Contactless Smart Cards Market Research, 2032

The global contactless smart cards market was valued at $9.4 billion in 2022, and is projected to reach $21 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032.

A contactless smart card is a contactless credential that is the size of a credit card. Its built-in integrated circuits are capable of storing data as well as communicating with a terminal through NFC. The contactless smart cards market is the industry that manufactures, distributes, and uses smart cards featuring contactless technology.

Moreover, contactless smart cards are a type of electronic payment card that combines radio-frequency identification (RFID) or near-field communication (NFC) technology to enable secure and convenient transactions without the need for physical touch between the card and the reader device. Transit tickets, bank cards, and passports are examples of common applications. In addition, contactless smart cards include a microprocessor and memory storage, allowing them to securely store and process data. They are widely used in a variety of applications, including as payment systems (such as credit and debit cards), public transit (such as metro and bus cards), access control (for buildings or secure areas), identification (employee ID cards) and many others.

The rise of the Internet of Things (IoT) has accelerated the expansion of the contactless smart cards market share. As IoT technology continues to spread across numerous industries, the necessity for seamless and secure device connectivity has become critical. With their capacity to wirelessly communicate data and authenticate users, contactless smart cards have emerged as a trustworthy alternative for facilitating safe interactions within IoT ecosystems.

Furthermore, by utilizing near-field communication (NFC) and RFID technology, contactless smart cards enable seamless communication between connected devices such as smartphones, wearables, and smart appliances. Thus, a rise in demand for contactless smart cards in industries such as transportation, healthcare, retail, and access control has been witnessed, where the ease of frictionless transactions and data transmission matches with changing customer desires.

Moreover, the ease of use and convenience for consumers of contactless smart cards fuels growth of the contactless smart cards market size as they offer effortless and efficient transactions and interactions for consumers. However, high infrastructure costs, along with security and data theft concerns, are hindering the expansion of the contactless smart cards market. Contactless technology implementation necessitates considerable investments in upgrading or installing new infrastructure, such as card readers and payment terminals, across multiple industries. This financial barrier hinders adoption of contactless smart cards, particularly for enterprises with limited resources. Moreover, limited compatibility and infrastructure hamper the growth of the contactless smart cards market, by limiting the card's usability and acceptance as users struggle to find appropriate terminals and systems to fully utilize the card's features.

On the contrary, the integration of contactless smart cards with IoT (Internet of Things) and mobile devices represents an ideal chance for the contactless smart cards market. As the world accepts digital technology, such connections are becoming easier, safer, and efficient in a variety of situations. Owing to Internet of Things, contactless smart cards easily communicate with a wide range of connected gadgets, allowing for innovative uses such as smart home access, automatic attendance tracking in workplaces, and easier inventory control in retail and logistics. By providing real-time data transmission and remote control, this connection simplifies operations and improves user experiences. Therefore, these are some of tha major contactless smart cards market trends

The report focuses on growth prospects, restraints, and trends of the contactless smart cards market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the contactless smart cards market.

Segment Review

The contactless smart cards industry is segmented on the basis of type, functionality, industry vertical, and region. On the basis of type, the market is bifurcated into memory, and MPU Microprocessor. Based on functionality, the market is segmented into transaction and security access control. By industry vertical, it is bifurcated into BFSI, retail, healthcare, hospitality, transport and logistics, media and entertainment, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

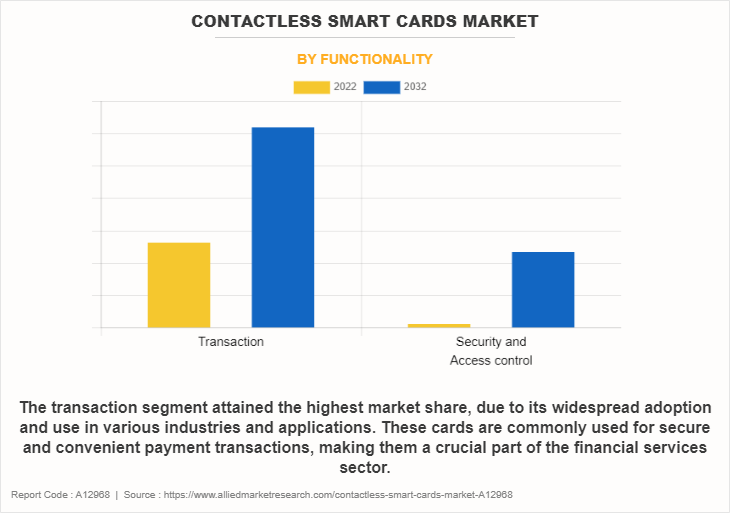

By functionality, the transaction segment held the highest share in the contactless smart cards market. This was attributed to contactless transactions, which allow customers to complete payments by simply tapping or waving their cards or mobile devices near a payment terminal, which are popular with both consumers and companies. Owing to their convenience of use, contactless payments have become the preferred method for making everyday purchases, both online and in physical places.

By region, Asia-Pacific attained the highest share in the contactless smart cards market, and it is forecasted to be the fastest-growing in the contactless smart cards market during the forecast period. This growth be attributed to the region’s huge population and fast urbanization created a large need for efficient and convenient payment methods, boosting the adoption of contactless smart cards. Furthermore, the increasing usage of smartphones and mobile technology in the Asia Pacific enabled the incorporation of contactless payment solutions, as mobile devices frequently serve as a gateway to these cards.

The report analyzes the profiles of key players operating in the contactless smart cards market such as CardLogix Corporation, CPI Card Group Inc., Giesecke+Devrient GmbH, HID Global Corporation, IDEMIA, Infineon Technologies AG, NXP Semiconductors, Sony Corporation, Thales, and Watchdata. These players have adopted various strategies to increase their market penetration and strengthen their position in the contactless smart cards market outlook.

Market Landscape and Trends

Contactless smart cards are becoming increasingly popular in a variety of industries, including retail, finance, transportation, and healthcare. Contactless transactions have gained popularity due to their convenience and speed, particularly in urban settings. Furthermore, contactless smart cards are rapidly being integrated with mobile wallets and apps, as consumers are using their smartphones to store and maintain contactless payment credentials, which adds another degree of convenience and allows for a seamless Omni channel payment experience. In addition, the combination of contactless smart cards and the Internet of Things (IoT) has created new possibilities smart cards may now communicate with a wide range of linked devices, providing access control, attendance tracking, and secure authentication in smart homes, workplaces, and other settings.

Moreover, security is still a top priority in the contactless smart cards market, the integration of biometric authentication (such as fingerprint or facial recognition) with contactless cards improves security, making transactions and access control more secure and tamper-proof. Therefore, these are the major landscape and trends in the contactless smart cards market.

Top Impacting Factors

Rise of IoT and Connected Devices

The proliferation of IoT and linked devices has aided the expansion of the contactless smart cards market. Contactless smart cards are commonly utilized in buildings, office, and security facility’s access control systems. It offer a quick and secure method of granting access to authorized individuals without requiring physical contact. The integration of smart cards with Internet of Things-enabled devices has improved security and accelerated entry processes.

Furthermore, contactless payment technologies, such as mobile wallets and contactless payment cards, have grown in popularity due to their convenience and quickness. Contactless systems frequently rely on NFC technology, which allows consumers to make payments by simply touching their cards or cell phones on compatible payment terminals. IoT devices, such as smartphones and smartwatches, have permitted the broad acceptance of contactless payments. In addition, in public transport systems, IoT-connected contactless smart cards are utilized to facilitate seamless ticketing and fare collection. Commuters use their smart cards to swiftly access buses, trains, and other modes of public transportation, decreasing wait times and improving the entire mobility experience. Therefore, the Internet of Things (IoT) and the proliferation of linked devices are major factors in the contactless smart cards market growth.

Limited Compatibility and Infrastructure

Contactless smart cards frequently rely on certain technology standards for connection with payment terminals, such as NFC or RFID. Compatibility issues arise when there is a lack of standardization or when different regions or businesses use different technologies. Consumers are confused and discouraged from utilizing contactless payments if they are unsure whether their cards will function with a specific terminal.

Furthermore, a strong network is required for contactless payments to be effective, this includes having a sufficient quantity of contactless payment terminals, point-of-sale systems, and other suitable equipment. Consumers are not able to use their contactless smart cards in places where this infrastructure is missing, restricting the market's growth potential. In addition, many businesses, particularly small enterprises, be employing outdated payment systems that are unsuitable with contactless technology. Upgrading these systems is costly and time-consuming, causing the adoption of contactless payments to be hampering. Therefore, limited compatibility and infrastructure are hampering the growth of contactless smart cards market.

Integration with IoT and Mobile Devices

IoT-enabled products, such as smart appliances, wearable gadgets, and linked automobiles, enable automatic payments for services such as utility bills, parking, and tolls, among others, without the need for manual interaction. Furthermore, IoT data reveal information about user behavior and preferences, financial institutions offer personalized financial goods and services that suit individual needs by integrating contactless smart cards with IoT.

Moreover, Users perform transactions using their phones by combining contactless smart cards with mobile devices, simplifying the payment process and minimizing the need for physical cards. In addition, mobile devices serve as a platform for acquiring information on consumer buying habits, location-based preferences, and other topics. Financial institutions use this information to provide personalized financial advice and services. Moreover, mobile devices help with contactless smart card remote management by allowing users to adjust card settings, monitor transactions, and receive notifications straight from their phones. Therefore, integration with IoT and mobile devices are lucrative growth for contactless smart cards market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the contactless smart cards market forecast from 2022 to 2032 to identify the prevailing contactless smart cards market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the contactless smart cards market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global contactless smart cards market trends, key players, market segments, application areas, and market growth strategies.

Contactless Smart Cards Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 21 billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 419 |

| By Functionality |

|

| By Type |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Infineon Technologies AG, Watchdata Co., Ltd., IDEMIA, CARDLOGIX CORPORATION, Giesecke+Devrient GmbH., Sony Corporation, Thales, CPI Card Group Inc., HID Global Corporation, NXP Semiconductors. |

Analyst Review

Contactless smart cards players are increasingly adopting biometric identification technologies such as fingerprint recognition or facial recognition to improve security and expedite the user experience. Moreover, in response to?consumer preferences, more merchants are investing in contactless payment terminals and promoting contactless smart card methods, which is increasing acceptance further. In addition, contactless smart cards are becoming increasingly employed for cross-border payments and travel, minimizing the need for various currencies and improving these cards' global applicability. Furthermore, many smart city projects include contactless smart cards for public services including public transport, parking, and access control, which promotes market growth. Moreover, contactless smart cards are used for healthcare access, patient identification, and medical record storage, which is contributing to their expansion in the healthcare sector.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in June 2020, Zwipe partnered with Watchdata to launch contactless payment cards and wearables, bringing these technologies to banks across several areas. “This collaboration to create the next-generation?contactless experience resonates strongly with o their purpose of continual innovation. Biometric capabilities uniquely combine simplicity with security and safety, elevating the card payment experience to entirely new heights. Integrating Zwipe Pay ONE into their smart card program is expected to be critical to competing and securing future business in this rapidly growing area." Nicole Guo, Product Manager at Watchdata, agrees. Furthermore, in September 2021, ProvidusBank, in collaboration with Mastercard, Interswitch, and Thales Group, announced the launch of a new Tap-to-Pay service to further reduce reliance on cash transactions, promote innovation, and drive the expansion of digital payments in Nigeria. Cardholders use the service to make fast, secure, and convenient in-store payments by tapping their NFC-enabled smart device at any contactless payment terminal. Moreover, the system works by allowing a connected device, such as a smartphone or wearable gadget, to function as a safe and secure payment mechanism, just like a traditional card.

Some of the key players profiled in the report include CardLogix Corporation, CPI Card Group Inc., Giesecke+Devrient GmbH, HID Global Corporation, IDEMIA, Infineon Technologies AG, NXP Semiconductors, Sony Corporation, Thales, and Watchdata. These players have adopted various strategies to increase their market penetration and strengthen their position in the contactless smart cards market.

Contactless smart cards are becoming increasingly popular in a variety of industries, including retail, finance, transportation, and healthcare. Contactless transactions have gained popularity due to their convenience and speed, particularly in urban settings. Furthermore, contactless smart cards are rapidly being integrated with mobile wallets and apps, as consumers are using their smartphones to store and maintain contactless payment credentials, which adds another degree of convenience and allows for a seamless Omni channel payment experience.

They are widely used in a variety of applications, including as payment systems (such as credit and debit cards), public transit (such as metro and bus cards), access control (for buildings or secure areas), identification (employee ID cards) and many others.

Asia-Pacific is the largest regional market for Contactless Smart Cards

The global contactless smart card market was valued at $9,419.26 million in 2022 and is projected to reach $21,014.25 million by 2032, growing at a CAGR of 8.7% from 2023 to 2032.

CardLogix Corporation, CPI Card Group Inc., Giesecke+Devrient GmbH, HID Global Corporation, IDEMIA, Infineon Technologies AG, NXP Semiconductors, Sony Corporation, Thales, and Watchdata.

Loading Table Of Content...

Loading Research Methodology...