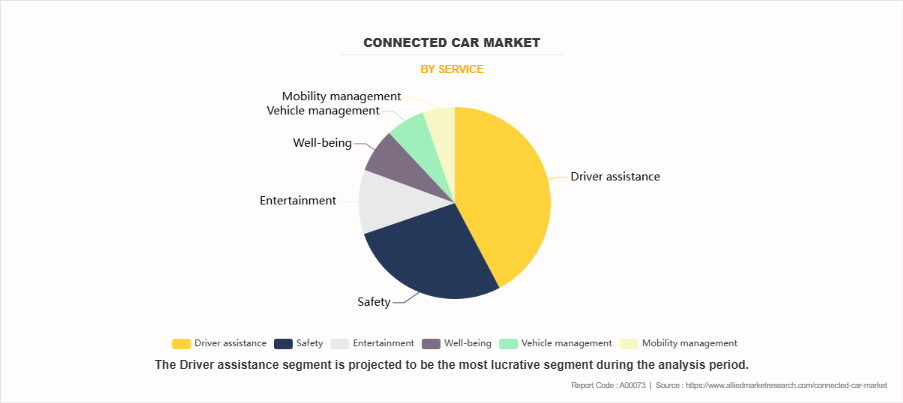

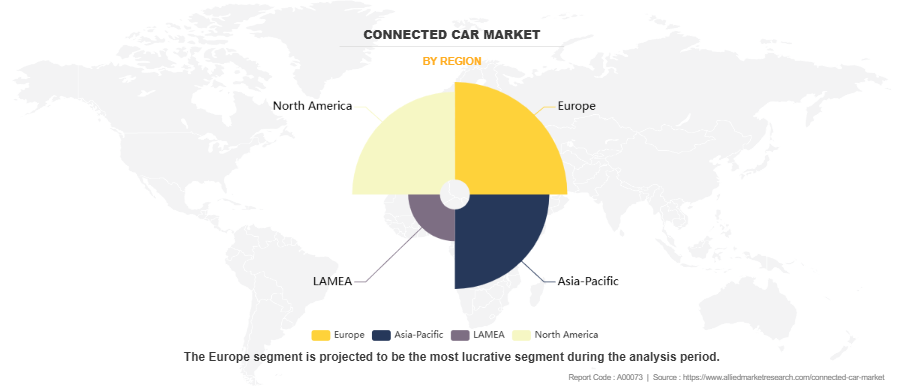

The connected car market size is segmented on the basis of technology, connectivity solution, service, sales channel, and region. On the basis of technology, the market is classified into 3G, 4G/LTE, and 5G. On the basis of connectivity solution, the market is bifurcated into integrated, embedded, and tethered. On the basis of service, the market is categorized into driver assistance, safety, entertainment, well-being, vehicle management, and mobility management. On the basis of sales channel, the market is divided into OEM, and aftermarket. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, Latin America. and Middle East & Africa.

By Technology

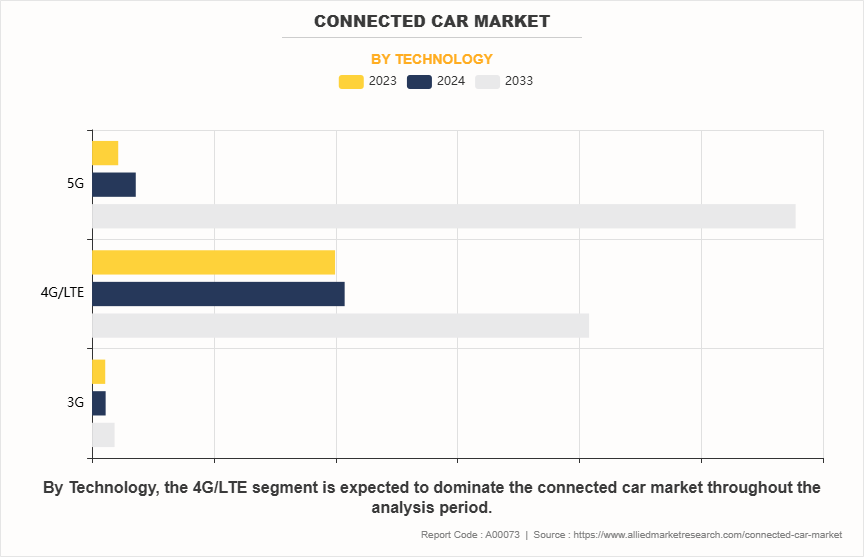

On the basis of technology, the market is classified into 3G, 4G/LTE, and 5G. The 4G/LTE segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period due to its widespread availability, reliable performance, and cost-effectiveness. Most automakers and consumers rely on 4G networks for connected vehicle services like real-time navigation, driver assistance, and infotainment. 4G infrastructure is well-established globally, making it the default choice for many connected cars. While 5G adoption is growing, 4G's extensive network coverage and compatibility with existing systems ensure it will remain dominant during the forecast period. As emerging markets continue to upgrade, 4G remains crucial for regions where 5G infrastructure is still developing.

By Connectivity solution

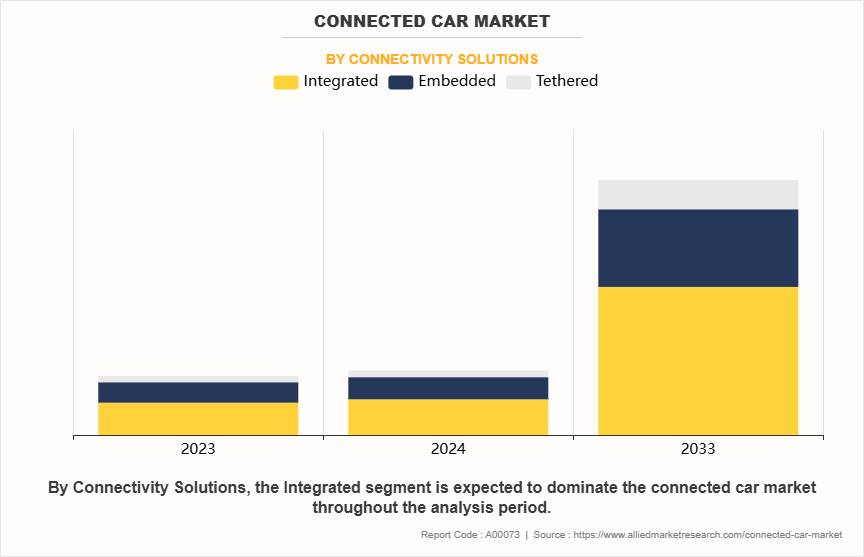

On the basis of connectivity solution, the market is bifurcated into integrated, embedded, and tethered. The integrated segment dominated the global market in the year 2023 due to its seamless integration with vehicle systems and enhanced user experience. Integrated systems provide real-time data, such as vehicle diagnostics and safety features, without relying on external devices. Automakers prefer integrated solutions as they enhance control over the car's software, allowing for smoother updates and better security. This segment is likely to remain dominant throughout the forecast period as manufacturers continue to prioritize seamless in-car experiences, and consumers demand more sophisticated, user-friendly technology that integrates infotainment, safety, and driver assistance systems into a unified platform.

By Service

On the basis of service, the market is categorized into driver assistance, safety, entertainment, well-being, vehicle management, and mobility management. The driver assistance segment dominated the global market in the year 2023 due to rising demand for safety features like lane-keeping assistance, adaptive cruise control, and automated emergency braking. Increasing regulations around vehicle safety, particularly in regions like North America and Europe, have made these systems standard in many new vehicles. Consumer demand for safer driving experiences also fueled the adoption of these technologies. As automakers integrate more advanced driver assistance systems (ADAS) to meet both regulatory standards and consumer expectations, the segment is expected to remain dominant, especially with advancements in autonomous driving technology further enhancing vehicle safety and performance.

By Sales Channel

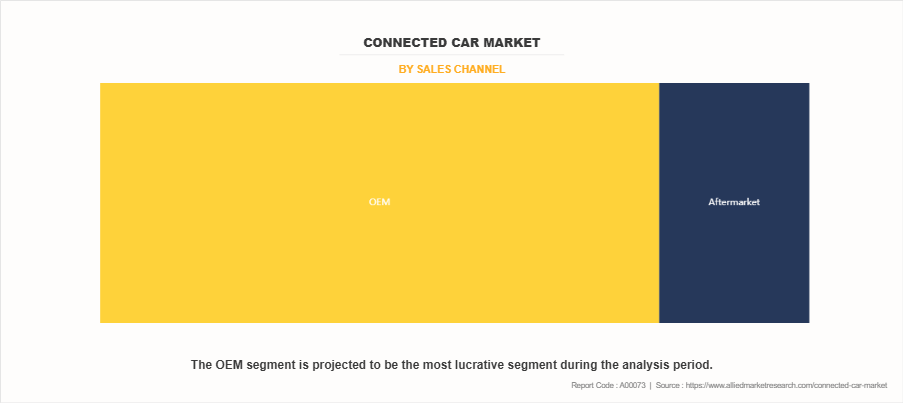

On the basis of sales channel, the market is categorized into OEM, and aftermarket. The OEM segment dominated the global market in the year 2023 due to the growing integration of connectivity solution directly into vehicles by manufacturers. As automakers increasingly offer built-in systems like infotainment, safety, and vehicle management solutions, the demand for factory-installed connected technologies surged. OEMs have capitalized on partnerships with tech companies to integrate advanced telematics and connectivity features, enhancing vehicle appeal. This dominance is expected to continue as automakers shift towards developing vehicles with integrated 5G connectivity and autonomous driving capabilities, providing a seamless, comprehensive experience that aftermarket solutions cannot fully replicate, further solidifying their market position.

By Region

On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Europe region dominated the global market in the year 2023 due to the region's advanced automotive industry and stringent safety regulations. European automakers, such as BMW, Mercedes-Benz, and Volkswagen, have led the adoption of connected technologies by integrating advanced telematics, driver assistance, and safety systems into vehicles.

The European Union's strict emission standards and safety directives, like eCall, which mandates emergency call systems in cars, further fueled the growth of connected vehicles. Additionally, Europe's strong 5G infrastructure development and investments in autonomous vehicle testing solidified its leadership, positioning the region for continued dominance throughout the forecast period.

Competition Analysis

The key players in the connected car market are AT&T, Audi, Continental AG, Ford Motor Company, Harman International, Intellias Ltd, Qualcomm Technologies, Inc., Robert Bosch GmbH, TomTom International BV, Verizon, and Visteon.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the connected car market analysis from 2023 to 2033 to identify the prevailing connected car market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the connected car market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global connected car market trends, key players, market segments, application areas, and market growth strategies.

Connected Car Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 501.8 billion |

| Growth Rate | CAGR of 16.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 280 |

| By Technology |

|

| By Connectivity Solutions |

|

| By Service |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Qualcomm Technologies, Inc. , Verizon, AT&T, Visteon Corporation, HARMAN International, TomTom International BV, Continental AG, AUDI AG, Ford Motor Company, Robert Bosch GmbH, Intellias |

Analyst Review

Connected car refers to a vehicle equipped with features to connect to internet or wireless local area network, which can be used for sharing of data with other devices and vehicles. Moreover, special technologies for internet access are integrated in the car to provide additional benefits such as navigation, vehicle diagnosis, mobility management, and others. The connected car market is in its nascent stage, and is contributing significant revenue for the overall automotive industry. Moreover, the connected car technology has witnessed increasing popularity among end users. In addition to the advantages, increase in its awareness among consumers is expected to lead to rapid growth of the market during the forecasted period.

Rise in trend of connectivity solutions, ease of vehicle diagnosis, and increase in need of safety & security are the key factors that fuel the growth of the global connected cars market. However, high likelihood of data hacking and unavailability of uninterrupted & seamless connectivity hinder the market growth.

Among the analyzed geographical regions, currently, North America is the highest revenue contributor, however, by the end of the forecast period, Europe is expected to garner highest revenue in the global market, followed by Asia-Pacific, North America, and LAMEA. This is attributed to rise in trend of connectivity solutions in Europe.

Partnerships between automakers & tech companies and expansion of autonomous vehicle fleets are the upcoming trends of connected car market in the globe.

Integrated is the leading connectivity solutions of connected car market.

Europe is the largest regional market for connected car.

The estimated industry size of connected car is $501.8 Bn in 2033.

Vehicle management is the fastest growing segment by service segment.

Loading Table Of Content...

Loading Research Methodology...