Container Handling Equipment Market Insights, 2032

The global container handling equipment market size was valued at $7.5 billion in 2022, and is projected to reach $11.9 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032.

Report Key Highlighters:

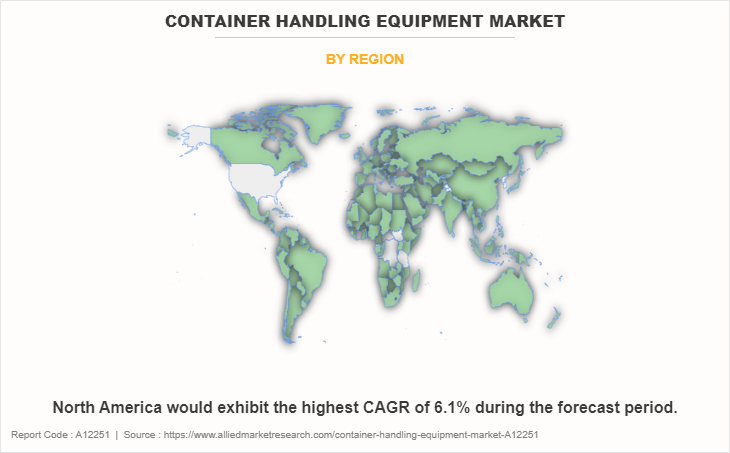

- The container handling equipment market study covers regions such as North America, LAMEA, Europe, and Asia-Pacific. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The container handling equipment market share is highly fragmented, into several players including Cargotec Corporation., Liebherr Group, Sany Group Co., Ltd., Hyster-Yale Materials Handling, Inc., Toyota Industries Corporation, PALFINGER AG, China Communications Construction Company, Ltd., Tadano Ltd., CVS ferrari S.P.A., Ambergate Invest Sverige AB. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

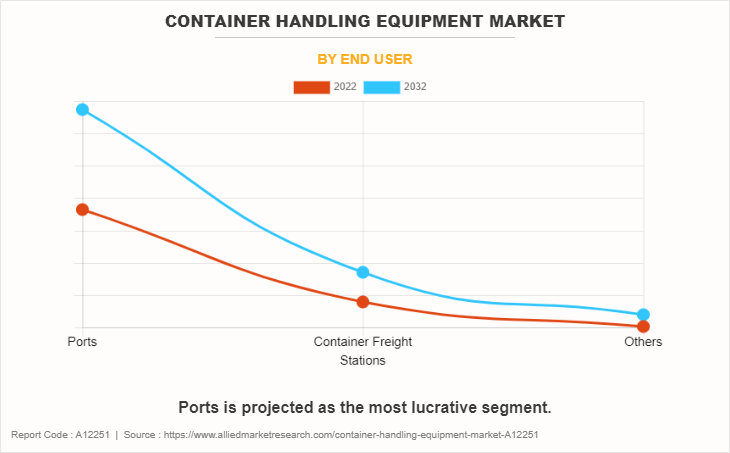

Container handling equipment is an important component used in multiple industries. It facilitates efficient movement and transportation of goods. It is used in ports, warehouses, and distribution centers to help in container loading, unloading, and stacking.

There are various types of container handling equipment, each of which is built for a certain duty. The crane, sometimes known as a ship-to-shore crane, is used in a variety of operations. These massive machines are used to load and unload containers from ships in ports. They are equipped with a spreader and can lift and stack containers with ease. Reach stackers are container handling machines that are used to stack containers in small places. These machineries are frequently seen in container yards and terminals.

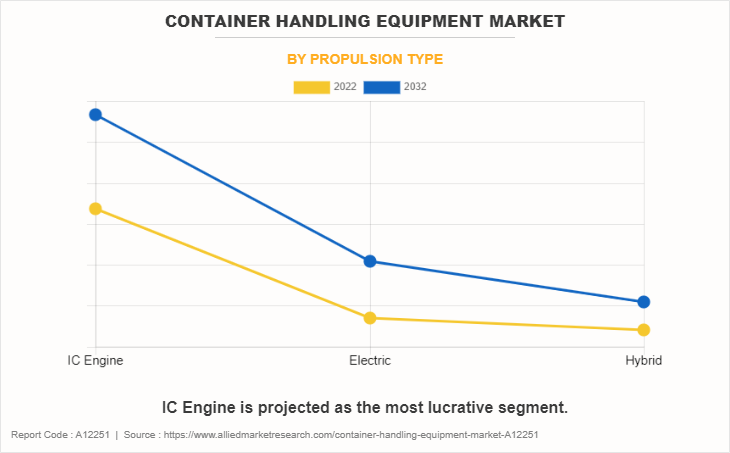

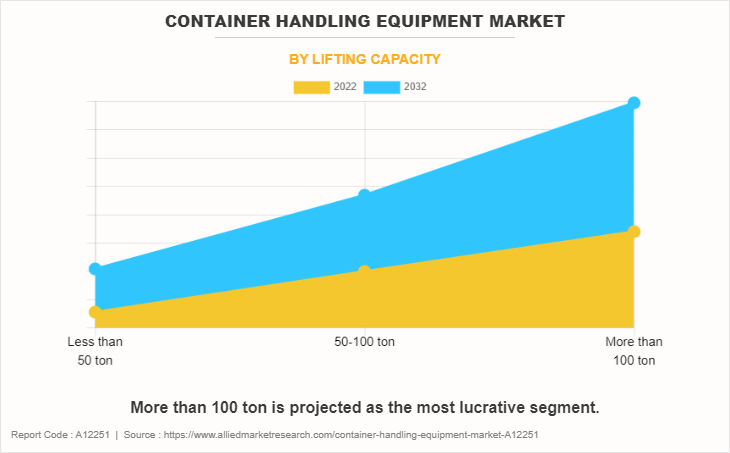

Reach stackers have arms that can be extended to reach numerous rows of stacked containers. The straddle carrier is another common type of container handling equipment. These large-wheeled vehicles are specifically built for hauling and stacking containers in ports or terminals. The container handling equipment are adept to lift weight from below 50 ton to above 100 ton effortlessly. Most of the container handling equipment use internal combustion engine specially diesel engine to propel the load, however, due to the emission norms and government regulations, manufacturers are proposing hybrid as well as electricity powered container handling equipment. For instance, Kalmar a container handling equipment company offers hybrid straddle carrier, which helps the user to reduce its service and energy cost.

By Equipment Type

Crane is projected as the most lucrative segment.

The factors such as surge in global trade and infrastructure development supplement the growth of the container handling equipment industry. However, high capital requirement for the container handling equipment and equipment optimization challenges are the factors expected to hamper the growth of the container handling market. In addition, automation of container handling equipment and introduction of self-propelled modular transporters (SPMTs) creates market opportunities for the key players operating in the container handling equipment industry.

The container handling equipment market is segmented into by equipment type, propulsion type, lifting capacity, end user, and region. By equipment type, the market is classified into carrier, crane, mobile carrier vehicles and automated equipment. By propulsion type, the market is classified into IC engine, electric, and hybrid. By lifting capacity, the market is divided into less than 50 ton, 50-100 ton, and more than 100 ton. By end user, the market is categorized into ports, container freight stations and others. By region, the market is analyzed across North America, Europe, Asia-Pacific and LAMEA.

The Asian container handling equipment market has grown significantly and is expected to provide enticing prospects in the coming years. The Asia-Pacific region's rapid industrialization and expanding logistics industry are driving rising demand for container handling equipment. Ports such as port of Shanghai in China, which has experienced exponential growth in container handling. The port has implemented automated cranes, robotic systems, and advanced tracking technologies to enhance efficiency and reduce turnaround times. These advancements have helped Shanghai maintain its position as a key gateway for international trade.

Another significant example is the Port of Singapore, which has witnessed a substantial demand for container handling equipment to meet the increasing demands of containerized goods. The port has implemented vehicles and machinery like automated stacking cranes, remote-controlled quay cranes, and smart container tracking systems. These innovations have significantly improved efficiency, enabling faster and more reliable container handling operations. Similarly, In South Korea, the Port of Busan has also witnessed substantial growth in container handling equipment.

The port has adopted advanced technologies such as automated guided vehicles (AGVs) and intelligent cargo tracking systems. These innovations have streamlined operations, reduced manual labor, and improved overall productivity. The growth of container handling equipment in Asia is driven by the region's expanding role in global trade. Ports like Shanghai, Singapore, and Busan have invested significantly in advanced equipment and technologies to meet the increasing demands for efficient container handling.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In November 2023, Kalmar, a Cargotec company, has agreed to supply Kingston Freeport Terminal Limited (KFTL) with 12 Kalmar hybrid straddle carriers for use at their Kingston, Jamaica, terminal. The agreement is expected to expand the company's outreach in the African region.

- In September 2023, Palfinger AG partnered with Steyr Automotive. Steyr Automotive will assemble truck mounted forklift for the Palfinger. The partnership is expected to cater the growing demand for forklift trucks in the North American Market.

- In August 2023, The Hyster Company designed and delivered a hydrogen fuel cell reachstacker for a trial project at the Port of Valencia in Spain. This Hyster reachstacker is a revolutionary zero-emission device that converts hydrogen into power via a Nuvera's Fuel Cell Engine.

- In December 2022, CVS Ferrari SpA has acquired the German distributor and service partner Reesink Schwerstapler GmbH from the Dutch firm Royal Reesink BV. The acquisition is expected to help the company to expand its network in the Germany.

Growth in Global Trade

Global trade expansion is critical to the progress and advancement of the container handling equipment market. The requirement for fast and dependable commodities transportation develops as countries boost their international trade, resulting in a surge in demand for container handling equipment. The export and import between China and U.S. are one of the primary examples for global trade expansion. The two countries' bilateral trade has increased significantly because of this trading alliance. China has emerged as a major global exporter as it exports variety of products from electronics to consumer goods, while the U.S. has been a significant importer of Chinese commodities.

Also, considering the maritime industry as an example, larger cargo vessels are being deployed to accommodate rising volumes of products as global trade expands. Advanced and capable container handling equipment, such as cranes, forklifts, and reach stackers, is required to load and unload containers from these larger ships. Moreover, the growth in global trade also leads to the expansion and development of ports and terminals worldwide. These facilities require a significant investment in container handling equipment to handle the increasing cargo volumes efficiently. Ports and terminals often upgrade their equipment, invest in automation technologies, and implement advanced systems to improve productivity and streamline operations. This, in turn, boosts the demand for container handling equipment industry.

Infrastructure Development

Infrastructure development plays a crucial role in the growth of container handling equipment. The expansion and improvement of ports, terminals, and logistics networks directly impact the efficiency and capacity of container operations. By investing in infrastructure, countries can attract larger vessels, accommodate increasing trade volumes, and enhance overall supply chain capabilities. For instance, the development of deep-water ports allows for the arrival of larger container ships, which can carry a higher number of containers. This increase in vessel size necessitates the deployment of advanced container handling equipment, such as gantry cranes, straddle carriers, and reach stackers, capable of efficiently loading and unloading these larger vessels. These specialized machines are designed to handle containers with precision, speed, and safety, ensuring smooth operations at the port.

High capital requirement for the container handling equipment

High capital requirement for container handling equipment can pose a significant challenge to its growth. The substantial investment required to acquire and maintain specialized machinery can become a barrier for ports, terminal operators, and logistics companies, hindering their ability to expand and upgrade their container handling capabilities. For instance, the cost of purchasing and maintaining large-scale container cranes, straddle carriers, or reach stackers can be exorbitant. The container handling equipment requires significant investment, as well as ongoing expenses for maintenance, repairs, and upgrades. For smaller ports or developing countries with limited financial resources, the high capital requirement can prevent them from acquiring the necessary equipment to handle larger volumes of containers efficiently.

Automation of container handling equipment

The automation of container handling equipment presents significant opportunities for improving efficiency, productivity, and safety in the container handling industry. Container handling processes can be streamlined by leveraging automation technologies, reducing manual labor and human error while increasing operational speed and accuracy. One example of automation in container handling is the use of automated stacking cranes (ASCs) in container terminals. ASCs are robotic cranes that can autonomously stack and retrieve containers from the yard. These cranes are equipped with advanced sensors and control systems, allowing them to navigate the terminal, identify containers, and perform precise movements without human intervention.

Russia-Ukraine War Impact Analysis

The ongoing war between Russia and Ukraine has had a negative impact on global trade. The conflict has generated an atmosphere of uncertainty which has had a severe impact on the global economy. The war not only has hampered trade flows, but has also disrupted supply chains, and harmed the confidence of any investor. One example of the impact on trade is the disruption of energy sources. Russia exports petroleum and petroleum products, and many countries rely on Russian imports to meet their energy demands. The conflict had cause sanctions on the Russian oil, leading to greater energy insecurity and potential disruptions.

The countries have uncertainty about buying oil from Russia and are exploring alternative energy sources and diversify their energy supply chains. Furthermore, the war has also resulted in trade containment policies. Countries have implemented sanctions and trade restrictions on Russia, affecting global trade dynamics These measures have disrupted established trade relationships and supply chains, leading to a decline in trade volumes and increased costs for businesses. The container handling equipment market witnessed a negative impact, as the demand for container handling equipment decreases.

The war has impacted the trade containment policies, including sanctions and trade restrictions on Russia, leading to disruptions in established supply chains and trade relationships. These disruptions have caused a decline in trade volumes and increased costs for businesses, thereby reducing the need for container handling equipment. The container handling equipment market is expected to grow as the countries are searching alternatives to meet the required demand of oil and food related products, and is anticipated to match the pre-war demand for container handling equipment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the container handling equipment market analysis from 2022 to 2032 to identify the prevailing container handling equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the container handling equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global container handling equipment market trends, key players, market segments, application areas, and market growth strategies.

Container Handling Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.9 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 466 |

| By Equipment Type |

|

| By Propulsion Type |

|

| By Lifting Capacity |

|

| By End User |

|

| By Region |

|

| Key Market Players | Ambergate Invest Sverige AB, Cargotec Corporation., Hyster-Yale Materials Handling, Inc.,, PALFINGER AG, CVS ferrari S.P.A., Tadano Ltd., Toyota Industries Corporation, China Communications Construction Company, Ltd., Sany Group Co., Ltd., Liebherr Group |

Automated equipment are the upcoming trends of Container Handling Equipment Market in the world.

Lifting containers in the ports is the leading application of Container Handling Equipment Market

Asia-Pacific is the largest regional market for Container Handling Equipment

The global container handling equipment market size was valued at $7.5 billion in 2022, and is projected to reach $11.9 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032.

The key players in the container handling equipment market include Cargotec Corporation., Liebherr Group, Sany Group Co., Ltd., Hyster-Yale Materials Handling, Inc., Toyota Industries Corporation, PALFINGER AG, China Communications Construction Company, Ltd., Tadano Ltd., CVS ferrari S.P.A., Ambergate Invest Sverige AB.

Loading Table Of Content...

Loading Research Methodology...