Construction Adhesives & Sealants Chemical Market Overview:

Global Construction Adhesives & Sealants Chemical Market was valued at $7,131 million in 2016, and is expected to reach $12,844 million by 2023, growing at a CAGR of 8.8% from 2016 to 2023. Adhesive is a chemical mixture, which holds at least two surfaces together to form a single unit. Sealant is a semisolid substance, which is used to fill the space between the two surfaces, thereby providing a barrier or protective coating. Adhesives have high shear and tensile strength and are used for holding and bonding applications. Sealants are preferably used for their ability to fill gaps, and resist relative movement of the substrates. They are more flexible, but have lower strength than adhesives.

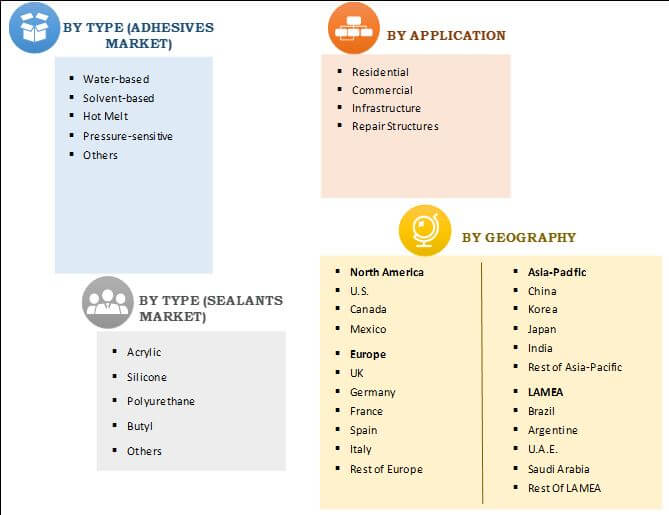

The global construction adhesives & sealants chemical market is segmented based on adhesive type, sealant type, application, and geography. On the basis of adhesive type, the market is divided into water-based, solvent-based, hot melt, pressure-sensitive, and others (reactive and formaldehyde adhesives). Sealants are classified into acrylic, silicone, polyurethane, butyl, and others (polysulfide, latex, and silyl-modified polymers sealants). Applications covered in the study include residential, commercial, infrastructure, and repair structures. Geographically, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Construction Adhesives & Sealants Chemical Market Segmentation

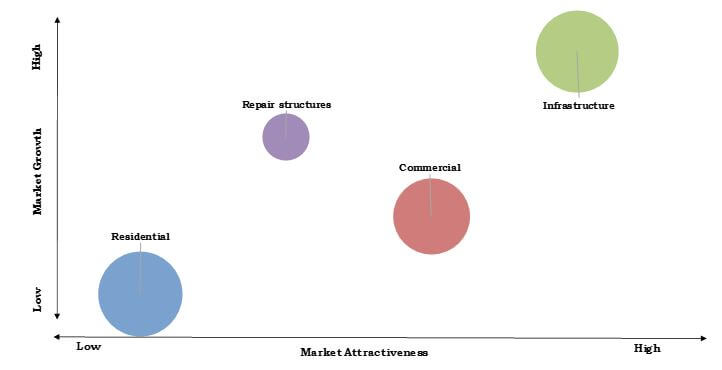

Top Investment Pocket

The residential segment accounted for about one-third share in 2016, and is expected to grow at a CAGR of 8.5% during the forecast period. Growth in urbanization has led to increase in construction of residential complexes and buildings, which in turn boosts the demand for adhesives & sealants. Construction firms initiate large number of residential projects with high-grade construction materials to provide improved structural integrity and sustainability.

Construction Adhesives & Sealants Chemical Market: Top Investment Pockets, By Application

Segment Review

Utilization of adhesives and sealants in infrastructure application was the most lucrative application segment, in terms of both value and volume, with three-tenth of the global market volume share. Developing economies like China, India, Brazil and Saudi Arabia are focusing on construction activities of basic infrastructural facilities, which is expected to boost up the demand for adhesives and sealants during the forecast period. Infrastructure application is expected to grow at a CAGR of 9.2% in terms of revenue.

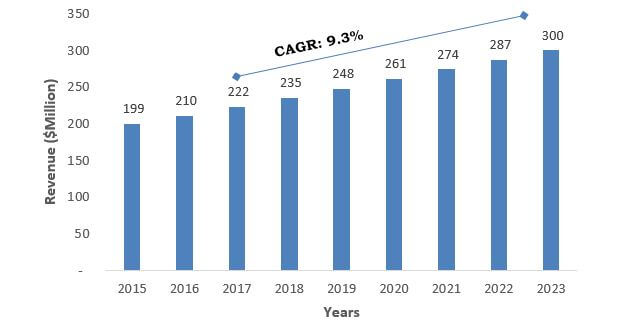

LAMEA Review

The emergence of new markets in the LAMEA region boosts construction schemes and improves lifestyle. As per the Brazilian Institute of Geography and Statistics, in 2012, the construction industry in Brazil accounted for about $109 billion. Owing to hosting of Rio Summer Olympics 2016, Brazil is an active province market for adhesives & sealants construction chemicals due to increased construction activities of golf course, swimming pools, volleyball stadium, subway links, and others. Thus, development in construction industry is expected to drive the growth of the market.

Brazil Construction Adhesives & Sealants Chemical Market, 2016-2023 ($Million)

The major players operating in the global Adhesives & sealants construction chemical market are Henkel AG & Company, H.B. Fuller, Bostik SA, Sika AG, 3M Company, Illinois Tool Works Corporation, Avery Dennison Corporation, DAP Products, Royal Adhesives & Sealants, LLC, and Franklin International.

Other key players (not profiled in the report) operating in the market includes Henkel AG & Company, H.B. Fuller, Bostik SA, 3M Company, Illinois Tool Works Corporation, Avery Dennison Corporation, DAP Products, Royal Adhesives & Sealants, LLC and Franklin International

Key Benefits

- This report provides the quantitative analysis of the current market and estimations from 2015 to 2023, which assists to identify the prevailing market opportunities

- This report provides an extensive analysis of the current & emerging market trends and dynamics in the market

- The study covers competitive landscape and value chain analysis, which help to understand the competitive environment across the geographies

- An in-depth analysis of current R&D activities is provided that helps to understand the behavior of the market

- Extensive analysis of segment by type helps in understanding the current adhesives & sealants construction chemical being used along with the variants that would gain prominence in the future

- Extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework

Construction Adhesives & Sealants Chemical Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | ILLINOIS TOOL WORKS CORPORATION, DAP PRODUCTS, H.B. FULLER, FRANKLIN INTERNATIONAL, ROYAL ADHESIVES & SEALANTS, LLC, 3M COMPANY, AVERY DENNISON CORPORATION, HENKEL AG & COMPANY, SIKA AG, BOSTIK SA |

Analyst Review

Adhesives are chemical mixtures, which are used to hold two or more surfaces together to form a single unit. Sealants are semisolid substances, which are used to fill the space between the two surfaces, thereby providing a barrier or protective coating. Adhesives have high shear and tensile strength and are used for holding and bonding applications. Sealants are used for their ability to fill gaps, and resist relative movement of the substrates. They are more flexible, but have lower strength than adhesives. Adhesives & sealants improve the stress distribution in the structures, help enhance structural integrity, dampen vibration or movement in structure, seal dissimilar substrates, and act as protective seal in harsh environmental conditions. These characteristics drive the demand for adhesives & sealants construction chemicals in complex modern structures.

Improvements in lifestyle patterns in emerging countries such as China, India, Brazil, Middle East, and Africa boost the demand for housing and commercial infrastructure. Expansion of production facilities of adhesives & sealants to meet the surging demands in the emerging economies such as India and China has a positive impact on the market growth.

Loading Table Of Content...