Construction Equipment Rental Services Market Research, 2034

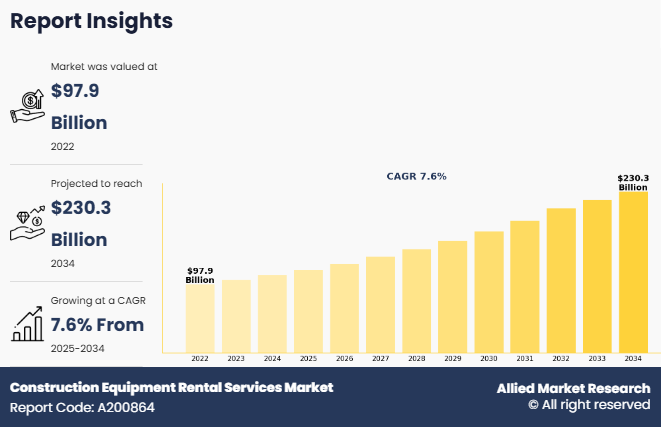

The global construction equipment rental services market size was valued at $97.9 billion in 2022, and is projected to reach $230.3 billion by 2034, growing at a CAGR of 7.6% from 2025 to 2034.

Construction equipment rental services refer to the provision of heavy machinery and tools on a temporary basis to contractors, builders, and construction companies. Instead of purchasing expensive equipment, companies can rent items such as excavators, bulldozers, cranes, loaders, and concrete mixers for specific project durations. This model helps businesses reduce upfront capital costs, maintenance expenses, and storage issues, making it a cost-effective solution, especially for short-term or specialized projects. Rental companies typically offer flexible terms, including daily, weekly, or monthly rates, and often include delivery, setup, and maintenance services.

Key Takeaways

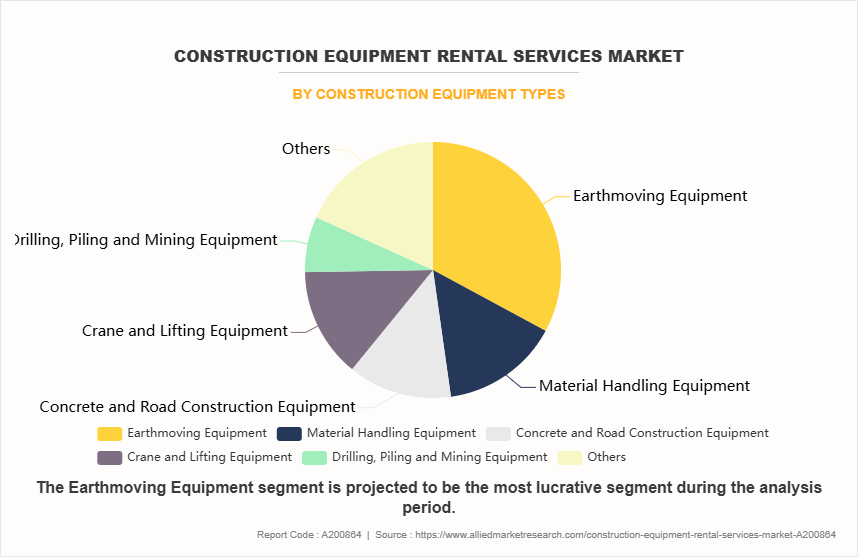

- On the basis of construction equipment types, the earth moving segment held the largest share in the construction equipment rental services market in 2022.

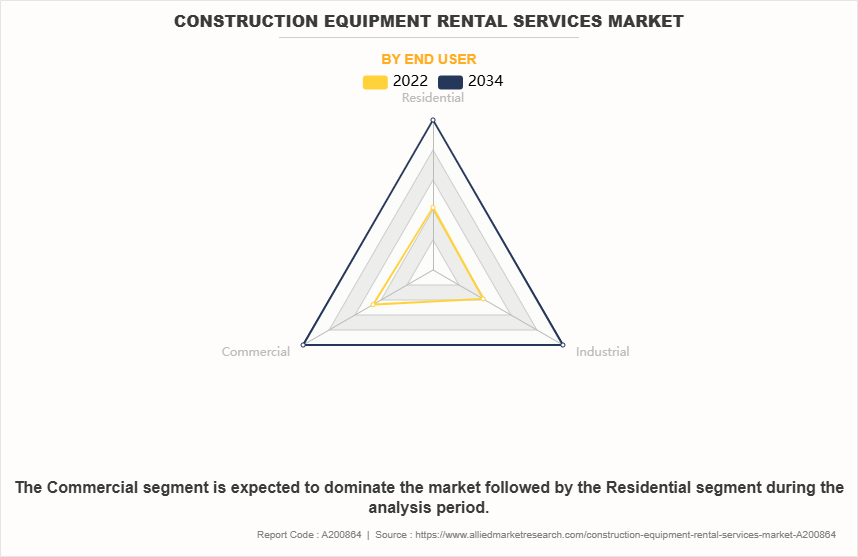

- By End User, the commercial segment was the major shareholder in 2022.

- By mode of operation, the dry lease segment dominated the market, in terms of share, in 2022.

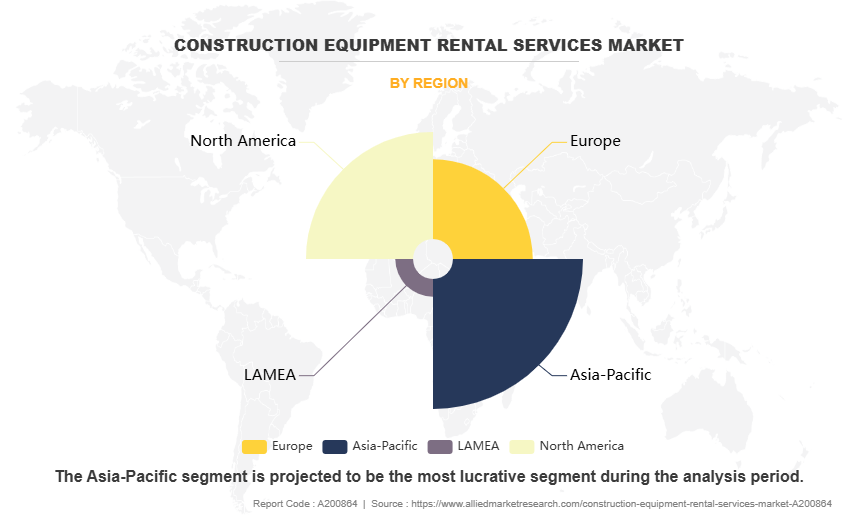

- Region wise, North America region held the largest market share in 2024.

These services are widely used across residential, commercial, and infrastructure construction projects. As the construction industry becomes more dynamic, rental services enable companies to access the latest, well-maintained machinery without the long-term financial commitment. The growing demand for operational efficiency, along with rise in infrastructure development activities worldwide, continues to drive the adoption of construction equipment rental services across the industry.

For instance, in April 2023, Boels Rental acquired Norwegian company BAS Maskinutleie to strengthen its Nordic subsidiary Cramo’s presence and advance its strategic objective of securing a top-three position in all markets, enhancing resilience, and supporting future growth in the construction equipment rental services market. Moreover, in June 2023, H&E Equipment Services Inc. (H&E) expanded its construction equipment rental services market in Texas with the opening of its 22nd rental branch in Houston South. This expansion is designed to serve a wide range of construction and general industrial equipment needs, reinforcing the company’s commitment to support regional growth and improve customer access to reliable rental solutions.

Increase in infrastructure development projects worldwide is significantly driving demand for construction equipment rental services market. Governments and private sectors are investing heavily in large-scale projects such as highways, bridges, railways, and commercial buildings. Renting equipment allows contractors to access the latest machinery without the high upfront costs, making it a cost-effective solution for temporary or project-specific needs. Renting equipment is especially prominent in developing regions, where rapid urbanization and industrialization are fueling the need for flexible, efficient construction equipment solutions. Furthermore, advancements in rental equipment technology and expansion of urbanization and smart city projects have driven the demand for construction equipment rental services market. However, high maintenance and repair costs are hampering the growth of the construction equipment rental services market growth. Rental companies must ensure that machinery is in top condition, which involves frequent inspections, servicing, and part replacements. These ongoing expenses reduce profit margins and can lead to higher rental rates, discouraging potential customers. Unexpected breakdowns result in equipment downtime, disrupting rental schedules, and damaging client trust. This challenge is particularly burdensome for smaller rental firms with limited budgets and technical resources. Moreover, lack of skilled operators for specialized equipment are major factors that hamper the growth of the construction equipment rental services market share. On the contrary, the integration of telematics and IoT in rental equipment presents a lucrative opportunity for the construction equipment rental services market. These technologies enable real-time monitoring of equipment usage, location, performance, and maintenance needs, improving operational efficiency and reducing downtime. Rental companies can optimize fleet management, enhance customer service, and implement predictive maintenance strategies. For trades, it ensures better accountability and cost control. As digital transformation accelerates across the construction industry, tech-enabled equipment rental services are becoming increasingly attractive and competitive.

Segment Review

The construction equipment rental services market is segmented on the basis of construction equipment type, end user, mode of operation, and region. On the basis of construction equipment type, the market is divided into heavy equipment, earthmoving equipment, material handling equipment, concrete and road construction equipment, crane and lifting equipment, drilling, piling and mining equipment, pipe laying equipment, and others. By end user, it is classified into residential, commercial, and industrial construction. On the basis of mode of transportation, it is categorized into self-service, dry lease, and wet lease. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

By Construction Equipment Type

On the basis of construction equipment types, the earthmoving equipment segment acquired the highest market share in 2024 in the construction equipment rental services market. This dominance is primarily due to the extensive use of machinery such as excavators, backhoes, and loaders in a wide range of construction and infrastructure projects. These machines are essential for tasks such as digging, grading, and land clearing, which are foundational activities in almost every construction project. Renting earthmoving equipment is a costeffective solution for contractors that need high-performance machines for specific tasks without the financial burden of ownership. The segment’s versatility and consistent demand contribute to its leading position in the construction equipment rental services market.

By End user

On the basis of commercial, the pharmaceutical companies segment acquired the highest market share in 2024 in the construction equipment rental services market. This is attributed to rise in number of commercial infrastructure projects such as office buildings, retail complexes, hotels, and urban development initiatives. These projects often require a broad range of construction equipment for site preparation, material handling, and structural work. Renting equipment offers flexibility, reduces capital expenditure, and ensures access to the latest machinery, making it an ideal solution for commercial contractors. The steady growth of commercial construction activities across urban areas globally continues to drive strong demand in this segment, securing its market leadership.

By Region

Region-wise, North America attained the highest market share in 2024 and emerged as the leading region in the construction equipment rental services market. This is due to its well-established construction industry, extensive infrastructure development, and widespread adoption of rental models. The region has seen continuous investment in commercial and residential construction, along with large-scale public infrastructure projects such as highways, bridges, and smart cities. Contractors in North America prefer renting over owning to reduce operational costs, access advanced equipment, and improve flexibility. The presence of major rental companies, availability of technologically advanced machinery, and favorable government initiatives further contribute to North America’s dominance in the global construction equipment rental services market.

Meanwhile, Asia-Pacific is projected to grow at the fastest rate during the forecast period. This is due to rapid urbanization, industrialization, and increasing infrastructure investments across emerging economies such as China, India, and Southeast Asian countries. Massive government-led projects in transportation, housing, and energy are fueling demand for flexible and cost-effective equipment solutions. Renting allows contractors to meet project needs without large upfront capital, which is particularly beneficial in cost-sensitive markets. Rise in awareness of rental benefits, growing construction activity, and the entry of global rental companies are accelerating market expansion in the region, making Asia-Pacific the fastest-growing region in the construction equipment rental services market.

The report focuses on growth prospects, restraints, and trends of the construction equipment rental services market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the construction equipment rental services market.

Competitive Analysis

The report analyses the profiles of key players operating in the construction equipment rental services market such as United Rentals, Inc., Sunbelt Rentals, Herc Rentals Inc., EquipmentShare, Hande Equipment Services, Loxam Group, Boels Rental, Kiloutou Group, Modulaire Group (ALGECO), Sarens, Kanamoto Co. Ltd, AKTIO CO. LTD, Sin Heng Heavy Machinery Limited, RENT (THAILAND) CO. LTD, and Tat Hong Holdings Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the construction equipment rental services market.

Increase in Infrastructure Development Project Globally

Global surge in infrastructure development projects is significantly driving the demand for construction equipment rental services market. Governments and private entities across developed and developing nations are investing heavily in large-scale infrastructure projects such as highways, railways, airports, bridges, and urban development initiatives to support economic growth and population expansion. These projects require a diverse range of heavy machinery and equipment, making rentals an ideal choice for contractors seeking flexibility and cost-effectiveness. For instance, in January 2025, Geismar, a longstanding player in the road-rail loader segment, partnered with JCB to launch the GEISMAR x JCB HYDRADIG, a next-generation 14-ton road-rail excavator that combines Geismar’s rail technology with JCB’s construction machinery expertise. This innovative machine is engineered for improved agility, safety, and versatility in rail operations, making it highly valuable for specialized infrastructure projects. As demand grows for multi-functional and high-performance machinery, such equipment is increasingly sought after in the construction equipment rental services market, enabling rental companies to cater to niche railway construction and maintenance needs with advanced, efficient solutions. Moreover, instead of incurring the high capital costs of purchasing equipment, construction firms are opting to rent modern and well-maintained machines tailored to specific project needs. This approach also reduces the burden of maintenance, storage, and depreciation. Therefore, increase in infrastructure development project globally is driving the demand for the construction equipment rental services market.

Advancement in Rental Equipment Technology

Advancements in rental equipment technology are significantly driving the demand for the construction equipment rental services market. For instance, in November 2022, United Mobility Technology AG (UMT), a German technology company, launched Smart Rental, a mobile app-based online platform for construction equipment rentals. The service enables users to rent machinery such as excavators, vibratory plates, and loaders through a model similar to 'Car2Go.' It offers convenient, contactless rentals with 24/7 availability and equipment located close to job sites, enhancing flexibility and accessibility for construction professionals. Furthermore, modern rental equipment now features cutting-edge innovations such as telematics, GPS tracking, automation, and fuel-efficient engines, which enhance operational efficiency, safety, and cost control on construction sites. These technological upgrades enable real-time monitoring of equipment usage, predictive maintenance, and better fleet management, offering clear advantages to contractors and project managers. Renting such high-tech machinery allows companies to access the latest tools without investing heavily in purchasing and maintaining them. Moreover, as construction projects become more complex and time-sensitive, demand is rising for smart equipment that can improve productivity and reduce downtime. Rental providers that offer technologically advanced equipment are better positioned to meet the evolving needs of the construction industry. This shift is encouraging more firms to turn to rental solutions, fueling sustained growth in the global construction equipment rental services market.

Expansion of Urbanization and Smart City Projects

Expansion of urbanization and growth of smart city projects are significantly increasing the demand for the construction equipment rental services market. As more people migrate to urban areas, there is a rise in need for enhanced infrastructure, including residential housing, commercial buildings, transportation systems, and utilities. Simultaneously, governments and private stakeholders are investing in smart city initiatives that require modern, technology-driven construction approaches. These projects demand access to advanced equipment such as earthmovers, cranes, and concrete machinery, which are often expensive to purchase and maintain. Renting such equipment becomes a practical solution, offering flexibility, reduced capital expenditure, and access to the latest technologies. For instance, in December 2024, in India, the government's Smart Cities Mission aimed to develop 100 smart cities across the country, which is driving substantial demand for construction equipment rental services market. These large-scale infrastructure projects require a wide range of advanced machinery for tasks such as road building, utility installation, and high-rise construction. However, purchasing and maintaining such equipment can be financially challlenging, especially for mid-sized contractors. As a result, many construction firms are turning to rental services as a cost-effective and flexible solution. This shift enables companies to access modern equipment without heavy capital investment, thereby accelerating project timelines and ensuring efficiency. In addition, short project timelines and fluctuating equipment needs make rental services more attractive to contractors and developers. As urban development and smart city initiatives continue to expand across Asia-Pacific, North America, and Europe, the construction equipment rental services market is expected to grow steadily, meeting the evolving demands of modern infrastructure projects. Therefore, expnasion of urbanization and smart city projects is driving the demand for the construction equipment rental services market

High Maintenance and Repair Costs for Rental Companies.

High maintenance and repair costs are emerging as significant challenges, hampering the growth of the construction equipment rental services market. Rental companies are required to keep their fleets in top operational condition to meet customer expectations and safety standards. This involves frequent inspections, servicing, replacement of parts, and unplanned repairs, all of which contribute to rise in operational expenses. As equipment ages, these costs increase further, reducing profit margins and affecting pricing strategies. In addition, Equipment undergoing maintenance is temporarily unavailable for rental, which can reduce machine availability, negatively affect customer satisfaction, and lead to revenue loss. In a competitive market, the pressure to maintain newer and more technologically advanced equipment adds to the financial burden, especially for small and mid-sized rental firms. These growing costs discourage some companies from expanding their rental fleets, which ultimately slows market growth. As a result, high maintenance and repair expenses continue to be a critical restraint for the construction equipment rental services industry.

Lack of Skilled Operators for Specialized Equipment

Lack of skilled operators for specialized equipment is a key factor hampering the demand for the construction equipment rental services market. Many advanced machines, such as cranes, drilling rigs, and automated earthmovers, require trained professionals to operate them safely and efficiently. However, there is a growing skills gap in the construction industry, especially in emerging markets, where training facilities and certification programs are limited. Without qualified operators, contractors are reluctant to rent complex machinery, fearing improper usage, safety risks, and project delays. This challenge becomes more pressing as equipment technology advances, demanding even more specialized knowledge. Rental companies often struggle to provide operator support, which further discourages clients from renting high-end or technical equipment. Thus, under-utilization of such machinery due to operator shortages limits rental companies’ potential revenue and slows the market growth, making workforce development an urgent need in the equipment rental services ecosystem. Therefore, a lack of skilled operators for specialized equipment are hampering the demand for the construction equipment rental services market outlook.

Integration of Telematics and IoT in Rental Equipment.

Integration of telematics and IoT in rental equipment presents a lucrative opportunity for the construction equipment rental services market. These technologies enable real-time monitoring of equipment usage, performance, location, and maintenance needs, significantly improving operational efficiency. Rental companies can track how and when equipment is used, optimize fleet utilization, and proactively schedule maintenance to reduce downtime and extend machinery lifespan. For customers, telematics offers better visibility into equipment usage and job site productivity, helping to control costs and improve safety. IoT-enabled equipment can also alert operators and rental providers to potential issues before they become critical, enhancing reliability. For instance, in April 2024, Hitachi partnered with ShareMat to enhance construction equipment rental services market in France by enabling real-time telematics, which improves fleet monitoring, reduces downtime, and boosts operational efficiency for rental companies. In addition, data collected through telematics supports transparent billing and reduces disputes over usage hours or damages. As digital transformation gains traction in the construction equipment rental services industry, the demand for smart rental solutions is growing. Companies that invest in connected equipment stand to gain a competitive edge through improved service delivery and customer satisfaction. therefore, integration of telematics and IoT in Rental Equipment is a lucurative opportunity for the construction equipment rental services market

Increase in Demand for Rental Service in Residential Construction.

Increase in demand for rental services in residential construction presents a lucrative opportunity for the construction equipment rental services market. As urbanization accelerates and housing demand rises, particularly in densely populated regions, residential construction projects are expanding rapidly. Renting construction equipment offers developers and contractors a cost-effective alternative to purchasing machinery, which involves significant capital investment and ongoing maintenance costs. By opting for rentals, companies can access a wide range of specialized equipment tailored to specific project needs without the financial burden of ownership. This flexibility is especially beneficial for small to medium-sized enterprises that may not have the resources to maintain an extensive fleet. Moreover, advancements in rental services, such as online booking platforms and mobile applications, have made equipment access more convenient, further driving the adoption of rental solutions in residential construction. Therefore, increase in demand for rental services in residenatial construction is lucurative opportunity for the construction equipment rental services market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the construction equipment rental services market analysis from 2022 to 2034 to identify the prevailing construction equipment rental services market forecast.

- Market research is offered along with information related to key drivers, restraints, and construction equipment rental services market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the construction equipment rental services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global construction equipment rental services market trends, key players, market segments, application areas, and market growth strategies.

Construction Equipment Rental Services Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 230.3 billion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2034 |

| Report Pages | 396 |

| By Construction Equipment Types |

|

| By End User |

|

| By Mode of Operation |

|

| By Region |

|

| Key Market Players | EquipmentShare, Modulaire Group, Boels Rental, Sin Heng Heavy Machinery Limited, United Rentals, Inc., Sunbelt Rentals, Inc., Sarens, Kanamoto Co., Ltd., H&E Rentals, Tat Hong Holdings Ltd., Kiloutou, AKTIO Corporation, LOXAM GROUP, Herc Rentals Inc., Rent (Thailand) Co., Ltd. |

The global Construction Equipment Rental Services market is evolving rapidly toward tech-driven and sustainable solutions expect widespread adoption of telematics and predictive maintenance systems, growth in electric and hybrid equipment to meet ESG goals, flexible dry-lease and bundled service options (including operators and training), emergence of autonomous and semi-autonomous machinery, and expansion of digital rental platforms that streamline access, pricing transparency, and scalability.

The leading application of the Construction Equipment Rental Services market is in commercial construction, which includes the development of office buildings, retail centers, industrial parks, and warehouses. This segment dominates due to the consistent demand for high-performance machinery to complete large-scale projects efficiently and cost-effectively, without the long-term investment in owning equipment.

Asia-Pacific is the largest regional market for Construction Equipment Rental Services

The global construction equipment rental services market was valued at $97,851.1 million in 2022

United Rentals, Inc., Boels Rental, EquipmentShare, LOXAM GROUP, Sunbelt Rentals, Inc., Herc Rentals Inc., H&E Rentals, Kiloutou, Modulaire Group, Sarens, Kanamoto Co., Ltd., AKTIO Corporation, Sin Heng Heavy Machinery Limited, Rent (Thailand) Co., Ltd., and Tat Hong Holdings Ltd.

Loading Table Of Content...

Loading Research Methodology...