Consumer Credit Market Overview

The global consumer credit market was valued at $11.8 billion in 2022, and is projected to reach $24.3 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032. Rising loan demand from individuals and small businesses, along with the benefits offered by consumer lenders and growing adoption of digital technologies, are contributing to the growth of the market.

Market Dynamics & Insights

- The consumer credit industry in North America held a significant share of 37% in 2022.

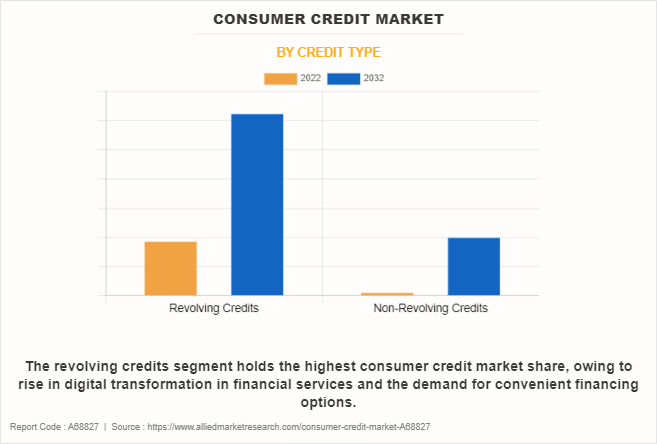

- By credit type, the revolving credit segment dominated the segment in the market, accounting for the revenue share of 65% in 2022.

- By payment method, the debit card segment dominated the industry in 2022 and accounted for the largest revenue share of 54%.

- The consumer credit industry in India is expected to grow significantly at a CAGR of 16.0% from 2023 to 2032.

Market Size & Future Outlook

- 2022 Market Size: $11.8 Billion

- 2032 Projected Market Size: $24.3 Billion

- CAGR (2023-2032): 7.8%

- North America: dominated the market in 2022

- Asia-Pacific: Fastest growing market

What is Meant by Consumer Credit

Consumer credit platform refers to the use of credit by individuals for personal, family, or household purposes. It involves borrowing money to make purchases or meet financial needs, with the understanding that the borrowed amount will be repaid over time, usually with interest. Consumer credit is a common financial arrangement that allows individuals to access funds for various purposes without having to pay the full amount upfront.

Increasing demand for loans from individuals and small businesses and numerous benefits provided by consumer lenders are boosting the growth of the global consumer credit market. in addition, the increase in use of digital transformation technology the positively impacts growth of the market. However, changes in interest rates and regulatory constraints and lack of security and privacy issues are hampering market growth. On the contrary, expansion of the Internet and growing adoption of smartphones are expected to offer remunerative opportunities for the expansion of the consumer credit market during the forecast period.

Consumer Credit Market Segment Review

The consumer credit market is segmented on the basis of credit type, payment method, Issuers, and region. On the basis of credit type, the market is categorized into Revolving Credits, and Non-Revolving Credits. On the basis of payment method, the market is fragmented into Direct Deposit, Debit Card, and Others. On the basis of issuers, the market is bifurcated into banks, NBFC, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of credit type, the revolving credits segment holds the highest consumer credit market share, owing to rise in digital transformation in financial services and the demand for convenient financing options. However, the same segment is expected to grow at the highest rate during the forecast period, owing to increase in the adoption of technology in the financial industry, including online lending platforms and digital loan processing.

Region wise, the consumer credit market size was dominated by North America in 2022, and is expected to retain its position during the forecast period, owing to rise in adoption of consumer credit in small & medium enterprises to ensure effective flow of financial activities. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to the growing adoption of web-based and mobile-based business applications in the sector of banking.

The key players that operate in the consumer credit market are Bank of America, Barclays, BNP Paribas, China Construction Bank, Citigroup, Deutsche Bank, HSBC, Industrial and Commercial Bank of China (ICBC), JPMorgan Chase, Mitsubishi UFJ Financial, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Market Landscape and Trends

The consumer credit market encompasses a diverse range of products, including credit cards, personal loans, mortgages, auto loans, and revolving credit lines. Each product serves different financial needs and has unique terms and conditions. In addition, traditional financial institutions such as banks and credit unions remain major players in consumer lending. However, the industry has witnessed the rise of alternative lenders, including online platforms and fintech companies, offering innovative credit solutions. Moreover, credit reporting agencies play a crucial role in the market, providing credit scores and reports used by lenders to assess the creditworthiness of individuals. Advances in credit scoring models and the use of alternative data sources are influencing lending decisions. Furthermore, the rise of buy now pay later (BNPL) services is transforming the consumer credit landscape, especially for online and retail transactions. Consumers can make purchases and pay in installments, often with interest-free options. The COVID-19 pandemic has accelerated certain trends, such as the adoption of digital services, increased focus on financial resilience, and changes in spending patterns. These trends reflect the evolving nature of the driven by technological advancements, regulatory developments, and changing consumer preferences.

Competition Analysis

What are teh Recent Partnerships in the Consumer Credit Market

- October 05, 2023: Mastercard partnered with Instacart and Peacock to provide greater everyday value and convenience where it matters most to consumers. Mastercard’s U.S. consumer credit card products empower cardholders with access to over $60bn+ in meaningful rewards and benefits. Moreover, New offerings with Instacart and Peacock bring value directly to consumers where they frequently spend.

Whcih are the Recent Product Launches in the Consumer Credit Market

- In June 30, 2022, Finastra launched embedded consumer lending solution, enabling access to traditional regulated lending options for consumers at point-of-sale (POS). Financial institutions, distributors and merchants will benefit from a platform that makes it easy for their customers to access lending options.

What are Recent collaboration in the Consumer Credit Market

- On November 14, 2022, Visa collaborated with Royal Bank of Canada (RBC) to provide eligible RBC personal credit cardholders with the convenient option of converting a qualifying purchase into smaller, equal payments made over a defined period of time when shopping at participating merchants across Canada both in-store and online.

What are the Top Impacting Factors in Consumer Credit Market

Increasing Demand for Loans from Individuals and Small Businesses

The increasing demand for loans from individuals and small businesses plays a significant role in driving the personal loan market. In addition, revenue growth of the global consumer credit market is significantly driven by rising gap between income and expenditure, along with growing needs. Moreover, financial institutions introduce a variety of personal loan products to cater to different purposes. This may include unsecured personal loans, debt consolidation loans, home improvement loans, medical loans, and other specialized offerings. The diversification of loan products reflects the varied needs of borrowers. For instance, in July 2023, Jenius Bank launched consumer product personal loans to help customers save thousands on higher-rate debt. They offer flexible terms and discounted rates to accommodate a variety of financial situations, particularly in an environment where individuals are seeking to reduce their debt and increase their savings. Such strategies are driving the growth of the consumer credit market.

Numerous Benefits Provided by Consumer Lenders

Due to its numerous benefits, consumer credit is generally well liked by consumers. Most of the time the loan amount can be accepted without any type of security. Another significant advantage of consumer credit is that it enables the management of numerous credit cards with varied interest rates and payment due dates. Additionally, borrowers can simplify their monthly payments and save money for future financial consequences if they are authorized for credit with an interest rate lower than credit cards. Therefore, the benefits that consumer credit provides are a major force behind the growth of the sector. The cost of borrowing through personal loan may include fees and penalties. Some loans have origination fees that range from 1% to 6% of the loan amount. Either the charges are built into the loan amount or deducted from the funds provided to borrower pays the sum in full before the loan’s term expires, many lenders charge prepayment costs. When borrowers don’t read the small print of terms, such as fees and penalties, before applying for credit, consumers also come to distrust lenders. This serves as a key roadblock to the growth of the consumer credit market.

Restraints

Changes in Interest Rates and Regulatory Constraints

Changes in interest rates can significantly impact on the consumer credit market. Higher interest rates can increase the cost of borrowing, potentially reducing demand for loans. Conversely, very low-interest rates may lead to concerns about excessive risk-taking and credit bubbles, which restraints the market growth. Moreover, stringent regulatory requirements and compliance standards can pose challenges for lenders in the consumer credit market. Regulatory changes and consumer credit awareness especially those aimed at consumer protection or financial stability, may impact lending practices, making it more challenging for some borrowers to access credit hampering the growth of the market.

Lack of Security and Privacy Issues

As the digital payment industry is experiencing rapid growth owing to the rapid technological advancements, there are some disadvantages associated with the utilization of the digital payment across end-user industries. Security and safety issues are considered one of the primary disadvantages of digital payment. The digital payments ecosystem is susceptible to nefarious participants, fraud, and data breaches without adequate security measures. Inadequate security settings will result in lost information for consumers and businesses, resulting in stolen money for users and substantial financial losses for business organizations. Additionally, insufficient privacy and anonymity concern digital payments among numerous people. Customers could be anxious concerning their facts becoming used by third parties without their agreement; or that they get identified regarding their payment themselves or some other person’s account. So, this factor is hindering the expansion and growth of the consumer credit market.

Opportunities

Expansion of the Internet and the Growing Adoption of Smartphones

With the rapid expansion of internet connectivity and smartphones within the global digital payments market, some of the consumer credit sector profound and far-reaching influences have been seen within consumer and business activity. Digital payments allow anyone to conduct retail transactions using an internet-connected device 24 hours a day, seven days a week, irrespective of whether that person is physically at the point of sale. This immediate availability allows consumers to make purchases and pay for services quickly and easily, avoiding the need to carry cash or use a bank or credit cards. Auxiliary payment service providers can be readily connected electronically to the devices used by customers to complete retail transactions, and this means dependable funds transfers could be done rapidly, securely, and efficiently in consumer credit companies. Thus, this factor is anticipated to provide lucrative growth opportunities in the upcoming years for consumer credit market growth.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the market analysis from 2023 to 2032 to identify the prevailing consumer credit market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the consumer credit market segmentation assists to determine the prevailing consumer credit market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global consumer credit market trends, key players, market segments, application areas, consumer credit market outlook and market growth strategies.

Consumer Credit Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 24.3 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Issuers |

|

| By Credit Type |

|

| By Payment Method |

|

| By Region |

|

| Key Market Players | HSBC, Industrial and Commercial Bank of China (ICBCFS) Financial Services LLC, Bank of America Corporation, JPMorgan Chase & Co, China Construction Bank, Barclays Bank Plc, Mitsubishi UFJ Financial Group,Inc., Wells Fargo, Deutsche Bank AG, Citigroup |

Analyst Review

The consumer debt is personal debt taken on to purchase goods and services. Although any type of personal loan could be labeled consumer credit, the term is more often used to describe unsecured debt of smaller amounts. It is one type of consumer credit in finance, but a mortgage is not considered consumer credit because it is backed with the property as collateral.

Key providers in the consumer credit market are Bank of America, Barclays, BNP Paribas, and China Construction Bank. With the rise in demand for consumer credit solutions, various companies have established acquisition strategies to increase their solutions offerings in AI solutions. For instance, in March 2023, Axis Bank acquired Citibank’s The transaction comprises the sale of the consumer businesses of Citibank India, which includes loans, credit cards, wealth management, and retail banking operations. The deal also includes the sale of the consumer business of Citi’s non-banking financial company, Citicorp Finance (India) Limited, comprising an asset-backed financing business, which includes commercial vehicles and construction equipment. Further, such strategies drive market growth.

In addition, with the surge in demand for consumer credit, several companies have expanded their current product portfolio to continue with the rising demand for fraud detection solutions in the market. For instance, in June 2023 Finastra launched embedded consumer lending solution, enabling access to traditional regulated lending options for consumers at point-of-sale (POS). Financial institutions, distributors and merchants will benefit from a platform that makes it easy for their customers to access lending options.

For instance, in June 2021, Orange Bank partnered with consumer lending fintech Younited to boost its credit options. In addition, the bank claims applications will be “faster and simplified”, while customers can also synchronize their banking information across multiple accounts.

The continued integration of digital technologies and the rise of fintech platforms in the consumer credit market are the upcoming trends of Consumer Credit Market in the world.

The leading application of the consumer credit market is the extension of credit to individuals for various purposes, allowing them to make purchases, meet financial needs, and manage expenses.

North America is the largest regional market for Consumer Credit.

$24,338.05 million by 2032 is the estimated industry size of Consumer Credit.

Bank of America, Barclays, China Construction Bank, Citigroup, Deutsche Bank, HSBC, Industrial and Commercial Bank of China (ICBC), JPMorgan Chase, Mitsubishi UFJ Financial, and Wells Fargo are the top companies to hold the market share in Consumer Credit.

Loading Table Of Content...

Loading Research Methodology...