Construction Equipment Market Research, 2031

The global construction equipment market size was valued at $195.8 billion in 2021, and is projected to reach $313.9 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

Construction equipment are specially designed machinery used to perform or assist in construction operations. Typically, these machines include Wheel Bulldozers, Front Loaders, Dump Trucks, Backhoe loader, Grader, Crawler Dozers, Compactors, Excavators, Forklifts, Concrete Mixer Truck, and Others. These equipment are used for different functions such as drilling, hauling, excavating, paving, grading, lifting, and others. construction equipment covers different industries such as construction & infrastructure, manufacturing, and oil & gas.

Construction Equipment Market Dynamics

Construction sector has been witnessing a rapid rise with increasing global population, and urbanization, which is positively affecting the construction industry. However, after the slowdown in construction activities led by COVID-19 pandemic in 2020 and 2021, the construction sector is expected to witness recovery and growth in the coming years. Moreover, owing to rapid urbanization, major cities across the world are getting crowded and resources are being overused. Simultaneously, real estate is also getting excessively expensive.

By 2040, the global population is estimated to grow approximately by two billion with the urban population growing by over 40%. Thus, to resolve this issue, various countries such as Egypt, India, Indonesia, and others are building cities to reaccommodate the population. For instance, Egypt is building New Administrative Capital at a cost of about $40 billion. In addition, rise in focus on public-private partnerships (PPP) is also positively affecting the construction equipment market growth. A public-private partnership as the name suggests is a partnership or some kind of joint venture between a private company or entity and a government entity.

Typically, these partnerships are meant for the construction of public infrastructure systems, in which a private company handles a project and lends technical & operational expertise, and sometimes financial support for the government projects. The growth in public-private partnerships in different countries such as India, Africa, and China are expected to fuel the growth of the construction equipment end-user segment. Further, the rise in urbanization across the world has also increased the demand to build infrastructure such as residential and transportation.

For instance, the government of U.S., has allocated $110 billion under its Bipartisan Infrastructure Law for the repair of roads and bridges. In addition, the country has also allocated $66 billion to modernize its Northeast Rail Corridor, along with other related railway developments. However, factors such as strict government regulations for construction and mining operations and regulations against carbon emissions from machinery are anticipated to restrain the construction equipment market growth.

Furthermore, technological innovations and other desirable improvements in construction equipment are expected to provide lucrative growth opportunities for players that operate in the construction equipment market. For instance, in April 2022, Doosan Corporation, a major player in the construction equipment market launched Doosan-7 Series mini excavators in the U.S., and Canada. The new equipment come with various improved features, along with companies proprietary DoosanCONNECT Telematics system.

This system allows users to remotely monitor and maintain their machines. Moreover, automation is also being widely adopted in the construction industry, as automated vehicles and machinery reduce the operation cost. In addition, automated vehicles can work in places where it may be harmful to the health of an operator. Thus, companies such as Doosan, Hitachi, Sandvik, and others offer a wide range of automated construction equipment. In February 2022, Caterpillars announced reaching the milestone sales of its more than 500 autonomous trucks worldwide. Such technologies are likely to improve the operations of construction equipment, thereby creating opportunities for an upsurge in the construction equipment market during the forecast period.

The demand for construction equipment decreased in the year 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic led to the shut-down of production of various products for the construction equipment market, mainly owing to prolonged lockdowns in major global countries. This hampered the growth of the construction equipment market significantly during the pandemic. The major demand for equipment and machinery was previously noticed from giant countries including the U.S., Germany, Italy, the UK, and China, which were badly affected by the spread of coronavirus, thereby halting demand for equipment and machinery.

However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. This has led to the full-fledged reopening of construction equipment manufacturing companies, and their end-user sectors as well, at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Contrarily, the increasing number of COVID-19 infection cases in China has brought negative sentiments in the construction equipment market, which may have a negative impact on the construction equipment market for a short duration. Thus, equipment and machinery manufacturers must focus on protecting their workforce, operations, and supply chains to respond to immediate crises and find new ways of working after COVID-19 infection cases start to decrease.

Construction Equipment Market Segmental Overview

The construction equipment market is segmented on the basis of solution type, equipment type, type, application, end-user, and region.

By solution type, it is divided into products and services. By equipment, market is classified into heavy construction equipment and compact construction equipment.

By type, it is categorized into wheel bulldozers, front loaders, dump trucks, backhoe loader, grader, crawler dozers, compactors, excavators, forklifts, concrete mixer truck, and others.

By application, it is divided into excavation & mining, lifting & material handling, earth moving, transportation, and others.

By end-user, it is divided into oil & gas, construction & infrastructure, manufacturing, mining, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

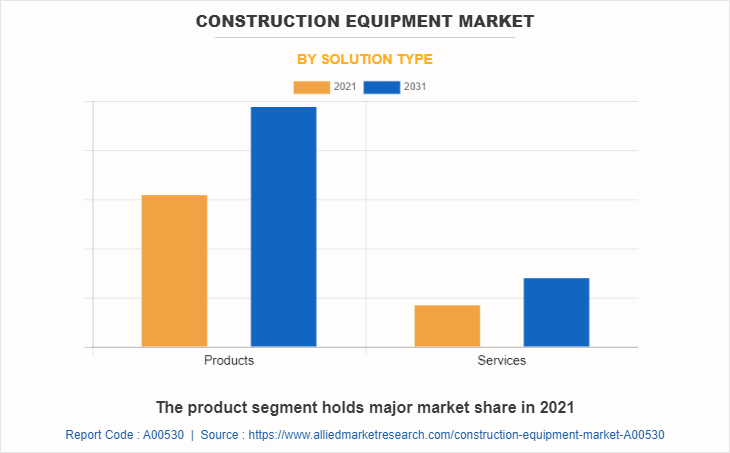

By Solution Type:

The construction equipment market is divided into products and services. In 2021, the products segment dominated the construction equipment market, in terms of revenue, and the services segment is expected to grow with a significant CAGR during the forecast period. The products segment includes all the construction machinery utilized in various construction operations such as loaders, dozers, excavators, cranes, forklifts, and similar others. Moreover, the services segment includes vehicle repair, inspection, maintenance, training for operators, and others. Construction equipment manufacturers and distributors have started to generate a sizeable portion of revenue by providing services and replacement parts associated with construction equipment.

By Equipment:

The construction equipment is classified into heavy construction equipment and compact construction equipment. The compact industry is expected to grow rapidly during the forecast period. Compact construction equipment are small in size and have less capacity, enabling it to be suitable for small jobs and for jobs in constrained spaces. Owing to a smaller size, their acquisition and maintenance cost is less. Furthermore, heavy construction equipment is heavy equipment or vehicles used for activities such as excavation, heavy lifting, tunneling, and material handling. Heavy construction equipment held a significantly larger construction equipment market share in 2021.

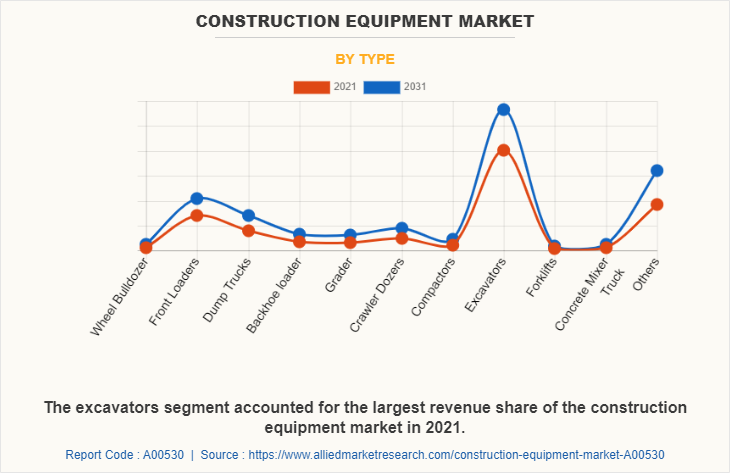

By Type:

The construction equipment is categorized into wheel bulldozers, front loaders, dump trucks, backhoe loader, grader, crawler dozers, compactors, excavators, forklifts, concrete mixer truck, and others. In 2021, the excavator segment held a major share of the construction equipment market. Excavators are widely used for digging earth. It is a very common construction equipment, as almost all construction sites involve digging operations. The forklift segment is expected to grow with a significant CAGR.

By Application:

The construction equipment is divided into excavation & mining, lifting & material handling, earth moving, transportation, and others. The lifting & material handling segment is expected to grow at the highest CAGR during the forecast period. Lifting and lowering objects in a construction site is a very common activity. Often cranes are used for such operations. For example, cranes are used for lifting heavy objects such as stones, sculptures, and other heavy materials from places including truck beds, grounds, and others. Moreover, building materials such as cement bags, formworks, and others are transported within a construction site using forklifts. Furthermore, the earthmoving segment dominated the construction equipment market in 2021. Earthmoving is a process of moving materials such as dirt, stone, land, etc. Majorly loaders, and dump trucks are used for earth moving.

By End User

The construction and infrastructure segment accounted for a larger market share in 2021, and is estimated to grow with the highest CAGR.

By End-User:

The construction equipment is categorized into oil & gas, construction & infrastructure, manufacturing, mining, and others. The construction & infrastructure segment dominated the market and is expected to maintain this trend during the forecast period. Construction equipment is used for building various types of infrastructure such as residential & commercial buildings, roads, rails, and other public works. Rising construction activities across the world are expected to drive growth in this segment. Increased demand for technologically advanced construction equipment is expected to increase the overall demand of the segment. Moreover, the manufacturing segment is expected to grow at the second-highest growth rate. In the manufacturing sector, machines such as forklifts, hoisting equipment, and others are used for performing material handling operations on a manufacturing site.

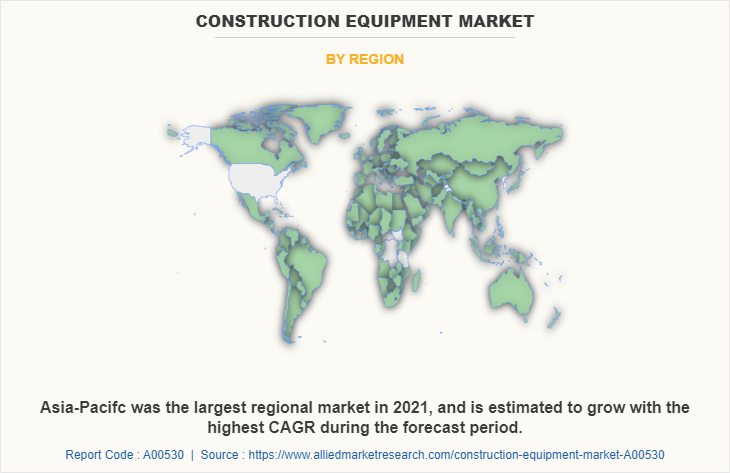

By Region:

The construction industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific accounted for the highest construction equipment market share and is anticipated to secure the leading position during the forecast period, due to extensive demand in the construction & infrastructure segment. Thus, various key players are expanding their presence in the Asia-Pacific to serve the growing construction sector, and also the oil & gas, mining, and other industries. For instance, CASE India, a major construction equipment manufacturer in India has spent around $200 million in the last decade in India to acquire 7% market share of backhoe loaders till 2022, and it is now planning to double its market share in India from 7% in 2022 to 12%-15% in the coming few years.

Such endeavors of the company are vastly dependent on various policies of the government to develop its infrastructure. Such factors influence the overall construction equipment market overview in these regions. Moreover, China is one of the major exporters of construction equipment globally. The rapid industrial development of China has motivated construction equipment manufacturers to establish their production units in the country. Furthermore, industries such as manufacturing, energy, mining, and agriculture are some of the major industries in China. Hence, the development of these industries creates opportunities for the growth of construction equipment in China.

Competition Analysis

Competitive analysis and profiles of the major players in the construction equipment end-user, such as AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Hyundai Doosan Infracore Co., Ltd., Hitachi Ltd., J C Bamford Excavators Ltd., Komatsu Ltd., Liebherr-International AG, and Xuzhou Construction Machinery Group Co., Ltd. (XCMG) are provided in this report. There are some important players in the construction equipment market such as Sany, CNH, and Terex. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the construction equipment market.

Some Examples of Product Launches in the Market

In January 2023, John Deere announced the addition of the 410 P-Tier articulated dump truck, and the 460 P-Tier truck to its P-Tier portfolio. The new vehicles have improved and attractive cabins and exterior styling. Similarly, in August 2021, AB Volvo launched single drum SD110C Compactor and double drum DD90C & DD100C Compactors in India. These machines feature VECV engines conforming to the latest emission standards.

Acquisitions in the construction equipment Market

In August 2021, Hyundai Heavy Industries Holdings acquired Doosan Infracore, a quarrying and construction equipment manufacturer. It will perform its business as Hyundai’s subsidiery. Similarly, in January 2020, Liebherr acquired the earthmoving business of Libero Baumaschinen GmbH & Co.KG and Libero Bau- und Industriemaschinen GmbH. The acquisition includes a takeover of Libero’s sales and service networks.

Key Benefits For Stakeholders

The report provides an extensive analysis of the current and emerging construction equipment market trends and dynamics.

In-depth construction equipment market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the construction equipment market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

The construction equipment market forecast analysis from 2022 to 2031 is included in the report.

The key players within the construction equipment market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the construction equipment market industry.

Construction Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 313.9 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 544 |

| By Solution Type |

|

| By Equipment Type |

|

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Hyundai Doosan Infracore Co., Ltd., AB Volvo, XCMG Group, J C Bamford Excavators Ltd. (JCB), CNH Industrial N.V., Hitachi Ltd., CATERPILLAR INC., Deere & Company, Komatsu Ltd., Liebherr-International AG |

Analyst Review

The construction equipment market has witnessed significant growth in past few years, owing to surge in construction and infrastructure development activities.

The rise in demand of compact construction equipment in countries such as U.S, Canada, UK, Germany, and China has fueled the growth of construction equipment. Furthermore, growth in infrastructure projects public-private partnerships is positively influencing the market growth, especially in developing countries such as India, China, and Vietnam. Heavy construction equipment are extensively used in construction sites owing to their larger capacities. Apart from these positive factors, the market is negatively impacted by strict government regulations regarding carbon emissions released by construction equipment.

Moreover, integration of latest advanced technologies such as automation in the construction equipment are providing lucrative opportunities for the growth of the market.

The global construction equipment market was valued at $195.8 billion in 2021 and is projected to reach $313.9 billion by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

The construction equipment market encompasses specially designed machinery used to perform or assist in construction operations, including equipment like wheel bulldozers, front loaders, dump trucks, backhoe loaders, graders, crawler dozers, compactors, excavators, forklifts, and concrete mixer trucks.

Key players in the construction equipment market include prominent companies such as Volvo Construction Equipment and Terex Corporation, which have merged to expand their market share, particularly in eco-friendly and energy-efficient machinery.

Asia-Pacific dominated the global construction equipment market, accounting for approximately 44.0% of the market share in 2021.

Factors driving the construction equipment market include rapid urbanization, population growth, and increased focus on public-private partnerships (PPPs), leading to heightened demand for infrastructure development and construction activities.

Challenges in the construction equipment market include fluctuations in fuel prices, high equipment maintenance costs, and the need for skilled operators to handle advanced machinery.

Loading Table Of Content...

Loading Research Methodology...