Consumer Electronics Repair And Maintenance Market Summary, 2031

The global consumer electronics repair and maintenance market size was valued at $15.3 billion in 2021, and is projected to reach $21.6 billion by 2031, growing at a CAGR of 3.6% from 2022 to 2031. Consumer electronics repair and maintenance is the process of repairing and replacing the physical components of electronic tools, gadgets, appliances, and devices that are used by end users for both professional and non-professional purposes. Along with selling used consumer goods, refurbished electronic product providers also work on televisions, stereos, speakers, video recorders, CD and DVD players, radios, and cameras. The majority of organized service is found in industrialized nations, particularly the developed nations, which have a highly organized service sector.

All electronic equipment has undergone a greater digitalization or metamorphosis during the past few years. Hence, the availability of equipment with AI-driven smart features has increased as a result of increased digitalization. With the market's selection of smart gadgets, repair and maintenance are required.

Digitalization is also required in the consumer electronics repair and maintenance industry, which includes the release of digitalized kitchen appliances, AI-powered technology, touchscreen computers, and washing machines. The digitization of most consumer goods has grown exponentially in recent years, which has led to a phenomenon known as the consumerization of information technology.

Consumer electronics and IT may soon have even closer ties due to the Internet of Things (IoT), which is bringing a large number of connected devices to the market. Electronic devices now are more technologically advanced than they were fifty years ago, and they are also more readily available, more diverse, and more reasonably priced. The requirement for upkeep and repair consequently grows. To meet this need, market participants are enlarging their service locations in developing nations. The market is already established in industrialized nations.

Moreover, predictive maintenance refers to a process for estimating when to repair and maintain any electrical equipment utilizing logic, technique, experience, and the equipment's lifespan. For years, both commercial and residential end users have had their equipment repaired using manual maintenance approaches. With the use of cutting-edge technology called predictive maintenance, technicians can now optimize their work in real time, extending the equipment's life and minimizing downtime.

Inadequate maintenance practices can lower the efficiency of any device by 5% to 20%. To address these issues, predictive maintenance is necessary, and new approaches are being used by business end users to access this technology for their electronic equipment. To determine the current timetable, predictive maintenance systems use a variety of inputs. Predicting the maintenance of electronic equipment can be done using sources such as vital equipment sensors, ERP systems, computerized maintenance management systems, and smart factory management systems.

These strategies allow market participants to collaborate with industrial end users to offer annual, biannual, quarterly, and monthly maintenance and repair contracts for their electronic equipment. The global consumer electronics repair and maintenance market is growing because of this new technology.

Consumer electronics are increasingly becoming affordable or less costly, and because there are few infrastructures for fixing them and the costs are often considerable, customers are generally not inclined to repair them. Furthermore, technological, operational, and financial challenges limit the expansion of the repair industry. Moreover, electronic devices like computers and cell phones have some costly spare parts. Residential end consumers will rather purchase new products than repair or maintain their existing ones because replacing electronic components is more expensive.

The cost of a display screen is significantly higher for mobile phones. As a result, consumers limit their investment to screen repairs and instead opt to purchase new mobile devices, hence in turn, limiting market expansion. Replacing a laptop's motherboard costs almost as much as buying a new one, therefore, buyers rarely rely on repairs for computers. Instead of just repairing the laptop and using it for another two to three years, customers opt to purchase a new laptop that will last them an additional eight to ten years. As a result, the market's expansion is constrained by the high cost of replacement parts.

Segmental Overview

The consumer electronics repair and maintenance market is segmented into Equipment Type, End Users and Service Type. Based on equipment type, the market is categorized into mobile, PC, washing machine, refrigerator, and others. According to the end user, it is fragmented into residential and commercial. Based on service type, the market is categorized into in-warranty and out-of-warranty.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, and the rest of LAMEA).

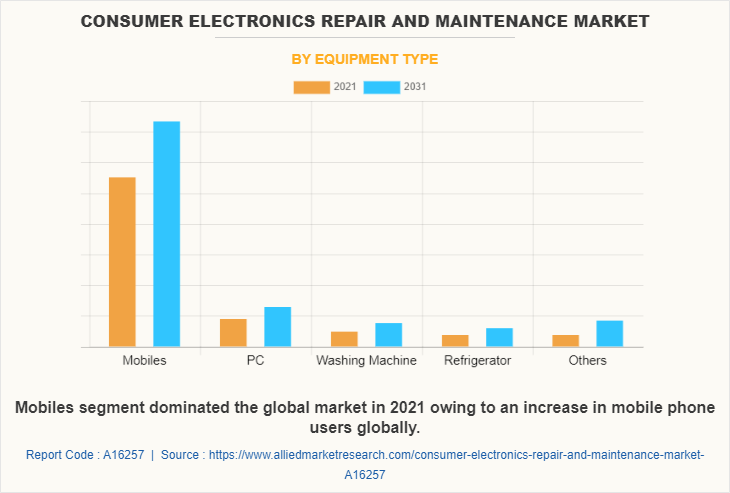

By Equipment Type

By equipment type, mobile garnered the highest consumer electronics repair and maintenance market share in 2021 with a CAGR of 2.95%. The fastest-growing nations in the globe are those in the developing world, such as Brazil and India. Due to the fact that these nations are developing, there is a growth in the number of mobile phone users in these nations. As more market players show an interest in making their phones available in these areas, there is an increase in the demand for service centers.

Some of the key participants in the market include Motorola, Samsung, Apple, BlackBerry, and Microsoft. Some market participants run their own mobile phone repair shops. The mobile service sector is largely organized in developed markets, but there is also a parallel unorganized economy, and the bulk of customers there cannot afford the expensive accessories that are sold in the businesses' official service centers. These factors will collectively propel the consumer electronics repair and maintenance market demand.

By End User

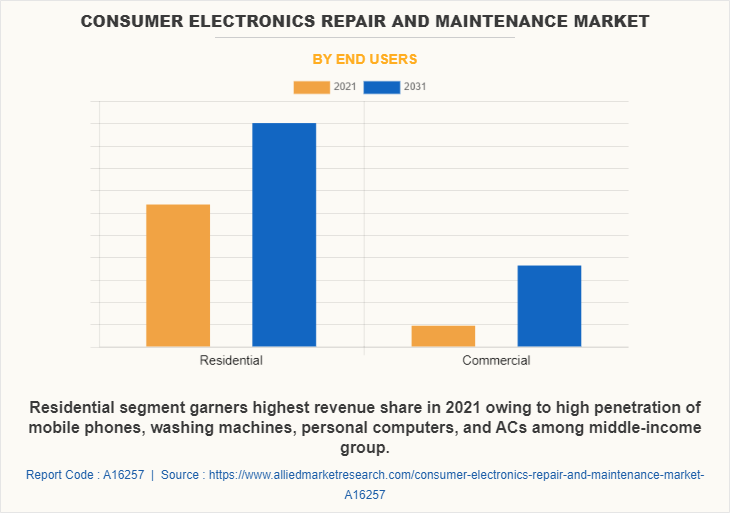

By end user, the residential segment was the highest revenue contributor i.e., $10,364.31 million in 2021, and is expected to reach $14,003.49 million by 2031 at a CAGR of 3.13%. Due to an improvement in the level of living, consumers tend to spend more money on appliances like washing machines and air conditioners. Service stations are now more necessary as a result.

While there are many unorganized service providers in developed regions, approved service centers predominate in developed nations. Since their consumer bases are growing in these cities, many market participants have been extending their service centers in tier 2 and tier 3 cities. Additionally, the middle-income group is becoming increasingly reliant on mobile phones, washing machines, personal computers, and air conditioning, necessitating a strong need for service stations. Thus, the increasing middle-class population along with the increasing use of home appliances in emerging as well as developed countries will spur the consumer electronics repair and maintenance market growth.

By Service Type

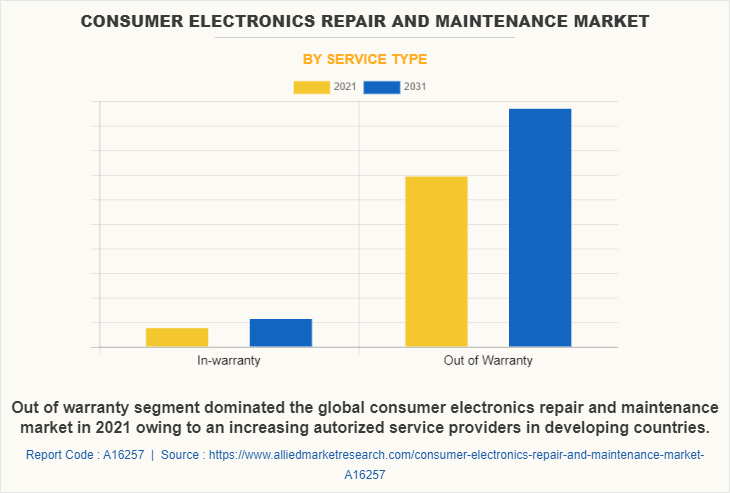

By service type, the out-of-warranty segment was the highest revenue contributor i.e., $13,819.01 million in 2021, and is expected to reach $19,359.96 million by 2031 at a CAGR of 3.5%. Consumer electronics are typically utilized for more than two years, although the warranties on items like mobile phones, laptops, and air conditioners are typically two to three years.

Depending on the brand and the product type, a product's lifespan might range from one to ten years. Because of this, a product typically outlives its warranty and requires additional maintenance and repair work. Either approved service centers or unlicensed individual service providers offer these services.

With the rising adoption of these items in smaller cities, there are many unorganized independent service providers in Brazil and India. Unorganized service providers offer services at low prices, therefore, they have a substantial market share in these nations. The organized sector dominates the market in the U.S. where most customers visit authorized service centers even after the product has passed its warranty period.

In contrast, the unorganized sector dominates the markets in Brazil and India where small business owners offer services at lower prices. As a result, the marketplaces in Brazil and India present profitable chances for the established market players to offer services at lower prices in order to counter the rivalry from the local independent service providers.

By Region

By region, Europe holds the largest share i.e., $5,085.63 million in 2021, and is expected to reach $6,332.7 million by 2031 at a CAGR of 2.28%. Also, the region is expected to dominate during the consumer electronics repair and maintenance market forecast period.

The consumer electronics repair and maintenance market is anticipated to be driven by rising consumer spending on online or e-commerce for consumer electronic items including PCs, mobile phones, washing machines, and kitchen appliances, among others. In 2020, more than 280 million European customers are expected to buy online and spend more than $150 billion on consumer electronics, according to AMR study. Hence, the market for consumer electronics repair and maintenance will grow as a result of increased consumer spending on consumer electronics devices and the necessity for repair and maintenance to keep the products in working order.

In addition, the market for consumer electronics repair and maintenance will be driven by the rising demand for reconditioned electronic items and the availability of such products in the marketplace. For instance, tasteful and updated refurbished gadgets are available on Refurbed, a European marketplace for used electronics. Back Market, Swappa, and Amazon Renew are more companies in the market for reconditioned gadgets.

The market is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in the global consumer electronics repair and maintenance are Encompass Supply Chain Solutions, Inc., American Home Shield Corporation, Asurion, LLC, Ensure Services, Best Buy Co., Inc., iCracked Inc., B2X Care Solutions GmbH, Electronix Services, CNS Brasil Informatica LTDA, and UrbanClap Technologies Private limited.

Recent Key Developments in the market

In September 2022, Asurion, LLC opened its new electronics repair shop, Asurion Tech Repair & Solutions in the Eagan. This new store offers professional fixes for consumer electronics and numerous repair services.

In July 2022, Best Buy Co., Inc. announced to establish its first small-format, digital-first store in Monroe. This new store features a curated selection of best-in-category products along with the expert services.

In July 2022, Best Buy Co., Inc. expanded its Samsung authorized service and repair services in more than 250 Best Buy stores to offer its customers with a full suite of repair solutions for their Samsung smartphones.

In April 2022, Encompass Supply Chain Solutions, Inc. was acquired by Parts Town, LLC, which is a technology-enabled global distributor of genuine OEM parts in order to expand its portfolio and business.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the consumer electronics repair and maintenance market analysis from 2021 to 2031 to identify the prevailing consumer electronics repair and maintenance market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the consumer electronics repair and maintenance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global consumer electronics repair and maintenance market trends, key players, market segments, application areas, and market growth strategies.

Consumer Electronics Repair And Maintenance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 21.6 billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 360 |

| By Equipment Type |

|

| By End Users |

|

| By Service Type |

|

| By Region |

|

| Key Market Players | Electronix Services, Asurion, LLC, Encompass Supply Chain Solutions, Inc., American Home Shield Corporation, B2X Care Solutions GmbH, Ensure Services, CNS Brasil Informatica LTDA, iCracked Inc., Best Buy Co., Inc., UrbanClap Technologies Private limited |

The global consumer electronics repair and maintenance market size was valued at $15.3 billion in 2021, and is projected to reach $21.6 billion by 2031.

The global consumer electronics repair and maintenance market to grow at a CAGR of 3.6% from 2022 to 2031.

Increase in digitization, rise in use of consumer electronic goods, predictive maintenance, and increase in growth of online aggregators are some of the upcoming trends of the Consumer Electronics Repair And Maintenance Market in the world.

Europe is the largest regional market for Consumer Electronics Repair And Maintenance .

Encompass Supply Chain Solutions, Inc., American Home Shield Corporation, Asurion, LLC, Ensure Services, Best Buy Co., Inc., iCracked Inc., B2X Care Solutions GmbH, Electronix Services, CNS Brasil Informatica LTDA, and UrbanClap Technologies Private Limited are some of the leading companies in global Consumer Electronics Repair And Maintenance market.

Loading Table Of Content...

Loading Research Methodology...