Constipation Treatment Market Research, 2032

The global constipation treatment market size was valued at $5.9 billion in 2022, and is projected to reach $10.1 billion by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Constipation refers to a condition characterized by infrequent passage of stool, often resulting in dry, hard, and painful bowel movements. It occurs when the muscles in the intestines are not effectively moving waste through the digestive system, causing stool to become compacted and difficult to eliminate. Common symptoms of constipation include straining during bowel movements, a sense of incomplete evacuation, abdominal discomfort, bloating, and a decrease in the frequency of bowel movements. Various factors, such as a lack of dietary fiber, inadequate fluid intake, a sedentary lifestyle, certain medications, and underlying medical conditions, can contribute to the development of constipation.

Market Dynamics

Growth of the global constipation treatment market size is majorly driven by rise in prevalence of chronic pain, increase in prevalence of constipation, and rise in availability of effective drugs for constipation treatment. Increase in prevalence of chronic pain is anticipated to drive the use of pain killers. Painkillers, also known as analgesics, can cause constipation through a variety of mechanisms, primarily by affecting the gastrointestinal (GI) tract and nervous system. Some of the most common painkillers, like opioids, can have significant constipating effects. Painkillers, especially opioids like morphine, codeine, oxycodone, and hydrocodone, can slow down the movement of the GI tract. This slowdown, known as decreased gastrointestinal motility or transit, can lead to constipation by delaying the passage of stool through the intestines. Thus, rise in prevalence of chronic pain is anticipated to drive the use of pain killers.

For instance, in November 2022, according to article shared by The Good Body, a health and wellness brand, it was reported that, at least 10% of the world’s population which is approximately 770 million is affected by chronic pain. Therefore, this factor is anticipated to increase in prevalence of constipation and expected to boost the growth of market.

Moreover, pain killer use and dependency vary by age and gender. Men are more likely to use opioids (pain killers), become dependent on various opioids, and they account for most opioid-related disorders such as constipation, thus driving the growth of market. For instance, report of Government of Canada 2022, reported, 75% of men consumed opioids and majority were among young and middle-aged adults (20 to 49 years). Thus, rise in usage of opioids by men results in rise in number of opioid induced constipation (OIC) disorder, thereby driving the growth of market. Thus, rise in incidence of chronic pain and increase in usage of pain killers are anticipated to promote prevalence of constipation. Therefore, this factor boosts the growth of the constipation treatment market.

Rise in prevalence of opioid-induced constipation, chronic idiopathic constipation, and irritable bowel syndrome with constipation (IBS-C) is anticipated to drive the growth of the constipation treatment market. For instance, an article published in the National Library of Medicine 2022, reported, 40-60% people suffer from constipation. Thus rise in number of patients suffering from opioid induced constipation (OIC) is expected to drive the growth of the market. In addition, rise in use of opioids for analgesia, misuse, and use of opioids without medical supervision can lead to opioid dependence, which results in rise in number of patients suffering from opioid induced constipation (OIC).

Moreover, according to National Library of Medicine, in July 2023, worldwide approximately 14% of population is suffering from chronic constipation. Thus, increasing prevalence of constipation is expected to drive the demand for constipation treatment drugs and boost the growth of market.

The rise in availability of number of effective drugs for treating constipation is expected to drive the growth of market. For instance, availability of drugs such as Relistor by Salix Pharma (Bausch Health), Motegrity (prucalopride), and Amitiza (lubiprostone) by Takeda Pharmaceutical and others in various dosage forms such as oral and parenteral is expected to drive the growth of market. In addition, many key players are adopting various strategies such as agreement and partnerships to cater to the demand and increase manufacturing capacity, which is expected to propel market expansion. For instance, in February 2021, Cosmo Pharmaceuticals announced a partnership agreement with RedHill Biopharma Ltd., for manufacturing Movantik, thus such adoption of strategies is expected to drive the growth of market.

Further, increasing R&D activities by major players for development of novel products and supporting government regulations are factors expected to boost the growth of opioid induced constipation (OIC) drugs market. For instance, report of the U.S. National Library of Medicine – Clinical Trials 2022, stated that ‘Lactobacillus gasseri DSM 27123’, is in clinical phase 2 trial and might receive approval in coming years, thus such R&D activities are expected to drive the growth of market.

On the other hand, the main factor which restrains the growth of constipation treatment market is side effects of drugs used for treating constipation diseases such as opioid induced constipation (OIC). For instance, methyl naltrexone bromide when administered subcutaneously possesses serious side effects such as cardiac-related adverse events, abdominal pain, and diarrhea, thus restraining the growth of market.

In addition, the high cost of novel medications for treating opioid induced constipation (OIC) is another factor hampering the growth of the market. Thus, increasing side effects associated with opioid induced constipation (OIC) medications and high cost of medications are the factors expected to hamper growth of the constipation treatment market.

Segmental Overview

The constipation treatment market share is segmented based on drug type, disease type, prescription type, distribution channel, and region. By drug type, the market is classified into opioid antagonist, laxative, chloride channel-2 activator, and others. Others includes selective 5-ht agonists, guanylate cyclase-C (GC-C) agonist and serotonin-4 receptor agonist. As per disease type, the constipation treatment market is segmented into opioid-induced constipation, chronic idiopathic constipation, and irritable bowel syndrome with constipation (IBS-C). Depending on prescription type, the market is classified into prescribed drugs and over-the-counter drugs. By distribution channel, the market is divided into hospital pharmacy, online pharmacy, and retail pharmacy.

On the basis of region, the constipation treatment market share is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

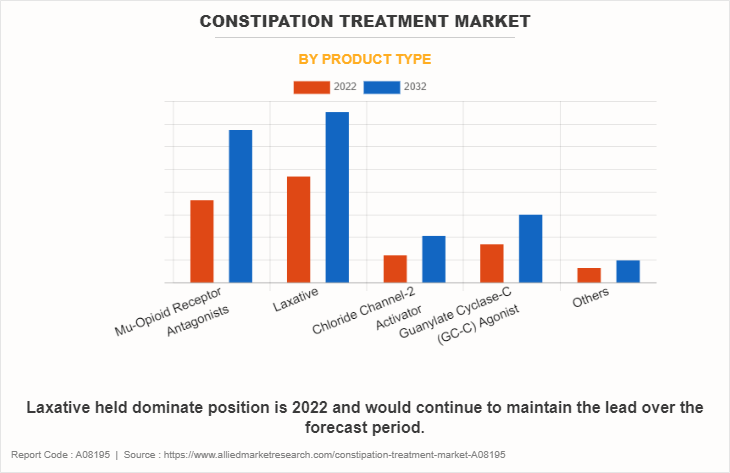

By Product Type

The market is classified into opioid antagonist, laxative, chloride channel-2 activator, and others. Others includes selective 5-ht agonists, guanylate cyclase-C (GC-C) agonist, and serotonin-4 receptor agonist. The opioid antagonist segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to rise in prevalence of opioid-induced constipation (OIC) and increase in prevalence of chronic pain.

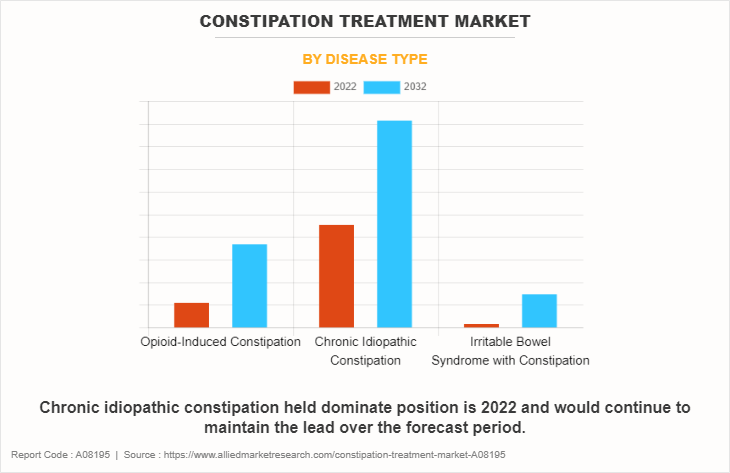

By Disease Type

The constipation treatment market is segmented into opioid-induced constipation, chronic idiopathic constipation, and irritable bowel syndrome with constipation (IBS-C). The opioid-induced constipation segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to increase in prevalence of chronic pain and rise in usage of pain killers by population.

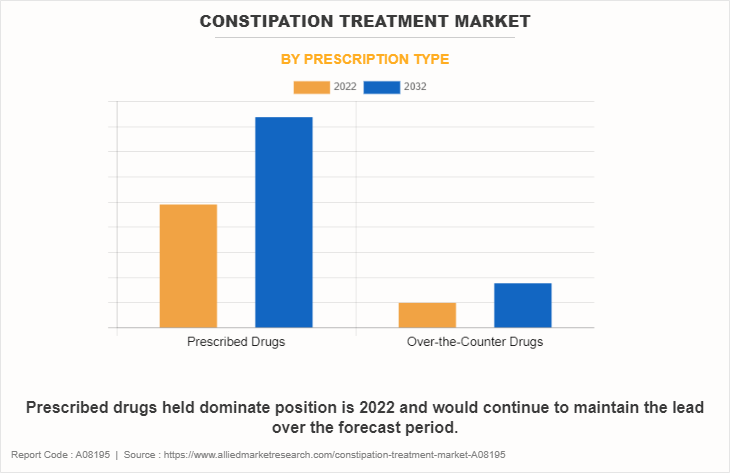

By Prescription Type

The market is classified into prescribed drugs and over-the-counter drugs. The prescribed drugs segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to rise in awareness among the population regarding prescribed drugs and increase in prevalence of constipation.

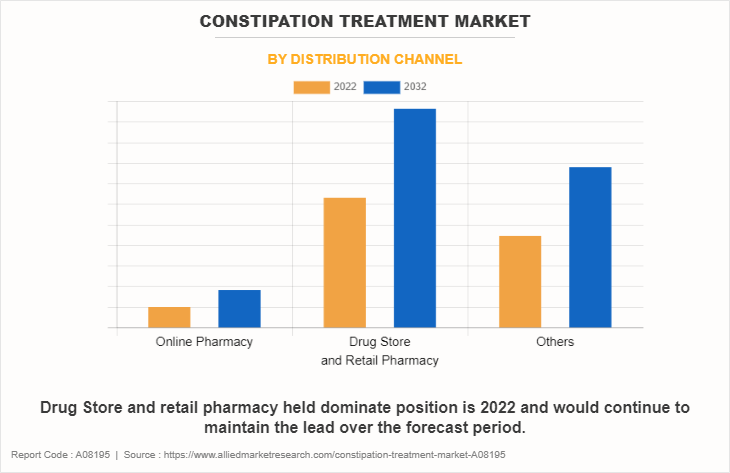

By Distribution Channel

The market is divided into hospital pharmacy, online pharmacy, and retail pharmacy. The retail pharmacy segment dominated the market in 2022 and is expected to continue this trend during the forecast period, owing to increase in preference of the people toward retail pharmacies, as retail pharmacies guide regarding medications and usage during treatment period.

By Region

The North America constipation treatment market growth is expected to grow during the forecast period, owing to high presence of market players who manufacture constipation drugs and increase in number of product approvals for constipation treatment. For instance, Salix Pharma (Bausch Health), AbbVie, Abbott, Ironwood Pharmaceuticals, Inc., and Ardelyx are some major market players in North America who manufacture constipation treatment drugs.

Moreover, increase in number of product launch for treatment of constipation and rise in number of adoptions of key strategies by market players are anticipated to boost the growth of market. For instance, in April 2022, Ardelyx, Inc., a biopharmaceutical company, announced the launch of IBSRELA, the first and only NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults. IBSRELA is the first FDA-approved product for Ardelyx.

Moreover, rise in prevalence of chronic pain disorder and surge in use of opioids for pain management are anticipated to increase the prevalence of constipation. Thus, these factors contribute to growth of market. For instance, report of U.S. Pain Foundation 2022, stated that, every year 50 million people suffer from chronic pain and about 47% of people consume opioid medications, thus driving the growth of market. In addition, rise in regulatory approval of medications for treating opioid induced constipation (OIC) is expected to drive the growth of market. In addition, according to Agency for Healthcare Research and Quality, every year the U.S. government spends over $560-635 billion on pain medications which is expected to contribute to growth of constipation treatment market forecast.

Furthermore, the Asia-Pacific constipation treatment market opportunity is expected to grow during the forecast period, owing to rise in prevalence of constipation and increase in number of geriatric population which is more susceptible to constipation. For instance, according to report shared by Pace Hospital in 2022, constipation is a frequent gastrointestinal condition, that affects people of all ages, with a prevalence of around 20% in the general population and 29.6% in children. Constipation is more common in the elderly than in the younger population. Elderly women suffer from severe constipation more frequently (two to three times) than male counterparts. In India, 22% of adults suffer from constipation, where 59% of them complain of severe constipation and 27% complain of constipation associated with certain comorbidities.

In addition, rise in awareness among the people regarding treatment of constipation, high prevalence of chronic pain, and increase in usage of opioids by people are expected to boost the growth of market.

Competition Analysis

Some of the major companies that operate in the global constipation treatment industry include Salix Pharma (Bausch Health), Takeda Pharmaceutical, AbbVie, Abbott, Sanofi, Bayer AG, AstraZeneca plc., Ironwood Pharmaceuticals, Inc., Prestige Consumer Healthcare Inc. and Ardelyx.

Recent Agreement in the Constipation Treatment Market

In May 2023, Ironwood Pharmaceuticals, Inc., a GI-focused healthcare company, and VectivBio, a clinical-stage biopharmaceutical company, announced that they have entered into a definitive agreement for Ironwood to acquire VectivBio. This acquisition pioneered novel treatments for severe rare gastrointestinal diseases such as constipation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the constipation treatment industry segments, current trends, estimations, and dynamics of the constipation treatment market analysis from 2022 to 2032 to identify the prevailing constipation treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the constipation treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global constipation treatment market trends, key players, market segments, application areas, and market growth strategies.

Constipation Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.1 billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 479 |

| By Product Type |

|

| By Disease Type |

|

| By Prescription Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Ardelyx Inc., Bayer AG, Takeda Pharmaceutical Company Ltd., Sanofi S.A., AbbVie Inc., Abbott Laboratories, Bausch Health Companies Inc., Prestige Consumer Healthcare Inc., Ironwood Pharmaceuticals, Inc., AstraZeneca plc |

Analyst Review

Constipation occurs when bowel movements become less frequent and stools become difficult to pass. It happens most often due to changes in diet or routine, or due to inadequate intake of fiber. Rise in number of adoptions of key strategies such as agreement, business expansion and others drive the growth of market. For instance, in May 2023, Ironwood Pharmaceuticals, Inc., a GI-focused healthcare company, and VectivBio a clinical-stage biopharmaceutical company announced that they have entered into a definitive agreement for Ironwood to acquire VectivBio. This acquisition pioneered novel treatments for severe rare gastrointestinal diseases which also includes treatment of constipation. Thus, this factor is anticipated to drive the growth of market.

In addition, in February 2022, Ardelyx, Inc., a biopharmaceutical company, announced that it has entered into a debt financing agreement with investment affiliates managed by SLR Capital Partners (SLR). This agreement includes the launch and commercialization of Ibsrela for the treatment of irritable bowel syndrome with constipation in adults. This financing further strengthens the balance sheet and extends the cash runway offering operational flexibility to further support the launch of Ibsrela.

The top companies that hold the market share in constipation treatment market are Salix Pharma (Bausch Health), Takeda Pharmaceutical, AbbVie, Abbott, Sanofi, Bayer AG, and Ardelyx.

North America is anticipated to witness lucrative growth during the forecast period, owing to rise in number of population suffering from constipation and high presence of market players.

The key trends in the constipation treatment market are large presence of constipation treatment drug manufacturers and rise in number of population suffering from chronic pain

The base year for the report is 2022.

10 constipation treatment companies are profiled in the report.

The total market value of constipation treatment market is $5,888.08 million in 2022.

The forecast period in the report is from 2023 to 2032.

Alternative options available for treatment of constipation is restraining factor for constipation treatment market.

Loading Table Of Content...

Loading Research Methodology...